July 2025

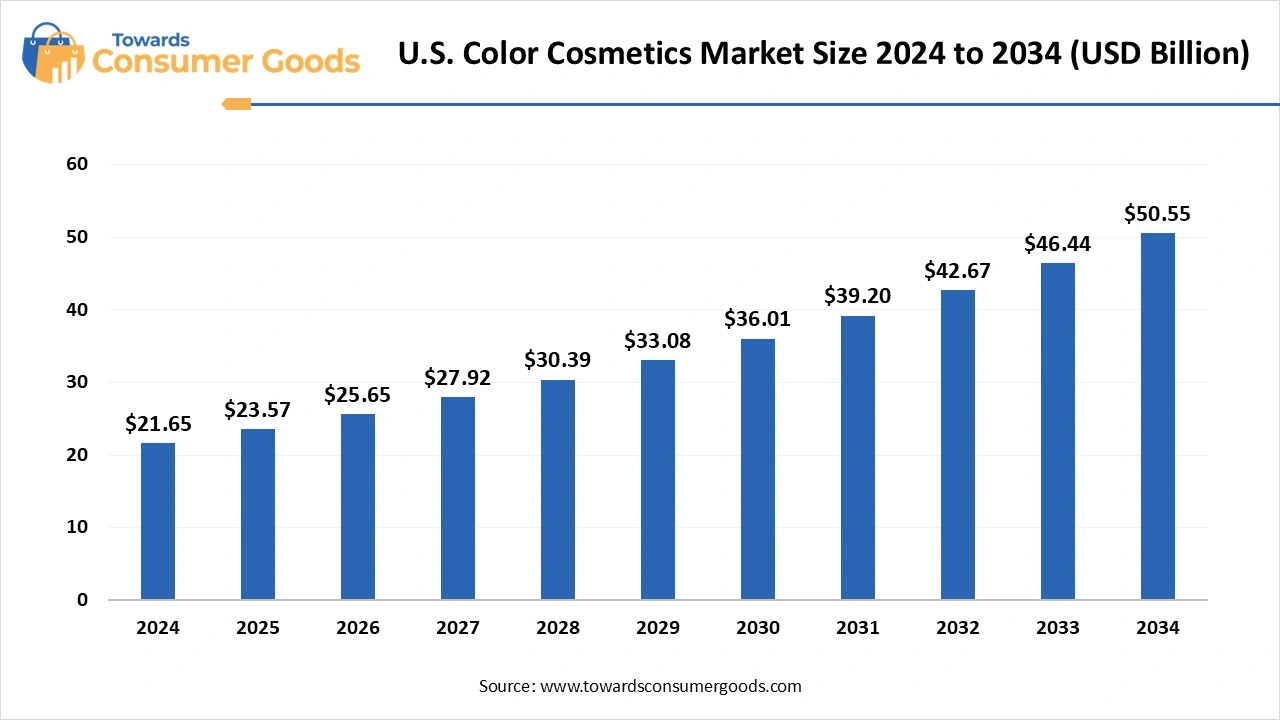

The U.S. color cosmetics market size was valued at USD 21.65 billion in 2024 and is expected to hit around USD 50.55 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.85% over the forecast period 2025 to 2034. This market is growing due to increasing beauty consciousness, product innovation, and the rising influence of social media.

The U.S. color cosmetics market is undergoing a vibrant transformation with dynamic shifts in consumer preference and brand positioning driven by the market for clean vegan and multipurpose products grows bands are responding to this demand with creativity inclusivity and digital influence. The prestige makeup market is still strong even though some consumers have reduced their discretionary spending due to inflationary pressures.

Value-conscious consumers are drawn to hybrid beauty products that combine skincare and makeup. The use of AI-powered product matching and virtual beauty consultations is growing. Brands that align with consumer values and support social causes are gaining enduring loyalty.

Gen Z consumers are changing the color cosmetics market by emphasizing ethical principles, self-expression, and authenticity. Bold color branding that is inclusive of all genders and open ingredient sourcing is preferred by this generation. To find products and provide tutorials, they mainly rely on TikTok, YouTube, and Instagram which help create viral products and quick trends. They are trendsetters and early adopters because they are open to trying new products. Gen Z anticipates ongoing brand innovation messaging about sustainability and mental wellness.

| Report Attributes | Details |

| Market Size in 2025 | USD 23.57 Billion |

| Expected Size by 2034 | USD 50.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel |

| Key Companies Profiled | L’Oréal USA, Estée Lauder Companies, Revlon Inc., Coty Inc., e.l.f. Beauty Inc., Procter & Gamble Co., Mary Kay Inc., Shiseido Americas, Anastasia Beverly Hills, Huda Beauty |

Social media can help small brands reach specialized audiences and take advantage of partnerships with micro-influencers. They can emotionally connect with customers by producing genuine narrative content. Specifically, TikTok makes viral growth possible with little financial outlay. Brand visibility is increased by utilizing user-generated content and real-time interaction. E-commerce platforms that offer direct-to-consumer business models allow small businesses to quickly expand while gaining insightful data about their customers.

Even though cosmetics innovation is crucial, the FDA's strict regulations regarding color additives and product claims pose difficulties because brands must guarantee complete compliance; product launches may be delayed, and expenses may rise. Regulation violations may lead to recall penalties to harm one's reputation. Startups may find the expenses of testing and documentation to be prohibitive. State-by-state variations in labeling regulations and ingredient bans add complexity. Due to the current regulatory environment brands must spend money on legal supervision and compliance teams.

The U.S. remains a global leader in the color cosmetics market, driven by its large consumer base significant influence on beauty culture, and high spending per capita. Celebrity endorsements and fashion week partnerships continue to fuel trends in major cities like New York, Los Angeles, and Miami. High-end brands and innovative products are preferred by consumers in these areas. Demand for natural and reasonably priced cosmetics is rising in the Midwest and the South. Cross-border e-commerce makes European and K beauty brands accessible. U.S. customers react very quickly to influencer opinions and product reviews.

Why does the facial color cosmetic segment dominate the U.S. color cosmetics market?

Facial color cosmetics including brushes, concealers, primers, and foundations dominate the market. Customers look for products with longevity, a natural finish, and extra skincare advantages like sun protection and hydration. Product innovations like oil-free solutions, SPF-infused bases, and breathable formulations help this market. Demand is increased because inclusive shade ranges appeal to a wide range of consumers. Regular use of facial makeup for events and virtual appearances keeps sales steady. Both high-end and low-end brands have benefited from this trend by expanding their product lines.

Nail color cosmetics are anticipating witnessing the fastest growth, driven by growing consumer interest in doing nail art and at-home grooming. The rise in sales has been attributed to the growing popularity of clean formulations gel polish and nail stickers. Trends in nails such as chrome finishes and minimalist designs have gained popularity thanks to influencer tutorials on websites like TikTok. Younger consumers are drawn to nail products due to their affordability and recurring purchase cycle. Quick dry and chip-resistant formulas are examples of innovations that improve the user experience. Limited edition nail collections have also gained popularity as a result of celebrity and fashion house partnerships.

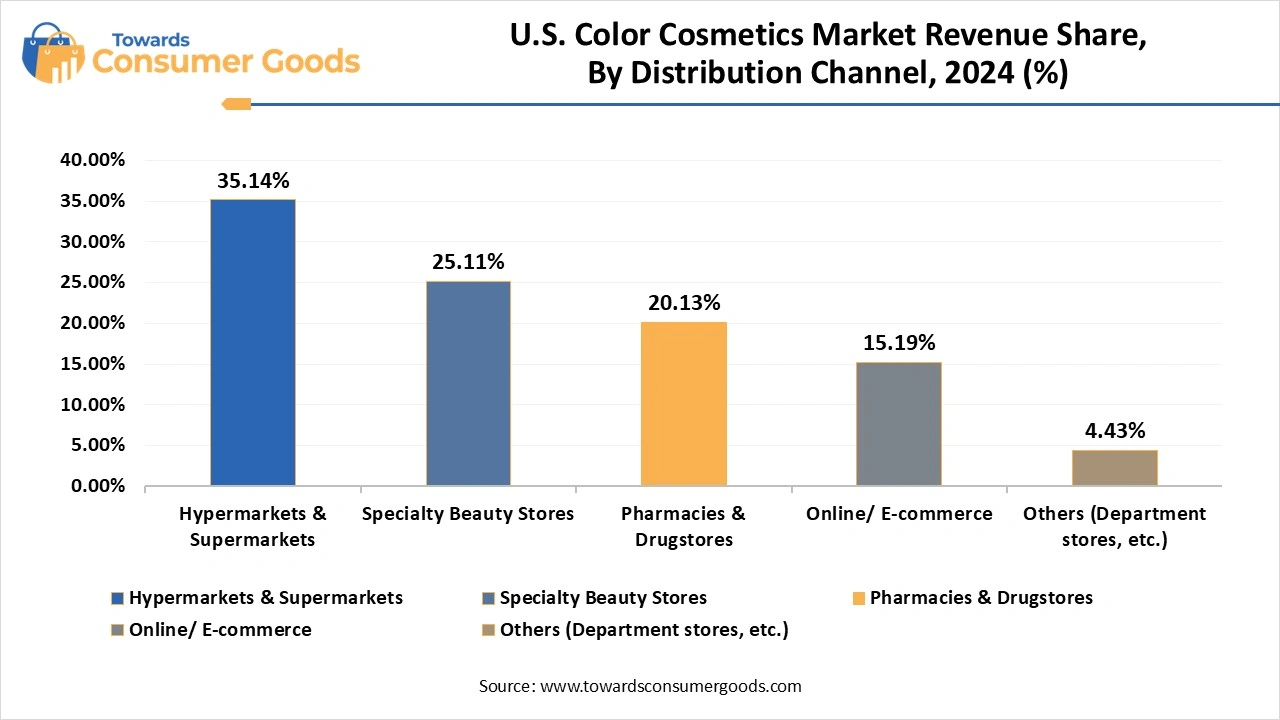

Why do hypermarkets and supermarkets dominate the distribution of color cosmetics?

Hypermarkets and supermarkets dominated the market due to their convenient one-stop shopping option, competitive pricing, and extensive geographic reach. In addition to providing a large shelf space, these retailers frequently replenish their inventory with popular and seasonal cosmetics. Accessibility is important because color cosmetics are readily available to consumers during routine grocery or housekeeping shopping excursions a day. A lot of supermarkets have special beauty sections with branded testers and kiosks. Their offerings have been improved through collaborations with both mass and luxury brands. Volume sales in these retail channels are increased through promotional offers and package discounts.

Online distribution channels are anticipated to grow at the fastest rate, driven by the ease of home delivery digital marketing and evolving shopping habits. Access to a greater range of brands including exclusive online launches and foreign products is advantageous to consumers. Real-time reviews of beauty quizzes and virtual try ones driven by AI boost online shoppers' confidence. Impulsive purchases are increased by influencer marketing flash sales and social commerce trends. Brands can monitor consumer preferences and customize products using e-commerce platforms. In this channel, subscription models' free samples and loyalty incentives are also improving customer retention.

By Product

By Distribution Channel

The global laundry care products market size was valued USD 107.19 billion in 2024 and is projected to grow from USD 112.39 billion in 2025 to USD 172...

According to market forecasts, the asia pacific rum market size accounted for USD 7.82 billion in 2025 and is forecasted to hit around USD 11.28 billi...

According to latest report, the U.S. real estate market size is calculated at USD 1.75 trillion in 2024, grew to USD 1.80 trillion in 2025 and is pred...

July 2025

July 2025

July 2025

June 2025