July 2025

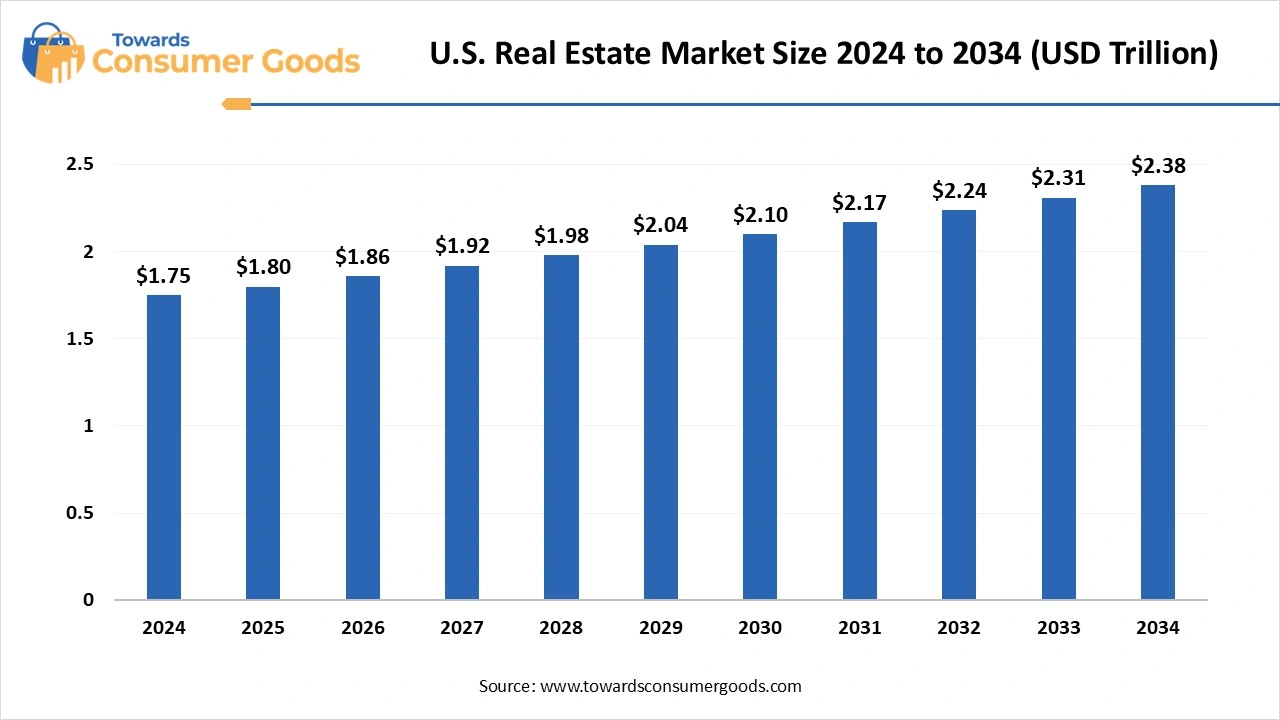

The U.S. Real Estate market size was valued at USD 1.75 trillion in 2024 and is expected to hit around USD 2.38 trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.11% over the forecast period 2025 to 2034. This market is growing due to increasing demand for housing driven by low mortgage rates and demographic shifts.

The U.S. real estate market is experiencing a shift toward stabilization, marked by a modest decrease or stabilization in home values because of growing mortgage rates and difficulties with affordability. While sales activity has slowed down in comparison to prior years, inventory levels have increased, providing buyers with more options. Price declines are still occurring in some coastal cities while Sun Belt markets like Dallas and Florida are exhibiting resilience. As the market strikes a balance between supply and demand amidst continuous regulatory and economic changes, this environment is opening new opportunities for financially prepared buyers.

How do higher mortgage rates affect home buyers?

A higher mortgage rate raises borrowing costs, making monthly mortgage payments more costly for homebuyers. As a result, many buyers might have trouble affording the homes they want or might have to search for less costly options. Slower home sales and occasionally stabilizing or declining home prices can result from this decrease in the overall demand for homes. Higher rates frequently require careful budgeting and more time to make decisions before purchasing for those who are still able to obtain loans.

| Report Attributes | Details |

| Market Size in 2025 | USD 1.80 Trillion |

| Expected Size by 2034 | USD 2.38 Trillion |

| Growth Rate from 2025 to 2034 | CAGR 3.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Property, By Type, By Geography |

| Key Companies Profiled | Prologis, Inc., American Tower Corporation, Equinix, Inc., Welltower Inc, Simon Property Group, Inc, Public Storage, Digital Realty Trust, Inc, Realty Income Corporation, AvalonBay Communities, Inc, CRBE Group, Inc., Equity Residential |

How can buyers use more homes for sale to get better deals on today's market?

Buyers can use the larger number of homes for sale to their advantage by having more choices and bargaining power. Customers can compare costs, bargain for better offers, and take their time in search of a house that suits their needs and budget when they have more options. Buyers can find value in the market at this time because there is less competition which may lead sellers to offer incentives or lower prices. To find the ideal fit, buyers can also investigate various neighborhoods and property types. Having patience and knowledge enables buyers to avoid overspending and make better choices.

There are still not enough affordable homes available in many important markets despite an increase in the overall housing inventory. Entry-level purchasers are left behind as builders frequently concentrate on more upscale or luxurious homes. Families with lower and middle incomes find it difficult to find acceptable housing because of this shortage. Lack of reasonably priced options may force purchasers to relocate to less desirable areas, lengthening commutes and lowering the standard of living. Resolving this imbalance is essential to the long-term viability of the market.

The U.S. real estate market continues to be one of the largest and most dynamic globally, supported by strong economic fundamentals, a large population base, and diverse property types. Due to steady demand from first-time homebuyers' urban migration and supportive government policies, residential real estate dominated the market in 2024. Due to the influx of people with affordable housing and employment opportunities, areas like Texas, Florida, and North Carolina are experiencing rapid growth.

As e-commerce and supply chain investments grow, commercial real estate, especially logistics and warehouse spaces, is growing quickly. In the meantime, the rental housing market has been further stimulated by rising further stimulated by rising mortgage rates which have made renting more alluring. Across states, the use of technology is changing how buyers and sellers behave.

Examples of this include digital closings and virtual tours. All things considered, the U.S. although the real estate market exhibits significant regional variances is resilient and offers fresh chances for investment in both the residential and commercial sectors.

Why did the residential property segment dominate the U.S. real estate market in 2024?

Homes are a basic need; residential properties are always in demand. More people are searching for long-term stable housing, particularly young buyers and families. Home loan programs and tax breaks are examples of government assistance that make homeownership simpler due to the consistent demand. The residential market continues to be the largest segment of the real estate market. In secondary cities and suburbs, demand has also increased due to trends toward remote work and growing urbanization. Due to their consistent returns and reduced risk when compared to commercial spaces, residential properties are also preferred by investors.

Commercial type segment is anticipated to witness the fastest growth over the forecast period as businesses grow and adjust to new economic trends. The commercial real estate segment is the one with the fastest rate of growth. This expansion is being driven by the growing demand for retail establishments, industrial warehouses, and office space. Due to increased investments in logistics facilities and distribution hubs brought about by the growth of e-commerce and supply chain demands, commercial real estate is now a dynamic and quickly changing market segment.

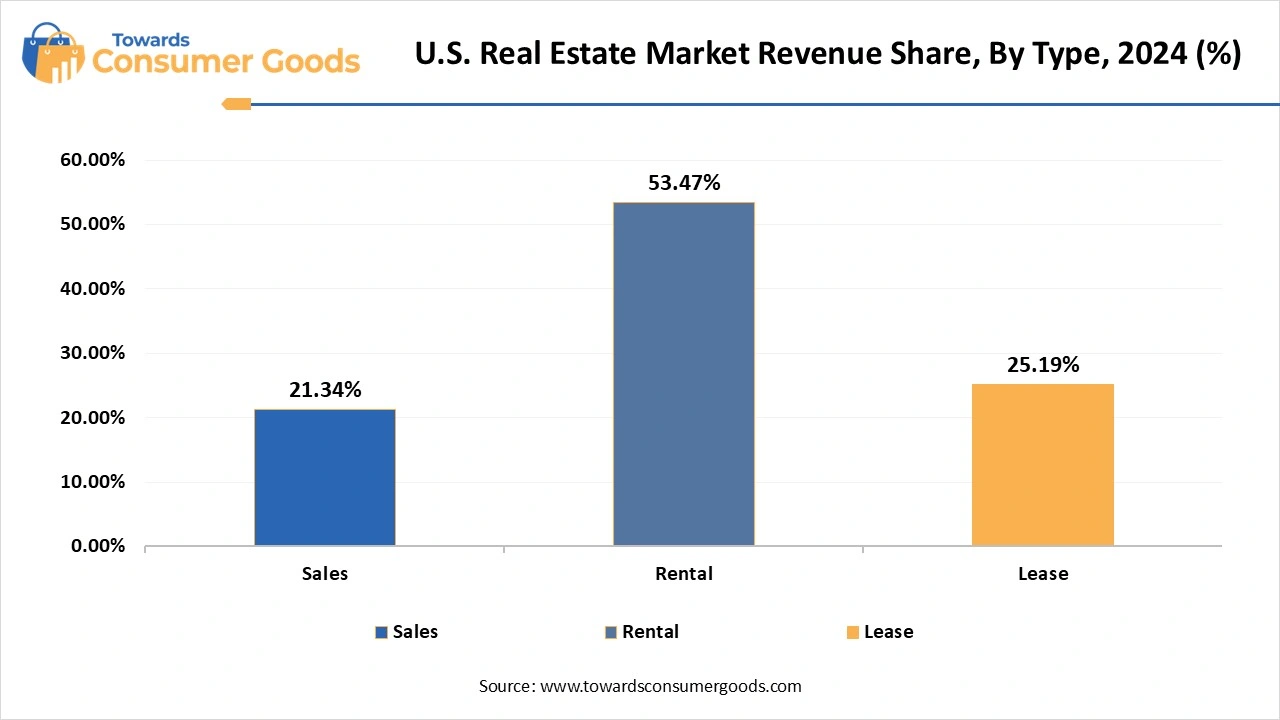

What makes the rental model the dominant choice in real estate market?

The rental model is popular because it offers flexibility, especially for people who move often or can't afford to buy a home. Renting is preferred by many students and young professionals because it involves fewer obligations and lower upfront expenses. Due to the extremely high cost of homes in cities, renting is frequently the only reasonably priced option. Additionally, more people are renting rather than buying due to rising mortgage rates. As a result, a significant portion of the population now prefers rental housing.

Lease industry segment is anticipated to witness the fastest growth of businesses looking for flexible real estate options without the long-term responsibilities of ownership driving the rapid growth of the lease industry segment. Businesses can react quickly to shifts in the market by scaling up or down through leasing. This flexibility supports the expansion of leased office and industrial spaces, which is especially appealing in the commercial real estate market.

By Property

By Type

By Geography

July 2025

July 2025

July 2025

June 2025