July 2025

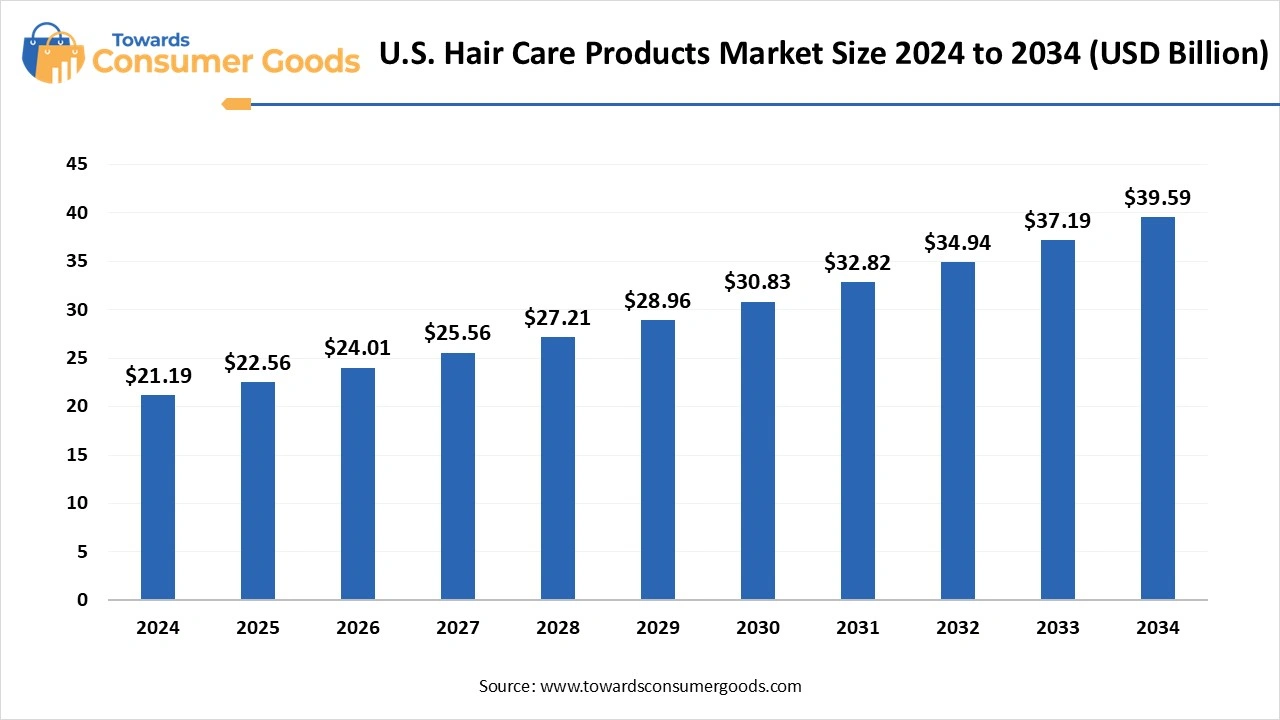

The U.S hair care products market size was valued at USD 21.19 billion in 2024 and is estimated to hit around USD 39.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.45% during the forecast period 2025 to 2034. This market is growing due to rising consumer awareness about personal grooming and increasing demand for natural and organic products.

The U.S. hair care products market is experiencing steady growth, driven by growing consumer attention to personal grooming growing knowledge of the health of the scalp, and a strong desire for formulations that are naturally organic and chemical free. The market offers a vast array of products to suit various hair types and requirements such as shampoos conditioners, hair oils, serums, and styling products.

Demand is also being increased by targeted treatments, new product formulations, social media influence, and beauty influencers. Furthermore, hair care products are now more widely available due to the rising popularity of e-commerce platforms, which has helped the market expand across a range of demographics.

The U.S. hair care market is evolving rapidly as consumers seek more personalized, health-conscious, and inclusive products. Scalp health has become a focal point for products targeting issues like dryness and dandruff using ingredients like salicylic acid and probiotics. Additionally, there is a significant shift towards natural and sustainable products with consumers favoring clean, eco-friendly formulations. Additionally, the market is being shaped by inclusivity as brands expand their offerings to cater to diverse hair types and textures. Artificial intelligence-driven tools and digital consultations are helping to meet the growing demand for customized solutions tailored to individual hair types and concerns.

| Report Attributes | Details |

| Market Size in 2025 | USD 22.56 Billoin |

| Expected Size by 2034 | USD 39.59 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By product, By Gender, By Distribution Channel, By Geography |

| Key Companies Profiled | Procter & Gamble (P&G) Company, Unilever plc, L'Oréal USA, Inc., Johnson & Johnson Consumer, Inc., Henkel Corporation, Revlon Consumer Products Corporation, The Estée Lauder Companies Inc, John Paul Mitchell Systems, Kao Corporation, Coty Inc. |

How is the rising demand for natural and organic hair care products creating new opportunities for manufacturers?

The rising demand for natural and organic hair care products is creating new opportunities for manufacturers by encouraging the development of clean, plant-based formulations that appeal to health-conscious and environmentally aware consumers. Giving customers convenient access to a wide range of hair care products at affordable prices. A large demographic finds these channels appealing due to the convenience of one-stop shopping and the high foot traffic. Many customers choose them because of their well-established brand and wide range of products. Through these conventional retail formats, in-store promotions and loyalty programs also increase sales.

The high cost of premium, organic, and natural hair care products continues to be a significant barrier in the U.S. market. Higher production and retail costs are a result of these products' frequent use of cruelty-free formulations, environmentally friendly packaging, and ingredients sourced from sustainability. This makes it hard for many customers, particularly those in the middle- and lower-income ranges, to defend the cost when compared to more traditional options.

Market penetration is hampered by this, especially in mass retail channels. Additionally, consumers are more likely to place a higher priority on affordability than brand values like sustainability or ingredient purity during times of inflation or economic uncertainty, which further slows adoption. Budget-conscious consumers may be discouraged from investigating premium options due to the belief that higher prices do not always translate into better outcomes.

The U.S. hair care products market is one of the largest globally, increased demand for natural and clean ingredients increased consumer spending and growing consciousness of the health of the scalp and hair. Important product categories include shampoo, conditioners, hair oils, styling aids, and treatments. These are distributed through pharmacies, mass merchants' salons, and internet platforms.

Products that accommodate different hair textures are becoming more and more popular, particularly among GenZ and multicultural consumers. To gain market share, major corporations such as Proctors and Gamblers, Unilever, and Loreal USA are constantly innovating. Future expansion is being shaped by trends like eco-friendly packaging, customized hair care, and tech-driven solutions. Nevertheless, the market is confronted with obstacles such as fierce rivalry, scrutiny of ingredients, and saturation in fundamental categories. Overall, high-end environmentally friendly, and multicultural hair care products present opportunities.

Shampoo segment dominated the market in 2024 since it continues to be an essential component of customers' daily hair care regimens. Shampoos' fundamental cleansing qualities keep them the most popular product. Furthermore, product innovations like organic and sulfate-free shampoos have increased sales and maintained consumer interest. Shampoos are widely available and in high demand, which makes this market a major source of income for many brands.

Serum segment is anticipated to witness the fastest growth over the forecast period stimulated by growing consumer demand for specialty treatments that provide benefits for styling repair and nourishment. Because of their lightweight formulas and capacity to address hair issues like split ends and frizz serums, they are becoming more and more popular. The need for multipurpose hair care products and growing awareness of hair health are additional factors contributing to this growth.

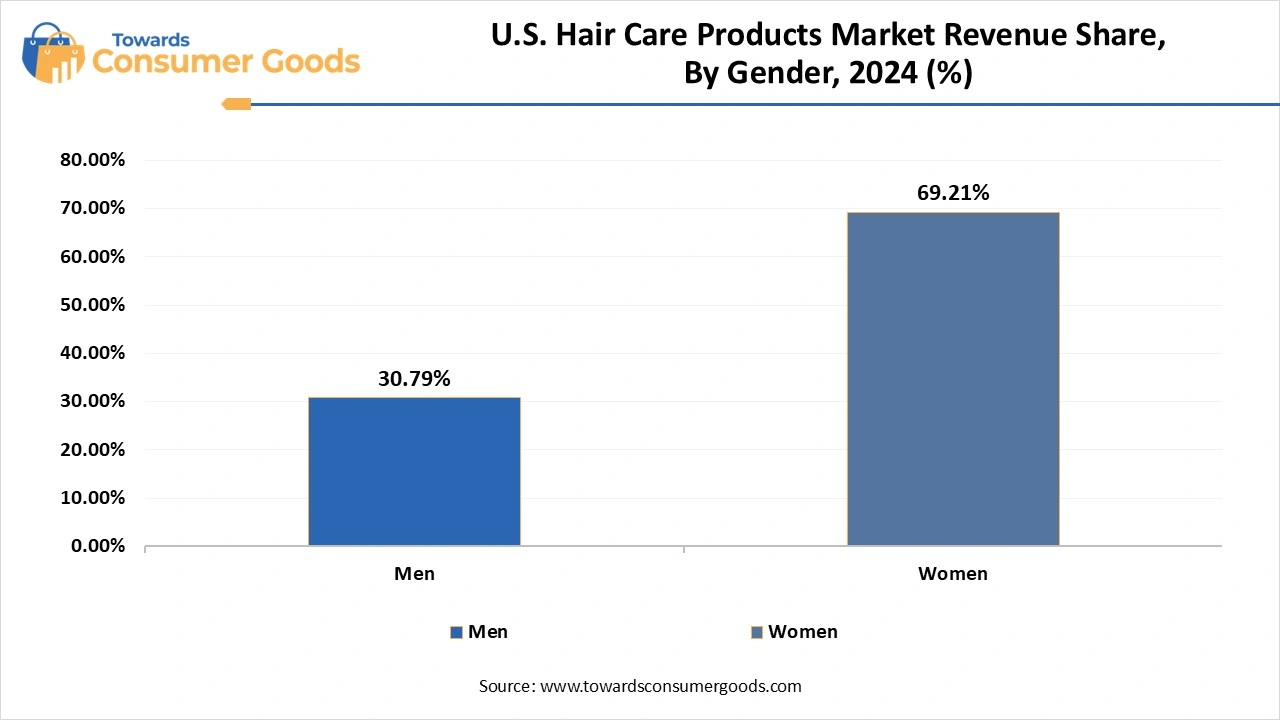

Women segment dominated the market in 2024 reflecting a greater selection of goods marketed to female customers and their increased propensity for use. Advanced formulas for different hair types and concerns are frequently found in women's hair care products which sustain demand. The market is bolstered by continuous innovation and intensive marketing campaigns targeted at female consumers.

Men segment is anticipated to witness the fastest growth over the forecast period Increased male grooming awareness and a wider range of products tailored to men's hair care requirements are driving this growth. This growing trend has produced new revenue streams for the market due to increased marketing efforts and the acceptance of men's self-care practices. Furthermore, the growth of salons catering to men and specialized grooming kits is motivating men to spend more money on hair care products.

Hypermarkets & supermarkets dominated the market in 2024 making a wide range of hair care products easily accessible to customers at affordable costs. The convenience of one-stop shopping and heavy foot traffic are advantages of these channels that appeal to a broad range of consumers. For many customers, they are the best option due to their well-established brand and wide range of products. Through these conventional retail formats, loyalty programs and in-store promotions also increase sales.

Online/e-commerce segment is anticipated to witness the fastest growth over the forecast period, giving customers convenient access to a wide range of hair care products at affordable costs. The convenience of one-stop shopping and heavy foot traffic are advantages of these channels that appeal to a broad range of consumers. For many customers, they are the best option due to their well-established brand and wide range of products. These conventional retail formats also increase sales through in-store promotions and loyalty programs.

By Product

By Gender

By Distribution Channel

By Geography

July 2025

July 2025

July 2025

July 2025