June 2025

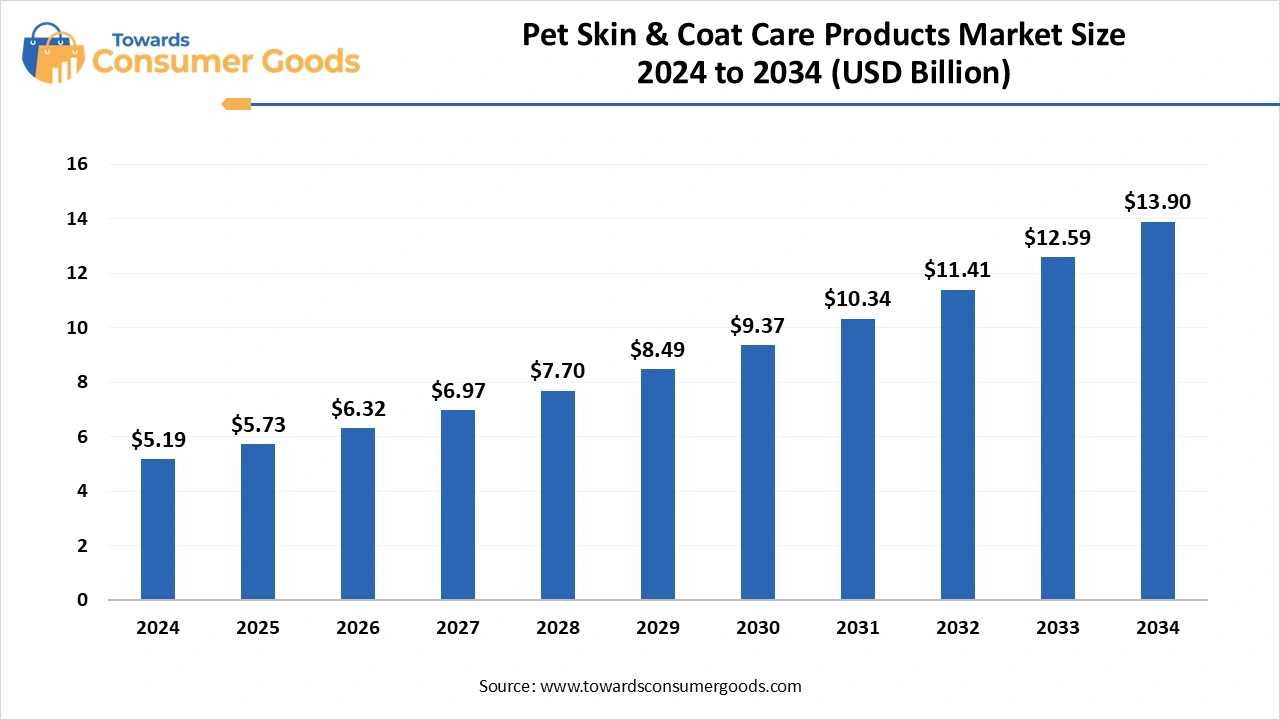

The pet skin & coat care products market was valued at USD 5.19 billion in 2024 and is projected to reach around USD 13.9 billion by 2034, growing at a CAGR of 10.35% during the forecast period from 2025 to 2034. The global pet skin and coat care products market is witnessing robust growth, driven by increasing pet humanization and heightened awareness regarding pet hygiene and dermatological health.

The global pet skin and coat care products market has gained significant momentum in recent years, fuelled by the growing trend of pet humanisation. Pet owners are increasingly treating their furry companions as part of the family, leading to rising demand for specialised grooming and wellness products. This shift is particularly noticeable in urban areas, where premium care routines and pet spas are becoming mainstream. Skin and coat health is central to a pet’s overall well-being, prompting a surge in demand for targeted solutions such as anti-itch shampoos, medicated conditioners, moisturising balms, and oral supplements.

These products not only help manage common conditions like dry skin, dandruff, and shedding but also serve preventive roles by enhancing skin hydration and improving fur texture. E-commerce has played a pivotal role in boosting market visibility. Pet care brands are increasingly launching exclusive product lines online, coupled with educational content and subscription services.

Digital platforms also allow pet owners to make informed choices based on breed, fur type, or skin sensitivity, which has enhanced customer engagement and loyalty. Natural and organic formulations are becoming increasingly desirable. Consumers are actively seeking products free from parabens, sulphates, and artificial fragrances, instead favoring herbal, plant-based, and vet-approved solutions. This green shift is prompting companies to reformulate and rebrand their offerings for eco-conscious pet parents.

| Report Attributes | Details |

| Market Size in 2025 | USD 5.73 Billion |

| Expected Size by 2034 | USD 13.9 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Pet Type, By Condition Treated, By Ingredient Type, By Distribution Channel |

| Key Companies Profiled | Zoetis Inc., Elanco Animal Health ,Virbac S.A. , Nestlé Purina PetCare , Hill’s Pet Nutrition (Colgate-Palmolive) , Bayer Animal Health (now part of Elanco), Vetoquinol S.A. , Nutramax Laboratories , Mars Petcare (Royal Canin, Iams) , PetAg, Inc. , TropiClean Pet Products , Earthbath , Vet’s Best (Central Garden & Pet) ,Zesty Paws (H&H Group) |

Paws and Potential: Where the Market Is Headed

One of the most promising opportunities in the pet skin and coat care products market lies in the expansion of premium and holistic grooming solutions. As pet owners increasingly treat pets as family members, they are willing to invest in high-quality, luxury grooming products that offer long-term skin health benefits and a spa-like experience. This presents a lucrative opportunity for brands to introduce curated, breed-specific, and wellness-focused product lines.

The rise of pet ownership in emerging economies, particularly in Asia-Pacific and Latin America, opens an untapped customer base. With growing disposable income, rising urbanization, and the influence of Western pet care standards, consumers in these regions are shifting from basic hygiene to specialized care. Introducing affordable, locally relevant, and educationally marketed products could yield significant growth in these developing markets. Veterinary partnerships and D2C (Direct-to-Consumer) channels are becoming strategic levers to tap into targeted skin and coat care. Collaborations with veterinary clinics for dermatologically approved formulations, as well as dedicated online stores offering subscription models, allow companies to build brand trust and consumer loyalty.

Not All Smooth Fur: What’s Holding the Market Back?

Despite its growth potential, the pet skin and coat care market is not without its challenges. A significant restraint is the lack of standardized regulations and quality control across many countries. In several emerging markets, products may be sold without stringent checks, leading to the presence of substandard or harmful ingredients. This undermines consumer confidence and damages the reputation of the market. Price sensitivity and affordability remain barriers to adoption, especially in developing regions. While premium products offer superior quality, they are often out of reach for average consumers, especially those with multiple pets or limited access to specialty retailers.

Without affordable options or awareness of long-term benefits, many owners resort to generic or human-grade products, which may not be suitable for pets. Limited veterinary and dermatological education among consumers also restrains market penetration. Pet owners may not be aware of the importance of coat care until a condition becomes visible or severe. This results in reactive rather than preventive purchasing behavior, making it difficult for brands to promote routine care products.

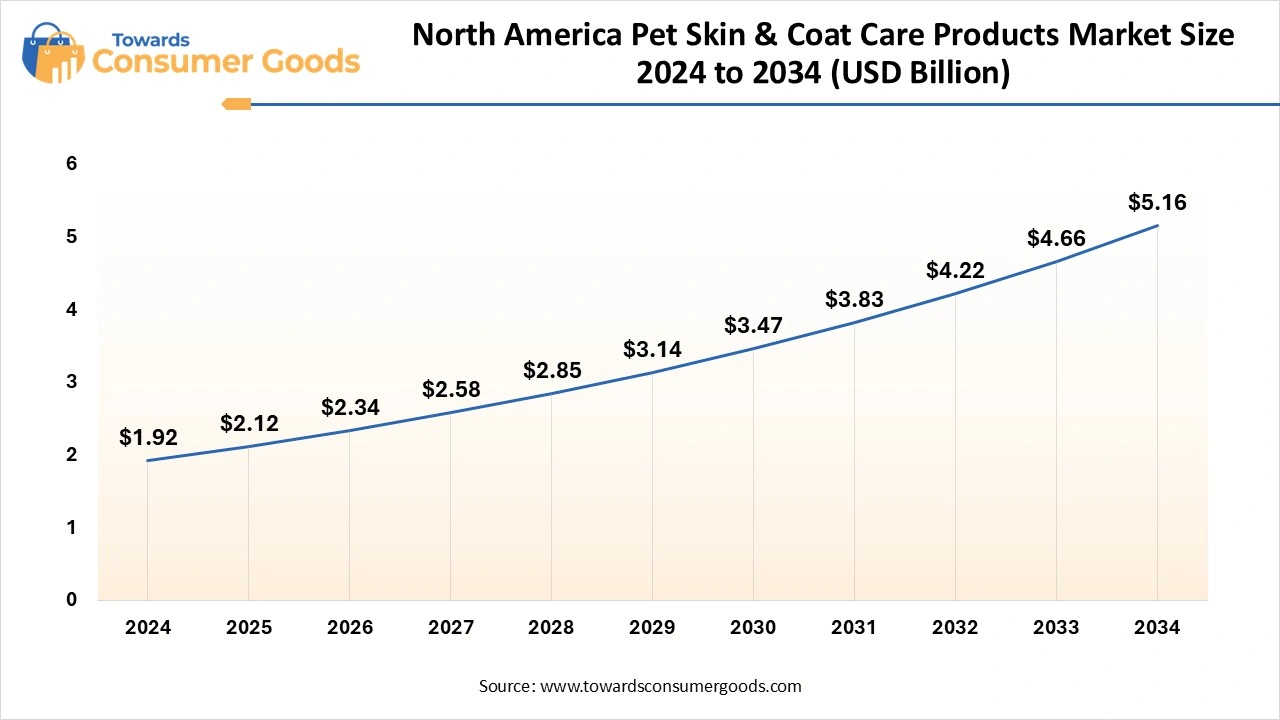

Why Is North America Leading the Pack in Pet Skin and Coat Care?

North America continues to dominate the global pet skin and coat care products market, thanks to a combination of high pet ownership rates, elevated spending per pet, and an advanced grooming culture. The region accounts for the largest market share, driven by the United States and Canada, where pets are deeply integrated into family life and considered companions deserving of premium care. The presence of a highly developed veterinary infrastructure and pet product ecosystem significantly boosts market growth in North America.

Pet parents in this region are more aware of dermatological issues such as hot spots, allergies, and dry skin, prompting them to invest in specialized products like anti-itch shampoos, soothing balms, and Omega-3 supplements for coat health. Innovation and product customization are also key market enablers. North American brands are at the forefront of launching organic, breed-specific, and condition-targeted formulations, catering to the discerning preferences of a well-informed customer base.

Asia-Pacific is the fastest-growing region in the pet skin and coat care products market, driven by rapid urbanisation, changing cultural attitudes towards pets, and rising middle-class incomes. Countries such as China, India, Japan, and South Korea are witnessing a pet boom, with increasing preference for dogs, cats, and even exotic animals in urban households. The concept of pet parenting is evolving quickly in the region. As more families adopt pets, there is a noticeable shift from basic hygiene to advanced grooming and skin care.

Social media influence and Western lifestyle adoption are accelerating awareness about coat maintenance, skin allergies, and breed-specific grooming needs. E-commerce is playing a pivotal role in expanding market access. Online platforms and mobile apps are making it easier for consumers in Tier 2 and Tier 3 cities to discover and purchase premium grooming products. Local brands are also emerging with competitively priced natural and herbal alternatives, catering to regional tastes and price points.

Why Are Medicated Shampoos Lathering Up the Top Spot?

Medicated shampoos are dominating the global pet skin and coat care market due to their effectiveness in treating a wide range of skin conditions. These formulations are designed to address specific issues such as dermatitis, bacterial infections, dandruff, and hot spots conditions, increasingly recognised and diagnosed by veterinarians and informed pet parents alike. Unlike regular grooming shampoos, medicated options offer therapeutic value. They contain ingredients like chlorhexidine, ketoconazole, or oatmeal, which provide targeted relief and faster healing, making them essential for pets with chronic or recurring skin problems. As awareness of pet dermatology rises, so does the preference for such specialised products. Moreover, these shampoos are frequently recommended by veterinary clinics, further strengthening their position in the market. Prescription-based or vet-endorsed shampoos command trust and are often considered the first line of defence against skin ailments, especially in dogs.

On the other hand, Functional chews and Omega-3 supplements are the fastest-growing segment, as the industry moves towards a preventive, wellness-oriented approach to pet care. These internal supplements offer benefits beyond basic nutrition by actively supporting skin hydration, reducing inflammation, and promoting a shinier, healthier coat. Omega-3 fatty acids, derived from fish oil and flaxseed, are scientifically proven to alleviate symptoms of dryness, itching, and seasonal shedding. Pet parents increasingly include these supplements in daily diets to enhance skin resilience and manage chronic allergies from within. Functional chews are particularly popular due to their palatable form, which simplifies administration and ensures compliance. These are often infused with multivitamins, biotin, and collagen to support both coat texture and joint health, making them ideal for ageing pets.

Why Do Dogs Lead the Pack in Skin and Coat Care Products?

Dogs dominate the pet skin and coat care market due to their high population, diverse coat types, and greater grooming needs compared to other domestic pets. With millions of households globally owning at least one dog, the demand for coat care and hygiene solutions is naturally high. Different breeds have unique coat textures ranging from short and smooth to long and curly, each requiring specific grooming regimens. This has encouraged manufacturers to develop a wide variety of shampoos, conditioners, sprays, and supplements tailored to breed-specific needs. Dogs are more likely to suffer from dermatological conditions such as fleas, dry skin, eczema, and bacterial infections due to their active lifestyles and exposure to outdoor environments. As a result, products addressing itching, shedding, and dull coats are more widely used for dogs than for other pets.

Moreover, Cats are the fastest-growing pet type in the skin and coat care market due to a rise in cat ownership and growing awareness of feline dermatology. As more urban households adopt cats, especially in apartments and smaller spaces, the market for feline-specific grooming products is expanding. Cats have a naturally self-cleaning mechanism, but this does not always suffice, particularly for long-haired or indoor cats that experience matting, dry skin, or shedding. Owners are increasingly realizing the importance of supportive grooming routines to maintain a healthy coat. Cat-specific products like waterless shampoos, anti-static sprays, and Omega-rich chews are gaining traction due to their gentle formulations and ease of use. Innovations focused on non-invasive grooming and stress-free application are fueling interest among cautious cat owners.

Why Do Itching and Allergies Lead the List of Treated Conditions?

Itching and allergies dominate the market by addressing the most common dermatological concerns among pets. Conditions like flea allergies, food sensitivities, environmental triggers, and seasonal dermatitis affect a significant percentage of household animals, especially dogs. Products targeting these conditions are in high demand because they provide visible, immediate relief, often using soothing ingredients like aloe vera, oatmeal, or antihistamine-based formulations. Pet parents prioritize these products as a first step toward solving discomfort and preventing scratching-induced injuries. Veterinarians frequently recommend medicated shampoos, anti-itch sprays, and allergy control supplements, which lends credibility and increases product usage among cautious consumers. These products are also more likely to be included in regular pet grooming routines.

On the other hand, Coat brightening and hair regrowth solutions are the fastest-growing segment, reflecting a growing consumer interest in aesthetic enhancement and holistic wellness for pets. Pet parents now want their companions not just healthy but also glowing with a glossy, vibrant coat. These products often target issues like fur dullness, thinning, bald patches, and post-allergy hair loss. With increasing exposure to social media and pet grooming trends, visual appearance is becoming an important factor in pet care spending. Hair regrowth serums, Omega-3 supplements, keratin sprays, and protein-rich shampoos are gaining favor for their restorative benefits. Often used post-treatment or post-shedding seasons, they help pets regain their natural shine and coat density. Premium pet salons and grooming chains are also offering value-added services and product bundles that include coat-enhancing solutions, further boosting consumer exposure and acceptance.

Why Are Omega Fatty Acids and Online Retail Dominating the Scene?

Omega fatty acids and online retail channels dominate the market by offering a combination of internal wellness and shopping convenience. Omega fatty acids, particularly Omega-3 and Omega-6, are proven to improve skin hydration, reduce inflammation, and support shiny coats. Their inclusion in a wide variety of products, from chews and oils to fortified shampoos, makes them a versatile and sought-after ingredient. Consumers trust Omega-rich products for both therapeutic and preventive care, especially in pets with dry, flaky skin. Simultaneously, the online retail segment is thriving, offering pet parents the convenience of ordering specialized products from the comfort of their homes. Product reviews, breed filters, and detailed ingredient explanations help buyers make more informed decisions.

Furthermore, CBD-infused and botanical blends are the fastest-growing ingredient category in the pet skin and coat care market, fueled by the trend towards natural, holistic, and anxiety-reducing solutions. Pet parents are increasingly open to using non-pharmaceutical options to treat skin inflammation, stress-induced itching, and allergy-related issues. CBD (Cannabidiol), derived from hemp, is being used in topical balms, shampoos, and treats for its anti-inflammatory and calming properties. It is particularly popular in markets like the United States and Canada, where regulations around CBD in pet care have become more favorable.

Why Are Veterinary Clinics and Online Retail Still the Go-To?

Veterinary clinics and online retail dominate the market because they offer a trusted and accessible path to premium, condition-specific care. Veterinary recommendations carry significant weight in influencing pet owners' choices, especially for medicated shampoos, supplements, and therapeutic sprays. Clinics serve as a point of education, diagnosis, and product purchase, making them a one-stop solution for skin and coat health concerns. Pet parents are more likely to follow treatment plans when products are endorsed and sold directly by vets. Simultaneously, online retail offers round-the-clock access, broad product ranges, and home delivery, an irresistible combination for the modern, convenience-seeking consumer. Digital platforms also educate buyers through blogs, videos, and product ratings.

On the other hand, E-commerce platforms and Direct-to-Consumer (DTC) subscription brands are the fastest-growing distribution channels, disrupting traditional pet care retail with personalization, transparency, and speed. These digital-first brands are redefining how pet parents discover and access grooming solutions. DTC brands offer customized grooming kits, breed-specific products, and targeted care plans, often bundled into subscription models. This not only builds customer loyalty but ensures consistent use of products, crucial for long-term skin and coat improvement.

By Product Type

By Pet Type

By Condition Treated

By Ingredient Type

By Distribution Channel

June 2025

June 2025

June 2025

June 2025