July 2025

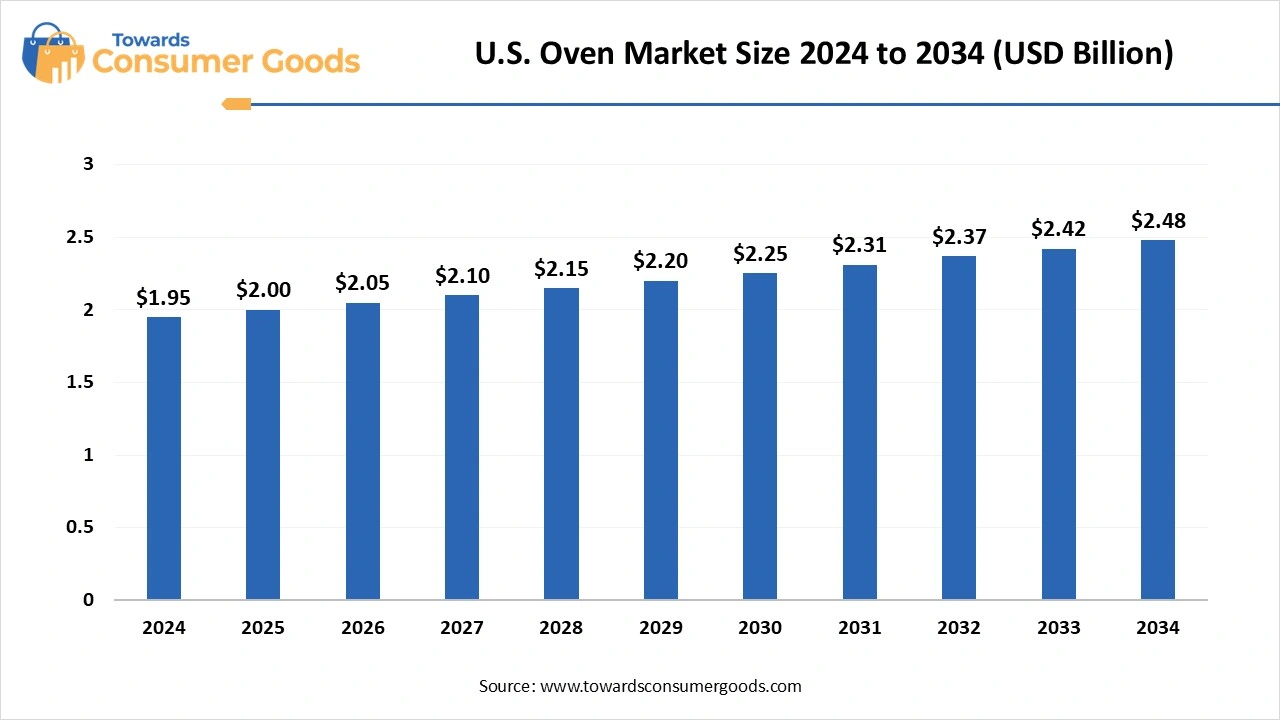

The U.S. oven market size was valued at USD 1.95 billion in 2024 and is expected to hit around USD 2.48 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.45% over the forecast period 2025 to 2034. This market is growing due to rising consumer demand for convenient and energy-efficient cooking applications.

The U.S. oven market in 2025 is evolving rapidly, due to the growing desire of consumers for intelligent features energy-efficient operation, and small space-saving designs. Th most of the U.S. the market is moving towards premium upgrades and replacements for the basic ovens that households currently own. Multipurpose ovens with AI-assisted cooking, streaming, and air frying capabilities are becoming more and more popular. Additionally, the switch from contemporary electric models is being encouraged by government-backed programs supporting electrification and sustainability.

How can brands deliver smarter ovens without overcomplicating user experience?

As smart ovens become more advanced, brands face the challenge of integrating high-tech gestures without overwhelming users. The secret is to create voice-activated features customizable presets and user-friendly interfaces that make cooking easier. Manufacturers can provide smart technology advantages while keeping all customer segments accessible by emphasizing user-friendly innovation.

U.S. Government Initiatives in Promoting Oven Market in –2025, On 9 May 2025, the Trump administration's significant reduction in funding for the U.S. Agency for International Development (USAID) led to the cancellation of 80% of its programs, including those supporting clean cookstove initiatives in Africa. This reduction threatens vital health and climate solutions in regions that rely on traditional cooking methods. (Source: energyconnects.com)

In 2025, DOE increased funding for research into next-generation cooking appliances, focusing on electrification and smart controls to boost efficiency. This program supports innovation that could lead to ovens with lower energy use and enhanced user features. It also encourages partnerships between government, industry, and academia. (Source : energy.gov)

On 4 February 2025, the U.S. Environmental Protection Agency (EPA) collaborated with international partners to publish updated ISO standards for testing institutional cookstoves. These standards assess energy performance, emissions, safety, and durability, aiming to ensure cleaner and safer large cookstoves used in various institutional settings worldwide. (Source : epa.gov)

| Report Attributes | Details |

| Market Size in 2025 | USD 2.00 Billion |

| Expected Size by 2034 | USD 2.48 Billion |

| Growth Rate 2025 to 2034 | CAGR 2.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Segment Covered | By Capacity , By Fuel, By Application, By Region |

| Key Companies Profiled | Whirlpool Corporation, GE Appliances, KitchenAid, Grieve Corporation, LEWCO, Inc, Bakers Pride |

Innovative Oven’s Production

The market for ovens is ready for innovation as customers seek kitchens that are smarter, greener, and use less space. The development of AI-powered ovens that adjust to user preferences, use less energy thanks to cutting-edge heating technology, and fit into small urban areas presents this opportunity. Businesses can reach a growing market of tech-savvy environmentally conscious and space-constrained consumers by combining intelligence sustainability and elegant design.

The increasing demand for small multipurpose countertop appliances like air fryers and toaster ovens, which frequently take the place of conventional ovens in small homes and urban environments, is one of the main obstacles. Additionally, smart and energy-efficient oven models are not as appealing to consumers on a tight budget due to their high cost.

Additionally, many users, particularly older groups with lower levels of digital literacy, find it difficult to navigate the sophisticated user interfaces of smart ovens, which results in the underuse of the more sophisticated features. Larger oven units are also discouraged by the lack of kitchen space, particularly in urban areas. Furthermore, production costs are rising, and product availability is being delayed due to supply chain disruptions and component shortages, especially semiconductors. For manufacturers looking to satisfy changing consumer demands while preserving affordability and functionality, these factors together pose serious challenges.

United States serves as a major stakeholder in its oven market, driven by a robust home appliance culture, strong consumer demand, and advanced manufacturing capabilities. Growing demand for smart energy-efficient ovens and a move toward home cooking are two factors supporting expansion. A major U.S. with extensive distribution networks and strong brand loyalty-based companies like GE Appliances and Whirlpool dominate the market.

The United States is further strengthened by strong infrastructure and supportive regulations U.S. share of the market. While a well-established logistics network and omni-channel retailing guarantee widespread consumer access to energy efficiency initiates like ENERGY STAR spur innovations. These elements collectively strengthen the U.S. as a significant manufacturer and consumer in the oven sector.

Large segment dominated the market in 2024 motivated by their widespread use in kitchens both commercial and residential. Larger families and food service businesses favor these ovens because of their capacity to efficiently prepare large quantities of food. Large capacity models are valued by consumers for their performance adaptability and time-saving advantages, particularly in suburban homes with spacious kitchens. Manufacturers keep adding intelligent features and energy-saving technologies to these models solidifying their position as market leaders.

Small segment is anticipated to witness the fastest growth over the forecast period driven by changing consumer habits and urban space limitations. Compact ovens provide a useful solution without compromising functionality as more people live in apartments consoles and smaller homes. Their growing appeal is also associated with the rise in young professionals students and single-person households that place a higher value on affordability, convenience, and energy efficiency. The rise in popularity of small-capacity ovens is indicative of a larger movement in contemporary American culture toward space-saving minimalist appliances.

Electric ovens segment dominated the market in 2024 driven due to their wider accessibility, simple installation, and work well with contemporary kitchen designs. Due to their reliable heating safety features and compatibility with smart home technologies, they are preferred by both residential and commercial users. In terms of both volume and value electric ovens continue to dominate the market due to a robust power grid infrastructure and consumer preferences for low maintenance energy-efficient appliances.

Dual fuel oven segment is anticipated to witness the fastest growth over the forecast period, becoming popular for fusing the cooking capabilities of gas cooktops with the accuracy of electric ovens. Foodies and professional chefs who want more control and versatility in their cooking will find these ovens appealing. Demand for dual-fuel models is being driven by consumers increasing interest in gourmet cooking at home and high-end kitchen appliances, particularly in upscale residential markets.

Residential oven segment dominated the market in 2024 fueled by the rising popularity of smart home appliances, home cooking, and kitchen renovation. Modern ovens with features like voice control, Wi-Fi connectivity, and energy-efficient cooking modes are becoming more and more popular among consumers. The rise in popularity of at-home dining experiences and health-conscious cuisine has also led to the widespread use of residential ovens in United States households.

Commercial ovens segment is anticipated to witness the fastest growth over the forecast period aided by the growth of bakeries, quick-service restaurants, and food service businesses. This market is being driven by the growing demand for multipurpose high-capacity ovens that increase kitchen productivity and produce reliable cooking results. Food businesses are also being encouraged to upgrade their ovens for improved performance and energy savings due to advancements in commercial kitchen equipment and the rising demand for gourmet and specialty cuisines.

By Capacity

By Fuel

By Application

The global leather goods market size was estimated at USD 471.19 billion in 2024 and is predicted to increase from USD 498.80 billion in 2025 to appro...

As per current market projections, the global direct selling market size was USD 223.93 billion in 2024 and is projected to grow from USD 239.04 billi...

July 2025

July 2025

July 2025

July 2025