July 2025

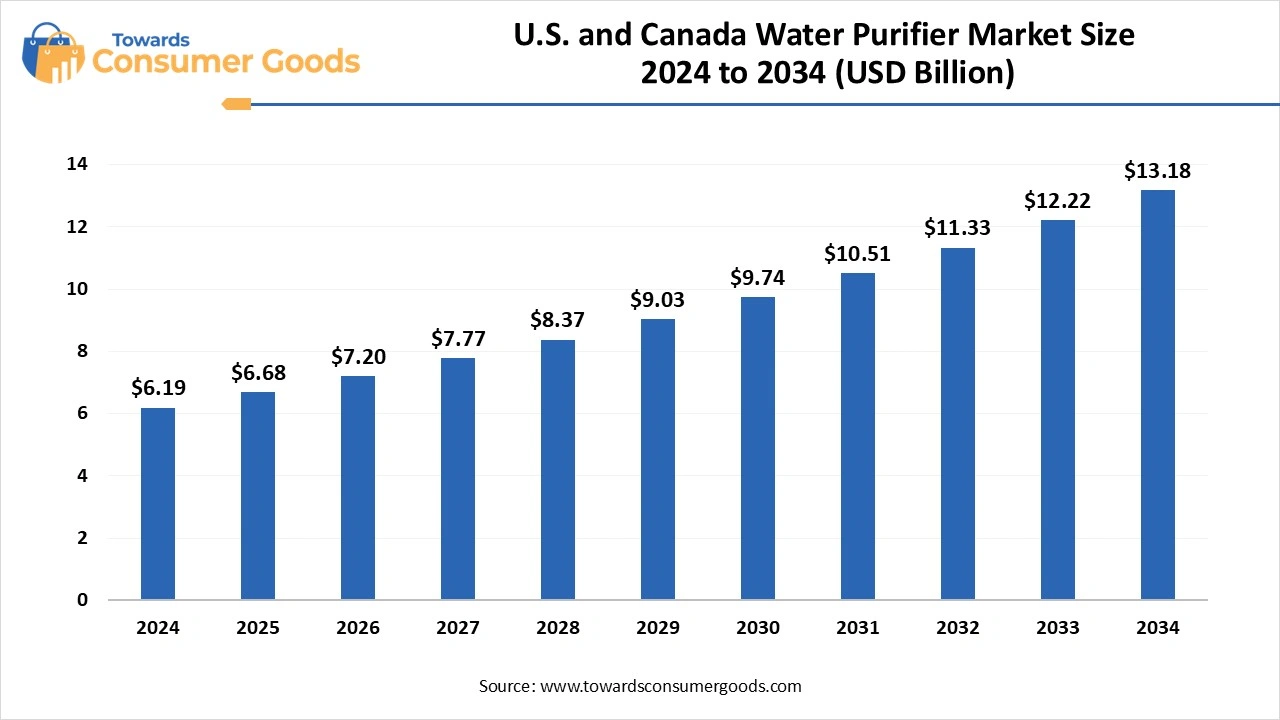

The U.S. and canada water purifier market size was reached at USD 6.68 billion in 2024 and is expected to hit around USD 13.18 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.85% during the forecast period 2025 to 2034. This market is growing due to increasing health awareness, rising concerns about water quality, and the growing appeal of alternatives to bottled water.

The U.S. and Canada water purifier market is undergoing significant transformation due to heightened concern over water quality and the increasing adoption of advanced purification systems. Smart purifiers equipped with IoT monitoring, filter alerts, and digital control are seeing growing interest. Additionally, the shift toward sustainable living is prompting the demand for energy-efficient and recyclable filtration units. Market players are focusing on affordability, reliability, and easy maintenance as key differentiators.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.68 Billion |

| Expected Market by 2034 | USD 13.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Technology, By Capacity, By Price, By Application, By Distribution Channel, By Region |

| Key Companies Profiled | A.O. Smith Corporation, Culligan International , GE Appliances, 3M, Brita (The Clorox Company), Aquasana, Whirlpool Corporation |

Rising Requirement for Advanced Water Purifier Solution, As customers look for water purification systems that are more intelligent, environmentally friendly, and portable, a new wave of innovation is emerging in a market that is becoming more and more competitive brands can achieve growth and differentiation by combining connectivity, high purification efficiency, and user-centric design.

Reaching impoverished rural areas with high-end purifiers is still difficult despite the high demand. Low awareness of cost issues and infrastructure constraints prevent penetration. Simplified technology creative financing strategies and regional education programs are needed to close this gap.

Fixed segment dominated the market in 2024 motivated by its extensive use in both residential and commercial settings. These systems ensure constant access to clean water by providing steady high-capacity purification and integrating with plumbing systems. For long-term installations, they are the recommended option due to their dependability and compatibility with multi-stage filtration techniques.

Flexible segment is anticipated to witness the fastest growth over the forecast period as a result of the growing demand for portable water filtration. Increased outdoor recreation camping popularity and awareness of emergency preparedness are all driving up adoption, particularly among urban and nomadic users looking for lightweight portable solutions. Additionally, these purifiers are becoming more popular among aid organizations and NGOs that provide water solutions in areas affected by disasters. They are appealing for temporary or mobile needs due to their affordability, ease of storage, and low maintenance requirements.

RO water purifiers segment dominated the U.S. and Canadian market in 2024 owing to their great efficiency in eliminating chemicals heavy metals and dissolved salts. Both the commercial and residential sectors favor them because of their capacity to provide safe and clean water even in places with contaminated or hard water supplies. They are also more appealing to consumers due to advancements in membrane technology and decreased water waste.

RO systems remain the preferred choice for buyers who are concerned about their health as they place a higher priority on thorough purification.

UV water purifiers segment is anticipated to witness the fastest growth over the forecast period as consumers seek chemical-free solutions that effectively kill bacteria and viruses. Their low maintenance, fast processing, and suitability for municipal water sources make them increasingly appealing in urban environments with microbiological concerns. UV systems are also often integrated into hybrid units alongside RO, offering layered purification at competitive prices. Their compact design and energy efficiency further support growing adoption in modern homes.

Medium (5L to 10L) segment dominated the market in 2024 providing a perfect balance between footprint and storage. This market is the most sensible and well-liked choice because it serves nuclear families and small offices where daily water consumption necessitates neither bulk nor minimal storage. To improve taste and quality medium units frequently have auto-refill capabilities and mineral boosters. Without sacrificing everyday requirements their moderate size guarantees compatibility with modular kitchen designs.

Small (Below 5L) segment is anticipated to witness the fastest growth over the forecast period owing to the growing demand for small household appliances and urbanization. These purifiers are perfect for dorms apartments and single-person homes where convenience and space savings are more important than high output. Manufacturers are aiming to attract students and millennials with affordable models that are portable and simple to use. Their increasing market penetration is also a result of their expanding use as secondary purifiers in larger homes

Medium segment dominated the market in 2024 because it offers an economical and necessary feature combination that is well-balanced. Customers are drawn to this market because it offers reliable purification technologies like RO and UV without the added expense of smart technology or high-end design finishes. These models usually provide long-term value due to their sturdy construction and low maintenance requirements. Their market dominance is reinforced by their availability through both offline and online channels and their compatibility with current kitchen configurations.

High segment is anticipated to witness the fastest growth over the forecast period due to increasing demand for premium appliances with smart features. High-income households and commercial spaces are investing in IoT-enabled systems with app controls, self-cleaning filters, and multi-stage purification technologies. These purifiers also offer elegant aesthetics and sleek user interfaces that appeal to luxury buyers. As health and hygiene become lifestyle priorities, consumers are willing to spend more for superior water quality and convenience

Residential segment dominated the market in 2024 driven by the need for clean drinking water at home and rising consumer awareness of waterborne illnesses. Increased emphasis on health and wellness, ease of installation, and growing disposable income have all contributed to household adoption. This market is also supported by the growing popularity of in-house purification and bottled water substitutes. Customers are being drawn in by improved features like voice assistance and mineral cartridges.

Commercial segment is anticipated to witness the fastest growth over the forecast period as offices, hospitals, restaurants, and schools increasingly invest in water purification systems. These institutions prioritize water safety for employees, customers, and patients, leading to rising demand for durable and high-capacity solutions. Regulatory compliance and hygiene protocols in public spaces further accelerate installation. Additionally, branding efforts around safe and clean environments encourage commercial establishments to invest in premium purifiers.

Offline segment dominated the market in 2024 since customers favored in-store interactions where they could interact with live demos, physically assess product features, and get prompt installation and support services. Appliance stores, neighborhood dealers, and retail showrooms continued to be important touchpoints for reliable purchases. Building brand confidence is aided by the in-person interactions and post-purchase service network found in physical stores. Offline retail continues to be the main method of purchase in many rural and semi-urban areas.

Online segment is anticipated to witness the fastest growth over the forecast period driven by the convenience of e-commerce, wider product variety, and aggressive discounting strategies. Tech-savvy consumers increasingly rely on online platforms to compare specifications, read reviews, and enjoy doorstep delivery with installation services included. Influencer marketing and social media promotions are also accelerating online purchases. The availability of EMIs, exchange offers, and 24/7 customer support adds to the appeal.

By Product Type

By Technology

By Capacity

By Price

By Application

By Distribution Channel

By Region

July 2025

July 2025

July 2025

June 2025