July 2025

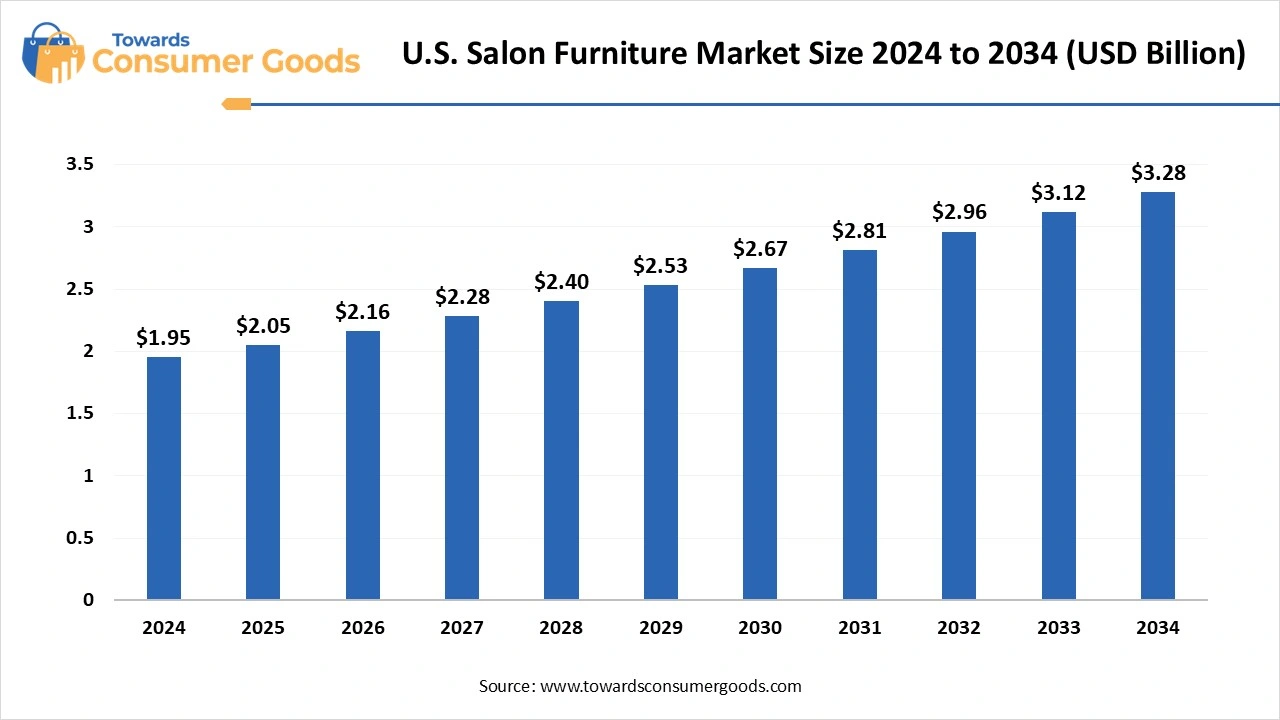

The U.S. salon furniture market size was accounted for USD 1.95 billion in 2024 and is expected to be worth around USD 3.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% during the forecast period 2025 to 2034. The demand for salon furniture in the country is increasing due to the rising growth of the beauty and personal care industry, mainly through the higher adoption of spas and salons.

Salon furniture is a specialized furniture designed for use in beauty salons, hair salons, barber shops, wellness centers and spas. This furniture and equipment are designed to improve the comfort of the clients, which also ensures the ergonomic needs of the professionals and technicians. There are various types of furniture, which include styling chairs, barber chairs, shampoo units, reception areas and many more.

The rising salon density in urban areas is one of the drivers that has managed to attract significant revenue in the country. The 2023 data by IBSI World also states that there are approximately 952,000 hair salons in the United States as of 2023. Cities like New York, Los Angeles, Chicago, and Houston are witnessing higher disposable income, which is providing several business opportunities for the salons and wellness centres in these areas.

| Report Attributes | Details |

| Market Size in 2025 | USD2.05 Billion |

| Expected Size by 2034 | USD 3.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Sales Channel |

| Key Companies Profiled | Takara Belmont Corporation, Maletti Group, REM UK Ltd, AgvGroup S.r.l., Collins, Minerva Beauty, GAMMA & BROSS S.p.A., Pietranera S.r.l., Salon Ambience, Nelson Mobilier |

Rising Popularity of Sustainable Furniture

The furniture industry in the U.S. has been witnessing rapid changes, like sustainable manufacturing and many more. This is attributed to the regulatory bodies in the country, which are promoting the use of renewable and recycled sourced materials. FSC certification for wood, bamboo and other metals has been made mandatory for businesses, which will help the companies and startups in the personal care and grooming industry grow. The U.S salon furniture market is expected to gain popularity as the salon chains are adopting these initiatives as a part of their brand management.

The professional settings in the United States usually use premium furniture like stylish chairs, backwash units and many more. The consumer preferences also attract demand for more customized salons, which are usually unaffordable for the startup companies. The U.S. salon furniture market may face certain challenges as the market competitiveness is increasing, which demands a customized and personalized service approach in spas and salons.

What made the styling & all-purpose chairs segment dominant in U.S. Salon furniture products?

The styling and all-purpose segment marked its dominance by generating the highest revenue share in 2024. These chairs are mainly used for purposes like hair cutting, coloring and other styling services. The dominance of the segment is attributed to the core need for chairs in every professional setting, like salons and spas. The majority of the services require this equipment, which also leads to the rising replacement rate due to frequent use.

The U.S. salon furniture market is growing significantly as owners are investing towards customer comfort-based chairs. The rapid growth in changing consumer preferences is also one of the major factors contributing towards the rising demand for premium chairs with an aesthetic appeal. The country is also witnessing a higher number of salon chains, which mandate the use of certain equipment like chairs in their settings.

The back bar and cabinetry segment is expected to grow at the fastest CAGR during the projected period of 2025 to 2034. These spaces are being adopted to manage the placement of shampoo stations, product display and many other more. The demand for these products is mainly driven by to rising number of personalized service setups in the U.S., contributing towards the adoption of clean and managed spaces.

These cabinets and spaces also allow the salons to attract more revenue through displaying various beauty and personal care products. There are many premium salons, which are attracting several demands through back bars integrated with built-in plumbing and lighting, making it more functional and appealing.

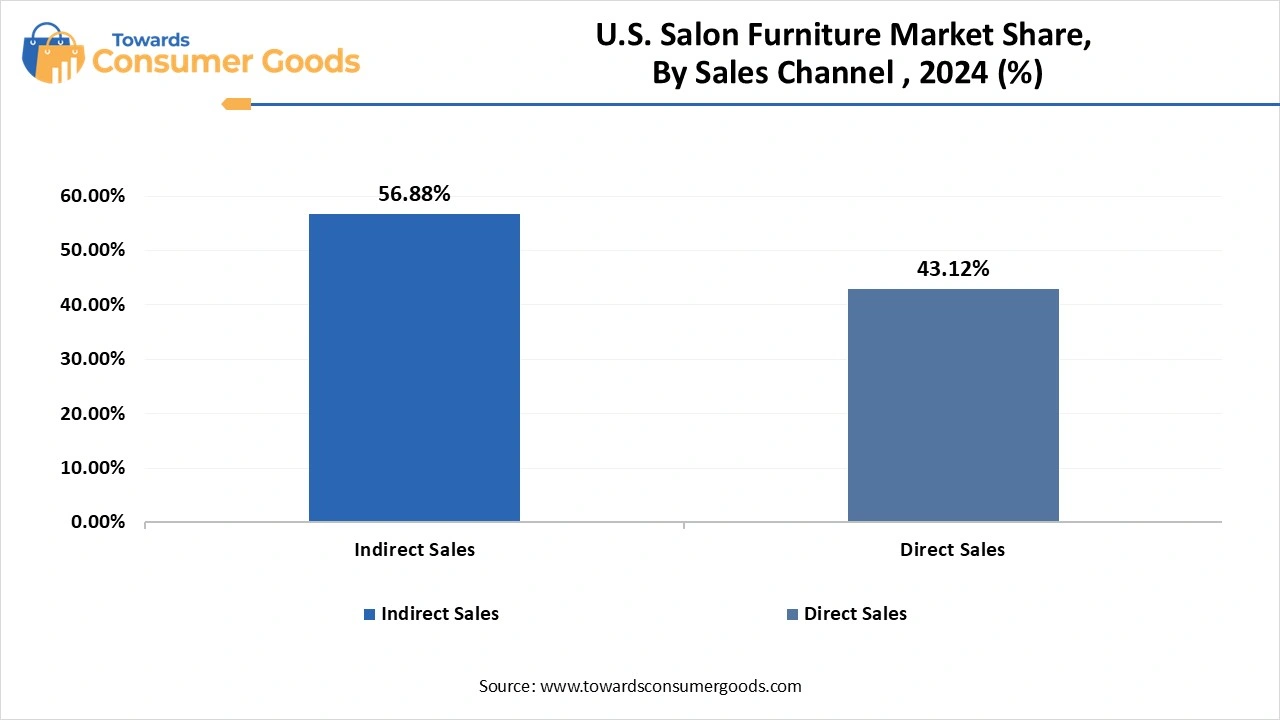

How did the indirect sales segment dominate the salon furniture in the U.S.?

The indirect sales segment marked its dominance by generating the highest share of revenue in 2024. The sales channel includes distributors, retailers and wholesalers and third-party online platforms like Amazon, Wayfair and others. The dominance of the segment is attributed to the wider distribution network, which helps in purchasing a wider range of products from multiple brands.

Shopping from these channels has become easier due to the rising number of social media users in the United States, attracting a huge demand for many market players. The U.S. salon furniture market has managed to attract wider growth due to higher discount rates, which helps in attracting startup salons and wellness centres. Moreover, the wholesalers are also collaborating with the salon chains, contributing revenue through bulk purchases.

The direct sales segment is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2034. The segment deals with purchasing furniture from the manufacturer or the brand. The growth of the segment is attributed to the rising demand for customization of furniture, according to the themes or aesthetics of the settings.

The rising market competitiveness in the U.S. has been attracting more sales through direct channels, to attract more revenue. The manufacturers are also gaining wider popularity as it helps them in increasing their profit margins. The rise of premium and franchise salons is expected to increase the collaborations with brands, which helps both to improve their brand image in the personal care and wellness industry.

DIR Salon Furniture

SalonCentric

By Product

By Sales Channel

July 2025

July 2025

July 2025

June 2025