July 2025

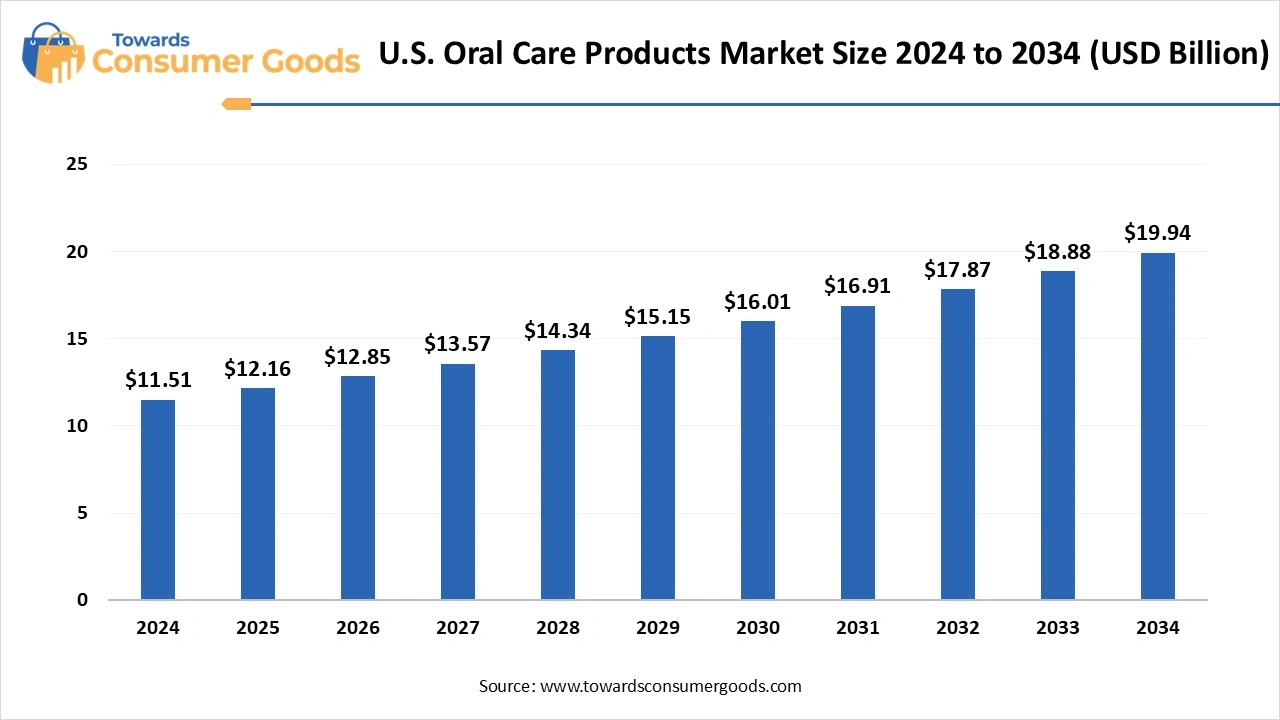

The U.S. oral care products market size reached USD 11.51 billion in 2024 and is projected to hit around USD 19.94 billion by 2034, expanding at a CAGR of 5.65% during the forecast period from 2025 to 2034. This market is growing due to increasing consumer awareness of dental health, technological advancements, a rising aging population, and demand for natural and cosmetic oral care solutions.

The U.S. oral care products market is experiencing steady growth, driven by the growing prevalence of dental diseases growing consumer awareness of dental hygiene, and the accessibility of cutting-edge oral care products. Dental floss toothpastes, toothbrushes, mouthwashes, and whitening products are just a few of the many products available in the market demand driven by both professional and over-the-counter segments.

Premium and natural oral care product adoption has been further accelerated by the growing emphasis on aesthetic appeal and the impact of social media. Additionally, it is anticipated that continued market expansion will be supported during the forecast period by the growth of e-commerce platforms and higher investments made by major players in product innovation and marketing.

Manufacturers in the U.S. oral care market are innovating products that are natural fluoride-free and customized to meet needs like whitening or sensitivity are being offered by the oral care industry. As the need for tech-driven and sustainable solutions grows smart toothbrushes with app connectivity and environmentally friendly packaging are also becoming more popular.

| Report Attributes | Details |

| Market Size in 2025 | USD 12.16 Billion |

| Expected Size by 2034 | USD 19.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Property, By Type |

| Key Companies Profiled | Prologis, Inc., American Tower Corporation, Equinix, Inc., Welltower Inc, Simon Property Group, Inc, Public Storage, Digital Realty Trust, Inc, Realty Income Corporation, AvalonBay Communities, Inc, CRBE Group, Inc., Equity Residential, |

Selling oral care products online or through subscription helps companies by making it super easy for customers to buy what they need without leaving home. Product deliveries are automated and on time, which fosters customer loyalty and keeps customers returning regularly. Furthermore, businesses can gather information to provide tailored offers and new products as well as reach a wider audience than just local stores. All things considered, it increases customer satisfaction and sales while lessening the burden on purchasers.

The oral care market is crowded with many well-established brands, making it challenging for new entrants to gain market share. Wide distribution networks, substantial marketing budgets, and strong brand loyalty are common characteristics of large businesses. Because of the fierce competition brands are forced to constantly innovate or offer discounts which can lower profit margins. Companies that are new or smaller may find it difficult to obtain online visibility or store shelf space. Additionally, consumers have a tendency to remain loyal to well-known brands, making it challenging for new products to persuade consumers to switch. Brands must spend a lot of money on promotions and advertising to remain relevant, which raises marketing expenses.

The U.S. oral care products market is one of the largest and most mature oral care markets globally, driven by frequent product high standards for oral hygiene and strong consumer awareness because consumers consistently brush floss, and rinse their teeth the demand for generalized products like toothbrushes and toothpaste remains steady throughout the year. Additionally, advanced oral hygiene products like water flossers, electric toothbrushes, and teeth whitening agents are becoming more and more popular, particularly among middle-class and upper-class urban populations.

Additionally, consumers purchasing habits for oral hygiene are evolving due to the emergence of DTC brands and e-commerce sites like Amazon and walmart.com with subscription models expanding quickly.

The market is supported by frequent dental visits, health insurance coverage for preventive care, and public campaigns like National Children's Dental Health Month led by the American Dental Association (ADA). Local and international businesses are being encouraged to innovate and introduce eco-friendly options by consumers' growing desire for natural fluoride-free and sustainable oral care products.

Since almost everyone needs commonplace items like toothpaste, toothbrushes, and mouthwash, generalized oral care products are the most widely used. Customers trust these products to maintain daily oral hygiene because they are reasonably proceeding easily accessible and reliable. Because so many households keep these necessities in hand, this category accounts for the largest portion of the market.

They continue to lead sales due to their extensive availability in practically every store. Furthermore, these products are a mainstay of oral hygiene regimens across the county because they are affordable and suitable for all age groups. A significant factor is brand loyalty as many customers continue to use well-known reliable products.

Beauty oral care products segment is observed to grow at the fastest rate during the forecast period as the demand for cosmetic toothpaste teeth whitening kits and other beauty-focused oral care products is being driven by people's growing desire to look better and have a white bright smile. Social media trends and celebrity endorsements promoting cosmetic dentistry also contribute to this growth.

This market is expanding rapidly as a result of companies creating new simple-to-use at-home treatment kits and formulas. The market is growing because consumers are prepared to pay more for goods that promise aesthetic advantages. Interest in beauty dental care is also growing as wellness and self-care become more widely recognized.

Why do women dominate the oral care products market?

Women tend to be most careful about their health and appearance, so they invest more in oral care products. Additionally, their propensity to try new products and adhere to beauty trends helps them maintain their market leadership. Since many women consider maintaining good oral hygiene to be a crucial component of their overall grooming regimen they spend more and more money on various oral care products. To further solidify their dominance marketing campaigns frequently target women with specialized products. Higher purchase volumes are also supported by the fact that women use cosmetic oral care products more frequently.

Men's segment is observed to grow at the fastest rate during the forecast period. The demand for products designed specifically for men is rising as more men become conscious of oral health and grooming. Companies are producing toothpaste mouthwash and brushes with features or fragrances targeted at men. The men's market is expanding quickly thanks to improved product availability and rising awareness. More men are investing in personal care because of the improved social acceptance of men's grooming. This expanding consumer base is being drawn in by innovations designed specifically for men like toothpaste made of charcoal and novel flavors.

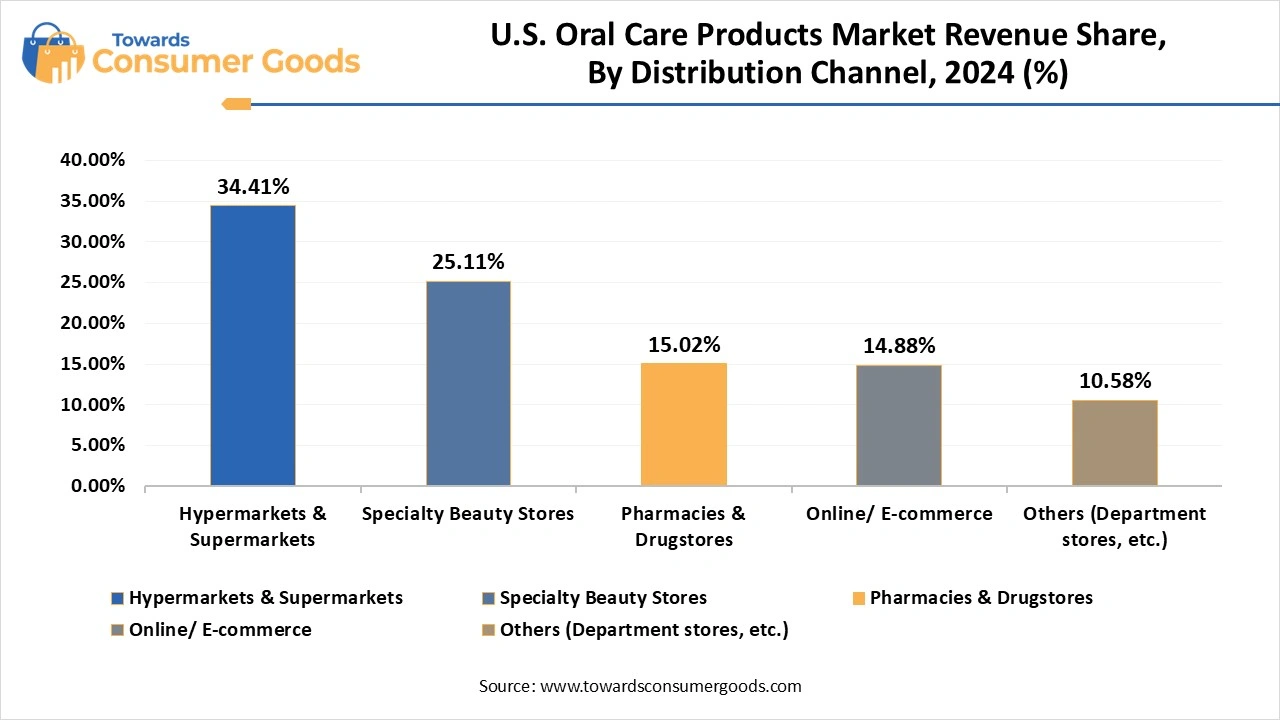

How do hypermarkets and supermarkets dominate oral care product sales?

Hypermarkets and supermarkets remain the top choice for buying oral care products owing to the wide range of brands and products available in one location. Customers enjoy being able to view and compare products before making a purchase, and these establishments frequently offer sales or discounts to draw clients. Purchasing dental care necessities during their frequent grocery shopping excursions is particularly convenient for families. These stores are accessible to the majority of customers due to their extended operating hours and high foot traffic. They maintain competitive pricing and a well-stocked inventory thanks to their well-established supply chain.

Online/ E-commerce segment is observed to grow at the fastest rate during the forecast period due to online shopping being quick and simple and allowing for doorstep delivery. More people are choosing to purchase dental care products online. We liked subscription services that deliver toothpaste or toothbrushes automatically regularly making it easy to never run out. The sharp increase in online sales is also supported by the rise in mobile shopping apps and internet usage. Online platforms help consumers make better purchasing decisions by giving them more options and product information. The ease of contactless payments and home delivery further promotes the move to online shopping.

By Product

Beauty Oral Care Products

By Gender

By Distribution Channel

July 2025

July 2025

July 2025

July 2025