July 2025

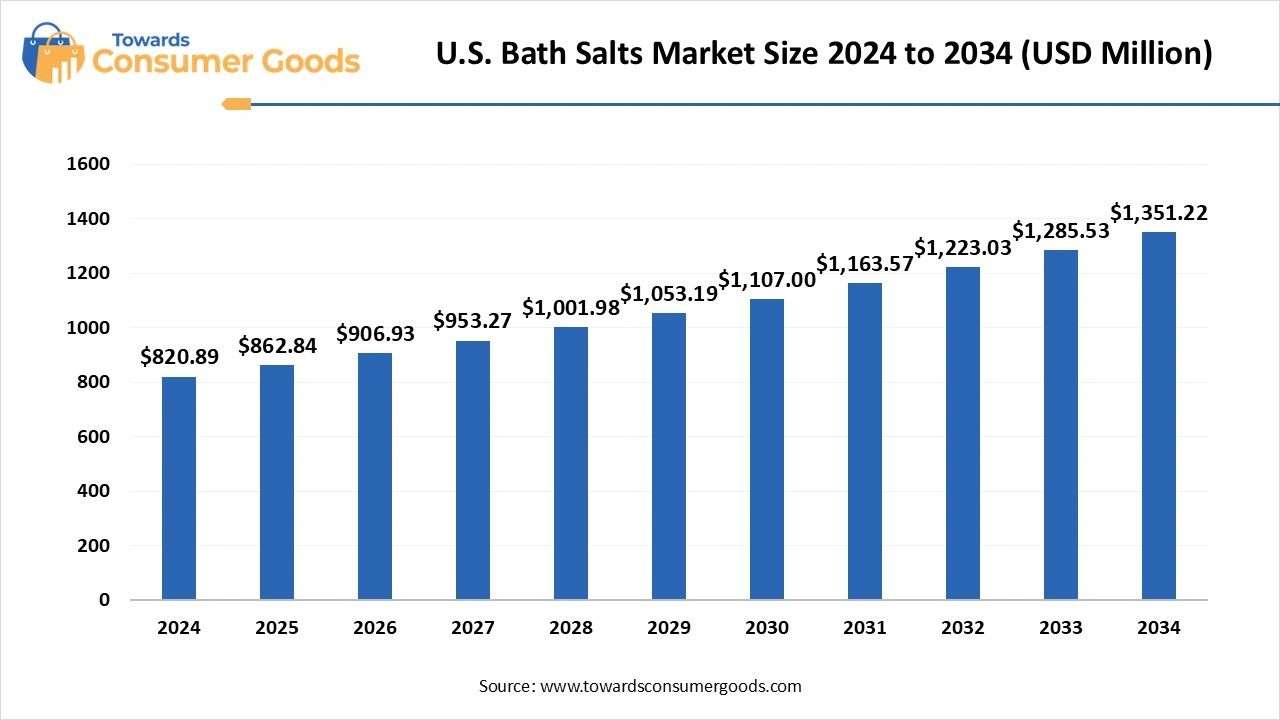

The U.S. bath salts market size was valued at USD 820.89 million in 2024 and is expected to reach around USD 1,351.22 million by 2034, growing at a CAGR of 5.11% from 2025 to 2034.This market is growing due to rising consumer preferences for self-care, relaxation, and wellness routines.

The U.S. bath salts market is experiencing steady growth driven by a growing consumer interest in stress management holistic self-care practices and personal wellness. The demand for bath salts containing natural ingredients, minerals, and essential oils has increased due to the growing popularity of at-home spa treatments, social media, and wellness influencers.

The market is also expanding as more people become aware of the therapeutic advantages of Epsom and Himalayan salts for skin care and muscle recovery. To appeal to consumers who are concerned about their health and the environment, manufacturers are also coming up with novel scent-based formulations and eco-friendly packaging.

The demand for bath salts is rising in the U.S. as consumers increasingly seek affordable and convenient ways to relax and unwind at home. People are using bath salts because of their calming cleansing and skin-nourishing qualities in the face of rising stress levels and hectic lifestyles. Interest in bath salts with organic ingredients, essential oils, and minerals has increased as a result of the popularity of wellness trends and natural beauty products. Because of this change in consumer behavior companies are being forced to diversify their product lines and provide specialized solutions for a range of needs including aromatherapy muscle relief and relaxation.

| Report Attributes | Details |

| Market Size in 2025 | USD 862.84 Million |

| Expected Size by 2034 | USD 1351.22 Million |

| Growth Rate from 2025 to 2034 | CAGR 5.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel, By Geographic |

| Key Companies Profiled | Basin, The Seaweed Bath Co., Parfums de Coeur, Ltd., SAN FRANCISCO SALT CO, Enviromedica., Bathorium., The Midwest Sea Salt Company Inc., Better Bath Better Body LLC, Yareli Bath & Beauty., SaltWorks |

Can Natural Ingredients Give you a Competitive Edge?

As consumers become more ingredient-conscious, there's a rising demand for bath salts made with natural, organic, and plant-based components. Products with Dead Sea minerals Himalayan pink salt essential oils and dried flowers are becoming more and more popular than synthetic ones. Clean toxin-free formulations are forging strong brand trust, and consumers are reading labels more carefully. Manufacturers have a great chance to highlight eco-friendly sourcing, cruelty-free testing, and sustainability. Companies can successfully stand out in a crowded market by trying their messaging to environmental preservation and holistic wellness.

The demand for personalized wellness is reshaping how consumers approach bath time. Deeper engagement can be achieved by providing choices such as mood-based bath salt kits, ingredient combinations based on skin concerns, or even personalized scent blends. AI-based suggestions or interactive online tests can improve user experience and increase conversion rates. Brand loyalty can be raised by offering subscription plans or personalized packaging that changes based on user preferences. Since self-care is increasingly focused on meeting personal needs, personalization offers a potent means of establishing a personal connection with customers.

Many mass-produced bath salts still contain synthetic fragrances, artificial colors, and preservatives that can cause skin irritation or allergic reactions. Due to concerns about potential negative effects, consumers with sensitive skin or certain dermatological conditions might completely avoid using bath salts. This growing concern is particularly pertinent in this era of increased awareness of clean beauty and skincare safety. The reputation of a brand can be seriously impacted by unfavorable reviews or skin-related issues. Consequently, the market's overall consumer trust and adoption are being hampered by the existence of subpar or chemically harsh products.

The bath salts market in the United States is experiencing consistent growth, driven by a growing consumer interest in stress management wellness and at-home self-care practices. In America, bath salts are becoming commonplace as people look for therapeutic and reasonably priced ways to relax ease aching muscles, and enhance the health of their skin. This trend is particularly noticeable among consumers who value natural formulations and clean ingredients and are wellness conscious.

Consumption is highest in metropolitan areas with greater disposable incomes and wellness-focused lifestyles such as the Southeast Coast and West Coast major cities. Additionally, these areas exhibit a greater preference for premium-grade organic and aromatherapy-infused bath salt products. Major offline channels such as pharmacies, retail chains, and specialty beauty shops continue to be important, but online shopping is becoming more and more popular.

E-commerce has gained significant traction, especially among younger consumers who value convenience, product variety, and personalized options. Subscription boxes, influencer-driven marketing, and wellness-themed online communities are further fueling this shift. Meanwhile, suburban and rural regions represent untapped potential, where awareness campaigns and affordability-driven offerings could expand market reach.

Overall, the U.S. market is being shaped by lifestyle-driven consumption, a preference for functional and relaxing bath products, and a strong demand for clean-label, aesthetically appealing solutions.

Why did Epsom Salt Dominate the U.S. Bath Salts Market?

Epsom salt holds the largest share in the U.S. bath salts market because of its longstanding reputation for easing stress detoxifying the body and relieving muscle soreness. Many American homes have made it a mainstay due to its accessibility in beauty routines and home remedies. Epsom salt is a magnesium-rich product that is widely recommended by medical professionals for both therapeutic and cosmetic purposes. The reason for its widespread popularity is still how simple it is to incorporate regular foot soaks and baths. Its presence in multifunctional personal care and wellness products serves as additional evidence of its dominance.

Himalayan salts are emerging as the fastest-growing product type due to natural wellness and luxury products becoming more and more popular. Customers who value appearance and health are drawn to its mineral-rich profile, unique pink color, and purported detoxifying properties. The growing popularity of high-end self-care rituals and spa trends is driving market demand. Retail and internet wellness retailers are seeing an increase in sales of Himalayan salt-based bath products as customers look for more holistic experiences. Companies are taking advantage of this trend by introducing Himalayan bath salts in crystal form and with aromatherapy added.

Why did Offline Sales Dominate the U.S. Bath Salts Market?

Offline retail channels, including supermarkets, pharmacies, and specialty stores, currently dominate the U.S. bath salts market. Before buying consumers frequently prefer to physically inspect products' smell fragrances and weigh their options. In brick-and-mortar stores sales are greatly influenced by impulse purchases and a trustworthy retail presence. Bath salt's attractiveness in physical stores is further increased by the fact that they are usually packaged with gift sets or seasonal promotions. Partnerships between major national retail chains and wellness brands also contribute to the dominance of offline channels.

Online sales are growing at the fastest pace, driven by the ease of online shopping, the growing popularity of digital devices, and focused advertising using platforms and wellness influencers. Customers appreciate being able to read reviews, browse a greater selection of products, and take advantage of sales or subscription plans. Additionally, this trend was accelerated by the move to digital shopping during and after the pandemic. Platforms like Amazon, Etsy, and direct-to-consumer websites are being used by bath salt companies to provide curated experiences and unique online goods. Social media interaction and tailored suggestions are also driving these channels' expansion.

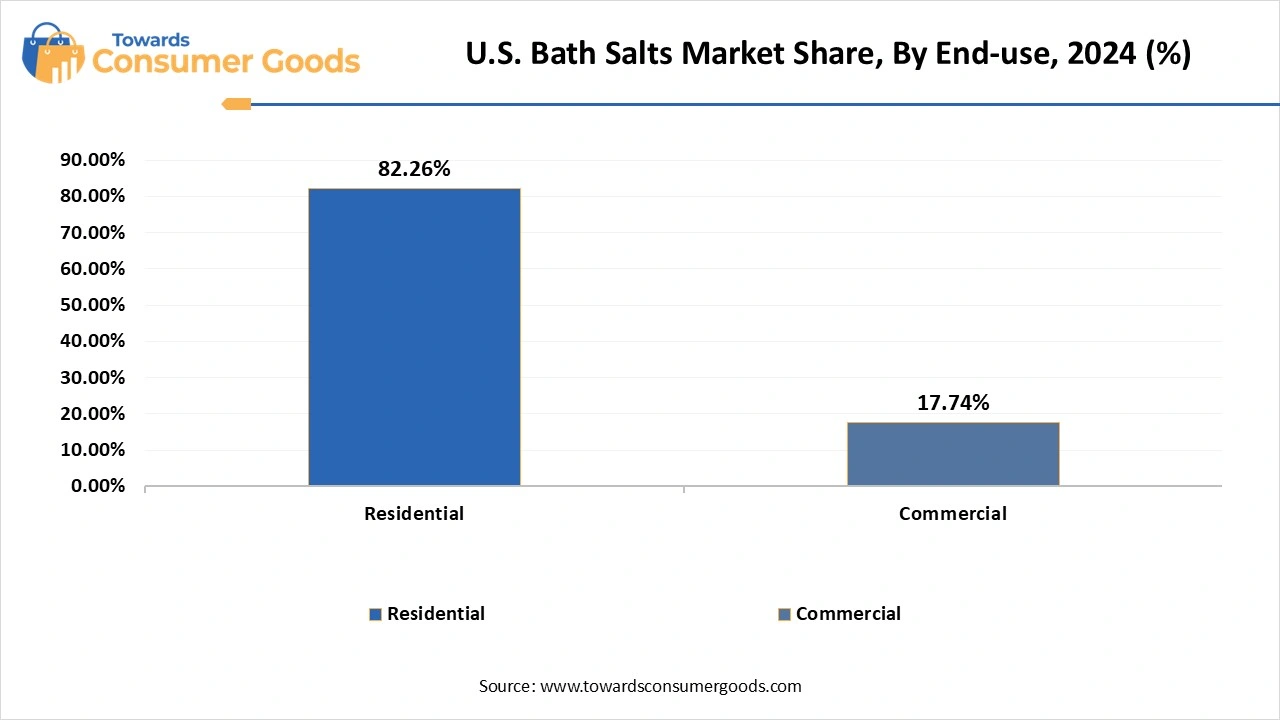

Why did Residents Dominate the U.S. Bath Salts Market?

Residential segment dominates the market as bath salts are primarily used for personal self-care routines at home. Particularly since the pandemic, consumers have come to see bathing as a calming healing ritual which has increased the frequency of at-home spa treatments. Bath salts are accessible for daily relaxation because they are less expensive than spa treatments. Additionally, the growing popularity of natural home remedies for stress sleep and skincare is supporting this market. The residential category's dominance is a reflection of the larger trend of at-home wellness that is self-driven.

Commercial segment is witnessing the fastest growth due to more spa wellness resorts and upscale hotel chains using bath salts. High-quality branded bath salts for guest treatments are becoming more and more in demand as the wellness tourism and spa services sector grows. Specialized bath salts are becoming more popular as more spas place an emphasis on natural and therapeutic bath rituals. Bulk orders from commercial clients are common, which propels volume-based growth in this market. Partnerships with luxury product lines and boutique wellness brands are accelerating this trend even more.

By Product

By Distribution Channel

By End-user

By Geographic

July 2025

July 2025

July 2025

June 2025