July 2025

The U.S. gluten free products market size was valued at USD 2.47 billion in 2024 and is expected to hit around USD 6.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.75% over the forecast period 2025 to 2034. This market is growing due to consumer awareness about celiac disease, rising health consciousness, and increasing demand for clean-label and allergen-free products are propelling the market forward.

The U.S. market for gluten-free goods is changing from being a specialized market for people who are intolerant to gluten to becoming a popular lifestyle choice for consumers who are concerned about their health. Increased diagnoses of gluten sensitivity and celiac disease as well as a general trend toward clean-label and gut-friendly foods are driving growth. Brands are responding to consumer demands for transparency by introducing minimal ingredient lists free from foods and are also changing product formulations. Large food producers are trying to gain market share by purchasing or establishing specialized gluten-free brands.

Consumers who are concerned about their health are choosing gluten-free products for both medical and wellness-related reasons. This includes people who follow paleo or low-carb diets, fitness enthusiasts, or who have digestive health issues. Gluten-free foods are processed less, which helps with weight management and digestion. Customers are paying close attention to labels and giving preference to non-GMO organic and preservative-free goods. Product experimentation is also encouraged by the growth of gluten-free meal-planning content on social media sites like Pinterest and Instagram.

| Report Attributes | Details |

| Market Size in 2025 | USD 2.71 Billion |

| Expected Size by 2034 | USD 6.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel |

| Key Companies Profiled | Conagra Brands, Inc., The Hain Celestial Group, General Mills Inc., Kellogg Co., The Kraft Heinz Company, Siete Foods, Barilla G. e R. Fratelli S.p.A, Seitz glutenfree, Dr. Schär, Ecotone |

How can brands scale in the U.S. Gluten-free space?

To effectively scale smaller gluten-free brands can employ social media storytelling DTC (direct to consumer) models and specialized influencer collaborations. They can educate customers and establish trust through platforms like Instagram and TikTok. Credibility is raised by taking part in third-party certifications, gluten-free community events, and food expos. Companies with a competitive advantage are those that provide subscription snack boxes with package discounts or allergen-safe production methods. Loyalty and virality are generated by sustainable messaging, emotional brand narrative, and transparent sourcing.

High production costs and cross-contamination risks

Producing gluten-free products requires specialized equipment to avoid cross-contamination, raising manufacturing costs. Sourcing gluten-free grains like millet, quinoa, or sorghum is often more expensive than traditional wheat. Maintaining taste and texture parity with gluten-containing products poses R&D challenges. Strict FDA labeling guidelines and certification processes further increase regulatory overhead. For many small businesses, these factors limit scalability and entry into mainstream retail.

The U.S. has the highest rate of gluten-free consumption worldwide thanks to a strong retail ecosystem and growing health consciousness. Cities such as Los Angeles New York and San Francisco exhibit a high level of premium demand and product diversity. Stores have a large selection of gluten-free products and conduct in-store demonstrations. Prices for gluten-free private label products are rising in the Midwest and suburbs. Both independent cafes and national restaurant chains are making investments in innovative gluten-free menu items. Additionally, border imports are giving consumers more options, especially from Canada and Europe.

Which product segment is currently dominating the U.S. gluten-free products market?

Bakery products dominated the U.S. gluten-free products market due to their wide variety and consumer preferences. Pieces of bread cakes and cookies are examples of bakery goods that have long been mainstays in the gluten-free market because gluten-free bakery products mimic well-known flavors and textures consumers searching for substitutes for conventional wheat-based products frequently use them because of the improved product quality brought about by the development of novel gluten-free flours and baking methods bakery goods are now a major source of income for the gluten-free industry.

Desserts & ice creams are the fastest-growing segment, driven by increasing demand for indulgent yet gluten-free options. The market for desserts and ice cream is expanding quickly as more people look for decadent treats that satisfy their gluten-free diet. Both gluten-sensitive consumers and general consumers looking for healthier dessert options are drawn to new product launches that emphasize clean-label ingredients, allergen-free recipes, and creative flavors. The market is expanding more quickly thanks to this trend, moving beyond necessities to more upscale and varied products.

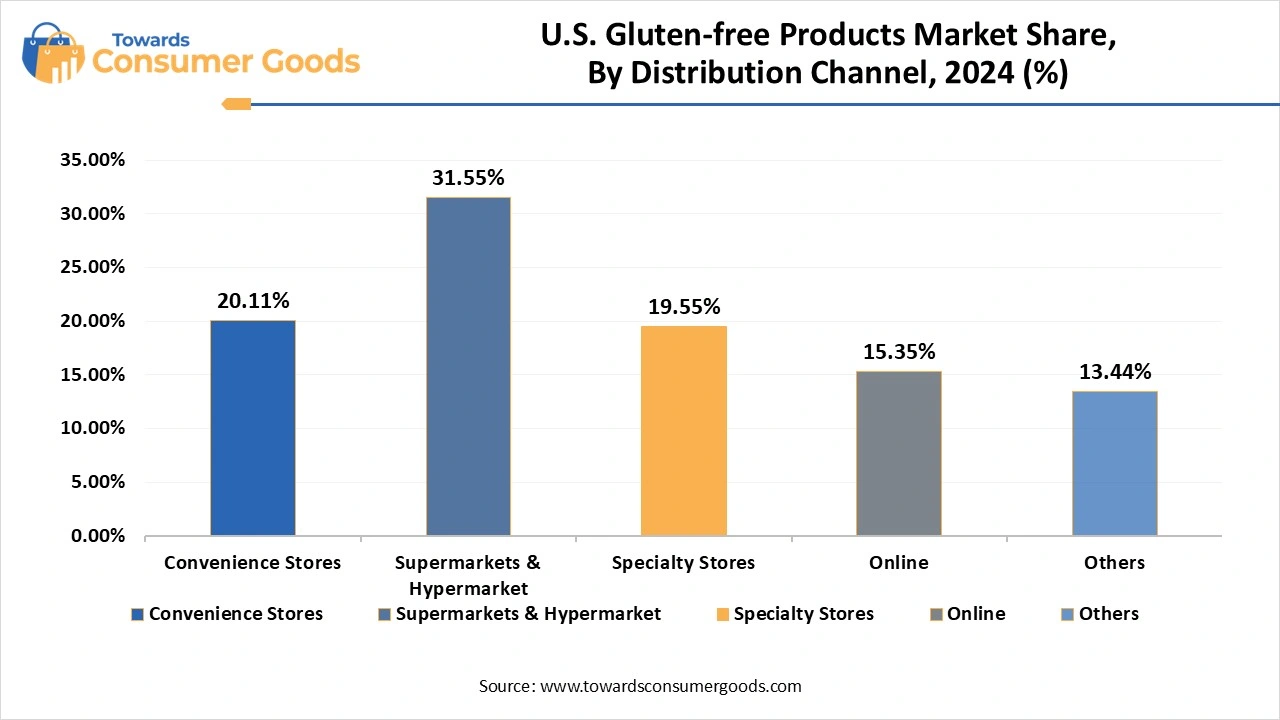

Which distribution channel is dominating the U.S. gluten-free market?

Supermarkets and hypermarkets hold the largest share, benefiting from wide reach and product variety because they provide wide product assortments under one roof supermarkets and hypermarkets are the dominant players in the gluten-free distribution landscape making it easy for customers to find everything they need. These stores further solidify their market position by utilizing private label brands to attract budget-conscious customers and allocating particular sections for gluten-free products.

By Product

By Distribution Channel

The global household refrigerators and freezers market size was valued USD 119.31 billion in 2024 and is projected to grow from USD 125.28 billion in ...

July 2025

July 2025

July 2025

July 2025