July 2025

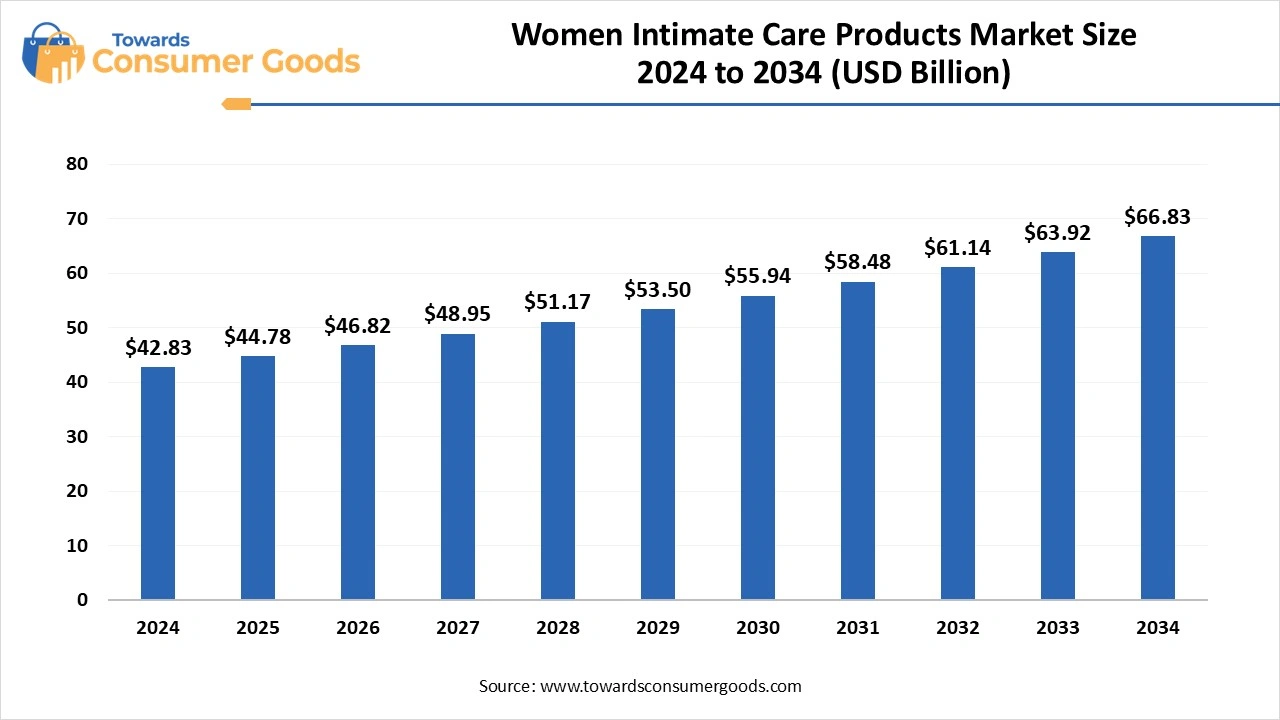

The global women intimate care products market size was reached at USD 42.83 billion in 2024 and is expected to be worth around USD 66.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.55% over the forecast period from 2025 to 2034. The rising awareness of intimate area hygiene and well-being among women is driving the global women intimate care products market. Continuous changing lifestyle and rising female workforce are contributing to market growth.

The global women intimate care products market has witnessed significant growth, driven by various factors like growing open discussion about intimate care, rising health-conscious consumer base, growing availability of disposable income, and the launch of innovative products. Companies are offering premium and innovative intimate care products to women, including high-quality and personalized products. Additionally, the growing e-commerce platform, enabling access to customized and personalized products, is making a significant impact on the market growth.

The market is further witnessing significant growth due to rising campaigns and events addressing women's health and intimate area hygiene. People worldwide still hesitate to talk about intimate area topics; however, ongoing brand initiatives in education and awareness are transforming the way of people's focus on the essential care of intimate areas.

The growing demand for natural and organic women's intimate care products is the major driver for the market growth. Women are becoming aware of the importance of intimate hygiene as well as the impact of chemical-containing products. The growing shift to natural and organic products has driven demand for natural and organic intimate care products among global women. The personalization and customization prioritizing consumer base is growing, and so are growing opportunities for manufacturers to develop novel and innovative products.

Indian FemiSafe, a women’s health company, raised Rs 3 crore in the recent funding round, which was led by investors like Jain University and Kerala Angel Network. The company is focusing on enhancing product development and strengthening its supply chain, and enhancing its QCommerce presence, an e-commerce type.

| Report Attributes | Details |

| Market Size in 2025 | USD 44.78 Billion |

| Expected Size by 2034 | USD 66.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

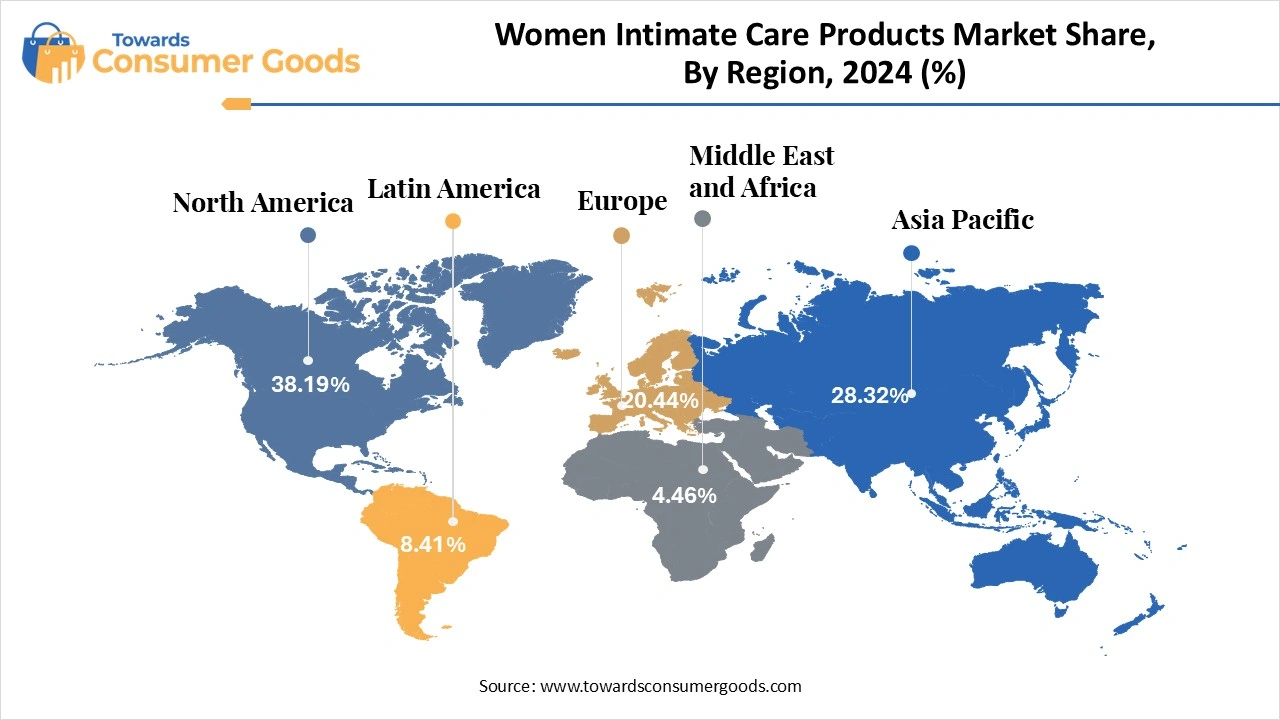

| Dominant Region | North America |

| Segment Covered | Product Type, Price Range, Distribution Channel , Regional |

| Key Companies Profiled | Seventh Generation, Lil-Lets, Kimberly-Clark Corporation, Procter & Gamble (P&G), Johnson & Johnson, Unicharm Corporation, Veeda, Cora , FemiSafe |

The women are seeking high-quality, comfortable, highly effective, and natural intimate care products. Companies are focusing on offering products with organic and natural ingredients, chemical additives, and fragrance-free products, to comply with the rising sustainable and clean products. Growing demand for personalized solutions is empowering companies' investments in research and development of innovative products, like wipes, specialized washes, and menstrual products. Major manufacturing companies are prioritizing product development with sustainable ingredients and advanced technologies to enhance product efficiency and consumer experiences.

Social stigma and cultural differences are the major restraints of the market. People hesitate to open up about the intimate care topic, leading to a lack of awareness and the importance of intimate hygiene. Lack of awareness about available products and hygiene hampers the adoption of intimate care products among women. Social stigma hinders women's approach to novel and innovative products. hover, ongoing awareness campaigns, and educational initiatives are helping women to overcome their stigma.

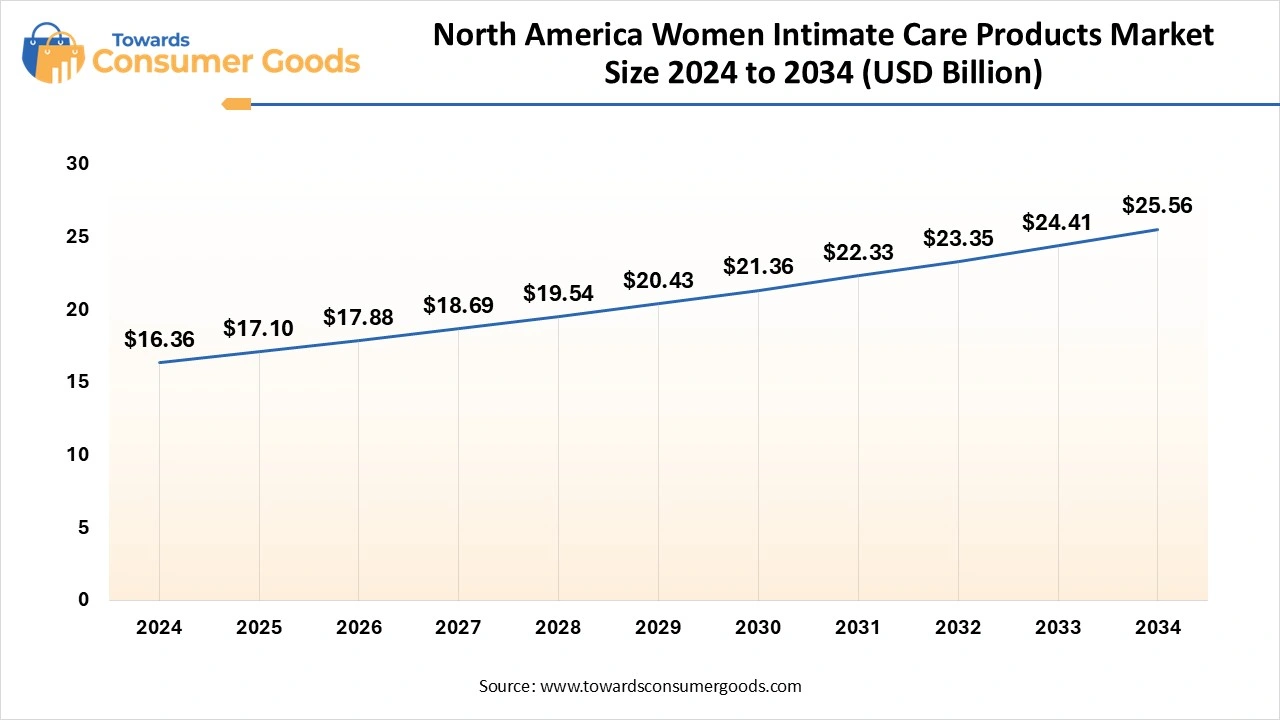

The North America women intimate care products market is expected to increase from USD 17.10 billion in 2025 to USD 25.56 billion by 2034, growing at a CAGR of 4.56% throughout the forecast period from 2025 to 2034.

North America dominates the global women's intimate care products market, driven by high awareness of feminine hygiene in the region. North America has high consumer awareness about hygiene and wellness. Additionally, the presence of major brands and their initiatives in increasing consumer awareness and reducing social stigma has shaped the market growth. The wide, expanded e-commerce sector enables access to premium and personalized products. The demand for organic and natural products has increased, which reason contributing to significant market competition.

The U.S. is a major player in the regional market, driven by various factors like high intimate care hygiene awareness, availability of innovative products, and changing consumer preferences. The U.S. has major key players, and offers initiatives like product innovations to meet with changing consumer shift and preferences. The growing trend of sustainable products, driven by increased awareness about chemical impacts on the body and the environment, has contributed to high market competition in the U.S. The presence of key market players, including Johnson & Johnson, Kimberly-Clark Corporation, Procter & Gamble, L’Oreal, and others, is shaping the market.

Asia Pacific is the fastest-growing region in the market, driven by a large population, growing intimate hygiene awareness, rising disposable income, and e-commerce expansion. Asia has witnessed significant growth in personal hygiene awareness. Growing middle-class populations and disposable income availability have increased spending on hygiene and wellness products, including women's intimate care products. the rising demand for natural and sustainable products, convenient, and on-the-go options is fostering the market in Asia. Additionally, the expanding e-commerce platform contributes to large purchases of intimate care products across the women's population.

China is a major player in the regional market, driving growth due to a large population, access to cost-effective products, and expanding e-commerce. China has a large female population across all age groups. The demand for intimate care products is high among the aging population. The country's economic growth has enabled a large availability of disposable income, enabling consumers to spend on premium and personalized products. Government initiatives in promoting menstrual hygiene and rising demand for eco-friendly options are shaping the country's market.

The pad segment dominated the market in 2024, due to rising awareness and education about intimate hygiene and women's wellness. Government initiatives and educational campaigns established by various brands are contributing to improving women's education about menstruation and have increased the use of sanitary pads. Key companies are providing customized pads made with organic, natural, and sustainable materials, to comply with the rising women's preference.

The increased awareness and availability of personalized sanitary pads are fostering segment growth.

The intimate wipes are the second-largest segment, leading the market. The segment growth is attributed to increased demand for convenience products, driven by a busy lifestyle and increased awareness about intimate area hygiene. Intimate wipes are easy to carry and use, making them a suitable solution for women who need a quick freshening up.

The medium segment led the market in 2024, due to high demand for cost-effective and better-quality intimate care products among women. Medium-priced products enable high-quality as well as affordability, making them suitable for consumers seeking quality but who cannot afford the premium-priced products. the major brands are focusing on increasing the availability of products, which balances quality and cost, are is high, further shaping the segment's continuous market dominance.

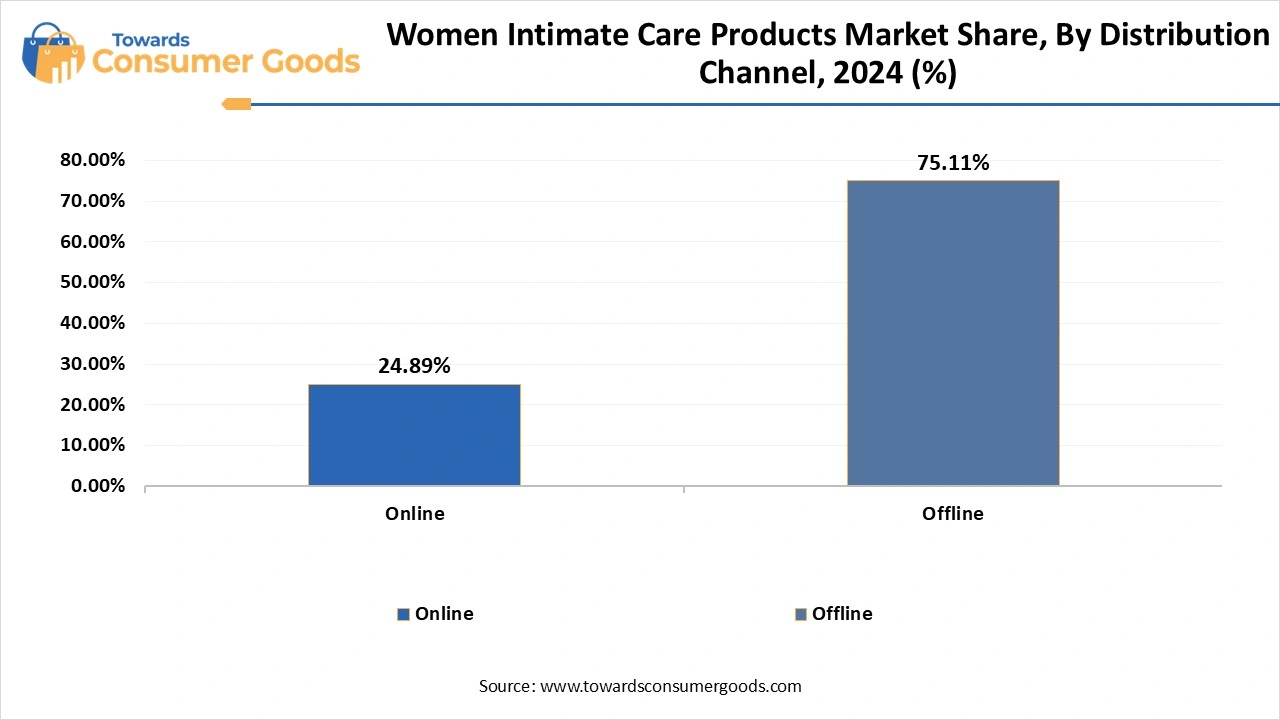

In 2024, the offline segment dominated the market due to consumer preference for purchasing products from supermarkets and pharmacies. Supermarkets, pharmacy stores, and convenience stores provide personalized experiences to consumers by offering specialized expertise and detailed information regarding products. the wide availability of products in offline stores attracts a wide range of consumers. Additionally, established relationships of offline stores with manufacturers and suppliers enable consumers to get products at competitive pricing.

The online segment is expected to lead the market over the forecast period, due to rising online shopping. Increased use of e-commerce is driving the segment growth. consumers seeking cost-effective and convenient purchases. Additionally, the other customers' reviews exist on products, making it a more trustworthy purchase choice. Major brands are focusing on expanding their reach to the e-commerce platform. Growing competition among brands on online platforms, enabling competitive pricing choices, and attracting a large consumer range.

By Product Type

By Price Range

By Distribution Channel

By Regional

The global online sports betting market size was accounted for USD 78.19 billion in 2024 and is expected to be worth around USD 142.29 billion by 2034...

July 2025

June 2025

June 2025

June 2025