July 2025

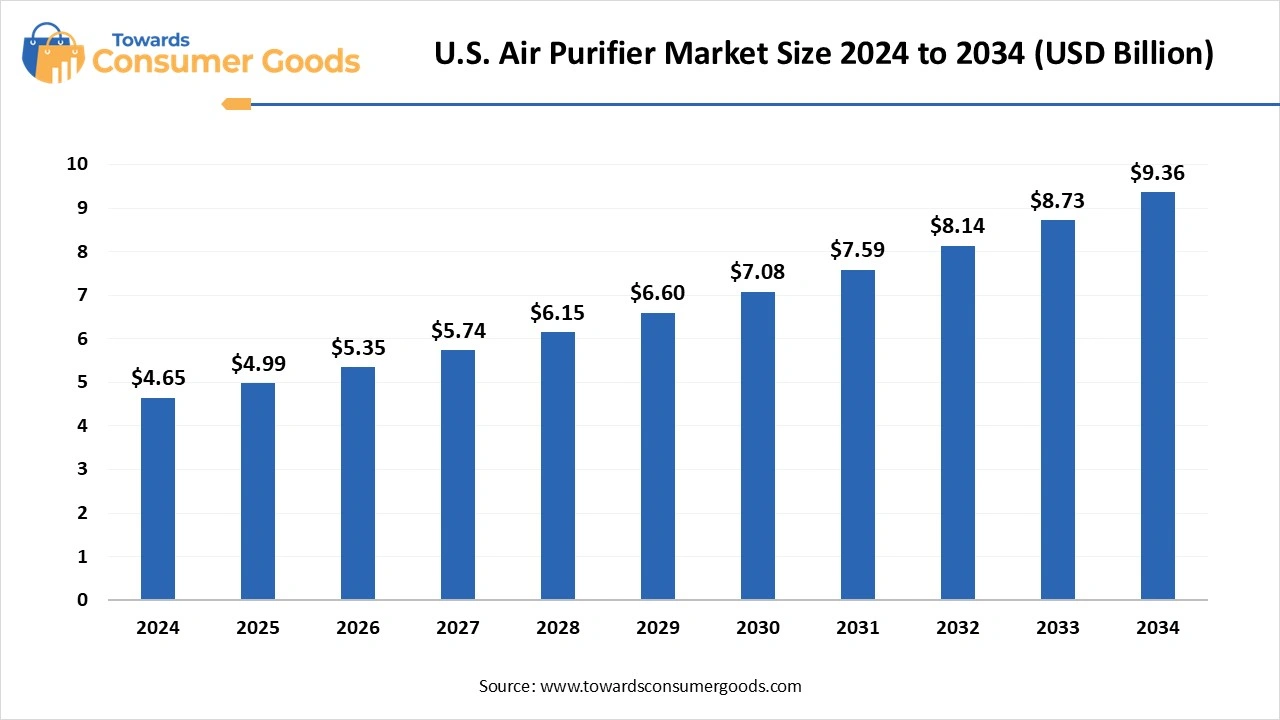

The u.s. air purifier market size was valued at USD 4.65 billion in 2024 and is expected to hit around USD 9.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.25% over the forecast period 2025 to 2034. The 24/7 availability and the integration of sensory technology have driven the market growth. The 24/7 availability and the integration of sensory technology have driven the market growth.

The U.S. air purifier market, which includes a broad range of air filtration systems, is experiencing substantial growth fueled by an increasing awareness of health issues, rising concerns over air quality, and a troubling escalation in air pollution incidents. This market expansion is further strengthened by stringent government regulations designed to protect air safety, significant advancements in filtration technologies, and an escalating demand for energy efficient as well as environmentally sustainable filtration solutions.

Consumers are becoming more cognizant of potential airborne contaminants—such as heavy metals, volatile organic compounds (VOCs), chemicals, and microorganisms—prompting an elevated demand for dependable and effective air filtration systems that ensure clean and safe breathing air. The issue of indoor air pollution, amplified by allergens like pollen and dust particles, as well as various industrial pollutants, is notably driving the burgeoning interest in air purifiers and filtration technologies. Additionally, underlying concerns regarding the health risks associated with waterborne contaminants are motivating a greater number of households to invest in water filtration systems.

Currently, the U.S. air purifier market is enjoying considerable momentum, mainly due to an increased awareness of the health risks posed by inadequate air quality. This proliferation is also being driven by rapid urbanization and government policies that advocate for cleaner air initiatives. Furthermore, technological innovations in filtration devices—including High-Efficiency Particulate Air (HEPA) filters and sophisticated smart filtration systems—are playing a pivotal role in propelling the market’s growth trajectory.

A growing public understanding of the long-lasting health implications associated with air pollution is encouraging consumers to actively seek effective filtration solutions. This awareness is magnified by the rising incidences of respiratory illnesses and other health disorders linked to poor environmental conditions. As urban areas continue to grow, pollution levels in both indoor and outdoor environments are on the rise, underscoring the critical need for highly efficient filtration systems.

| Report Attributes | Details |

| Market Size in 2025 | USD 4.99 Billion |

| Expected Size in 2034 | USD 9.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | California |

| Segment Covered | By Technology, By Sales Channel, By Type, By Application |

| Key Companies Profiled | Daikin Industries, Ltd., Sharp Electronics Corporation, Honeywell International, Inc., Panasonic Corporation, AprilAire, LG Electronics, Koninklijke Philips N.V., Samsung Electronics Co., Ltd., Unilever (Blueair), Dyson, Hamilton Beach Brands, Inc. SharkNinja, Lasko Products, LLC (Germ Guardian), Vesync Co., Ltd (Arovast Corporation), COWAY CO., LTD., PuroAir, IQAir Group |

The U.S. air purifier market, encompassing both air and water filtration systems, holds substantial growth potential. This opportunity is primarily driven by heightened awareness regarding health and environmental issues, particularly in urban areas grappling with pollution challenges. Increased residential construction activity is also propelling the demand for effective filtration solutions, underlining the growing importance of maintaining indoor air quality.

Consumers are increasingly recognizing the detrimental health effects tied to poor air quality, which in turn is driving their pursuit of cutting-edge filtration systems. Furthermore, the rising recognition of indoor air pollutants and allergens is significantly encouraging the adoption of air purifiers. Innovations in air quality monitoring technologies—including more compact and user-friendly devices, as well as solutions utilizing nanotechnology—are paving the way for groundbreaking advancements within the market.

However, several factors present challenges to the growth of the U.S. air purifier market. High initial purchase costs, along with expenses for replacements and ongoing maintenance, can hinder widespread adoption among consumers. The presence of cheaper, lower-quality air filter options in the market further complicates consumer decision-making.

Additionally, the emergence of alternative technologies, such as electrostatic precipitators and UV air filters—introduces competition that could stymie market expansion. The complexity of indoor pollutants, combined with a generally low level of consumer awareness regarding their potential health risks, may also impede market growth. For many consumers, the significant upfront investment required for high-quality electronic air filters, coupled with the ongoing operational costs associated with their usage, can deter new buyers from entering the market.

The high-efficiency particulate air (HEPA) segment led the U.S. air purifier market in 2024. HEPA filters, predominantly made up of submicron glass fibers, fall under the category of extended surface mechanical filters. This efficiency makes HEPA filters particularly proficient in improving overall air quality by effectively removing a wide range of particulate matter.

The activated carbon segment expects the significant growth in the market during the predicted period. The growth of the segment primarily due to its exceptional capability to absorb various gases and unpleasant odors generated from cooking, mold, chemicals, pets, and smoke. This unique modification substantially increases the surface area available for absorption, thereby enhancing the filter's capacity to capture airborne pollutants and particulates effectively.

The 250-400 segment dominated the U.S. air purifier market in 2024, These air purifiers are more suitable for larger rooms, open-concept spaces, and office environments. Many models in this category incorporate advanced features such as Wi-Fi connectivity, real-time air quality monitoring, and multiple fan speed settings, enhancing user convenience and air quality management.

The below 250 square feet segment expects the significant growth in the market during the forecast period. Some models feature activated carbon filters that effectively remove odors from the environment, making them particularly advantageous for households with pets or individuals who smoke. They adeptly tackle pollutants like dust, pollen, and pet dander, rendering them an excellent choice for individuals suffering from allergies or respiratory conditions.

The offline sales segment dominated the U.S. air purifier market in 2024. This traditional sales avenue enables market players to bolster their product presence, as a significant number of consumers still prefer to assess product quality through personal examination prior to purchasing. The offline sales channel encompasses a diverse array of retail formats, such as hypermarkets and supermarkets, specialized retail outlets, department stores, and discount retailers.

The online sales segment is anticipated to demonstrate the highest compound annual growth rate (CAGR) over the forecast period. Online sales primarily encompass transactions conducted via company-owned retail websites and third-party e-commerce outlets. With the rapid advancement of technology and an escalating number of users embracing online shopping, the penetration of this sales channel is expected to surge in the upcoming years.

The portable/standalone segment segment led the market in 2024 and expected to sustain its position during the forecast period, that are specifically designed to filter ambient air and eliminate airborne contaminants such as bacteria, viruses, and dust particles. These independent units can be conveniently placed in various rooms and easily relocated as required, providing flexibility in air purification.

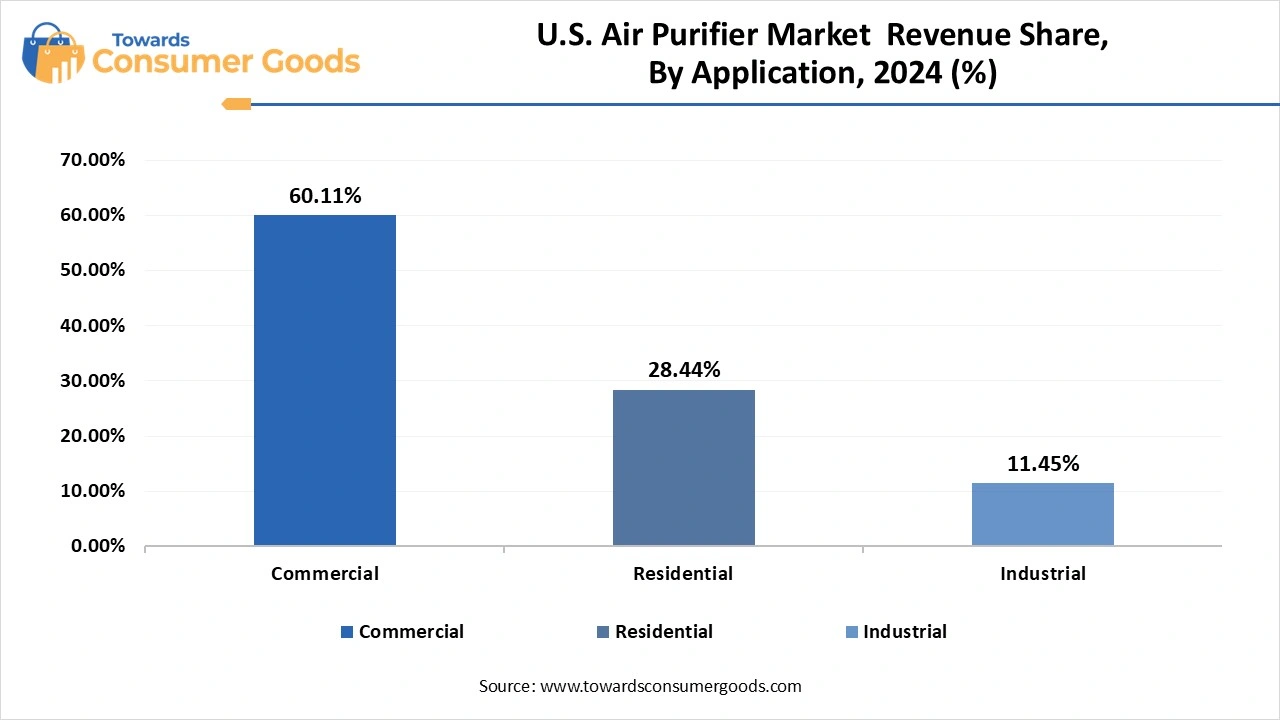

The commercial segment led the U.S. air purifier market in 2024. Businesses across a spectrum of sectors, including healthcare facilities, educational institutions, office complexes, retail environments, and hospitality venues, are recognizing the imperative need to provide clean, healthy air for employees, customers, and visitors alike.

The residential segment is anticipated to show the highest growth trajectory in the coming period. Many households—ranging from small apartments to expansive homes—are grappling with the challenge of declining air quality. Consequently, there has been a widespread adoption of air purifiers as essential tools for ensuring clean air within residences.

Versuni

Daikin Industries

Technology

By Sales Channel

By Type

By Application

The b2b hygienic paper market size was accounted for USD 134.15 billion in 2024 and is expected to be worth around USD 211.34 billion by 2034, growing...

July 2025

July 2025

July 2025

June 2025