July 2025

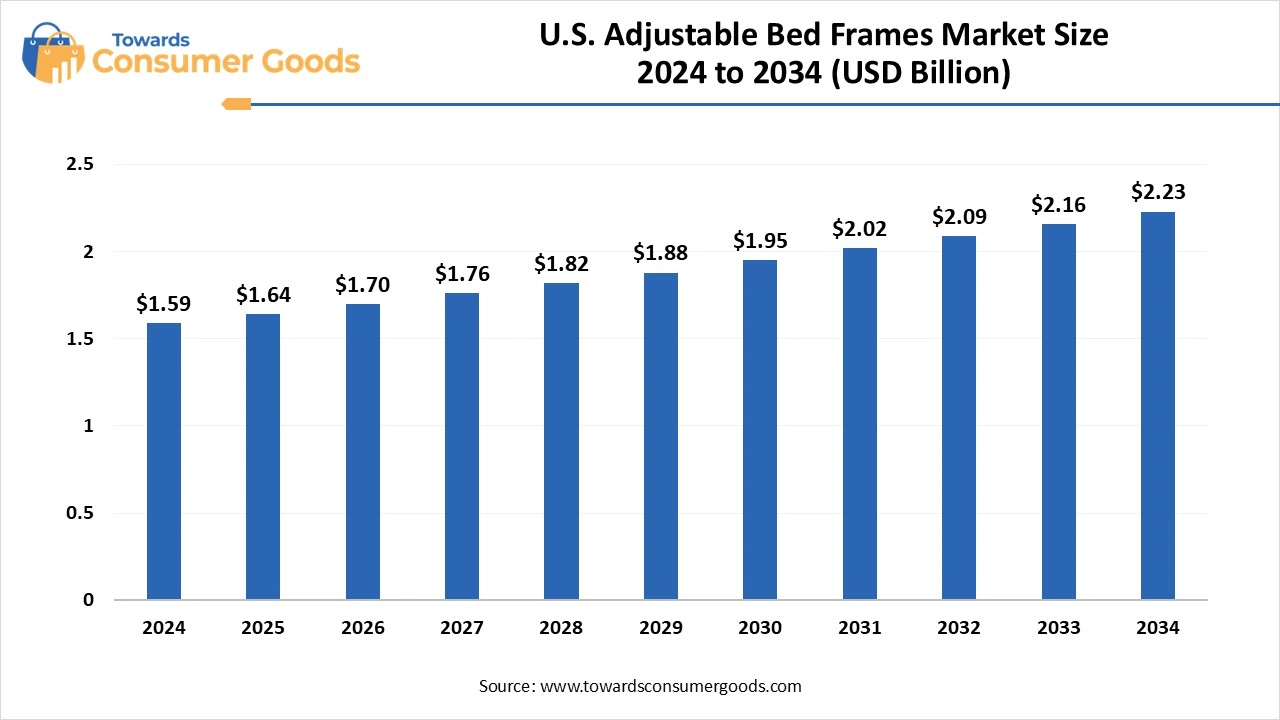

According to forecasts, the U.S. adjustable bed frames market will grow from USD 1.59 billion in 2024 to USD 2.23 billion by 2034, with an expected CAGR of 3.45%. The U.S. adjustable bed frames market is witnessing remarkable growth, driven by rising health consciousness, an ageing population, and increasing demand for comfort-enhancing furniture. With the integration of smart features and wellness-focused innovation, adjustable beds are no longer confined to hospitals; they are now redefining modern bedroom experiences.

Adjustable bed frames have evolved from a niche healthcare product to a sought-after lifestyle solution in American homes. Designed to offer customizable support for the head, legs, and spine, these beds cater not only to older adults and individuals with health concerns like acid reflux, sleep apnea, or back pain but also to younger consumers seeking luxury and relaxation. The market’s growth is further fueled by innovations like wireless remotes, zero-gravity positioning, massage functions, under-bed lighting, and app-controlled adjustability, making these frames a staple in smart homes.

Retailers and e-commerce platforms are expanding their offerings to include stylish, tech-integrated frames compatible with memory foam and hybrid mattresses, broadening appeal across income and age groups. With rising awareness of sleep quality’s impact on overall wellness, consumers are increasingly willing to invest in ergonomic sleeping systems. As a result, the adjustable bed frames market in the U.S. is positioned as both a medical necessity and a lifestyle enhancement, driving sustained consumer interest and commercial expansion.

| Report Attributes | Details |

| Market Size in 2025 | USD 1.64 Billion |

| Expected Size by 2034 | USD 2.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Frame Type, By Size, By End Use, By Distribution Channel, |

| Key Companies Profiled | Tempur Sealy International, Sleep Number Corporation, Reverie (Ascion, LLC), Serta Simmons Bedding, Leggett & Platt, Ergomotion, Nectar (Resident Home, LLC), Electropedic, Rize Home, Denver Mattress |

Opportunity

From Comfort to Wellness: Is the Bedroom the New Wellness Hub?

The growing consumer shift towards wellness-oriented living has created a substantial opportunity for adjustable bed frame manufacturers. As sleep becomes a core pillar of preventive health, more individuals are investing in ergonomic sleep systems to combat issues like insomnia, stress, acid reflux, and posture-related pain. This trend is especially amplified in the ageing population, post-pandemic lifestyle changes, and the remote work culture, where the bedroom now doubles as a workspace and relaxation zone.

Moreover, the integration of smart technology, including sleep trackers, app-controlled elevation, massage features, and IoT compatibility, has opened doors to cross-segment innovation in both the furniture and health-tech industries. Additionally, rising consumer awareness through digital marketing, wellness influencers, and DTC brands has broadened the customer base from older adults to younger, tech-savvy Millennials and Gen X buyers. The market is also ripe for customization, modular upgrades, and subscription-based comfort services, providing room for continuous innovation and brand differentiation.

Luxury or Necessity? The Price Tag Still Divides the Market

While demand is growing, one of the major restraints in the adjustable bed frame market is the perceived high cost of ownership. Many consumers still consider adjustable beds a luxury product rather than a health investment, especially when compared to traditional bed frames. This perception can deter price-sensitive segments despite increasing awareness of the benefits. Moreover, limited awareness in lower-income or rural demographics and a lack of sufficient retail display experiences also hinder growth. Some buyers are unsure about installation requirements, mattress compatibility, and after-sales service, which can further delay or prevent purchase decisions. In addition, the logistical complexity of delivering and assembling these large, often tech-integrated frames, especially in urban apartments or smaller homes, adds to the cost burden. The market needs better consumer education, flexible financing options, and accessible demo experiences to overcome this constraint and expand its reach.

Why is Adjustable Single Bed Frames leading the market?

Adjustable single bed frames dominated the market, primarily due to their affordability, ease of installation, and popularity among individual users, including seniors, students, and solo urban dwellers. These beds cater to users who require customized sleeping postures for medical or comfort reasons without the higher costs associated with larger or dual-motor units. Their compact design makes them ideal for small bedrooms, assisted living facilities, and guest rooms, thus maintaining a stronghold across both personal and institutional buyers.

On the other hand, Adjustable split bed frames are the fastest growing segment, fueled by rising demand among couples with different sleep preferences. With dual motors and independent controls, these frames allow each side of the bed to be adjusted separately, offering unmatched personalization. Their popularity has grown with the luxury and wellness segment, where comfort is no longer a compromise. The rise in smart homes and lifestyle upgrades has also made split frames a symbol of premium, tech-integrated living.

Is the Queen Still the Reigning Choice in American Bedrooms?

Queen-sized adjustable bed frames remain the most popular and widely adopted format in the U.S. market. They offer the perfect balance between space and comfort, fitting seamlessly into standard master bedrooms while accommodating individual or couple use. With broad compatibility across mattress brands, bedding accessories, and room layouts, queen-sized frames appeal to the largest demographic segment, from young professionals to retirees.

Are In-Store Experiences Still Essential for Comfort-Based Products?

Despite the digital shift, offline retail continues to dominate, especially for high-involvement purchases like adjustable bed frames. Consumers prefer testing the product physically, assessing its features, noise levels, and comfort before committing. Brick-and-mortar outlets also offer sales guidance, bundled packages, and post-sale service, which enhances buyer confidence. Retail showrooms, especially those of mattress and furniture chains, remain a key point of interaction for this market.

Furthermore, Online distribution is the fastest-growing channel, driven by the ease of comparison, wider choices, and attractive financing plans. E-commerce platforms ranging from Amazon to direct-to-consumer websites are now offering virtual demos, augmented reality room views, and customer reviews, making online buying more reliable. Younger consumers prefer this route for convenience, doorstep delivery, and discount options, which are often unavailable in physical stores.

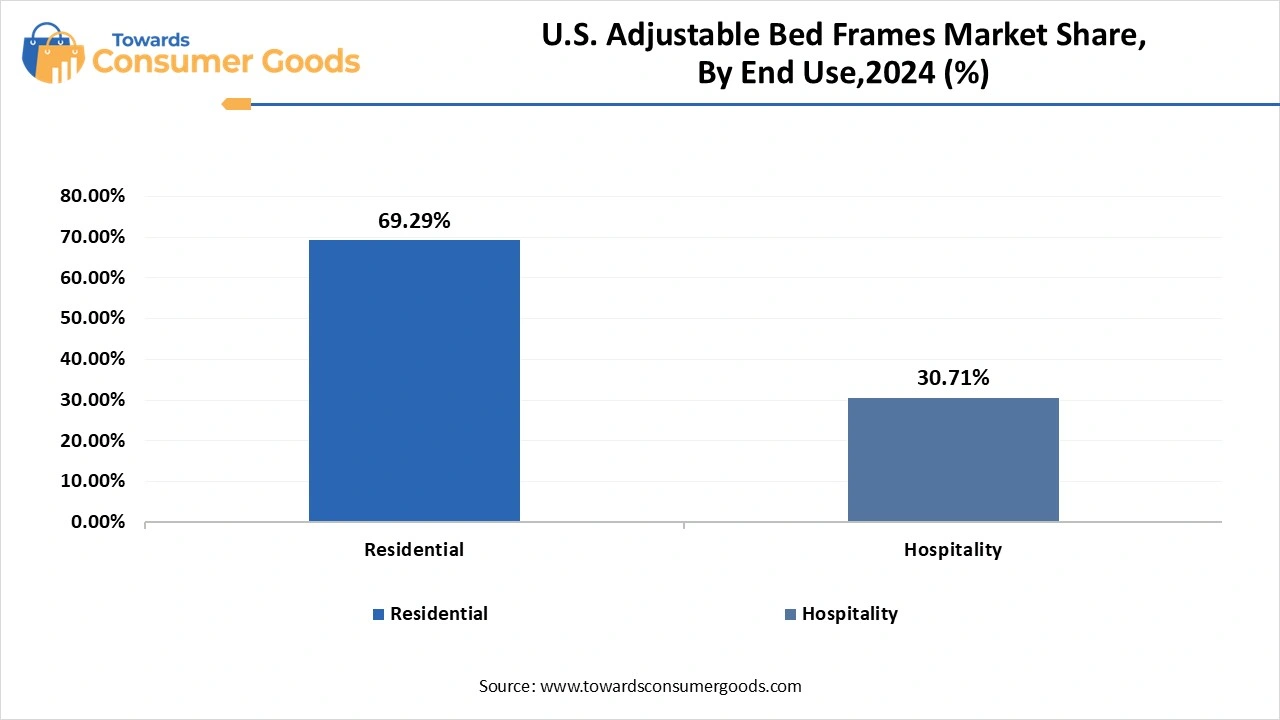

Is Home Still the Ultimate Destination for Custom Comfort?

Residential applications continue to dominate the market, as consumers prioritize sleep quality and physical well-being within their personal spaces. The rising adoption of wellness routines and smart bedroom setups has driven home users to invest in adjustable bed frames for everyday use, particularly among ageing adults, remote workers, and young families. The integration of these beds into modern bedroom aesthetics has made them a standard feature in contemporary home design.

By Frame Type

By Size

By End-Use

By Distribution Channel

July 2025

July 2025

June 2025

June 2025