May 2025

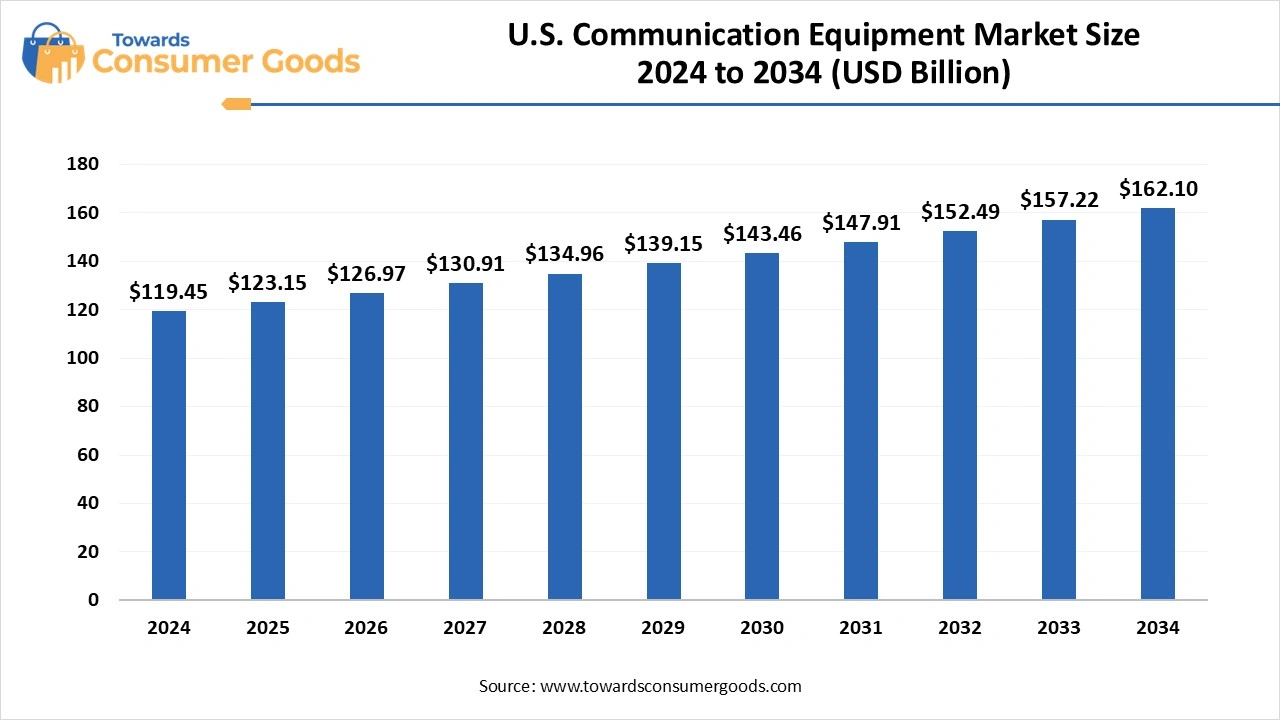

The U.S. communication equipment market size was calculated at USD 119.45 billion in 2024 and is projected to hit around USD 162.10 billion by 2034 with a CAGR of 3.10%. The demand for IoT devices and the advancement in 5G networks have driven the market growth.

The landscape of the U.S. communication equipment market is both multifaceted and dynamic, influenced by several transformative factors. Among the primary catalysts for growth is the widespread adoption of 5G networks, which promises to revolutionize connectivity with lightning-fast internet speeds.

This technological leap is accompanied by a surging demand for high-speed internet access, driven by both consumers and businesses seeking seamless connectivity for their operations and activities. The transition to cloud-based communication solutions, such as Voice over Internet Protocol (VoIP) and unified communications platforms, is reshaping the way organizations communicate and collaborate.

This trend necessitates the development of advanced infrastructure and equipment capable of supporting the increased demands for reliability and speed, particularly as businesses adapt to remote and hybrid work models. Moreover, the proliferation of Internet of Things (IoT) devices across various sectors, such as industrial applications, healthcare innovations, and automotive advancements, greatly contributes to the market's momentum. These devices require low-latency edge computing and dependable connectivity to function optimally, thereby intensifying the demand for advanced communication equipment.

Government initiatives, including substantial funding for smart city projects, defense communication enhancements, and broadband infrastructure expansion, provide an additional layer of stimulus to the market. Meanwhile, the incorporation of artificial intelligence (AI) and machine learning technologies is ushering in innovations in network management and security, creating new prospects for growth in the industry.

As the U.S. communication equipment market continues to expand, several key trends are emerging. The ongoing rise of 5G networks, coupled with the accelerating adoption of IoT devices, is propelling the need for superior networking solutions. This includes sophisticated routers, modems, and other equipment engineered to manage increased data loads and facilitate rapid transmission speeds. The deployment of 5G infrastructure underscores the importance of high-performance communication equipment, such as optical transceivers, which are essential for meeting the demands of faster internet and lower latency.

In addition, the growing reliance on high-speed internet and streaming services by both consumers and enterprises is driving the necessity for modern routers and modems that can support heightened bandwidth requirements. The increasing popularity of smart home devices—ranging from smart TVs and security systems to innovative appliances—further fuels the demand for communication equipment that can efficiently manage the connectivity of these diverse devices. Moreover, rigorous government regulations aimed at ensuring safety and security, including those about fire safety systems, are also contributing to the expansion of the communication equipment sector.

The Bring-Your-Own-Device (BYOD) trend in workplaces is additionally influencing the U.S. communication equipment market, as employees frequently utilize their devices for professional tasks, necessitating the enhancement of wireless communication infrastructure.

| Report Attributes | Details |

| Market Size in 2025 | USD 123.15 Billion |

| Expected Size in 2034 | USD 162.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.10% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Segment Covered | By Product Type |

| Key Companies Profiled |

Apple Inc., SAMSUNG All, LG Electronics, Lenovo, Panasonic Corporation, Xiaomi, AT&T Intellectual Property, Google Inc., Sony Corporation, OnePlus |

The U.S. communication equipment market holds tremendous potential for growth, particularly in key areas such as the expansion of 5G networks, the widespread adoption of Internet of Things (IoT) technologies, and advancements in cloud computing infrastructure. As the demand for high-speed connectivity and sophisticated technological frameworks escalates, this market is poised for continuous expansion, creating a wealth of opportunities for companies engaged in the development and deployment of various communication devices.

With the ongoing rollout of 5G networks across the United States, there is a pronounced surge in demand for essential equipment such as fiber optic cables, small cell sites, and base stations. These components are critical for ensuring robust network performance and coverage. Simultaneously, the proliferation of IoT devices—ranging from smart home appliances to industrial-grade sensors—exacerbates the need for scalable and resilient networking solutions capable of handling vast amounts of data.

Furthermore, as businesses and consumers increasingly turn to cloud-based services, there is a growing need for high-performance networking hardware within data centers. The integration of artificial intelligence (AI) and machine learning (ML) into networking devices is revolutionizing network management and security protocols, thereby generating significant avenues for innovative solutions.

Additionally, the escalating threat of cyberattacks necessitates the development of networking equipment equipped with advanced integrated security features. Government initiatives focused on public safety and security also play a pivotal role in shaping demand for specific types of communication equipment. For example, the evolution of smart cities, which leverage cutting-edge communication technologies, is driving a diverse array of networking solution requirements.

In the rapidly growing SATCOM-on-the-Move market segment, there are abundant opportunities for businesses specializing in satellite communication equipment. While mobile communication networks continue to dominate the landscape, fixed-line networks remain vital for sectors such as government, healthcare, and finance, providing specialized opportunities for companies in those fields.

Over the next decade, Wi-Fi technology is expected to transition from being primarily confined to indoor locations to encompassing outdoor spaces, vehicles, warehouses, and freight yards—essentially achieving universal connectivity. This extensive level of interconnectivity will facilitate high-precision functionalities, including positioning systems, gesture recognition, breathing detection, emotional analysis, and advanced perimeter security measures.

NextGen Wi-Fi technologies are on the brink of widespread adoption, poised to play an instrumental role in enhancing individuals' quality of life while simultaneously boosting productivity levels. The underlying Wi-Fi infrastructure is anticipated to become predominantly cloud-driven, enabling a range of smart digital services. These services may include innovative solutions for waste management, enhanced security systems, and intelligent lighting applications within public areas.

he implementation of high-speed Wi-Fi, combined with excellent bandwidth connectivity, serves as a substantial asset for the tourism industry, effectively elevating customer satisfaction rates and potentially stimulating local economies through increased tourism-related growth. In the healthcare sector, the application of Wi-Fi technologies is destined to transform the operational efficiencies of hospitals and clinics. For instance, wireless applications allow healthcare providers instantaneous access to vital clinical information, facilitating seamless communication with patients.

Additionally, public Wi-Fi networks can enhance healthcare access for individuals residing in rural areas, enabling remote consultations with medical professionals. The technology also supports real-time location tracking, which allows for better resource allocation within healthcare facilities, ensuring that patients and medical staff are directed to the appropriate locations when needed.

The U.S. government plays an active and influential role in the communication equipment industry through a variety of initiatives designed to foster competition, boost innovation, and enhance supply chain resilience. Key programs include the Broadband Equity, Access, and Deployment (BEAD) program, the Rural Digital Opportunity Fund (RDOF), and the Public Wireless Supply Chain Innovation Fund, alongside ongoing efforts by regulatory bodies such as the Federal Communications Commission (FCC) and the National Telecommunications and Information Administration (NTIA).

For example, the Broadband Equity, Access, and Deployment (BEAD) program allocates an impressive $42.45 billion for the expansion of high-speed Internet access. This funding is earmarked for a comprehensive array of activities, including strategic planning, infrastructure development, and initiatives aimed at increasing Internet adoption. All 50 states, along with the District of Columbia and five U.S. territories, are participating in this vital program and have already established their Internet for All plans. With NTIA’s approval, all 56 states and territories are prepared to take the subsequent steps to access their designated BEAD funding and select the service providers tasked with constructing and enhancing the high-speed Internet networks of the future.

The U.S. communication equipment market is currently grappling with a myriad of challenges that significantly affect its growth and sustainability. Among these hurdles are the escalating costs associated with infrastructure development, heightened cybersecurity threats, and intensifying competition from emerging communication technologies. Additionally, the imposition of tariffs on imported components complicates matters further, while the imperative for continuous innovation and upgrades creates an ongoing financial burden.

Establishing and maintaining advanced communication infrastructure—such as 5G networks and fiber-optic systems—demands a substantial capital investment. This encompasses the expenses tied to constructing network towers, setting up data centers, and implementing comprehensive security solutions. Moreover, government regulations and spectrum licensing fees contribute to the soaring operational costs, making the financial landscape even more complex for companies in this sector.

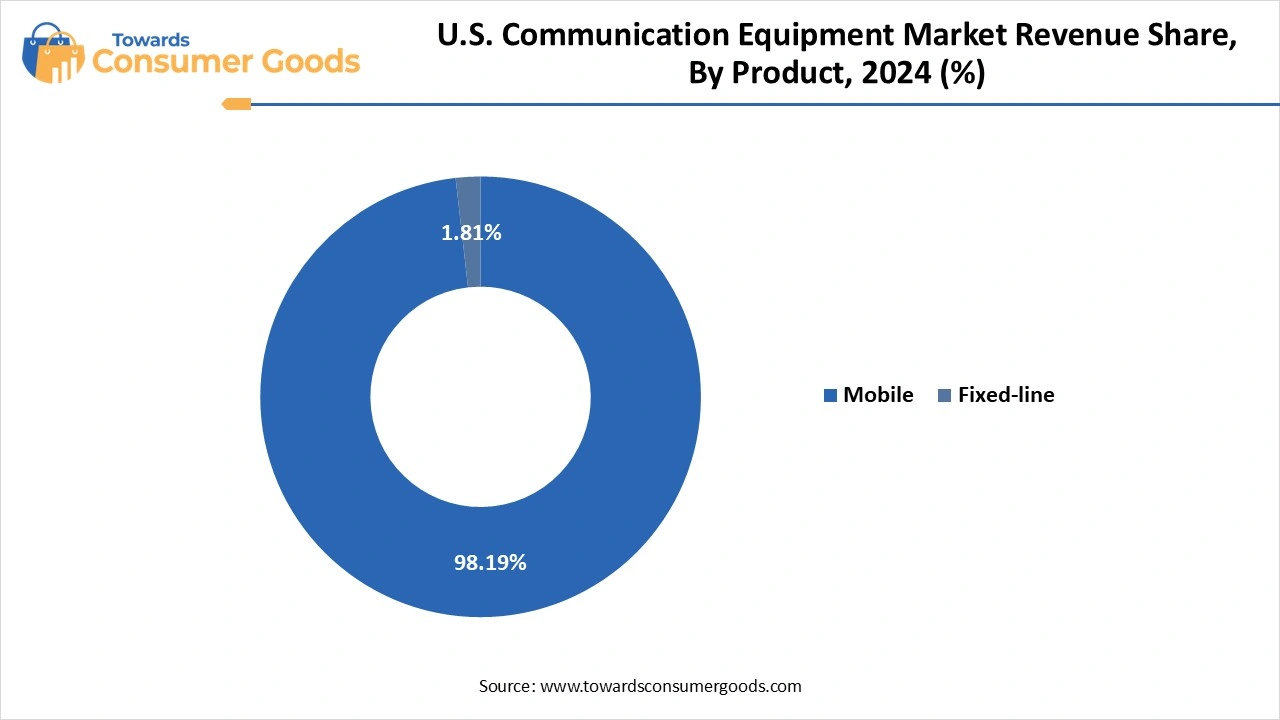

The mobile segment dominated the U.S. communication equipment market in 2024, primarily due to the pervasive adoption of smartphones and mobile devices. The expansion of 5G networks has played a crucial role in enhancing connectivity and supporting a growing range of mobile applications for communication, entertainment, and remote work. This shift has markedly increased consumer demand for not only mobile devices but also complementary equipment such as smartphones, tablets, and various accessories. The superior data speeds and enhanced network reliability provided by 5G technology have further fueled the enthusiasm for mobile devices, solidifying their importance in daily life.

The fixed-line communication equipment segment expects the significant growth in the U.S. communication equipment market during the forecast period, largely attributable to the rising popularity and market penetration of wireless devices. This trend is further exacerbated by the lack of significant innovation within the fixed-line equipment sector, which has led to a diminished interest among consumers.

Innovation: In May 2025, Looking ahead, notable developments in the industry include Apple's strategic decision made in May 2025 to target 2026 for the launch of its much-anticipated smart glasses, while placing plans for an AI smartwatch on hold. This indicates a shift in focus toward augmented reality technologies. (Source: communicationstoday)

Innovation: In February 2025, Hyundai Motor Company successfully completed a pilot project in collaboration with Samsung Electronics Co., Ltd., centered around Private 5G (P-5G) RedCap technology, marking a significant step forward in the application of advanced communication strategies in the automotive industry. (Source: drivespark)

May 2025

May 2025

May 2025

April 2025