July 2025

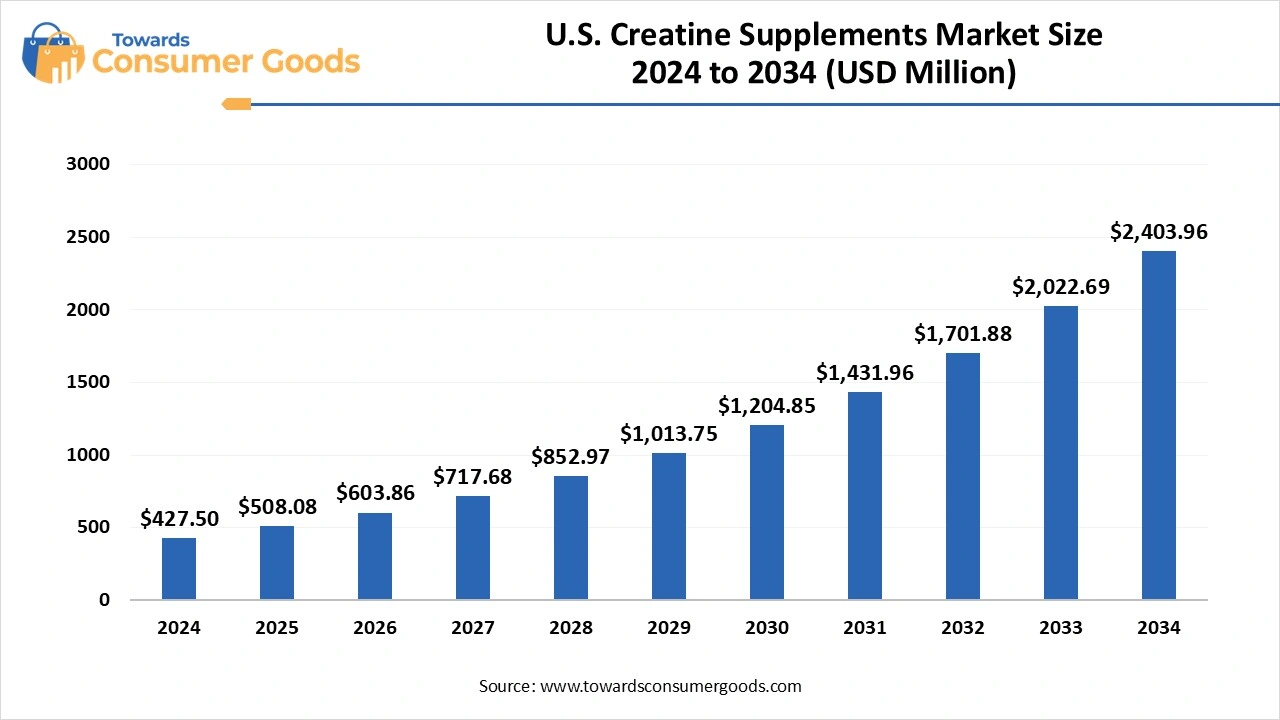

The U.S. creatine supplements market was valued at approximately USD 427.50 million in 2024 and is projected to grow at a CAGR of 18.85% from 2025 to 2034, reaching a value of USD 2,403.96 million by 2034. This market is growing due to increasing fitness awareness, rising participation in sports and bodybuilding, and the expanding availability of clean-label vegan and flavored creatine variants.

The U.S. creatine supplements market is gaining traction as consumers increasingly prioritize physical performance, muscle recovery, and cognitive health. The increasing popularity of plant-label supplements has encouraged manufacturers to develop new vegan and micronized formulations because of their benefits which have been supported by science creatine is becoming popular among athletes' gym goers and even casual fitness enthusiasts.

The market is also growing to include applications like neurological and aging-related support in addition to sports performance. Businesses are spending money on R&D to improve bioavailability and develop supplements that stack up. Lifestyle branding and digital personalization are becoming more and more important in marketing strategies.

By embracing social validation efficacy and transparency Gen Z consumers are revolutionizing the creatine market. Brands with clean reputations science-backed claims and shared ingredient sources are preferred by them influencer endorsements frequently drive widespread product discovery through short-form content platforms like Instagram Reels, YouTube Shorts, and TikTok.

Creatine is frequently added to stackable supplements along with protein and nootropics because GenZ values personalized wellness regimens. Choosing a brand requires careful consideration of ethical factors like sustainability and cruelly free testing. A new wave of product development is being influenced by this generation's desire for options that are both flavorful and multifunctional.

| Report Attributes | Details |

| Market Size in 2025 | USD 508.08 million |

| Expected Size by 2034 | USD 2,403.96 million |

| Growth Rate from 2025 to 2034 | CAGR 18.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Form, By Distribution Channel, By Geography |

| Key Companies Profiled | NutraBio, Allmax Nutrition, Nutrex Research, Inc., Glanbia PLC, Weider Global Nutrition, MuscleTech, Weider Global Nutrition, GNC Holdings, Ajinomoto Co Inc, THG PLC Ordinary Share |

How can niche brands break into the U.S. creatine supplements space?

focusing on niche markets like female athletes' vegans or biohackers smaller and more specialized brands can prosper. Reddit and Discord are two examples of community-driven platforms that can be used to build devoted user bases. Supplying distinctive delivery methods (e.g. G. RTDs and chewable) and collaborating with micro-influencers for genuineness can help gain traction in a particular niche. Rapid iteration based on consumer feedback is made possible by a DTC model. Younger audiences also respond well to eco-friendly packaging with minimalist design and sourcing transparency. Quick reactions to trends such as the use of creatine for brain health can help smaller players beat out more established rivals.

Creatine is governed by FDA regulations as a dietary supplement which includes labeling GMP compliance and safety disclosures. However, consumers may become confused and health concerns may arise due to the absence of official upper dosage limits. Warnings of legal action or bans may result from mislabeling or unsupported claims. Complicating matters further are state-specific laws about ingredients in sports nutrition. Claims of anti-aging or neurological benefits also need to be supported under FTC scrutiny. Brands are spending more money on third-party testing and regulatory compliance in order to protect their reputation.

Consumer Awareness & Product Diversity: What to Expect from U.S. Creatine Supplements Market by 2040?

The U.S. continues to lead the global creatine supplements market with high levels of consumer awareness, spending capacity, and robust distribution infrastructure. The demand for performance and aesthetic-related supplements is high in urban areas like New York, Miami, and Los Angeles. Social media influence and the availability of online shopping are causing suburban and rural areas to catch up more and more. College athletic departments and professional athletes are important adoption catalysts. Additionally, the growth of wellness chains and boutique fitness centers has increased the use of creatine among a variety of demographics including women and the elderly.

Why did the powder form segment dominate the U.S. creatine supplements market?

Powder form segment held a dominating share in the U.S. creatine supplements market due to being very popular among bodybuilders professional athletes and gym goers looking for ways to improve their performance. Easy mixing rapid absorption and high potency at a low cost are the hallmarks of powdered creatine. Additionally, because of the adjustable serving sizes users can modify dosages to suit their unique recovery requirements and level of exercise intensity. Additionally, the increased accessibility of flavored and micronized creatine powders has improved customer satisfaction and brand loyalty. By providing combo packs and bundle packs centered around creatine powders, retailers and brands are also profiting from this trend.

Capsules/tablets segment is projected to grow at the fastest rate in the market driven by a change in consumer preference toward easy supplementation, profitability, and convenience. These forms are particularly appealing to people who prefer ready-to-consume formats such as travelers, busy professionals, and casual fitness enthusiasts. Because they don't require mixing or carrying shaker bottles, capsules are perfect for routines that require on-the-go use.

To improve absorption and lessen stomach discomfort, brands are also introducing sophisticated delivery systems like enteric-coated and sustained-release tablets. The clean label movement is also promoting vegan gelatin-free and minimally excipient-based capsule formulations which will increase their appeal.

Why did the online distribution channel dominate the U.S. creatine supplements market in 2024?

Online segment dominated the distribution landscape of the U.S creatine supplements market in 2024, motivated by modern consumers' preference for digital purchases, ease of use, and accessibility. From the comfort of their home, consumers can read reviews, compare brands, and make well-informed choices. Digital sales have increased further because of the emergence of health and wellness influencers and sponsored advertising on websites like Instagram, YouTube, and TikTok due to the availability of subscription models customized bundles, and special discounts many customers have also turned to direct-to-consumer websites. This change has improved the entire online shopping experience and is backed by quick shipping, easy checkout procedures, and accommodating return policies.

E-commerce is witnessing the fastest growth in the market driven by individualized consumer experiences targeted by digital advertising and mobile-first purchasing habits. To increase their market share, fitness companies are making significant investments in social commerce integrations, SEO-optimized product pages, and influencer partnerships. Customers gain access to verified reviews through ingredient breakdowns and digital loyalty benefits. Adoption has also been accelerated by the ease of mobile order tracking and auto-renewal of subscriptions. Additionally, e-commerce allows businesses to quickly test new product flavors, formats, and bundles based on real-time consumer feedback and buying trends.

By Form

By Distribution Channel

The global musical instruments market size is calculated at USD 47.61 billion in 2024, grew to USD 50.99 billion in 2025 and is predicted to hit aroun...

The latest market outlook reports that, the global tissue paper market size is calculated at USD 97.55 billion in 2025 and is forecasted to reach arou...

Based on comprehensive market projections, the global eyewear market size was accounted for USD 201.19 billion in 2024 and is expected to be worth aro...

The global handbag market size is calculated at USD 56.85 billion in 2024, grew to USD 60.57 billion in 2025 and is predicted to hit around USD 107.22...

July 2025

July 2025

July 2025

June 2025