July 2025

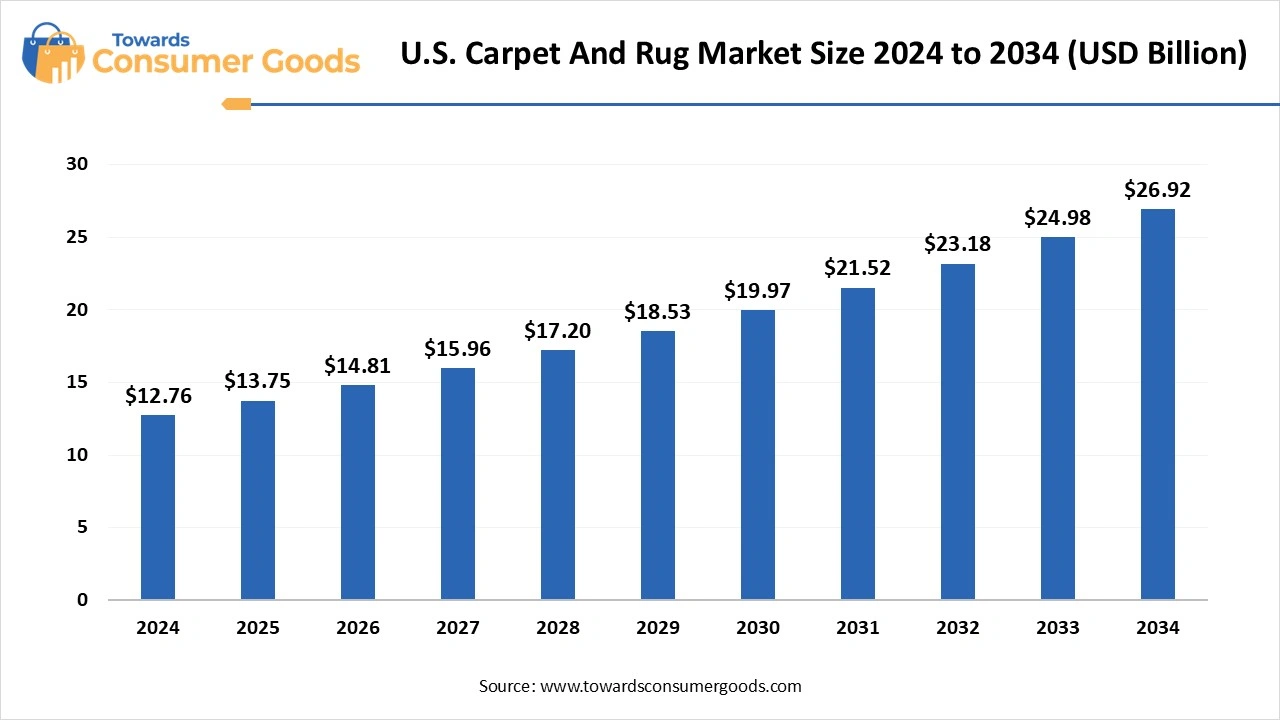

The U.S. carpet and rug market size was estimated at USD 12.76 billion in 2024 and is predicted to increase from USD 13.75 billion in 2025 to approximately USD 26.92 billion by 2034, expanding at a CAGR of 7.75% from 2025 to 2034. The demand for carpet and rugs in the U.S. is increasing due to the rising number of residential and commercial construction projects.

Carpet and rugs refer to textile and floor coverings, which differ in sizes, installation and usage. A carpet is a large floor covering which is often installed across the entire floor of a room. Carpets are often adopted in the bedroom, hallway, hotels or offices to enhance the aesthetic appeal and thermal comfort of individuals. On the other hand, a rug is a smaller and movable piece of carpet, which is used as a decorative piece to cover a portion of a floor. They are commonly used to highlight the furniture in the room.

The rising home remodelling and renovation trends in the country are one of the major drivers that have led to the rising popularity of various home décor items, including textiles. The U.S. carpet and rug market is growing rapidly as the houses in the country are witnessing an aging housing stock. This is promoting the growth through digital platforms like Houzz, Wayfair, Pinterest and many more, which are inspiring the owners to adopt rugs and carpets in their renovation process. The rising disposable income is also expected to increase the consumer spending on comfort and aesthetics.

| Report Attributes | Details |

| Market Size in 2025 | USD 13.75 Billion |

| Expected Size by 2034 | USD 26.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Material, By End User |

| Key Companies Profiled | Shaw Industries Group, Inc., Milliken & Company (Flooring Division), Tarkett North America, J+J Flooring Group (Division of Engineered Floors), The Dixie Group, Inc., Mohawk Industries, Inc., Interface, Inc., Engineered Floors, LLC, Nourison, Stanton Carpet Corporation |

The American consumer base has been highly preferring sustainable and eco-friendly consumer goods in recent years. The U.S. carpet and rug market is growing rapidly as the government and regulatory bodies are implementing policies like the U.S. EPA Safer Choice Program to push the use of greener materials. The rising support is also adopting many changes from the U.S.-based startups, which will help them in their initial years. Moreover, the corporate sector is also adopting the use of sustainable products, which will help them grow more rapidly in the future. The growing Millennial and Gen Z population is expected to play a crucial role in promoting the sustainable shift in the U.S.

The production of rugs and carpets is mainly dependent on various materials like synthetic fibres and natural fibers like PET, Olefin, Wool, Jute and many more. The current tariff war in the U.S. has been a major restraint on many industry players, due to higher import costs. These factors are affecting the profit margins of the companies, which is leading towards the rising cost of the overall products. The majority of the affected businesses are small and mid-sized companies due to lower financial stability.

What made the tufted segment dominant in carpet and rugs in the U.S. in 2024?

The tufted carpet and rugs segment marked its dominance by generating the highest revenue share in 2024. These carpets and rugs are made by inserting yarn into fabric backing using a tufting machine. The dominance of the segment is attributed to the high production volume of tufting manufacturing carpets and rugs in the country.

The U.S. carpet and rug market has been dominant over the past years, with a production rate of 90% tufted carpets in the country. These textiles can mimic other loop, frieze and cut pile carpets at lower costs, which helps in targeting a wider number of residential and commercial populations. The higher usage volume is attributed to the affordable pricing of these tufted carpets in the country.(Source: abc-oriental-rug.com)

The knotted segment is seen to grow at the fastest CAGR during the forecast period. These products are handmade by tying yarn around the warp threads on a loom, gaining popularity as a luxury textile in the U.S. carpet and rug market. The majority of the growth is attributed to the rising demand for artisan and luxury products among American consumers. The higher disposable income of these individuals is also one of the major factors that allows them to purchase these luxurious products. Moreover, the rising home renovation trends are expected to attract a wider consumer base in the coming years.

How did polyester segment dominate the material in U.S. carpet and rugs in 2024?

The polyester segment stood as the dominant one by generating the highest revenue share in 2024. The material is a synthetic fibre made from petroleum-based polymers. The dominance of the segment is attributed to the cost-effectiveness of the material, which helps in targeting the budget-conscious population. The rising advancements in the polyesters are offering stain and water resistance properties, which are playing a crucial role in the adoption by families having kids and pets. Moreover, the material has managed to gain significant popularity due to its recyclability and eco-friendly appeal in recent years.

The wool segment is anticipated to emerge at the fastest CAGR during the forecast period of 2025 to 2034. The material is a natural fibre, sourced from sheep, mainly used in knotted or woven products. The growth of the segment is attributed to the durability and longevity of the carpets, which provide a better ROI for commercial and some residential settings. The U.S. carpet and rug market is expected to grow due to a greater demand as the American population is preferring natural and biodegradable materials like wool.

The companies are also promoting these products as a part of their marketing strategy, which has managed to attract the majority of the consumers in the country. Additionally, the homes in the United States usually prefer temperature-regulating textiles, which will lead the market growth in the future.

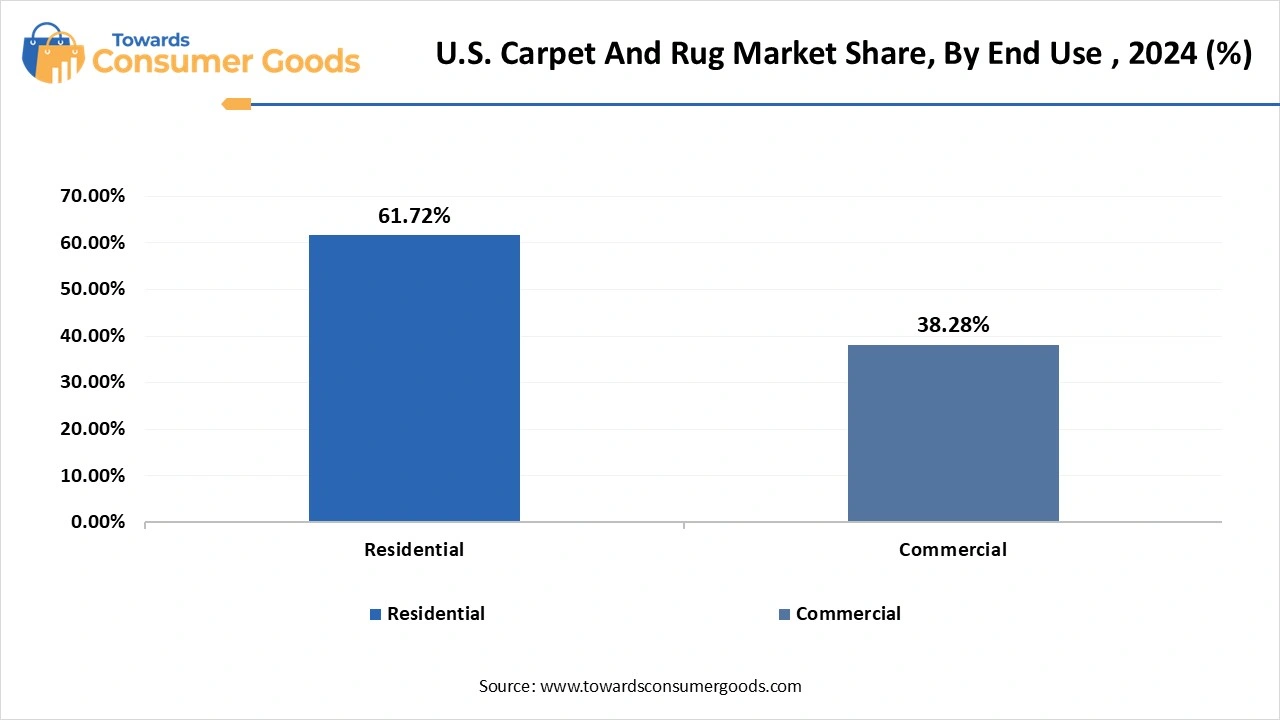

How did the residential segment dominate in the carpet and rug sales in the U.S. in 2024?

The residential segment generated the largest revenue share in 2024. The dominance of the segment is attributed to the rising residential construction rate in the country. For instance, in 2024, a total of 1,627,900 residential housing units were completed in the USA, representing a 12.4% increase compared to the 1,448,800 units completed in 2023. The usage of carpets and rugs is widely popular in bedrooms, living rooms and stairways due to a higher preference for comfort and aesthetic appeal. Moreover, the companies in the U.S. have an upper hand in the production cycle, which makes these products affordable due to less import reliance from other countries.

The country is also witnessing a wider demand for home renovation trends, mainly influenced by social media platforms. The expansion of e-commerce platforms in the country is also expected to lead to the market growth rate in the future.(Source: www.housingwire.com)

The commercial segment is expected to grow at the fastest CAGR during the projected period of 2025 to 2034. The growth of the segment is attributed to the rising hotel construction in the country. The data by the American Hotel and Lodging Association states that, as of September 2024, the U.S. hotel pipeline had 157,253 hotel rooms under construction, marking a 7% year-over-year increase. Additionally, 268,190 rooms were in the final planning stage (up 10.4% year-over-year), and 336,205 rooms were in the planning stage (up 38.4% year-over-year).

These commercial settings have seen a rapid increase in the past few years, which has also resulted in rising market competitiveness. The U.S. carpet and rug market is expected to witness higher demand as the companies are keen on investing in luxurious products in hotels, offices, resorts and other commercial facilities. The higher product volume and purchasing power will help the market grow more rapidly in the future. (Source: www.ahla.com)

Natco Home

Interface

By Type

By Material

By End User

July 2025

July 2025

July 2025

June 2025