July 2025

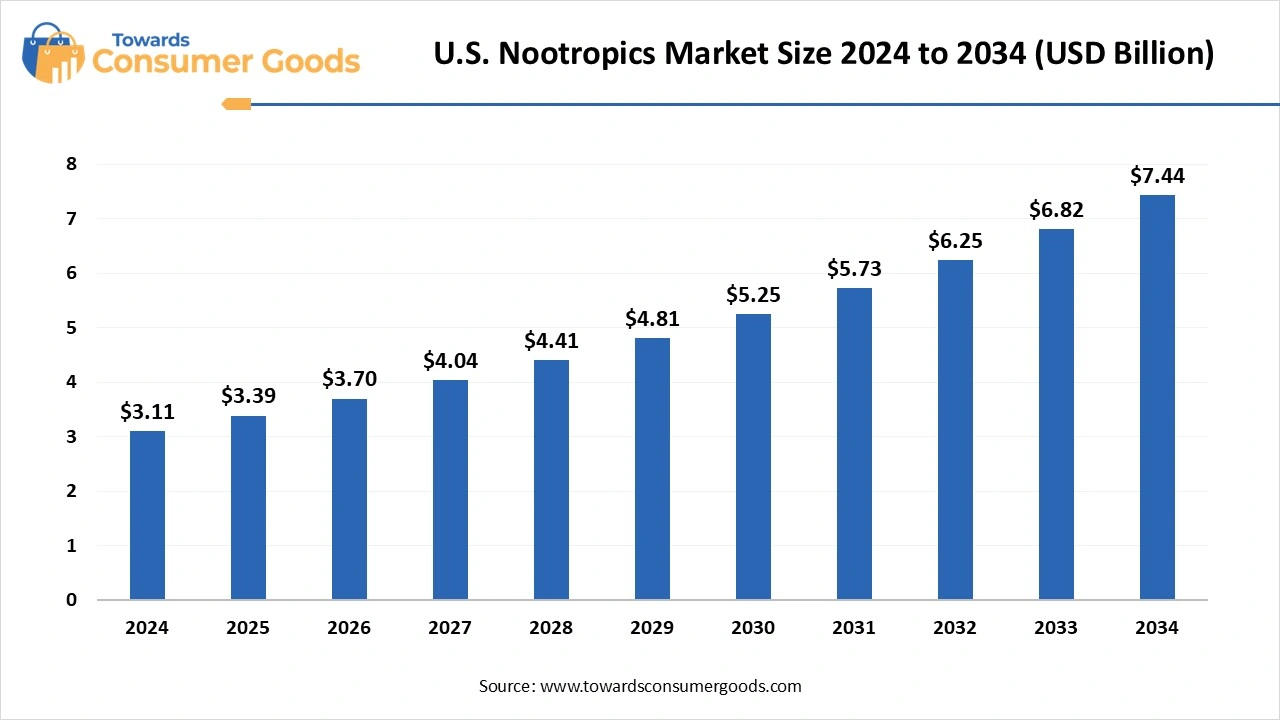

The U.S. nootropics market size accounted for USD 3.11 billion in 2024, grew to USD 3.39 billion in 2025, and is expected to be worth around USD 7.44 billion by 2034, poised to grow at a CAGR of 9.11% between 2025 and 2034. This market is growing due to increasing consumer focus on cognitive enhancement, mental clarity, and stress management in daily life.

The U.S. nootropics market refers to the market for cognitive-enhancing supplements, drugs, and functional products designed to improve mental functions such as memory, focus, creativity, motivation, and executive functions. These substances, also known as "smart drugs" or cognitive enhancers, span natural supplements, synthetic compounds, and prescription drugs. Nootropics are increasingly used by students, professionals, older adults, athletes, and health-conscious consumers seeking improved brain performance, mental clarity, and neuroprotection. The market is driven by rising stress levels, increasing awareness of mental health, aging demographics, and demand for productivity enhancement.

Under the 2025 FDA legislative proposals, the agency reiterated its push for a Mandatory Product Listing (MPL) system. If approved, this would require all dietary supplement manufacturers—including nootropics—to register products with the FDA before marketing, enabling more effective post-market surveillance and quicker removal of unsafe or misbranded items.(Source: www.foodnavigator-usa.com)

The HFP’s 2025 guidance agenda includes draft recommendations to improve the identification, safety assessments, and data requirements for New Dietary Ingredients (NDIs), including nootropic substances. The guidance aims to raise the bar on safety documentation and help companies align with FDA expectations.(Source: nutraceuticalbusinessreview.com)

| Report Attributes | Details |

| Market Size in 2025 | USD 3.39 Billion |

| Expected Size by 2034 | USD 7.44 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Form, By Application, By Distribution Channel, By End User, By Region (U.S. Only – Census Regions) |

| Key Companies Profiled | Onnit Labs, HVMN (Health Via Modern Nutrition), Nootrobox (now part of HVMN), Thorne HealthTech, Neurohacker Collective, TruBrain, Gaia Herbs, Zhou Nutrition, Jarrow Formulas, Natrol, Irwin Naturals, NOW Foods, Pure Encapsulations, BrainMD, Life Extension, Mind Lab Pro (by Opti-Nutra), Genius Brand, Performance Lab, Nootrogen, Nurofy |

Nootropics brands can tap into the growing functional food trend by incorporating cognitive-enhancing ingredients like L-tryptophan, ginseng, or lion’s mane mushroom into ready-to-drink beverages, coffees, teas, protein bars, and gummies. Customers who are concerned about their health and would rather sip or snack on their supplements than take pills or powders will find these handy formats appealing. Brands can establish themselves at the nexus of performance lifestyles and wellness by providing easy-to-use, delicious, and clean-label products. Working strategically with retail establishments, wellness cafes, or fitness centers can boost awareness and customer adoption even more.

One of the largest limitations in the United States. There is little scientific proof that many of the ingredients in nootropics are effective. There are established benefits to certain compounds, such as caffeine and L-theanine, but many others lack extensive peer-reviewed clinical trials. Furthermore, the FDA does not strictly regulate nootropics because they are frequently marketed as dietary supplements, which raises questions regarding the quality, safety, and deceptive claims of the products. This mistrust undermines consumer confidence and prevents widespread adoption. To establish credibility and prevent regulatory backlash, brands need to make investments in research and clear labeling.

The U.S. nootropics market is experiencing robust growth driven by the growing desire among students, working professionals, and wellness-conscious consumers for cognitive enhancement. Due to their hectic lifestyles and growing mental health issues, Americans are using supplements that improve their ability to concentrate, remember things, and handle stress. Especially through e-commerce and direct e-commerce, and growing mental health issues, Americans are using supplements that improve their ability to concentrate, remember things, and handle stress. Especially through e-commerce and direct-to-consumer channels, innovation in convenient formats like snack bars, gummies, and functional beverages is increasing consumer access. However, there are issues with safety and consumer trust due to the FDA's lax regulation and uneven scientific validation. Despite this, adoption in one of the most developed wellness markets in the world is still fueled by personalization, lifestyle positioning, and effective brand marketing.

Why are natural nootropics leading the market over synthetic alternatives in 2024?

Natural nootropics dominated the market with the largest market share in 2024, driven by the rising demand from consumers for adaptogenic herbal and plant-based ingredients such as Bacopa monnieri, ashwagandha, and ginkgo biloba. These products fit in nicely with the growing clean-label and wellness trends since they are thought to be safer and devoid of artificial additives. An additional factor driving demand is growing knowledge of holistic and traditional Ayurvedic health practices that prioritize cognitive well-being. Customers are increasingly linking natural products to longer-term safety and fewer adverse effects. Furthermore, a lot of brands are combining vitamins with herbal ingredients to increase the appeal of their products to a wider range of consumers.

Synthetic nootropics are expected to grow at the fastest rate in the upcoming years due to their targeted effectiveness, fast onset of action, and higher potency. Products like racetams, modafinil, and noopept are gaining traction among users seeking enhanced focus, memory, and learning capacity. These compounds are popular among students, professionals, and gamers aiming for performance enhancement. The growing availability of clinical data supporting efficacy is building trust, while newer compounds are being explored for mood enhancement and neuroplasticity. Many synthetic options are also becoming available as over-the-counter supplements in low dosages.

What factors make capsules and tablets the most dominant form in the nootropics market?

Capsules/Tablets dominated the market with the largest market share in 2024 because they are convenient, have a long shelf life, and allow for precise dosage control. These forms come in both prescription and over-the-counter forms, and they are generally accepted across demographics. They are the format of choice for regular users because they are also simple to incorporate into daily supplement regimens. To satisfy changing consumer demands, producers are experimenting with vegan-friendly formats of combo pills and delayed-release capsules. Furthermore, subscription services based on capsules are expanding, improving client compliance and retention.

Beverages & drinks are expected to grow at the fastest rate in the upcoming years, supported by demand for functional beverages like brain-boosting shots, nootropic-infused coffees, and energy drinks. The appeal lies in portability, taste variety, and quicker absorption. These formats resonate well with on-the-go consumers looking for mental clarity without taking pills. Crossovers with wellness beverages like kombucha, sparkling adaptogen drinks, and infused teas are fueling innovation. Major beverage brands are entering the nootropics space, expanding retail visibility through convenience stores, gyms, and cafés.

Why is attention and focus on the primary application in the nootropics market?

Attention and focus dominated the market with the largest market share in 2024 because gamers, students, and working professionals are looking for products that increase productivity, mental clarity, and concentration. Formulations that support these results frequently include ingredients like citicoline, L-theanine, and caffeine. Increasing stress levels and lifestyle demands, particularly in tech-driven, fast-paced environments, are driving the market. Increased digital fatigue and multitasking in daily life have highlighted the need for products that improve focus. Furthermore, to appeal to consumers who are productivity-focused, nootropics are being promoted as alternatives to prescription stimulants.

Anti-aging & neuroprotection is expected to grow at the fastest rate in the upcoming years as consumers who are health-conscious and aging look for long-term solutions for brain health. Particularly among senior citizens and wellness-conscious consumers, nootropics that lower oxidative stress, promote neurogenesis, and maintain memory are becoming increasingly popular. Targeted formulas to promote mitochondrial function and slow cognitive decline are being developed thanks to scientific breakthroughs. Professionals in their middle years who are actively addressing mental longevity are also adopting this segment. Demand for neuroprotective compounds is also being driven by more research that links inflammation in the brain to cognitive disorders.

Why does offline retail still dominate nootropics sales in the digital era?

Offline retail dominated the market with the largest market share in 2024 due to strong customer preference for in-person purchasing, especially at health stores, pharmacies, and supplement outlets. Shoppers often value expert recommendations and product trials, which build trust and support impulse purchases. Brick-and-mortar visibility remains a key advantage for well-known brands. Retail staff play a critical role in customer education and upselling high-margin products. Many shoppers prefer to see certifications (like non-GMO, vegan, or gluten-free) and feel more confident making supplement decisions in-store.

Online retail is expected to grow at the fastest rate in the upcoming years, driven by subscription models for the ease of home delivery and the availability of a large range of products. E-commerce is a potent medium for both niche and mainstream brands since consumers are depending more on price comparisons, influencer recommendations, and product reviews. Brands are successfully reaching new audiences thanks to the availability of targeted advertisements and SEO-optimized content. Consumer confidence in digital-first purchases is also being increased by online marketplaces through the use of third-party testing reports and verified purchase reviews.

What drives the dominance of working professionals in nootropics consumption trends?

Working professionals dominated the market with the largest market share in 2024 as they actively search for cognitive enhancers to boost energy concentration and stress reduction during long workdays. In the tech, financial, and creative sectors, interest in nootropics is fueled by the expanding culture of biohacking and performance optimization. These customers value outcomes above all else, and they frequently try stackable products for mood energy and sleep balance. The market has grown even more in the hybrid work era as professionals now manage their productivity outside of traditional office environments. Additionally, trends in corporate wellness are opening doors for employer-sponsored brain health programs.

Older adults (50+) are expected to grow at the fastest rate in the upcoming years as awareness about brain aging, cognitive decline, and dementia prevention rises. This demographic is increasingly turning to natural and clinically supported nootropics for memory support and neuroprotection, aided by physician recommendations and targeted marketing. Age-related anxiety over Alzheimer’s and mild cognitive impairment is encouraging preventive habits. Supplement brands are designing easy-to-swallow formats, low-stimulant blends, and co-formulated products with omega-3s or multivitamins to attract this demographic.

By Product Type

By Form

By Application

By Distribution Channel

By End User

By Region (U.S. Only – Census Regions)

July 2025

July 2025

July 2025

July 2025