July 2025

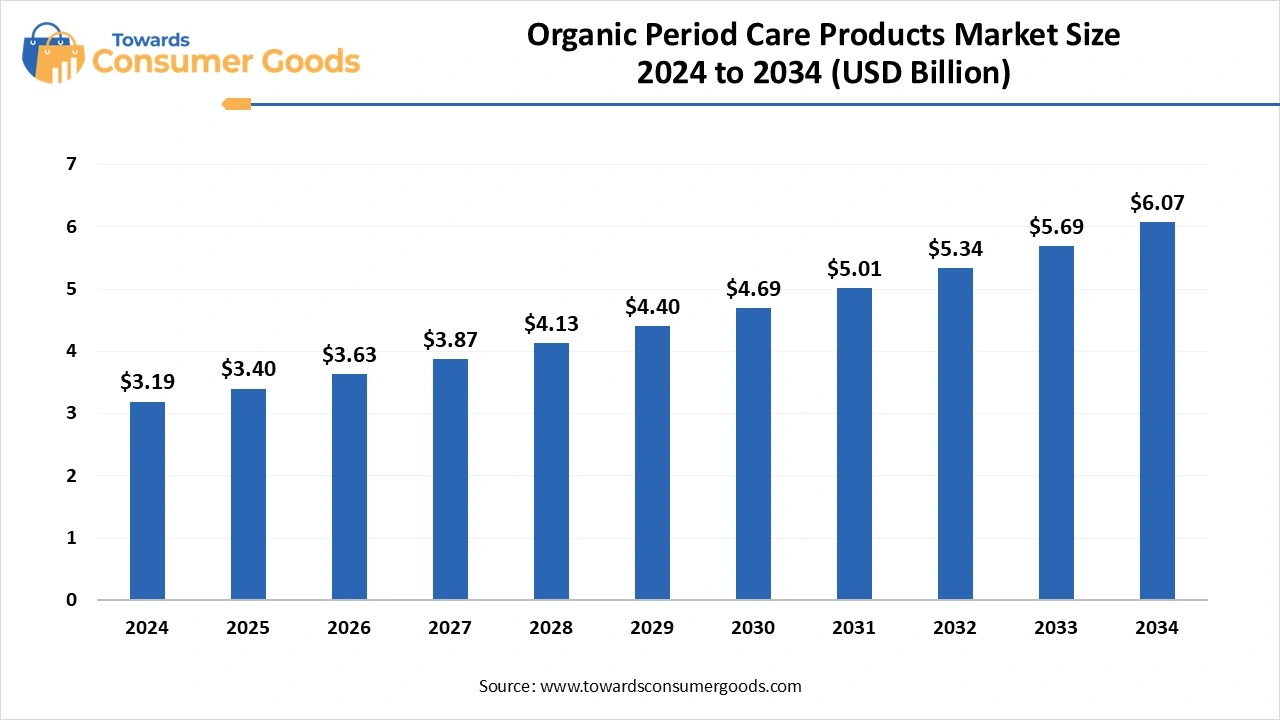

The global organic period care products market size was valued at USD 3.19 billion in 2024 and is estimated to hit around USD 6.07 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% during the forecast period 2025 to 2034. The rising demand for sustainable and eco-friendly products is driving the global organic period care products market.

The global organic period care products market has witnessed transformative growth, driven by factors like increased awareness of menstrual hygiene & health, rising demand for chemical-free alternatives, and environmental sustainability. The number of health-conscious females in the population is increasing, driving demand for sustainable products. Additionally, government initiatives and NGO programs are contributing to boosting awareness of menstrual health and hygiene, promoting natural and sustainable period care products.

The growing millennials and Gen Z consumers are fueling the market growth. The demand for organic products is high among millennials and Gen Z consumers due to their high focus on eco-consciousness. To comply with changing consumer demands and compliance, companies are focusing on developing innovative organic products like biodegradable packaging and flushable sanitary pads.

The growing trend toward natural and sustainable products is the major driver for the market. The trend has emerged due to increased awareness about menstrual health and harmful chemicals used in period care products. Consumers are seeking eco-friendly alternatives like biodegradable sanitary pads, reusable cloth pads, medical-grade silicone-made menstrual cups, sustainable period underwear, and organic tampons and pads, without synthetic additives. The natural and suitable product trend encourages manufacturing companies to innovate in production. Additionally, regulations associated with menstrual product safety and consumer complaints play a crucial role in increasing natural and sustainable period care products.

| Report Attributes | Details |

| Market Size in 2025 | USD 3.4 Billion |

| Expected Size by 2034 | USD 6.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By Material, By End-user, By Distribution Channel, By region |

| Key Companies Profiled | Natracare Ltd., Cora, Inc., Seventh Generation, Inc., The Honest Company, Inc., Rael, Inc., Highamp Srl, Lunapads International, Inc., Happy Period, Inc., Greenspace Brands Inc.,Organic Initiative |

Governments worldwide are focusing on increasing awareness of mental hygiene and health consciousness among the female population. Government initiatives and NGO’s programs are driving sustainable living and menstrual health, contributing to the growth of the shift toward organic care products. Government investments and support for eco-friendly products and smart menstrual products are emerging in the market. Strict regulations for period care products are encouraging manufacturing companies to innovate and developments of high-quality products to comply with sustainability and health demands.

The high cost associated with organic period care products is a major restraint for the market. Organic products use premium materials, including organic bamboo, cotton, and biodegradable materials, which are expensive in nature. High cost of sustainable production process, ethical and eco-friendly manufacturing practices, and obtaining certification of organic label and ensuring regulatory compliance increased product cost. This cost hampers product adoption among price-conscious consumers.

High Demand for Chemical-free Products: Key Trend for North American Production

North America dominates the global organic period care products market, driven by the region’s high demand for chemical-free alternatives. North America is well-known for having mature and highly- educated consumers about health and hygiene. The increased awareness of menstrual hygiene, wellness, and the growing trend of sustainability are driving the adoption of organic period care products in the region. The presence of key market vendors and strict health & safety regulations is contributing to the market growth.

The U.S. is a major player in the regional market, growth driven by increased preference for natural products, especially among millennials and the Gen Z population. The rising awareness of potential health risks associated with the use of chemical products has driven the need for eco-friendly alternatives.

The consumers of the U.S. have become highly environmentally conscious, driving a surge in demand for organic period care products, made from biodegradable cotton and bamboo materials. Expanded e-commerce platform contributing to offering significant access to customized and personalized consumer needs, including advanced organic period care products.

Asia Pacific Organic Period Care Products Market

Asia Pacific is the fastest-growing region in the market, driven by increased awareness of menstrual hygiene and health. The government initiatives and support for sustainable products have contributed to the rising preference for organic period care products in the region. The demand for organic sanitary cotton pads, menstrual cups, tampons, organic feminine wipes, and period panties is high in the Asian market. The popularity of direct-to-consumer brands and online purchases has increased, becoming the emerging trend for market growth in countries like China and India.

China is a major player in the regional market, growth driven by a high population, availability of disposable income, and increased awareness about health risks associated with chemical products. Increasing urbanization and changing female consumer preferences for chemical-free alternatives are fostering market growth. The rising cultural norms with openness and acceptance are contributing significantly growing adoption of products, including organic period care products.

Which Product Types Dominant Segment the Organic Period Care Products Market?

The sanitary pad segment dominates the market, due to increased consumer preference for natural and chemical-free alternatives. The awareness of health and environmental consumers regarding traditional sanitary pads has increased, and so has increased demand for natural and organic sanitary pads. Companies like The Honey Pot, My Box, Natracare, and LOLA are major players offering sustainable sanitary pads.

The menstrual cups segment is significant in the market, growth driven by consumer awareness for environmental sustainability and preference for long-term savings. Menstrual cups are reusable, making them a cost-saving solution. The digital and social media platforms are major players and have contributed to increased awareness about organic menstrual cups.

How Organic Cotton Segment hold the Largest revenue of the Organic Period Care Products Market?

The organic cotton segment held the largest market revenue in 2024, due to increased consumer demands for sustainable, chemical-free, natural, and biodegradable period care products. The organic cotton segment holds major popularity for period care products, driven by their health benefits, including reducing the risk of allergies and skin irritation. The demand for organic cotton-based products like sanitary pads, menstrual cups, reusable cloth pads, and tampons is high in the market.

The bamboo is the second-largest segment, leading the market, due to rising consumer demand for sustainable and comfortable products. Bamboo-based period care products provide biodegradability, natural antibacterial properties, and high absorbency. The rising demand for health and environmental benefits products is fostering the adoption of bamboo-based period care products, like tampons, panty liners, and sanitary pads.

What made Adult End-users lead the Organic Period Care Products Market in 2024?

The adult segment led the market in 2024, due to high adoption of organic period care products among adults in age groups between 20-30, 31-40, and 41-50. Adults are seeking sustainable, eco-friendly, natural, chemical-free, and comfortable products for menstrual management. The growing trend for environmental sustainability among millennials is evolving market growth.

The teenagers segment is expected to grow significantly over the forecast period. The teenage consumers are becoming aware of mental health, wellness, and environmental sustainability. Government awareness campaigns, social media influence, and education initiatives are shifting tennerges' demands from conventional period care products to advanced organic period care products. The demand for smart organic period care products is emerging in the market.

How Offline Segment Dominated the Organic Period Care Products Market in 2024?

The online segment is expected to lead the market in the forecast period, driven by expanding e-commerce platforms. Consumers are preferring to purchase period care products online due to easy accessibility and availability of various options. Online platforms provide a wide range of products, making it convenient for consumers with diverse needs. Additionally, consumer reviews on products and detailed product transparency build trust for online purchases among consumers.

By Product Type

By Material

By End-user

By Distribution Channel

By Regional

July 2025

July 2025

June 2025

June 2025