July 2025

The u.s. commercial vacuum cleaner market size was valued at USD 437.98 million in 2024 and is expected to hit around USD 632.9 million by 2034, growing at a compound annual growth rate (CAGR) of 3.75% over the forecast period 2025 to 2034. The demand for specialized cleaning products and vacuum cleaners has increased in the commercial sector, including healthcare, hospitality, educational institutions, and offices, driving the U.S. commercial vacuum cleaner market.

The U.S. commercial vacuum cleaner market is experiencing significant growth, driven by various factors like heightened awareness of hygiene, sanitation, and cleanliness in commercial spaces, including healthcare, manufacturing, education, and hospitality. The commercial sector of the U.S. has witnessed spectacular growth in demand for efficient cleaning, particularly the cleaning solutions with advanced technology integration. The adoption of robotic, IoT connectivity, and AI-based vacuum cleaners is high across U.S. commercial industries. The Packback vacuum cleaners are trending in the market for their portability and versatility. Manufacturing industries need specialized cleaning solutions, including HEPA filters and real-time air quality sensors, fueling market competition.

The growing demand for efficient and technologically advanced cleaning solutions is the major driver for the U.S. commercial vacuum cleaner market. The demand has increased due to rising hygiene and sanitation importance, demand for the commercial sector, and easy access to cutting-edge technologies.

The U.S. is well-known for early adoption of cutting-edge technologies in all sectors, contributing to the need for advanced cleaning solutions as well. The multitask cleaning solutions are gaining popularity in the country. Vacuum cleaners with the ability to track and monitor trends in the market. The manufacturers are early developing vacuum cleaners with integration of advanced technologies like AI-powered cleaning, IoT connectivity, advanced filtration systems, and robotic vacuum cleaners for commercial spaces.

| Report Attributes | Details |

| Market Size in 2025 | USD 454.4 Million |

| Expected Size by 2034 | USD 632.9 Million |

| Growth Rate from 2025 to 2034 | CAGR 3.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Power Source, By Product Type, By End User, By Distribution Channel |

| Key Companies Profiled | Techtronic Industries Co. Ltd., Makita Corporation, Tennant Company, Nilfisk Group, Alfred Kärcher SE & Co. KG, Dyson Limited, Hako Group, Numatic International Ltd., Tacony Corporation, Solenis LLC, SEBO America, LLC, BISSEL Group, ProTeam, Inc. |

The rising awareness about the importance of indoor air quality is holding potential opportunities for the vacuum cleaners market in the U.S. commercial sector. The concern over indoor air pollution and its impact on health is growing, contributing to the rising demand for effective and advanced cleaning solutions, including vacuum cleaners in commercial spaces.

The government of the U.S. has implemented strict regulations to improve indoor air quality in the commercial sector, including healthcare, manufacturing, and hospitality, driving the need for efficient and specialized vacuum cleaners. The growing need for advanced vacuum cleaners with the ability to effectively remove dust, allergens, and pollutants is driving innovation and development.

The high initial cost associated with vacuum cleaners is the major restraint of the market. The commercial sector of the U.S. has shifted its preference toward Robotic and smart vacuum cleaners, which are equipped with advanced features, contributing to the cost. Many commercial spaces with cost-consciousness or low budgets may hesitate to adopt this vacuum cleaner. Additionally, the ongoing US-China Trade is increasing the cost of electronic goods, causing consumers to shift toward traditional products again.

Recent US tariffs applied in April 2025 have influenced several vacuum cleaner companies' business in the country. Major international companies for robotic vacuum cleaner developments, including SharkNinja (Shark Vacuums & Ninja Appliances), Dyson, iRobot (Roomba), Roborock, Ecovacs, and Other facing market challenges. The U.S. consumers are witnessing a short-term shortage and delay for robotic vacuum cleaners. The higher price seems inevitable for technology and appliance products, including vacuum cleaners.

Which Product Segment Dominated the U.S. Commercial Vacuum Cleaner Market in 2024?

The robotic commercial vacuum cleaners segment is expected to lead the market over the forecast period due to increased demand for automation and efficient cleaning solutions. The demand for professional robotic vacuum cleaners is high across the U.S., driven by high adoption in the commercial sector, industrial environments, and healthcare facilities. Robotic vacuum cleaners offer sophisticated features like specialized cleaning capabilities, management systems, and autonomous navigation.

What made Corded Segment hold the Largest Revenue of the U.S. Commercial Vacuum Cleaner Market?

The corded segment marked its dominance by generating the largest revenue in 2024, driven by the high adoption of corded vacuum cleaners in U.S. commercial spaces, driven by their uninterrupted power supply, strong reliability, and sustainability for large-scale cleaning tasks, including hotels, hospitals, and airports. The corded vacuum cleaners have high capacity, making them suitable for large-scale spaces, like commercial spaces. Ongoing advancements in lithium-ion batteries and preference for safe cleaning solutions foster the adoption of corded vacuum cleaners in commercial industries.

The cordless segment is expected to grow fastest over the forecast period due to increased focus on safety standards, practicality of cordless vacuum cleaners for deep and daily cleaning, and improvement of battery technologies, like enhanced battery life, faster charging, and strong suction power of cordless vacuum cleaners. The advancement of cordless vacuum cleaners is reducing the performance gap between corded and cordless vacuum cleaners.

How Cleaning Service Providers Segment Dominated the U.S. Commercial Vacuum Cleaner Market in 2024?

The cleaning service providers segment dominated the market in 2024, due to increasing demand for various vacuum cleaner types like upright, backpack, robotic, and canister models, in different commercial industries of the U.S. The increased demand has increased the need for cleaning service providers for adaptable and efficient cleaning solutions. Major cleaning service providers in the U.S. are offering advanced vacuum cleaners to enhance commercial and consumer experiences and engagements.

The offices and commercial buildings segment is expected to grow significantly. The offices and commercial buildings hold high foot traffic, need continuous and efficient cleaning. Vacuum cleaners are indispensable for maintaining cleanliness in these environments. The growing trend for sustainable cleaning practices in U.S. offices and commercial buildings is fostering the segment's growth. Additionally, the growing focus on indoor air quality and demand for smart cleaning solutions in office and commercial buildings is driving the adoption of advanced vacuum cleaners.

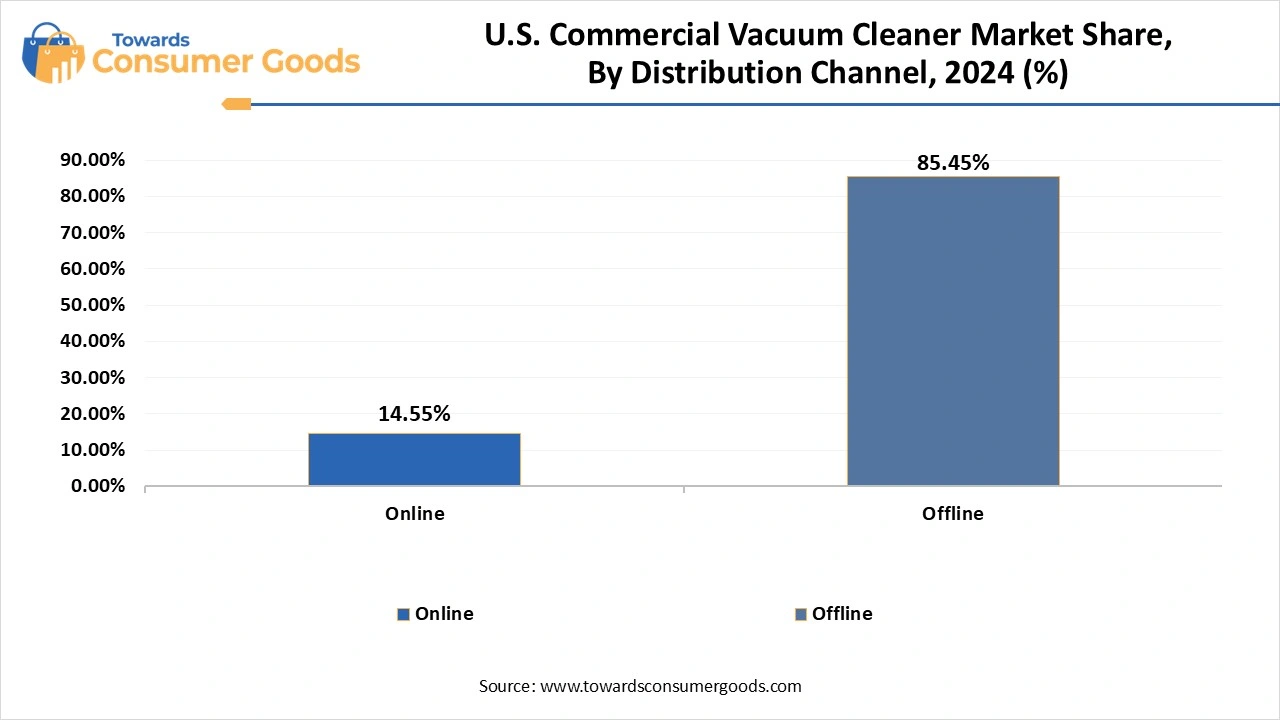

Which Distribution Channel Segment Led the U.S. Commercial Vacuum Cleaner Market in 2024?

The offline segment led the market in 2024, due to the availability of personalized services and strong after-sales support provided by the offline stores. Consumers prefer to buy goods through offline stores to experience hands-on purchasing. Offline stores are convenient for bringing damaged goods to gaining access to replacements. The agency and warranty facilities further contribute to increasing the popularity of offline distribution channels.

The online segment is expected to grow fastest over the forecast period, driven by changing consumer preferences toward online shopping. The growing e-commerce platform in the U.S. plays a crucial role in the increased online purchase of commercial vacuum cleaners in the country. Online stores offer price-sensitive and consumer reviews, making them a trustworthy and affordable choice for cost-conscious consumers. Additionally, the convenience and accessibility of various types of avccums through online channels foster segment growth.

By Power Source

By Product

By End User

By Distribution Channel

The global luxury furniture market size was estimated at USD 31.21 billion in 2024 and is predicted to increase from USD 32.54 billion in 2025 to appr...

Based on comprehensive market projections, the U.S. salon plumbing fixtures market size was USD 919.95 million in 2024 and is projected to grow from U...

Industry forecasts suggest that the North America pet food market size is calculated at USD 2.47 billion in 2024, grew to USD 2.71 billion in 2025 and...

July 2025

July 2025

July 2025

June 2025