July 2025

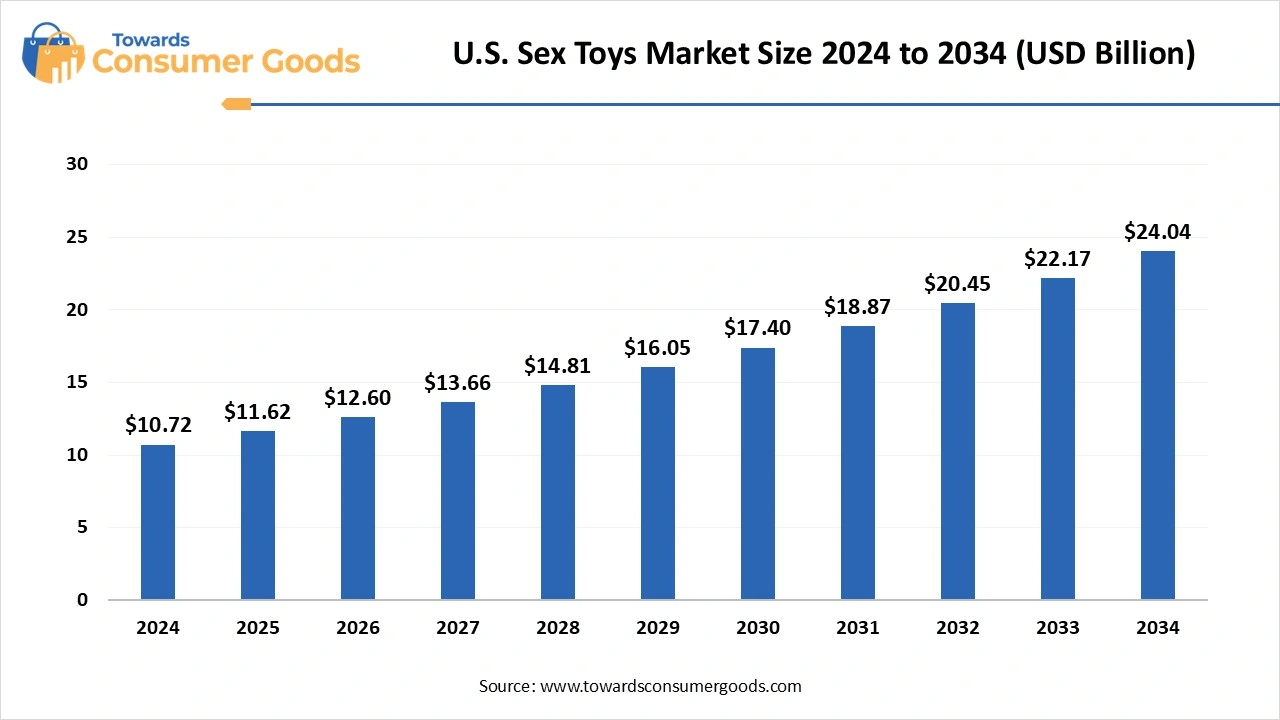

The U.S. sex toys market size is calculated at USD 10.72 billion in 2024, grew to USD 11.62 billion in 2025, and is projected to reach around USD 24.04 billion by 2034. The market is expanding at a CAGR of 8.41% between 2025 and 2034. The market is expected to grow at a CAGR of xx% from 2025 to 2034. This market is growing due to rising awareness, increasing acceptance of intimate products, and rapid innovation in tech-enabled, inclusive, and discreet pleasure solutions.

The U.S. Sex Toys Market encompasses all adult products designed to enhance sexual pleasure, promote sexual health, and support intimate wellness. These include devices and accessories such as vibrators, dildos, lubricants, BDSM gear, wearable stimulators, and tech-enabled (smart) sex toys. The market caters to diverse consumer segments, including singles, couples, LGBTQ+ communities, and aging populations seeking enhanced intimacy or therapeutic solutions.

Driven by growing sexual wellness awareness, destigmatization of adult products, female empowerment, and increased availability through discreet online retail, this industry has transformed from niche to mainstream. The integration of app-based controls, ergonomic designs, medical-grade materials, and inclusive marketing is further reshaping market dynamics. Regulatory oversight regarding product safety, materials, and age-appropriate marketing also influences this evolving space.

| Report Attributes | Details |

| Market Size in 2025 | USD 11.62 Billion |

| Expected Size by 2034 | USD 24.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.41% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Gender Target, By Material, By Distribution Channel, By Price Range |

| Key Companies Profiled | Lovehoney Group, Lelo (Intimina, Lelo Hex), We-Vibe (WowTech Group), Doc Johnson Enterprises, BMS Factory (PalmPower, Swan), Dame Products, Satisfyer, OhMiBod, Jimmyjane, Tenga Co., Ltd., Adam & Eve (Evolved Novelties), Lovense, Pipedream Products, Lora DiCarlo, Blush Novelties |

How is e-commerce reshaping the sales strategy for sex toy brands?

E-commerce has eliminated geographical and social barriers, enabling discreet access to intimate products. With features like secure checkouts, anonymous billing, and doorstep delivery, online platforms are attracting a larger audience. Brands are also using data analytics to personalize offerings and retarget customers effectively. The digital first approach ensures 24/7 availability and significantly improves conversion rates.

What regulatory and legal restrictions are restraining the U.S. sex toys market?

Laws that prohibit the sales and public display of sex toys are still being proposed or enforced in several conservative states. Legislation such as Texas SB 3003 seeks to restrict retail access and enforce stringent age verification procedures, particularly in convenience stores and pharmacies. Consumer access is restricted, legal uncertainty is increased, and compliance costs are raised, especially in rural and traditional areas. The expansion of national brands is hampered by this patchwork legislation, which also causes supply chain friction.

The United States stands as one of the largest and most progressive markets for sex toys in 2025, fueled by growing knowledge of sexual wellness, robust e-commerce, and changing societal perceptions of pleasure and self-care. Online platforms dominate sales because of their discreet delivery and extensive product availability, and urban millennials and Gen Z are rapidly adopting tech-enabled app-controlled and luxury-positioned products. Conservative state laws, cultural stigma in rural areas, and stringent advertising regulations that reduce brand visibility continue to be obstacles in the market despite its expansion. However, opportunities in subscription-based models, smart device integration, and male-focused offerings are still emerging, positioning the U.S. as a major centre for product innovation in sexual wellness.

Why are vibrators the most dominant product type in the U.S. sex toys market?

The vibrators segment dominated the market in 2024, motivated by universally embraced by people of all ages and genders highly trustworthy and adaptable. Their universal relevance stems from their ability to serve solo couples and therapeutic use cases. Their price accessibility in various formats (bullet wand and rabbit) and ease of use make them the preferred options. To lessen stigma, marketing has positioned them as self-care tools rather than taboo objects. Furthermore, vibrators are frequently recommended by therapists and health professionals for sexual wellness, which enhances their legitimacy. Stores like Amazon and Target carry them, which increases accessibility and visibility even more.

App app-controlled and smart toys segment is anticipated to witness the fastest growth as they are technologically advanced and interactive. These toys enable music-based vibration remote syncing, long-distance intimacy, and AI-guided enjoyment. Couples and long-distance partners find connected devices appealing as dating and relationships become more digital. These toys are fun, adaptable, and discreet, which fits in with Gen Z are millennials' lifestyles. Additionally, brands are using app data to tailor recommendations to increase user retention and satisfaction. Technology is closely linked to sexual wellness in the future, setting this market up for rapid expansion.

Why are female-oriented products dominating the U.S. sex toys market?

Female-oriented toys dominate the U.S. market because women are becoming more empowered, reproductive health is receiving more attention, and people are becoming more receptive to their pleasure. Since women are now through to make most decisions regarding intimate wellness, companies are creating toys that are discreet, aesthetically pleasing, and ergonomic just for them. Women are empowered to freely share reviews and recommendations through podcasts, influencers, and online forums. Additionally, brands target younger consumers with campaigns that emphasize equality of pleasure and body positivity. This category leads in revenue and user engagement thanks to improved representation of relatable language and trust-driven design. They are in demand by both novice and expert users.

LGBTQ+ & gender-neutral product-inclusive toys are growing swiftly as more customers seek inclusive nonbinary designs that celebrate a range of identities. By avoiding the male/female label, these toys are designed to accommodate a greater variety of anatomical orientations are expressions. Brands that embrace fluidity and embody queer values are particularly sought after by Millennials and Gen Z. companies are defying convention by launching strapless unisex and dual-purpose toys. Effective community-driven marketing and representation are also advantageous for this category. This market is growing faster as inclusivity grows in importance as a motivator for purchases.

Why is medical-grade silicone the most dominant material in U.S. sex toys?

Medical-grade silicone dominates due to unparalleled safety, hygienic advantages, and skin-friendly texture. It is perfect for prolonged intimate contact because it is nonporous, odorless, and hypoallergenic. It's a realistic, supple, and soft feel that increases user comfort and fosters loyalty. To maintain trust and assure FDA compliance, silicon is a top priority for the majority of premium and mid-tier brands. Nowadays, 100 percent body-safe silicone is a popular marketing slogan. The longevity of silicon also supports a higher price and longer lifespan. It is the industry standard for reliable performance and high-end user satisfaction.

Sustainable & body-safe designer material reshaping material choices, with increasing demand for recycled, biodegradable, and plant-based materials. Consumers, especially Gen Z, prioritize ethical sourcing and environmental impact when choosing personal items. Designers are introducing materials like bio-silicon, glass, stainless steel, and even bamboo. These options offer luxury aesthetics while being eco-conscious. Paired with reusable packaging and minimalist design, these toys appeal to environmentally aware buyers. Sustainability is now seen as a core brand value, not just a trend.

Why is online retail and e-commerce the leading distribution channel in the U.S.?

Online retail & E-commerce dominate due to consumer preference for discreet judgment-free shopping and 24/7 accessibility. Websites offer verified reviews, product comparisons, and instructional content to assist users in making informed decisions. Due to convenience and health safety, digital channels were the go-to option both during and after the pandemic. AI-powered recommendations of loyalty plans and targeted marketing are further features of e-commerce. Brands can now use digital tools to optimize inventory, track behavior, and get feedback. Fast fulfilment, simple returns, and regular discounts are additional advantages of online sales. E-commerce is, therefore, the most favored and effective sales channel.

Subscription-based & direct to consumers are growing fast as consumers embrace curated experiences and personalized intimacy kits. Brands like Unbound and Maude offer monthly boxes featuring toys, lubricants, and accessories, boosting retention. These models remove the discomfort of in-store visits while offering discovery and convenience. D2C also empowers brands to build stronger customer relationships and gather first-party data. This allows for targeted offering, repeat sales, and upselling opportunities. With enhanced user engagement and storytelling, subscription models are redefining loyalty in sexual wellness.

Why do mid-tier products ($50-$150) dominate the U.S. sex toys market?

Mid-Tier ($50-$150) products dominate because they provide premium products at an affordable price, offering the best value performance ratio. In this market, consumers anticipate multifunctional design, waterproofing, medical-grade silicon, and rechargeable batteries, all of which are readily available here. By balancing innovation and cost, these toys appeal to both novice and seasoned users. Brands heavily advertise this category through gift kits, starter bundles, and internet advertisements. Couples and those who give gifts it to be the sweet spot. As the mass market norm, mid-market norm, and mid-tier toys have the highest rates of repeat business.

Luxury & designer products are booming as consumers seek high-end, wellness, integrated, and aesthetic experiences. These products feature sculpted design, whisper-quiet motors, customizable patterns, gold plating, or ergonomic elegance. They blur the boundaries between intimacy, beauty, and technology and are frequently marketed as lifestyle accessories. Consumers are prepared to spend more money on durable, aesthetically pleasing, and discreetly packaged goods. They have gained widespread recognition thanks to retail alliances with Goop, Saks, and Nordstrom. This market is expanding quickly among wealthy and image-conscious consumers as luxury self-care and sexual wellness combine.

By Product Type

By Gender Target

By Material

By Distribution Channel

By Price Range

July 2025

July 2025

July 2025

June 2025