July 2025

The U.S. pet hard goods market was valued at approximately USD 29.11 billion in 2024 and is projected to grow at a CAGR of 4.95% from 2025 to 2034, reaching a value of USD 47.19 billion by 2034. The growing pet owners demand for premium and high-end goods for pets is the major factor driving the U.S. pet hard goods market.

The U.S. pet hard goods market is experiencing rapid growth due to increasing pet ownership in the country, especially among millennials and the Gen Z population. The U.S. has witnessed transformative growth in pet ownership, with 94 million households in the country having at least one pet. Millennials and Gen Z are having multi-pet ownership. The availability of innovative products and expanding e-commerce platforms enables access to advanced and customized products, supporting pet ownership. Additionally, the presence of key global market companies and their initiatives to meet changing consumer demands are further shaping pet owner numbers in the country.

In March 2025, the American Pet Products Association (APPA) announced the reach of U.S. pet industry expenditures to $152 billion in 2024. The result was unveiled with the association’s 2025 State of the Industry Report during the Global Pet Expo event.

However, the evolving U.S. pet hard good market has witnessed a slight decline in Q2 of 2025, due to President Donald Trump’s tariffs on Chinese goods. China used to supply cost-effective products to the U.S., contributing significant support to the price-conscious consumers. The ongoing U.S. tariffs have caused the higher prices of U.S. pet hard goods, resulting in a slight decrease in purchases, particularly premium goods.

The growing trend of pet humanization is the major driver of the U.S. pet hard goods market. The U.S. has a high number of pet owners, especially millennials and Gen Z owners, who have started to treat their pets as family members. The humanization trend has resulted in a rising focus on pet wellness, health, hygiene, and well-being. Pet owners have started to prioritize premium goods for their beloved pets. The growing emotional connection with pets, demand for human-like products, and owners' readiness to spend high on products are shaping the country's market.

| Report Attributes | Details |

| Market Size in 2025 | USD 30.55 Billion |

| Expected Size by 2034 | USD 47.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Distribution Channel |

| Key Companies Profiled | Chewy, Inc., Petco , Coastal Pet Products, KONG Company, Petmate , Central Garden & Pet Company, Radio System Corporation (PetSafe), BARK, Inc., The Kyjen Company, LLC, IRIS USA, Inc., COLLAR Company |

Rising Focus on Pet Wellness and Enrichments

The U.S. pet owners' focus has shifted toward wellness and enrichment of their pets, including their desire to enhance health, longevity, happiness, and favouritism, which is expanding the country's market for innovative, premium, and high-end products. The U.S. has witnessed significant growth in demand for wellness-focused products, like orthopedic beds, interactive toys, and grooming tools. Additionally, the rapidly rising demand for multifunctional, durable, sustainable, and perosnalized products is driving the market growth.

Consumer Spending Fluctuation

The fluctuation in consumer spending on pet hard goods due to economic pressure or continuously changing preferences is the major challenge for the market. The U.S. is a country with diverse consumer choices, which makes it hard to be a steady market. For instance, in recent years, the consumers' preferences have shifted toward essential spending. Additionally, the high focus on product quality as well as the growing trend for sustainable products are inflating the market. With frequent changing consumer priorities and their spending fluctuation hampering manufacturing industries' revenue in the U.S.

Which Product Segment Dominated the U.S. Pet Hard Goods Market in 2024?

The collars, lashes, & harnesses segment is expected to grow fastest over the forecast period, driven by growing owners' focus on pets' safety and wellness. The demand for GPS tracking, harnesses for better control, and products with reflective materials has increased in the country. Additionally, the rising preference for recyclable and durable collars, lashes, & harnesses is contributing to the market growth.

The presence of major e-commerce platforms like Amazon, Chewy, and eBay is enabling access to premium products for the owners.

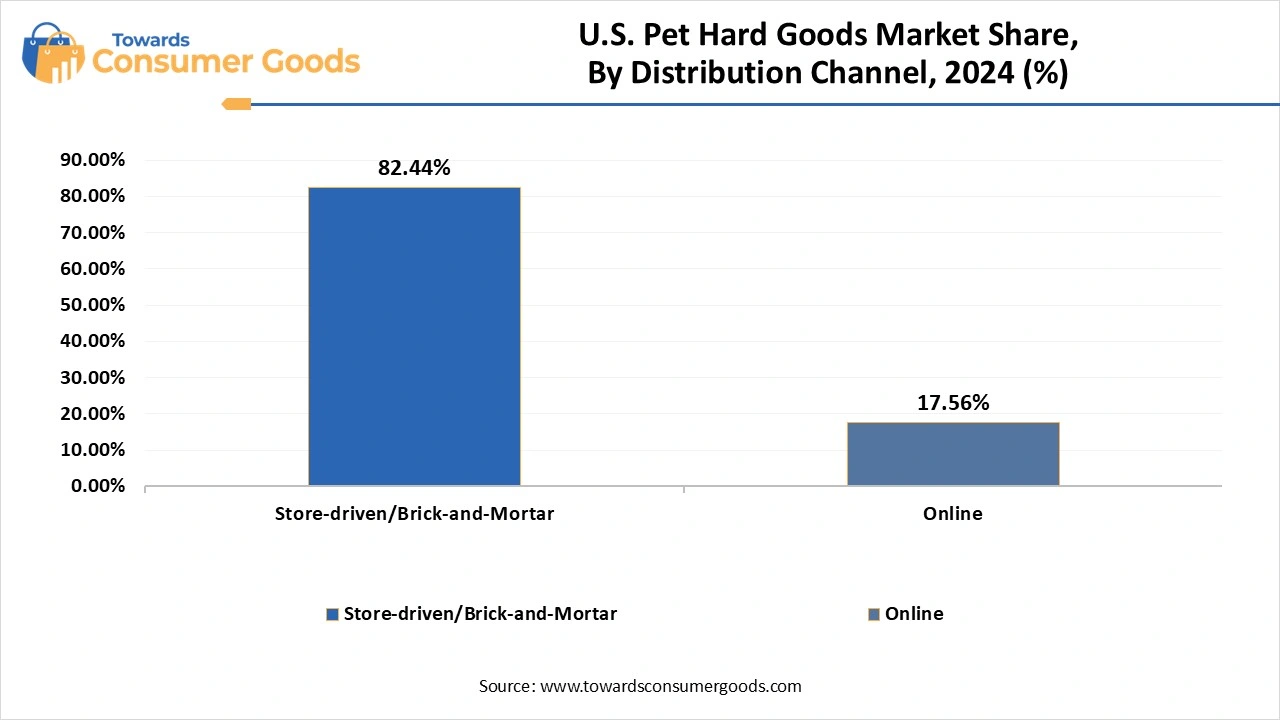

How Store-driven/Brick-and-Mortar Segment Leading the U.S. Pet Hard Goods Market?

The store-driven/brick-and-mortar segment led the market in 2024, driven by a high base of pet owners, who prefer traditional shopping values. Owners prioritize high-quality products, making them purchase products from offline stores with expert guidance, recommendations, and inspection facilities available in these stores. Additionally, the urge to take products home immediately for their pets makes offline purchases more convenient and preferred.

The online segment is the second-largest segment, leading the market, due to consumer demand for convenient and transparent products. An online platform provides full transparency of the products, such as price, quality & durability information, and honest consumer reviews. The expanding e-commerce platform in the country is contributing to increasing online purchases of pet hard goods. Additionally, traditional retailers are providing omnichannel experiences to their customers, making purchases more convenient and easier.

By Product

By Distribution Channel

July 2025

July 2025

July 2025

July 2025