July 2025

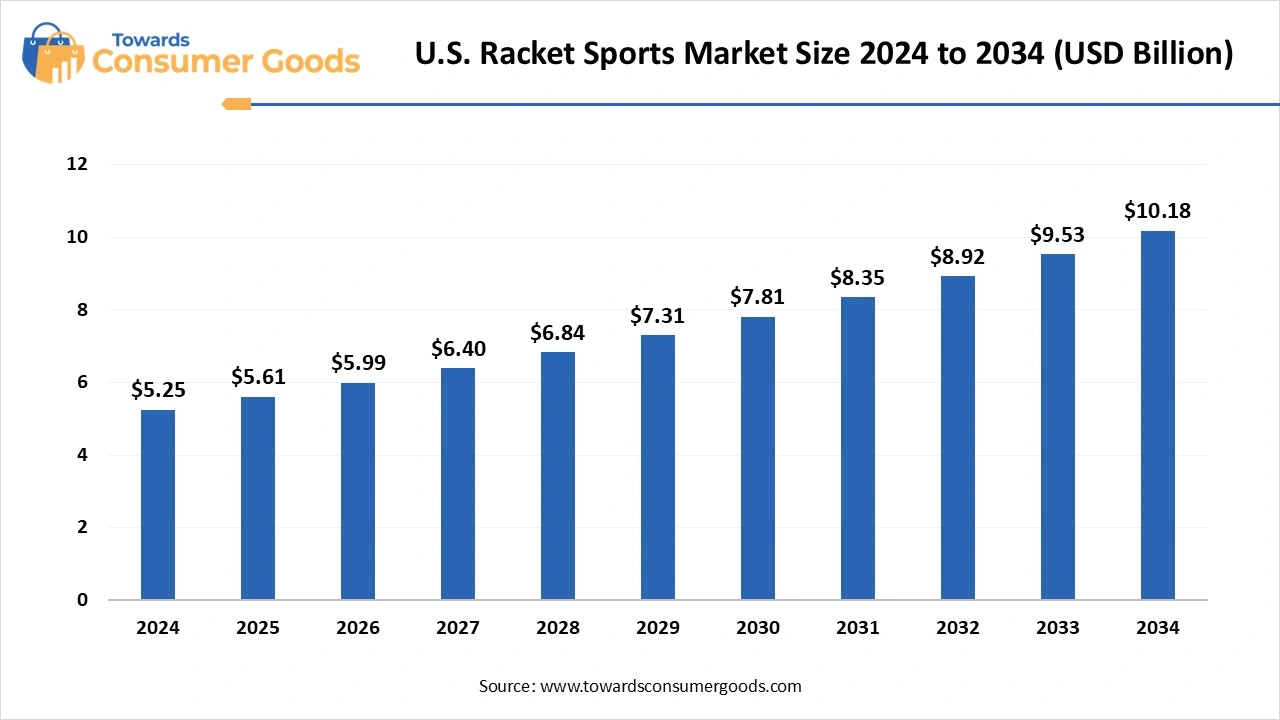

The u.s. racket sports market size reached USD 5.25 billion in 2024 and is projected to hit around USD 10.18 billion by 2034, expanding at a CAGR of 6.85% during the forecast period from 2025 to 2034. This market is growing due to rising health awareness, the social nature of racket-based activities, and the increasing popularity of sports like pickleball, tennis, and badminton across all age groups.

The U.S. racket sports market has transitioned from a niche athletic community to a nationwide recreational and competitive movement because of their low entry barriers social appeal and positive effects on cardiovascular health sports like pickleball tennis and padel are becoming more popular among all age groups. To meet demand, parks, fitness facilities, and wellness centers are constructing multipurpose courts and companies are introducing clothing and equipment tailored to sports. By hosting competitions and community gatherings, collaborations between private clubs and local governments are also encouraging involvement.

Pickleball which combines ping pong badminton and tennis is the sport with the fastest growth in the United States. Every year millions of new players join. It is a popular option for school senior citizens and urban populations due to its social nature, ease of play, and adaptability for all age groups. Exclusive pickleball collection complete with paddles, shoes, and accessories introduced by major brands. Shops are leveraging this trend by providing demo sessions and starter kits.

| Report Attributes | Details |

| Market Size in 2025 | USD 5.61 Billion |

| Expected Size by 2034 | USD 10.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Sports, By Product, By End User, By Player Category |

| Key Companies Profiled | Wilson Sporting Goods, HEAD, Prince Sports, Babolat, Yonex USA, DUNLOP SPORTS GROUP AMERICAS INC., Gamma Sports, Paddletek, LLC, ProKennex, Franklin Sports Inc., Selkirk Sport, Diadem Sports, Viking Athletics, Onix Pickleball, Gearbox |

How can brands scale in the U.S. racket sports space?

By utilizing digital platforms and encouraging community involvement, brands can grow. Local loyalty is increased by holding clinics, competitions, and pop-up events. Working together with YouTube, Instagram, and TikTok influencers promotes e-commerce sites. Recurring revenue can be raised by providing subscription boxes filled with seasonal gear training aids and replacement grips. Long-term adoption is made possible through collaboration with retirement communities and schools. Brand loyalty is increased by highlighting value-added services like free stringing or court finders.

Access to courts and top-notch equipment is still a barrier despite the fact that participation is increasing. While rural areas might not have any facilities at all, urban areas deal with court congestion. The high price of high-end rackets and shoes turns off consumers on a tight budget. Additionally, the variety of gear may be too much for novice players to handle. Predictability of revenue and inventory management are also impacted by seasonal variations in demand. These obstacles limit the market's full potential, particularly for casual and new players.

The U.S. racket sports market thrives in states like California, Florida, and Texas due to favorable weather and active lifestyle demographics. In Arizona and Colorado suburban communities are quickly becoming pickleball and padel hotspots. Investments in indoor and rooftop sports facilities are rising in coastal metro areas. Seasonal dome courts are being used in the Midwest to allow for year-round play. As customers look for flexibility and social interactions, court-sharing models and club memberships are becoming more and more popular. Nationwide demand is being further accelerated by senior leagues and school programs.

Why is tennis the dominant sport in the U.S. racket sports market?

Tennis remains the dominant racket sport in the U.S. in 2024 due to its history of organized competitions and broad availability in parks schools and clubs. High media exposure from tournaments like the U.S. Open robust brand sponsorships and many amateur and professional players all contribute to the sport's success. Its popularity is also maintained by the availability of youth development programs and certified coaches. In addition, tennis appeals to all age groups, which makes it a viable option for sustained market supremacy.

Pickleball is the fastest-growing racket sport, gaining tremendous popularity due to its low learning curve, small court size, and inclusive nature. Beginners and older adults looking for a less demanding but still very interesting activity will find it particularly appealing. Pickleball courts have been added to community centers and apartment buildings in recent years, encouraging more people to play sports. Celebrity endorsements and social media buzz have also helped it gain popularity. Its growth trajectory is anticipated to pick up speed as leagues and national events formally recognize it.

Why does apparel dominate the racket sports product market?

Apparel is the leading product segment, driven by a strong consumer desire or style of performance and comfort both on and off the court. Investments in flexible moisture-wicking textiles designed for mobility are made by both casual players and athletes. This category is further strengthened by athleisure trends, fashion-forward collections, and brand partnerships. Clothing is another tool that retailers use to boost repeat business and foster brand loyalty. Athlete-endorsed apparel and limited-edition releases give the product category aspirational value helping it to hold its top spot.

Equipment segments like rackets, balls, grips, and accessories are seeing a rise in sales, particularly among first-time buyers and returning players. Innovations in technology like smart sensors and rackets that reduce vibration have increased player interest. It is now simpler to purchase high-quality equipment thanks to e-commerce platforms that provide tailored equipment recommendations. The market's explosive growth is also fueled by the demand for upgraded and replacement equipment as more amateur and professional players enter the market.

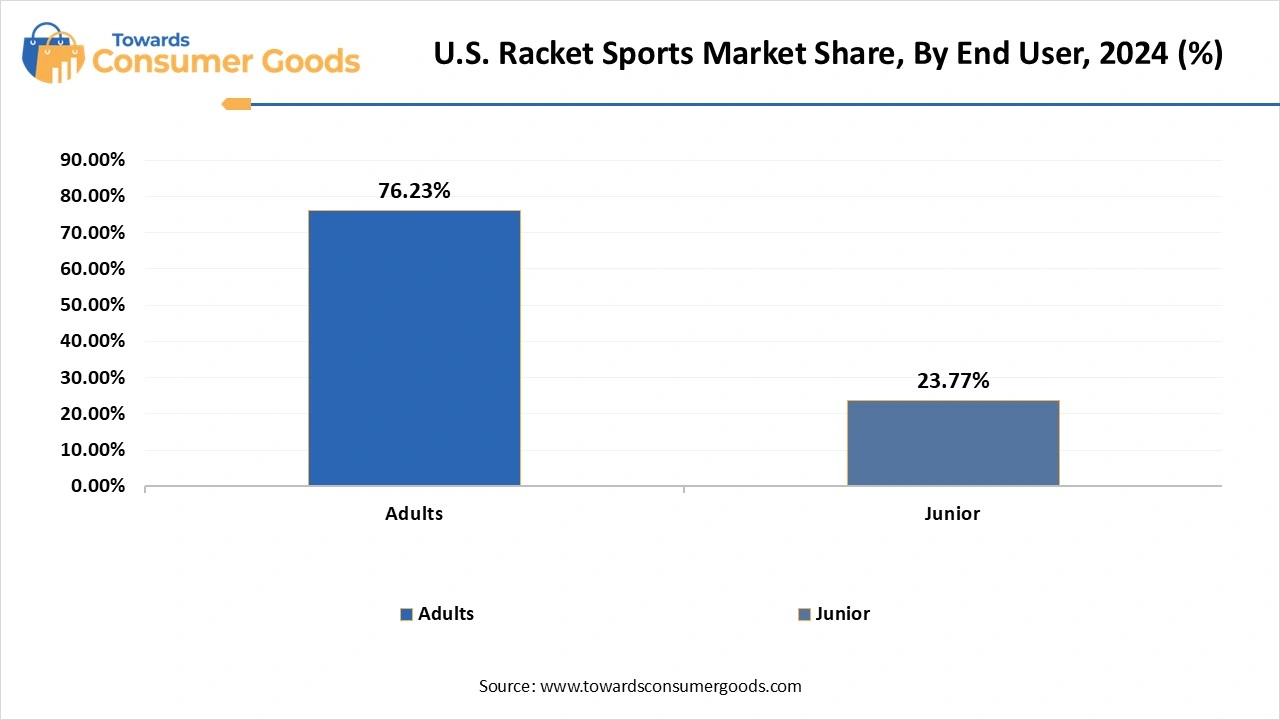

Why do adults dominate the racket sports market?

Adults dominate the market as they have higher purchasing power, established sports habits, and access to memberships in clubs and recreational leagues. Racket sports are becoming more and more popular among GenXers and fitness-conscious millennials. Additionally, because they participate in more weekend play sessions and community tournaments, this group consistently increases demand for clothing, equipment, and accessories. They can purchase high-end goods and coaching services because they have more money to spend.

Junior players are growing at a fast rate due to increased focus on sports by schools, academies, and national-level programs. To promote social interaction, discipline, and physical fitness parents are signing up their kids for racket sports. Entry into the sport has also been made simpler by youth-specific mini-court formats and kid-friendly equipment. Young athletes have also become more interested in sports as a result of media exposure and role model development. With sponsorship and training initiatives aimed at this demographic, their market share is anticipated to increase quickly.

Why are recreational players the dominant group in racket sports?

Recreational players represent the largest segment due to their casual, frequent, and cost-effective engagement with the sport. They frequently spend money on moderately priced gear and clothing while playing club or community-based games. They are devoted to long-term clients who are of all ages and don't care as much about professional performance. They maintain active local courts, clubs, and retail establishments through their social fitness-focused approach to the sport.

Professional players are becoming the fastest-growing category due to increasing participation in competitive leagues, rising prize pools, and growing media exposure. High-performance equipment, frequent replacements, and individualized coaching are necessary for these athletes, resulting in high-value transactions. Investment in this market is also fueled by sponsorships endorsements and brand ambassadorships. More athletes are switching from recreational to professional play as a result of easier access to training facilities and competition venues.

Why do sporting goods retailers dominate the racket sports sales channel?

Sporting goods retailers dominate due to the trust built through hands-on service, product expertise, and physical product trials. Customers frequently favor in-person consultations for shoe firm grip size and racket balance. Additionally, these stores increase customer loyalty by holding training sessions, community outreach events, and demo days. To maintain consistent foot traffic throughout the year, brands collaborate with these retailers to launch exclusive in-store events and seasonal promotions.

Online segment is growing faster due to its unmatched convenience, broader product variety, and cost benefits.

Customers can read reviews, compare brands, and shop around the clock, which appeals to younger tech-savvy consumers in particular. To overcome previous hesitancy, e-commerce sites now provide virtual racket selectors, augmented reality fitting tools, and simple returns. Additionally, free shipping policies influence marketing, and flash sales have greatly increased conversion rates.

By Sports

By Product

By End User

By Player Category

By Distribution Channel

July 2025

July 2025

July 2025

June 2025