June 2025

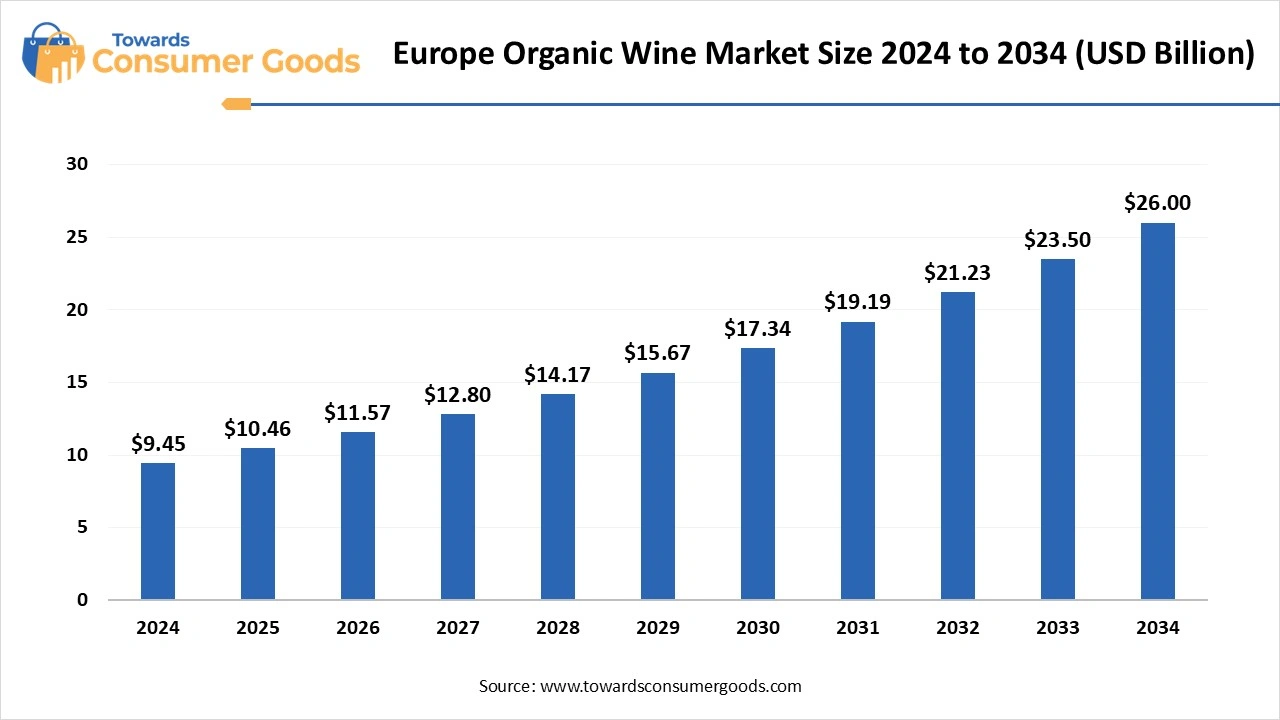

The Europe organic wine market industry is expected to grow from USD 9.45 billion in 2024 to USD 26 billion by 2034, reflecting a CAGR of 3.45%. The European organic wine market is poised for growth as the wine industry adapts to changing consumer preferences and increasing regulatory support for organic farming practices.

The Europe organic wine market refers to the production, distribution, and sale of wines that are cultivated without synthetic chemicals, pesticides, or genetically modified organisms (GMOs), and certified according to organic farming standards set by the EU and national authorities. Organic wines cater to growing consumer preferences for sustainability, health-conscious consumption, and environmentally responsible agriculture.

Europe is the world’s leading producer and consumer of organic wine, driven by established wine traditions, favorable regulations, and increasing demand for natural and premium beverages. The European organic wine market has been experiencing significant growth in recent years, driven by increasing consumer awareness of health and environmental issues. With a rich heritage in winemaking, Europe stands out as a leader in organic wine production, with countries like France, Italy, and Spain at the forefront.

The rising demand for organic products, coupled with a shift towards sustainable agricultural practices, has led to a marked increase in organic vineyard certifications and the availability of organic wines across the continent. As consumers become more discerning, they are seeking wines that not only taste good but also align with their values regarding sustainability and ethical production. The organic wine segment has evolved to accommodate this trend, with a diverse range of offerings that cater to various palettes and preferences.

Moreover, the region benefits from a robust distribution network, enhancing the visibility and accessibility of organic options for consumers. With a backdrop of centuries-old winemaking traditions, organic wines are gaining recognition for their distinct flavors and the absence of synthetic pesticides and fertilizers. This market not only represents a shift towards healthier consumption patterns but also reflects a broader commitment to sustainability and environmental stewardship.

| Report Attributes | Details |

| Market Size in 2025 | USD 10.46 Billion |

| Expected Size by 2034 | USD 26 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By End User, By Distribution Channel, By Drug Type, By Mechanism of Action, By Disease Stage, By Drug Class |

| Key Companies Profiled | Torres (Spain) , Château Maris (France) , La Rioja Alta S.A. (Spain) , Domaine Carneros (France) , Emiliana Organic Vineyards (Chile - European presence) , Tenuta di Arceno (Italy) , Weingut Clemens Busch (Germany) , Château de la Selve (France) , Domaine Zind-Humbrecht (France) , Avignonesi (Italy) , Albet i Noya (Spain) , Meinklang (Austria) , Domaine Bousquet (Argentina - strong EU exports) , Cantina Orsogna (Italy) , Giol Winery (Italy) , Domaine Jean Bousquet , Stellar Organics (South Africa - EU distribution) , Azienda Agricola Biodinamica San Michele (Italy), Mas de Gourgonnier (France) , Frey Vineyards (U.S. with EU presence) |

| 18-25 | 30-40 |

| The European organic wine market is gaining significant traction, reflecting a growing preference for sustainable and healthy choices among consumers. Many young adults are increasingly leaning towards organic wines, viewing them not just as beverages but as part of a lifestyle that emphasizes wellness and environmental consciousness. | This demographic often purchases organic wines for their unique flavors and the perceived health benefits associated with organic farming practices. The shift towards organic wines allows consumers to enjoy their favorite drinks while also supporting sustainable agriculture. Additionally, exploring different organic wine varieties can enhance their appreciation of the nuances in taste, thereby enriching their overall experience |

Focus on Health Conscious Consumers

The rising health consciousness among consumers, particularly among Millennials and affluent health-conscious individuals, presents a significant opportunity for the organic wine market. As these demographics increasingly prioritize sustainable and organic products, wineries can capitalize on the growing demand. The trend towards premium and boutique organic wines offers a chance for producers to diversify their portfolios. By creating unique blends and showcasing terroir-driven wines, brands can distinguish themselves in a competitive market. Adoption of innovative organic farming techniques and eco-friendly practices can enhance wine quality and sustainability.

Utilizing technology for better vineyard management can lead to higher yields and superior organic products. As online sales channels expand, wineries have a prime opportunity to reach a broader audience. Developing robust online marketing and distribution strategies can tap into the increasing preference for purchasing wine online. Supportive policies and regulations from the EU for organic farming practices create a favorable environment for organic wine producers, encouraging more vineyards to transition to organic methods.

Restraint

Organic wines often come with a higher price tag, which may limit their appeal to price-sensitive consumers. Economic downturns can exacerbate this challenge, as consumers may prioritize budget-friendly options over premium organic wines. The organic wine market can face challenges related to securing a consistent supply of organic grapes. Weather fluctuations and environmental factors can impact grape quality and availability, affecting production levels. Despite growing interest in organic products, there remains a significant portion of consumers unaware of the benefits of organic wine.

Overcoming barriers related to awareness and education is crucial for market growth. The dominance of established conventional wine brands and their marketing power can pose a challenge for organic wine producers. Convincing consumers to switch from familiar brands to organic alternatives will require significant marketing efforts. The process of obtaining organic certification can be costly and time-consuming for vineyards. These financial and bureaucratic barriers may deter some producers from transitioning to organic practices, limiting market growth. By strategically addressing these opportunities and challenges, stakeholders in the European organic wine market can navigate the evolving landscape and drive growth in this promising segment.

Why Southern Europe The Heart of Organic Wine Production?

In the realm of organic wine production and consumption, Southern Europe firmly holds the throne, capturing a significant market share in 2024. Countries like France, Italy, and Spain are not only celebrated for their rich winemaking heritage but also for their commitment to organic farming practices. The Mediterranean climate, with its warm summers and mild winters, provides ideal conditions for cultivating organic grapes. This established foundation has made Southern Europe the epicenter of organic wine culture, appealing to consumers who prioritize authentic flavors and sustainable practices. The passion for organic winemaking in Southern Europe is deeply rooted in tradition. Generations of vintners have embraced methods that respect the environment, using natural fertilizers, reducing chemicals, and promoting biodiversity in vineyards.

This connection to nature resonates with wine enthusiasts who seek products that not only taste good but also reflect the integrity of their origins. As sustainability becomes increasingly important in the global market, Southern European wines benefit from their longstanding commitment to organic techniques.

Festivals and events celebrating organic wine in countries like Italy and Spain are popping up, engaging consumers, and educating them on the benefits of organic consumption. These events serve as platforms for local producers to showcase their products, fostering community and building brand loyalty. The desire for organic wine is not merely a trend; it reflects a broader societal shift towards mindfulness and environmental stewardship, making the presence of these wines on the global stage more prominent than ever.

Why Northern Europe is a Rising Star in Organic Wine?

Northern Europe is emerging as a formidable contender in the organic wine market. With a projected rapid growth rate from 2025 to 2034, Northern Europe stands at the forefront of innovation and adaptation to consumer preferences. Countries such as Germany and the Nordic nations are redefining the organic wine landscape through their emphasis on quality and unique varietals, catching the attention of a new wave of wine drinkers eager for sustainable options. The shift towards healthier lifestyles and eco-conscious choices is resonating deeply with savvy consumers in the North. This demographic is not only interested in the provenance of their food and drink but also in how these products align with their values regarding health and sustainability.

As a result, Northern European producers are experimenting with indigenous grape varieties and sustainable practices, bringing unique flavors and styles to the market that distinguish them from their southern counterparts. the support from local governments and organizations in promoting organic farming practices is catalyzing this shift. Initiatives aimed at educating both producers and consumers about the benefits of organic wine are crucial for the region's growth. As awareness continues to increase, Northern Europe is likely to see a surge in demand, positioning itself as a key player in the global organic wine narrative.

Why is Still Wine a popular option and showcasing dominance in the market?

In the European organic wine market, the Still Wine segment continues to dominate due to its broad appeal and established consumer preferences. Still wines, characterized by their smooth texture and absence of carbonation, have long been favored by wine enthusiasts for their variety and complexity. This segment accounted for the largest market share in 2024, driven by the classic nature of still wines that match well with various cuisines and their deep-rooted presence in traditional winemaking regions. Consumers often appreciate the diverse flavors and profiles offered by still organic wines, ranging from light whites to robust reds, making them versatile choices for numerous occasions.

On the other hand, the Sparkling Wine segment is poised for remarkable growth in the coming years. As consumer tastes evolve, there is an increasing fascination with sparkling wines, particularly those produced using organic methods. Sparkling wines are often associated with celebrations and special occasions, but their popularity is also rising as consumers explore new tasting experiences and pairings. The growing trend towards health-conscious drinking has led to a rise in demand for organic sparkling options that promise quality without synthetic additives. This shift is particularly apparent among younger demographics, who are more likely to experiment with different wine styles and are drawn to products that align with their values of sustainability and authenticity as these dynamics unfold, the Still Wine segment remains a cornerstone of the market, while the Sparkling Wine segment is expected to gain momentum, offering exciting opportunities for producers and consumers alike.

Why Are Blended Wines Stirring Up a Storm in the Market?

Blended wines are dominating the market due to their balanced profiles, consistent quality, and wider appeal among both casual and seasoned wine drinkers. Winemakers expertly combine two or more grape varieties to enhance complexity and taste, allowing for versatility in both red and white blends. These wines are especially popular among large-scale producers and restaurants, as they offer consistency across batches and vintages.

Consumers also favor them for their affordability and approachability, especially when exploring new labels or pairings. Blended wines provide winemakers the flexibility to compensate for climatic or agricultural variability, helping maintain flavor stability. This adaptability translates into strong commercial viability, which is a key driver for their dominance in both domestic and export markets.

On the other hand, Single-varietal wines produced from a single type of grape are gaining rapid popularity among connoisseurs and millennials seeking authenticity and regional character. They offer a more transparent expression of terroir and winemaking style, making them a favorite among those who value individuality in every bottle. As wine consumers become more informed and curious, they increasingly seek labels that highlight specific grape varieties like Pinot Noir, Cabernet Sauvignon, or Chardonnay.

This educational and experiential appeal is driving demand for single-origin wines globally. The rise of wine tourism and sommelier culture has further bolstered the visibility of single-varietal wines. These wines are often tied to premium positioning and vineyard storytelling, which resonates well with discerning buyers looking for artisanal and origin-specific products.

Why Do Glass Bottles Still Reign Supreme in Wine Packaging?

Glass bottles continue to dominate wine packaging due to their perceived quality, tradition, and preservation advantages. For centuries, wine has been associated with glass, making it the gold standard in both visual presentation and functional integrity. From a storage and ageing perspective, glass offers the ideal oxygen barrier, allowing wines, especially reds, to mature gracefully.

Consumers still associate glass packaging with premium quality and authenticity, often preferring the familiar clink of the bottle for gifting or formal occasions. Sustainability efforts have also helped glass bottles remain relevant, with many producers now using lightweight and recycled glass to reduce their carbon footprint without sacrificing elegance. Despite growing interest in alternative packaging formats, glass bottles hold emotional and aesthetic appeal that continues to drive their dominance in both retail and hospitality sectors.

Moreover, Wine packaged in cans is witnessing explosive growth, driven by younger consumers and the rise of casual, on-the-go lifestyles. Lightweight, portable, and shatter-proof, cans offer convenience that aligns with picnics, festivals, and outdoor gatherings markets where glass bottles fall short. Cans are not only environmentally friendly due to their high recyclability but also cost-efficient in production and transportation.

This makes them ideal for emerging brands and experimental blends targeting price-sensitive yet quality-conscious audiences. Many consumers appreciate the smaller portion sizes that cans offer, encouraging sampling across varietals without committing to a full bottle. This aligns perfectly with the trend of mindful consumption and casual luxury. The market is also witnessing a rise in premium canned wine lines, breaking stereotypes about quality. As acceptance grows, cans are redefining how and where wine is enjoyed, making them the fastest-growing packaging type in today’s dynamic market.

Why Does the Mid-Range Wine Segment Hit the Sweet Spot?

Mid-range wines are dominating the market because they offer a balance of quality and affordability. Priced typically between USD 10–25, these wines attract a broad consumer base, from casual drinkers to enthusiasts looking for weekday indulgence. This price bracket is where many regional and global brands position their most versatile and accessible products. Mid-range wines often feature solid craftsmanship, enjoyable flavor profiles, and good branding, without the intimidation of ultra-premium pricing.

Retailers and restaurants often prefer mid-range labels due to their consistent movement and favorable margins. Their value proposition makes them highly competitive in both offline and online retail environments. With inflation-conscious consumers seeking quality without excess, mid-range wines remain the segment of choice, reliable, rewarding, and always within reach.

On the other hand, the premium wine segment is growing rapidly as consumers increasingly associate wine with lifestyle, sophistication, and personalized experiences. Often priced above USD 25–30, these wines appeal to discerning buyers who prioritize taste, origin, and exclusivity. Premium wines typically involve limited production, estate-grown grapes, and handcrafted techniques.

This artisan appeal, coupled with compelling narratives about vineyards and vintages, makes them stand out on the shelves and in cellars. As income levels rise and global palates evolve, there is a greater willingness to pay for premium experiences. Wine clubs, curated subscription boxes, and luxury hospitality also contribute to the visibility and sales of premium wines. This segment is particularly strong in urban centers and among millennials and Gen Z professionals who view wine as a cultural exploration. With aspirational branding and higher profit margins, premium wines are becoming the crown jewel of the modern wine economy.

Why Is the Offline Channel Still Pouring the Majority Share?

Despite digital advancements, the offline wine sales channel remains dominant due to consumer preference for physical interaction, trust, and curated recommendations. Wine is often an emotive purchase, and in-store experiences offer an immediate, tactile connection with the product. Specialty liquor stores, supermarkets, and duty-free outlets provide access to a wide range of labels along with expert advice, critical for buyers unsure about grape varieties, food pairings, or vintages. Tastings and displays further enhance the in-store wine journey. Restaurants, bars, and wine-tasting events also play a significant role in offline sales.

These environments not only drive awareness but also often influence repeat purchases based on positive dining experiences. Moreover, in many regions, regulatory barriers and logistics still favor offline transactions. This strong physical presence, especially in tier-one and tier-two cities, ensures that offline remains the backbone of wine commerce today.

Moreover, the online wine channel is experiencing meteoric growth, fueled by e-commerce convenience, wider selection, and targeted marketing. With just a few clicks, consumers can now access global brands, explore curated bundles, and read detailed tasting notes, something even physical stores often lack. COVID-19 acted as a catalyst, pushing both consumers and producers toward digital platforms.

Online platforms offer personalization, subscription models, and mobile app features that appeal especially to tech-savvy, younger demographics. Many wine brands are also embracing direct-to-consumer models, bypassing traditional distributors to build loyalty and transparency. These strategies, along with doorstep delivery and discounts, are transforming online into a thriving, mainstream channel.

How Millennials Driving the Organic Wine Revolution?

The organic wine market in Europe is witnessing a notable shift in consumer demographics, with Millennials (ages 25–40) leading the charge. This generation is not only dominating the market but also shaping its future direction. Millennials prioritize health, sustainability, and authenticity, which align perfectly with the principles of organic wine production. Their preferences for wines that reflect environmental consciousness and ethical farming practices are propelling organic wine sales to new heights.

Simultaneously, another segment experiencing rapid growth is that of affluent health-conscious consumers. This group is increasingly investing in premium organic wines that emphasize quality and craftsmanship. With their growing awareness of the health benefits associated with organic products, these consumers are willing to pay a premium for wines that align with their values. Their demand for sustainable and high-quality beverages is fueling innovation within the industry, encouraging wineries to enhance their offerings and adopt environmentally friendly practices.

By Disease Stage

By Mechanism of Action

By Drug Type

By Distribution Channel

By End User

June 2025

June 2025

April 2025