July 2025

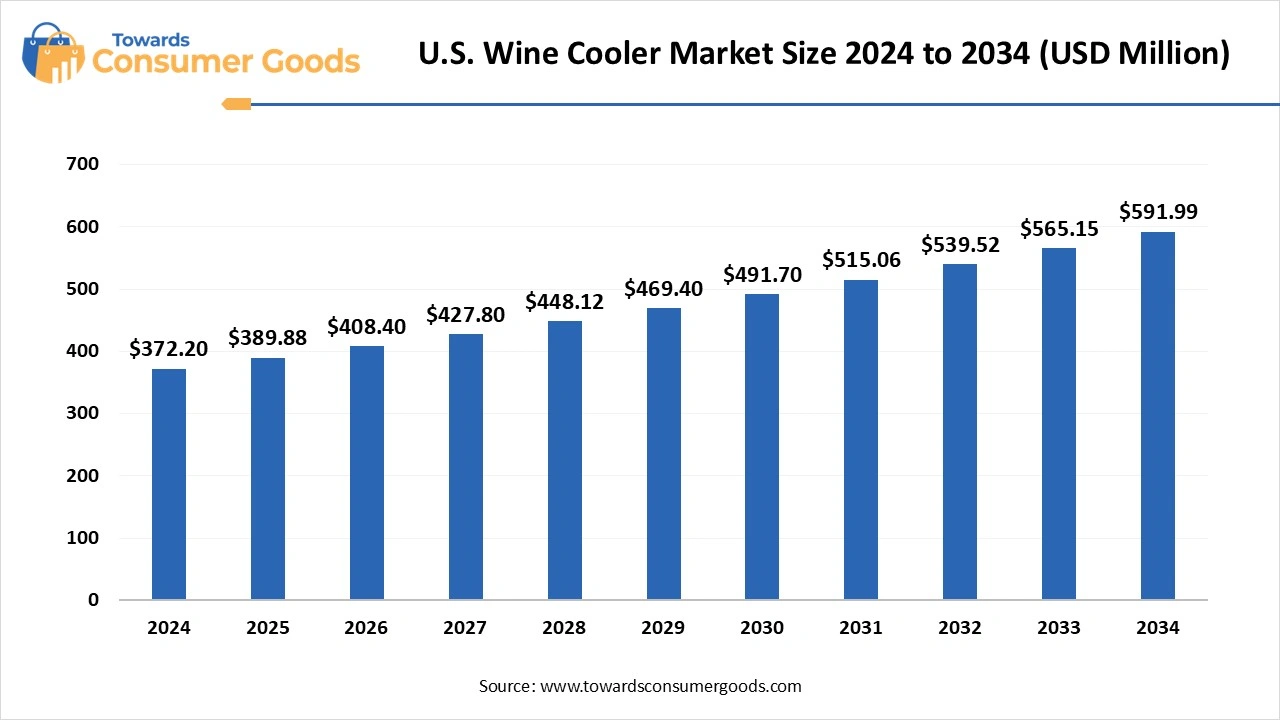

The U.S. wine cooler market size was reached at USD 372.2 million in 2024 and is expected to hit around USD 591.99 million by 2034, exhibiting a compound annual growth rate (CAGR) of 4.75% during the forecast period 2025 to 2034. In the United States, the growing culture of wine appreciation, combined with rising preference for premium kitchen appliances, is fueling the demand for wine coolers.

These specialized refrigeration units are no longer confined to luxury households but are increasingly being adopted by urban consumers, restaurants, and wine collectors who seek optimal wine storage conditions within their personal or commercial spaces.

The U.S. wine cooler market has evolved from a niche luxury segment into a rapidly expanding appliance category driven by lifestyle shifts, increasing disposable income, and a cultural tilt towards at-home wine consumption. With Americans embracing more refined palates, especially among millennials and Gen Z, the demand for wine coolers that offer precision temperature control, humidity regulation, UV protection, and aesthetic appeal has seen significant growth. The market is being shaped by the dual forces of design innovation and digital functionality.

Modern wine coolers now integrate seamlessly with smart home ecosystems, featuring touch controls, app-based monitoring, dual-zone cooling systems, and energy-efficient compressors. As consumers look for compact, silent, and visually sleek appliances, manufacturers are responding with built-in, freestanding, and under-counter models that blend form and function. Additionally, urbanization and real estate trends are contributing to the demand for compact, space-saving appliances, making wine coolers a desirable feature in condominiums, modular kitchens, and mini-bars.

Retailers and e-commerce platforms are capitalizing on this momentum, offering bundled deals, custom installations, and finance options to make wine coolers more accessible to a broader demographic. Commercial adoption is also rising, especially in boutique hotels, gourmet restaurants, tasting lounges, and wineries, where preserving the integrity of fine wines is crucial. These sectors are driving demand for high-capacity, multi-zone, and vibration-dampened cooling units.

| Report Attributes | Details |

| Market Size in 2025 | USD 389.88 million |

| Expected Size by 2034 | USD 591.99 million |

| Growth Rate from 2025 to 2034 | CAGR 4.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Type, By Price Range, By Distribution Channel, By End Use |

| Key Companies Profiled | Whirlpool Corporation, Danby, Frigidaire, Haier Inc., NewAir, kalamera, Robert Bosch GmbH, EdgeStar, Vinotemp |

In June 2025, the outlook for the Redding Public Market has been improving significantly in recent days. Sections of Market Street have been temporarily closed as construction crews, aided by a large crane, began installing the trusses for the market’s outdoor patio. This area will be fully enclosed with glass, garage-style doors at the front to provide shelter during bad weather. It will also be equipped with fans and a misting system for comfort. Surrounding the patio on three sides will be the new Fall River Brewing Taphouse, a wine boutique and retail store, and Redding’s first-ever outdoor bar, according to a recent update shared by Redding Public Market on Facebook.(source: msn)

In March 2025, JennAir showcased its ongoing commitment to transforming the conventional trade show format by presenting an immersive, multi-sensory exhibit designed to engage both architects and designers. During the event, the brand introduced fresh design concepts through a new collaboration with Nature Squared, revealed cutting-edge advancements in induction cooking, and brought back its Wine Columns and SlimTech technology. Olivia Edmundson, Director of Brand & Product Marketing at JennAir, emphasized the brand’s fusion of innovation and purposeful design: “From our new partnership with Nature Squared which incorporates upcycled natural materials like seashells into refrigerator panel designs to our debut Wine Column collection, each product reflects our pursuit of both superior functionality and artistic expression (source:prnewswire )

In March 2025, Liebherr introduced its latest freestanding wine refrigerators under the Vinidor and Vinidor Selection series, designed for premium wine preservation. These new models feature dual-zone and triple-zone cooling systems, offering independent temperature controls ranging from 41 °F to 68 °F. Enhanced with TempProtect Plus, they ensure precise regulation with dual sensors. To protect wine quality, the refrigerators are equipped with Vibrate Safe low-vibration systems, Fresh Air charcoal filters for odor control, and Protect Plus triple-layered UV-resistant safety glass. Their sleek Smart Steel and Glass Black door designs are both elegant and functional, while Light Tower LED lighting with dimming options enhances visibility. Energy-efficient and Energy Star-rated, the units also include Flex Fit beechwood shelves and a Sommelier board in the triple-zone model, catering to both aesthetic and functional demands of wine enthusiasts.(source: liebherr )

| Age group 30-45 | Age group 46-60 |

| The group includes young professionals, urban homeowners, and wine enthusiasts who seek convenience and lifestyle elevation. They often live in an apartment or a mid-sized home where a wine cooler fits seamlessly into the kitchen, living area, or dedicated bar space. | These customers typically have larger homes or dedicated wine rooms. They often seek high-capacity, dual-zone, or triple-zone wine coolers to store red and white wines at different temperatures. Their preference leans toward premium, built-in models with precise temperature and humidity control. |

(source: verifiedmarketresearch )

Is Wine Culture the New Luxury at Home?

The rising trend of home-based wine appreciation and the growing culture of luxury entertaining at home present a compelling opportunity for the U.S. wine cooler market. With millennials and Gen Z consumers increasingly investing in aesthetic, functional kitchen upgrades, wine coolers are seen not just as appliances, but as lifestyle statements. Additionally, the surge in remote work and home-centric leisure activities has encouraged consumers to curate premium in-home experiences, boosting demand for dual-zone and smart-enabled coolers.

Moreover, the growing popularity of wine subscription services and artisanal wineries has led consumers to explore wine collecting, thereby increasing the need for specialised storage solutions. The integration of wine coolers with smart home technology, offering app-based temperature control and inventory tracking, is another avenue with immense growth potential. Also, manufacturers are expanding offerings tailored to small spaces and apartment dwellers, ensuring broader accessibility. In summary, the wine cooler market is riding a wave of luxury living, tech innovation, and lifestyle-driven consumption.

Despite its appeal, the U.S. wine cooler market faces limitations primarily due to high upfront costs and space constraints in urban dwellings. Premium wine coolers, especially built-in or dual-zone models, can be perceived as non-essential or luxury items, making them less accessible to middle-income consumers or those prioritizing basic kitchen needs. Moreover, inflation and economic uncertainty may shift consumer focus away from discretionary spending, limiting sales in the mid-tier and luxury segments.

Space limitations in urban settings, especially in compact apartments and rented homes, also hinder market expansion. Consumers may opt for multi-functional appliances rather than single-purpose units like wine coolers. Additionally, energy consumption concerns and limited awareness about wine storage requirements among new buyers may reduce the urgency for adoption. Lastly, supply chain disruptions, particularly in sourcing high-grade cooling components and smart tech modules, can impact pricing and product availability, challenging sustained growth.

Why is the Free-standing Wine Cooler Dominating the Market?

Free-standing wine coolers are dominating the U.S. market because of their versatile placement, ease of installation, and cost-effectiveness. Unlike built-in models, they do not require cabinet modifications or professional setup, making them ideal for both homeowners and renters. Their availability in a wide range of capacities and aesthetic finishes attracts diverse consumer groups from casual wine drinkers to serious collectors.

On the other hand, countertop wine coolers are witnessing the fastest growth due to the compact lifestyle trend in urban U.S. households. These models are highly popular among younger consumers, apartment dwellers, and first-time buyers who seek entry-level storage solutions without sacrificing counter space.

Their affordability and portability make them a preferred choice for casual drinkers or gift buyers. With designs becoming sleeker and more visually appealing, countertop coolers are blending seamlessly into modern kitchens, living rooms, and even office setups, reflecting a shift towards minimalistic, functional luxury.

Why Are Compressor-Based Coolers Leading the Chill Revolution?

Compressor-based wine coolers dominate the market because they offer superior cooling performance, larger capacity, and reliability across varying ambient temperatures, making them ideal for both residential and commercial use. Unlike thermoelectric models, compressor systems are more effective at maintaining stable dual-zone temperatures, essential for storing both reds and whites optimally.

Moreover, Thermoelectric wine coolers are gaining rapid traction due to their silent operation, vibration-free mechanism, and eco-friendly design. Consumers in small homes and apartments favor them for their noise-sensitive settings and lower power consumption. As sustainability becomes a core consumer concern, these models appeal to buyers who prioritize green living. Ideal for short-term storage and small wine collections, thermoelectric coolers fit perfectly into the rising trend of sustainable, compact urban living.

Commercial users dominate due to the hospitality industry's rising focus on curated wine experiences. From restaurants and hotels to bars and wineries, establishments require high-capacity, temperature-stable coolers that offer not just functionality but aesthetic presence too. The integration of wine coolers into wine displays, event spaces, and tasting rooms amplifies the customer experience, making them essential in premium foodservice settings. Their need for high-volume, reliable storage solidifies their role as dominant end users in the market.

Furthermore, residential users are emerging as the fastest-growing segment, driven by the home entertainment boom, DIY bar setups, and evolving consumer sophistication. As people spend more time at home post-pandemic, there is a growing interest in replicating restaurant-like wine experiences within personal spaces. The desire to preserve wine quality, enhance kitchen aesthetics, and host with flair is fueling the rise of personal wine coolers, especially among young professionals, new homeowners, and hobbyist collectors.

Wine coolers priced at USD 1,500 and above dominate due to their premium build quality, advanced temperature control, and luxury appeal. These models are typically feature-rich, offering dual-zone cooling, smart controls, UV-resistant glass doors, and custom finishes that blend with designer kitchens or wine cellars. High-income consumers and commercial buyers prefer these coolers as a long-term investment in preservation and prestige, making them the go-to choice for top-tier market dominance.

On the other hand, wine coolers priced under USD 500 are the fastest-growing segment, largely due to their mass-market accessibility and value-for-money proposition. These are typically compact, thermoelectric models suited for small homes or first-time users, often sold during festive seasons and online sales. Their affordability encourages trial purchases and caters to budget-conscious consumers who still wish to maintain a refined lifestyle. The low entry barrier fuels growth, especially in urban centers and among younger buyers.

Why Do Electronic Stores Still Lead Wine Cooler Sales in the United States?

Electronic stores dominate distribution due to their in-store demonstration capability, warranty assurance, and hands-on assistance that gives buyers confidence in choosing the right model. Major retail chains often offer installation support, finance options, and bundled discounts, which attract both high-end and casual buyers. Additionally, partnerships with appliance brands ensure exclusive launches and better display infrastructure, reinforcing their lead in offline sales.

By Product

By Type

By Price Range

By Distribution Channel

By End Use

The global plus size clothing market size was valued USD 323.26 billion in 2024 and is projected to grow from USD 336.84 billion in 2025 to USD 487.79...

The global online book services market size was estimated at USD 23.45 billion in 2024 and is predicted to increase from USD 24.77 billion in 2025 to ...

According to market projections, the u.s air purifier market size was USD 4.65 billion in 2024 and is projected to grow from USD 4.99 billion in 2025 ...

The b2b hygienic paper market size was accounted for USD 134.15 billion in 2024 and is expected to be worth around USD 211.34 billion by 2034, growing...

July 2025

July 2025

July 2025

July 2025