July 2025

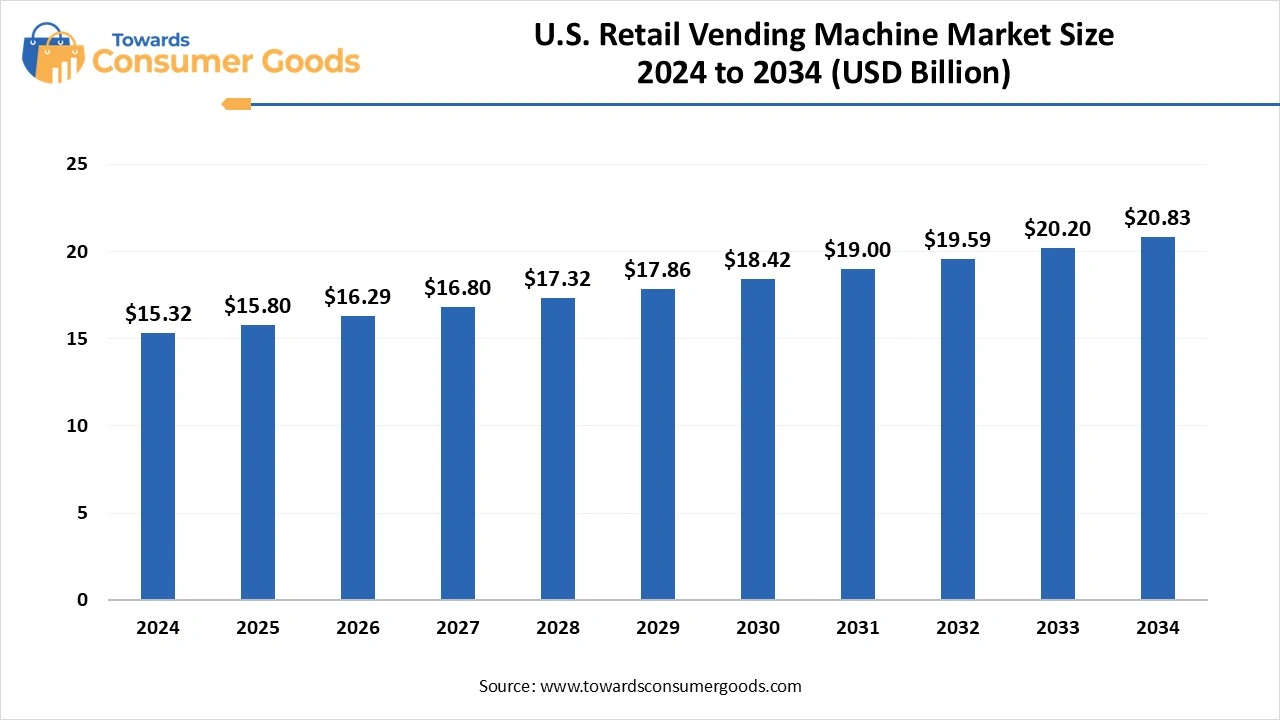

The U.S. retail vending machine market size was valued at USD 15.32 billion in 2024 and is expected to reach around USD 20.83 billion by 2034, growing at a CAGR of 3.12 % from 2025 to 2034. This market is growing due to rising demand for convenience across retail touchpoints, and advancements in smart vending technologies.

The U.S. vending machine market is transforming with the integration of cashless payment solutions, AI-driven inventory management, and more helpful product selections. Intelligent systems that can monitor customer behavior and replenish requirements are replacing traditional vending setups. Demand is further fueled by the expanding urban workforce and their preference for contactless and speedy solutions. Vending has expanded its reach to include electronics personal protective equipment (PPE) CBA products and cosmetics in addition to beverages and snacks.

The preference for seamless shopping experiences is growing among urban consumers. Without the need for human interaction, vending machines provide 24/7 access to a large selection of goods. Concerns about hygiene following the pandemic have increased the use of touchless and app-based bending machines. Customer engagement is increased through integration with dynamic pricing features and loyalty programs. To increase foot traffic and convenience, businesses and educational institutions are using vending machines to offer curated or subsidized product ranges.

| Report Attributes | Details |

| Market Size in 2025 | USD 15.80 Billion |

| Expected Size by 2034 | USD 20.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.12% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Location, By Payment Mode, By Geography |

| Key Companies Profiled | Azkoyen Group, U-Select-It (USI), Royal Vendors, Inc., Glory Ltd., Vending.com, Seaga Manufacturing Inc., Orasesta S.p.A, Incredivend, Fuji Electric Co., Ltd., Automatic Merchandising Systems (AMS), Express Vending, DGA Vending GmbH |

Strategic placement in co-working spaces of fitness centers and apartment buildings allows small to mid-sized vendors to grow. Collaborations with regional brands enabled the creation of carefully chosen products based on consumer preferences. Using integrated software to leverage customer data aids in personalizing promotions. App-based machine locators and subscription-based refill services increase user retention. Furthermore, brands can set themselves apart with gamified loyalty programs, limited-time sales, and environmentally friendly packaging.

Recurring expenses for vending machine maintenance include software updates, maintenance, and restocking. Profit margins are also impacted by location leasing costs in desirable metropolitan areas. Theft and vandalism are still issues, especially in unattended public areas. Brand reputation and retention may be impacted by technical issues and customer discontent brought on by out-of-stock merchandise or unsuccessful payments. Compliance becomes more complicated due to regulatory scrutiny surrounding the sale of age-restricted goods like alcohol and CBD.

The U.S. retail vending machine market is experiencing strong growth, driven by rising demand for convenience, health-focused products, and smart technology integration. The market is quickly embracing innovations like touchless interfaces, real-time inventory tracking, and cashless payments, and it holds a dominant share in North America. Business industrial and healthcare settings have a strong demand for beverage and food vending machines, particularly those that provide fresh gourmet and healthier options.

Because of the market's potential for passive income and low startup costs, it also offers entrepreneurs an alluring opportunity. Vending machines are extending their product offerings beyond snacks to include meals electronics and cosmetics as consumer preferences shift toward a wider variety of sustainable products making the U.S. pioneer in the development of automated retail.

Which Type of Product Dominates the U.S. Retail Vending Machine Market?

Beverage continues to dominate the U.S. market due to their extensive use in workplaces educational institutions fitness centers and transit hubs. The need for easy access to energy drinks, soft drinks, and bottled water is the source of their steady demand. Their market position has been further reinforced by technological developments like digital displays and energy-efficient cooling systems. Additionally, alliances with well-known beverage companies guarantee a consistent flow of well-liked beverages that satisfy a wide range of consumer preferences.

Snacks are emerging as the fastest-growing segment, driven by a rising demand for healthy and portable food options. These machines accommodate contemporary dietary trends with their growing product lines, which now include baked alternatives, gluten-free products, and protein snacks. The growing demand from consumers for quick yet wholesome snack options is reflected in their expanding installation in offices, classrooms, and fitness facilities. Also, operators can stock popular items and reduce waste by integrating AI-driven inventory management.

Which Locations are Driving the U.S. Retail Vending Machine Market?

Manufacturing facilities vending machines are most dominant in manufacturing and industrial settings, where they serve as a critical convenience for employees working in shifts and remote areas with limited food service options. Vending machines are essential to these settings because they offer steady access to snacks and drinks which boosts output and employee happiness.

Energy and hydration needs are met by the majority of machines in these areas which are stocked with both conventional and useful items. In addition to promoting the longevity and upkeep of vending machines, the controlled indoor environments make them the perfect high-return locations for operators.

Public places such as shopping malls, airports, train stations, and parks are the fastest-growing locations for vending machine installations. Frequent use and impulsive purchases are made possible by the high foot traffic in these areas. The number and popularity of vending machines in public areas are rising quickly as urban areas continue to grow, and digital payment integration becomes more common.

A few examples of innovative formats are smart kiosks, and specialty vending machines are being tested to appeal to a variety of consumer segments (e.g. electronics, cosmetics, or fresh foods.)

Which Payment Mode Dominates the U.S. Retail Vending Machine Market?

Cashless payment systems dominate the U.S. retail vending machine market, driven by the extensive use of contactless payment methods credit/debit cards, and mobile wallets. These systems improve user convenience, speed up transactions, and provide improved hygiene, particularly in the wake of COVID-19. They also give operators the ability to track inventory remotely, monitor sales, and obtain real-time insights into customer behavior. Repeat use is also encouraged by app promotions and loyalty integrations. In urban and affluent areas cashless vending is the preferred method since it fits with today's consumer's digital-first mentality.

Cash segment is the fastest growing in some demographic pockets, especially in rural areas. The cash segment continues to grow at the fastest rate despite the trend towards cashless transactions. Due to limited access to digital literacy and banking infrastructure, many consumers in these regions still rely heavily on cash for daily transactions. In response, operators are bringing back or keeping dual-mode payment devices that take both credit and debit cards. The placement of vending machines in places like community centers, laundromats, and transit stations where cash use is still common also has an impact on growth. Ensuring full market reach requires maintaining accessibility for all customer segments.

By Location

By Payment Mode

By Geography

July 2025

July 2025

July 2025

June 2025