July 2025

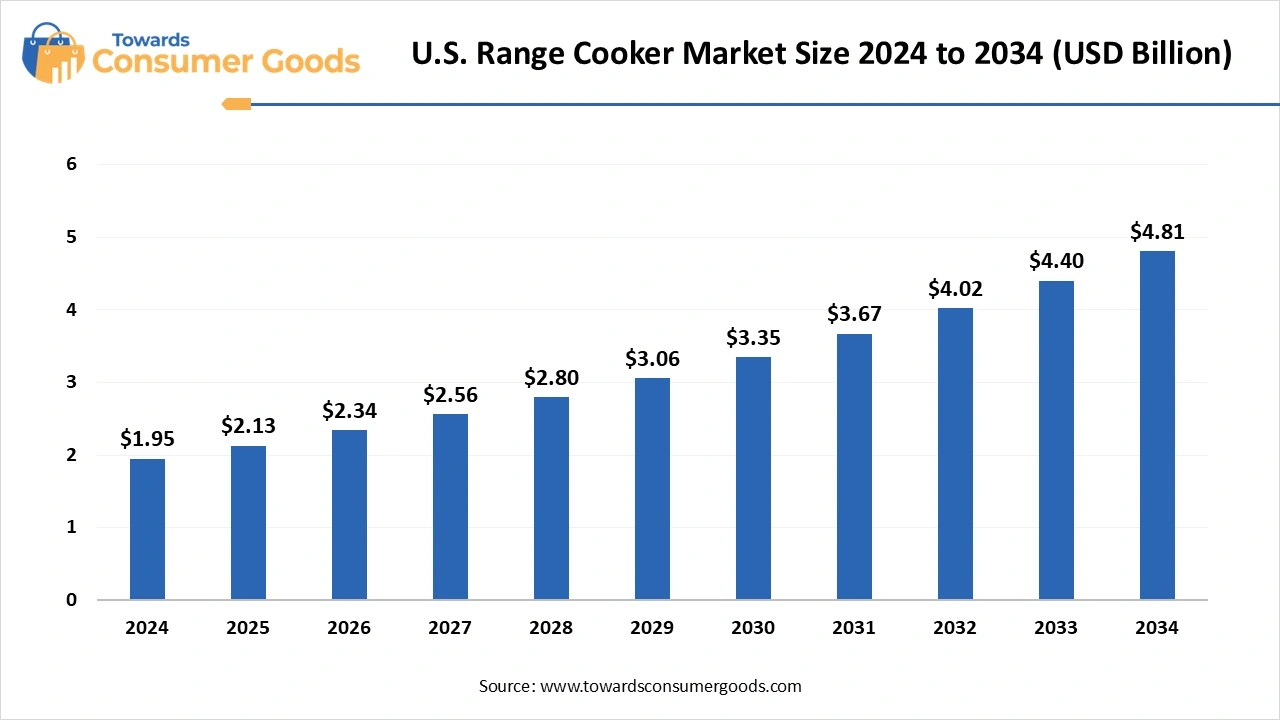

The U.S. range cooker market accounted for USD 1.95 billion in 2024 and is expected to reach around USD 4.81 billion by 2034, with a CAGR of 9.45% from 2025 to 2034. The demand for range cookers in the country is increasing due to rising kitchen renovations, which are promoting new concepts in urban living.

A range cooker refers to a freestanding kitchen appliance which is a combination of a stove (cooktop) and oven. The appliance is usually larger than the standard setups, as it covers multiple cooking tasks at once. These appliances contain multiple ovens, like conventional, grill compartment, fan, and warming drawer, which can be further used in several tasks. The demand for these cookers is rapidly increasing due to the rising number of large families and the influence of cooking culture in the United States. The demand is leading towards the innovation of various fuels, including electric, gas, and dual (electric + gas).

The rising home renovation trend in the U.S. is one of the major drivers that is attracting significant revenue in the kitchen and home appliances. The report by South Alabama reported that the homeowners in the U.S. spent a median of around $24,000 in 2023, which is a rapid increase of 60% increase from 2020. The individuals are more likely to invest in long-term and durable appliances, which increases the demand for the U.S. range cooker market. The leading companies are expanding their digital presence, which is helping them to attract consumers at a rapid pace. The real estate trends are also anticipated to shift the demand for urban kitchens sized appliances which can be used on a large scale.

| Report Attributes | Details |

| Market Size in 2025 | USD 2.13 Billion |

| Expected Size by 2034 | USD 4.81 Billion |

| Growth Rate | CAGR of 9.45% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | United States |

| Segment Covered | By Size, By Prize Range, By Application, By Distribution Channel, By Region |

| Key Companies Profiled | Amana, GE Appliances, SAMSUNG, Premier Marketing, Monogram, LG Electronics, Frigidaire, VIKING RANGE, LLC, THERMADOR, Dacor, Inc., Whirlpool |

Smart Kitchen Integration in the U.S.

The rapid technological adoption in kitchen appliances is playing a transformative role in enhancing consumer cooking experiences. The U.S. range cooker market is anticipated to emerge rapidly as families are adopting convenience-based solutions in their daily lives. The integration of smart systems is enabling individuals to use these appliances through their smartphone applications. Consumers can use these apps for preheating their ovens, using them remotely and also enabling alerts in case of any adjustments.

The rising disposable incomes in the country are boosting the consumer expenditure capacity on these smart kitchen appliances. The hectic work schedules are also expected to raise the demand for dual cooking appliances in the country. Additionally, the United States regulatory bodies are focused on introducing energy-efficient features, for which they are mandating eco-cooking modes in most of the new appliances.

GE Appliances has a product line of smart ranges, which has Wi-Fi connectivity, voice control, scan-to-cook technology, and no preheat air fry. The product is effectively helping families in the U.S. manage their cooking tasks in their daily routines.

Space Concerns in Urban Houses

The United States has gained significant popularity in the smart home appliance adoption due to their standard of living in the developed regions. The U.S. range cooker market may face certain challenges due to the higher urban living concept in cities like New York, San Francisco and others, which have limited kitchen spaces. The limited space availability restricts these families from adopting these appliances, as it requires remodelling and layout changes in these settings. The rising population in these areas is also expected to affect the modern-day housing sizes.

The 30-inch segment marked its dominance by generating the largest revenue share in 2024. The dominance of the segment is attributed to the higher popularity of the suburban apartment houses. The U.S. range cooker market is expanding rapidly due to the rising demand, which is boosting the product availability in many channels. The suburban demand is also marking significant changes towards the introduction of affordable products in different price ranges, helping to target a broader audience.

The commercial startups are also adopting these size ranges to manage their tasks effectively. Additionally, the smart upgradations in the U.S. are also boosting the demand for 30-inch ranges as they perfectly fit in the existing kitchen settings.

The above 30-inch segment is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising home renovations that are demanding spacious kitchens. These factors are significantly raising the demand for premium range cookers in large-sized families. The U.S. range cooker market is also expected to grow rapidly due to the rising demand for these ranges in professional settings that include up to 9 burners and multiple ovens. The American brands are introducing these products due to the rising popularity of restaurants and cafes.

The above USD 5000 segment dominated the U.S. range cooker market in 2024. The dominance of the segment is attributed to the luxurious kitchen renovation trends in the country. Most of the consumers in home and cloud kitchen settings prefer advanced functionality and designs of these appliances. The market is anticipated to grow rapidly due to the promotion of premium models by leading companies like Viking, Thermador and others. The higher investment capabilities are also expected to raise the demand for these premium appliances in the upcoming years.

The USD 3001 and USD 5000 segment is observed to expand at the fastest CAGR during the forecast period of 2025 to 2034. The rising disposable income of middle-class families is playing an influential role in promoting performance-based and affordable kitchen appliances. The American companies are introducing dual-fuel induction, which can be affordable for consumers in the long run. Additionally, the past few years have significantly changed the lifestyles of Americans, influencing their interest in home cooking. As a result, brands like Samsung, GE appliances and Bosch are introducing smart control-based range cookers.

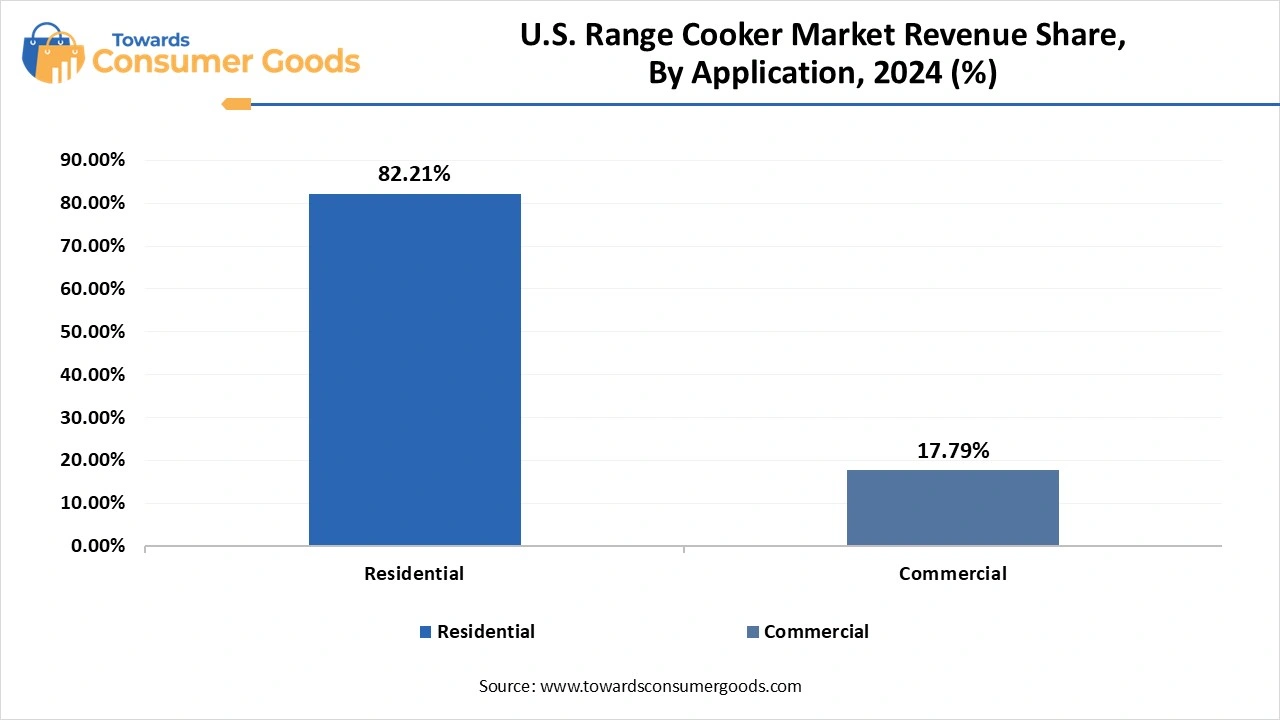

The residential segment accounted for the largest share of revenue in 2024. The dominance of the segment is attributed to the rising home cooking trends, promoting the demand for affordable range cookers. The U.S. range market is expanding rapidly due to the rising availability of 30-inch models that are highly suited for residential applications. Additionally, the home upgradations are constantly adopting smart appliance integration that can be used and adjusted remotely. The rising house party trends in the country are also anticipated to boost the adoption of advanced cooking equipment in the upcoming years.

The social media marketing by the companies is also expected to boost the demand for these appliances in future. The commercial segment expects significant growth in the market during the forecast period. The food service industry is witnessing significant popularity, which is leading towards multiple innovations.

In 2023, the highest sales of Food Away From Home (FAFH) outlets in the U.S. accounted for $813 million, which is the highest of the year. This data significantly boosts the adoption of range cookers in various restaurants, bakeries, cloud kitchens and other businesses. The U.S. range cooker market is expected to grow more rapidly as small startups are investing in these appliances to manage their requirements.

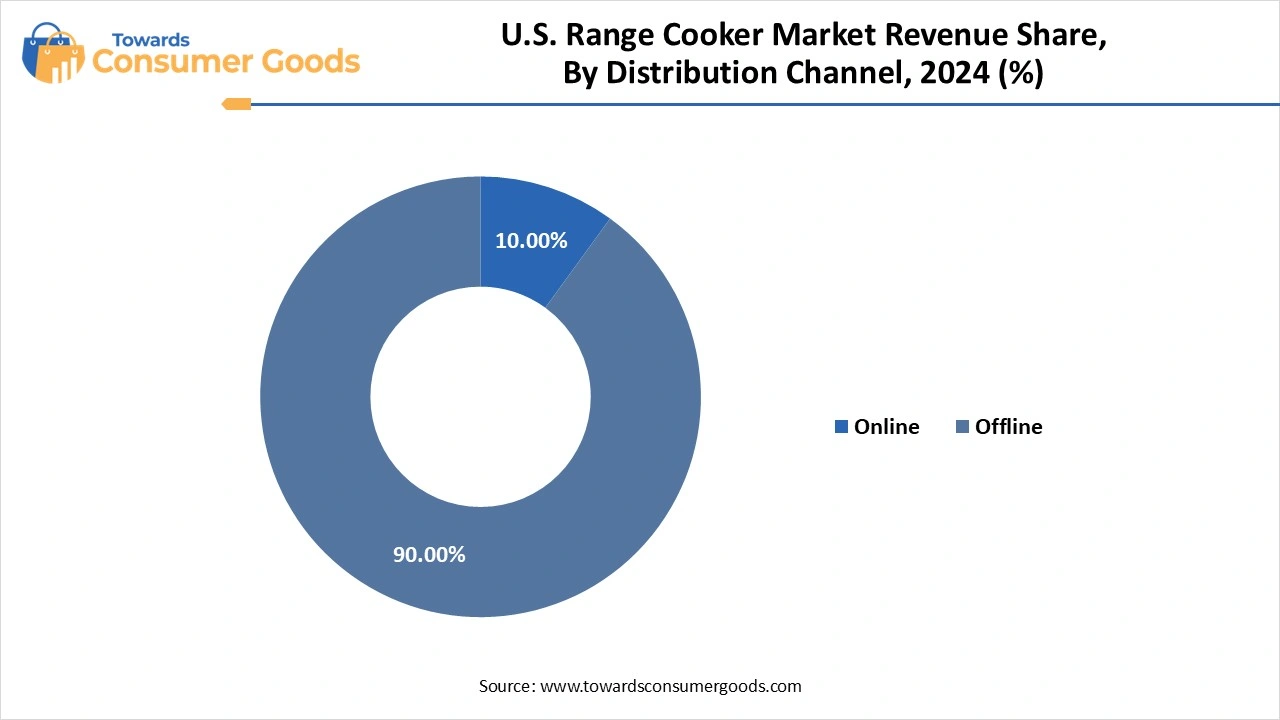

The offline segment marked its dominance by generating the largest revenue share in 2024. The dominance of the segment is attributed to the rising demand for in-store purchasing, as it enables evaluation of the specific product. Many brands have established their outlet across America, which helps them in accessing various home appliances, including range cookers. The U.S. range cooker market is expanding rapidly as consumers prefer offline shopping due to the personal guidance provided by the employees. These brands and offline stores also offer free installation and delivery service on many products, which makes offline purchasing dominant in the United States.

The online segment is anticipated to expand at the fastest CAGR during the forecast period. The rising digital adoption in the country is promoting home appliance products through applications like Amazon, Best Buy, and many more. These websites are also investing heavily in technological advancements that boost the integration of AR, AI and other technologies. Companies in the country are also expanding digitally, which helps consumers maintain their trust and reliability.

Launch: In April 2025, Equator launched the 24-Inch Electric Cooking Range with a connected oven. The product includes a ceramic cooktop with four burners and a freestanding installation configuration.

Launch: In April 2024, Samsung launched Bespoke AI kitchen appliances, which include induction cooktops and smart ovens that can be connected with the Samsung ecosystem.

July 2025

July 2025

July 2025

June 2025