July 2025

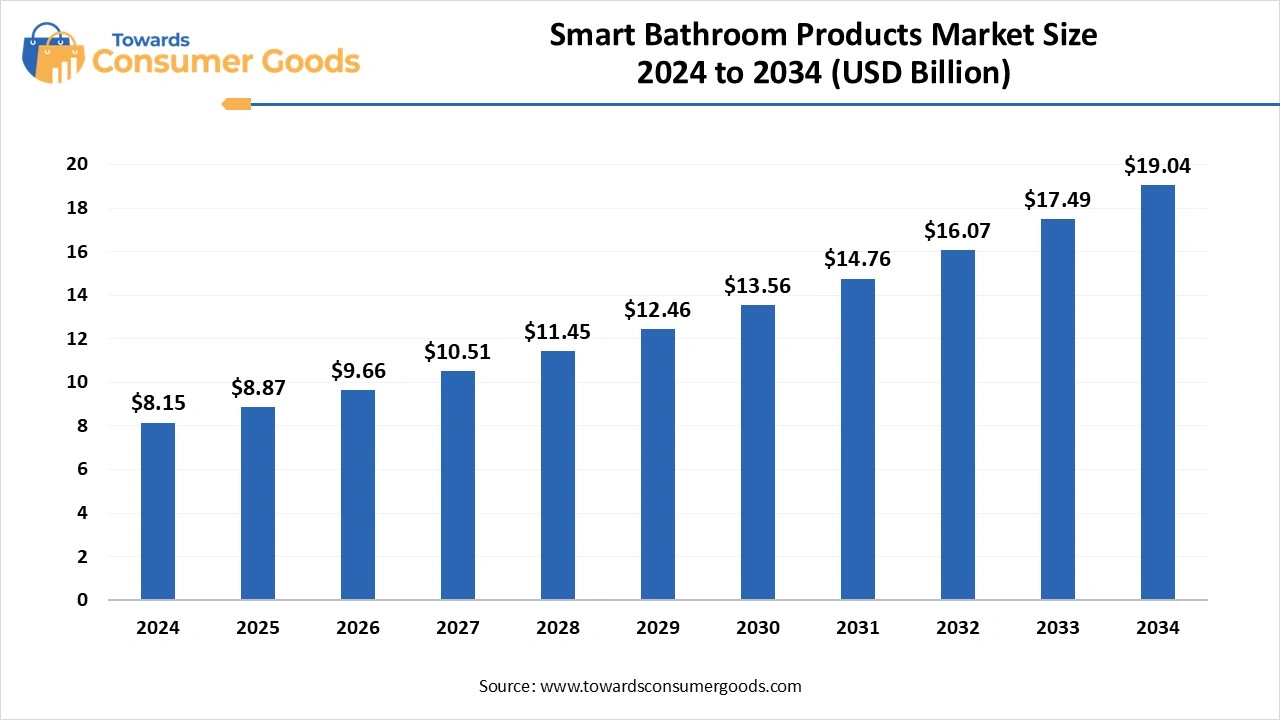

The global smart bathroom products market size was valued at USD 8.15 billion in 2024. The market is projected to grow from USD 8.87 billion in 2025 to USD 19.04 billion by 2034, exhibiting a CAGR of 8.85% during the forecast period. This market is growing due to rising demand for smart homes and home automation, increasing environmental consciousness, and the desire for enhanced comfort and convenience.

Smart bathroom products market is experiencing significant growth driven by the growing desire of consumers for modern aesthetics convenience and hygiene. Important product categories include faucets, showers, mirrors, dispensers, and smart toilets. Smart toilets are the market leader because of their cutting-edge features which include self-cleaning systems, hands-free operation, and bidet functionality. Increased hygienic consciousness and the use of touchless technology are driving the fastest-growing market for smart faucets. Voice-controlled systems IoT integration and sustainability trends all contribute to market expansion.

Can smart bathroom products redefine modern living standards?

With the growing desire of consumers for smarter, more connected home environments smart bathroom products are converting conventional spaces into wellness areas enabled by technology. By maximizing water and energy use these products not only improve comfort and hygiene through touchless and voice-activated features, but they also advance sustainability. Smart bathrooms are becoming more than just luxuries as people become more and more conscious of their health, cleanliness, and environmental impact. This is particularly true in urban homes, high-end hotels, and green building projects.

| Report Attributes | Details |

| Market Size in 2025 | USD 8.87 Billion |

| Expected Size by 2034 | USD 19.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By End Use, By Distribution Channel, By Geographic |

| Key Companies Profiled | TOTO Ltd, Kohler Co., LIXIL Group, Roca Group, American Standard, Dyson, Moen Inc., Villeroy & Bosh, Geberit AG, Panasonic Corporation, Hansgrohe SE, Duravit AG, Xiaomi Corporation, VOVO Corporation, Woodbridge Bath |

Can smart home integration boost the adoption of smart bathroom products?

Yes, smart home integration can significantly boost the adoption of smart bathroom products. As consumers increasingly adopt connected devices throughout their homes, the expectation for integrated convenience extends to bathrooms as well. A smooth user experience is offered by devices such as smart mirrors, showers, and toilets that can communicate with centralized home automation systems or voice assistants (Amazon Alexa, Google Assistant, Apple Siri). By enabling features like voice-activated temperature control, customized lighting usage analytics, and remote operation, this interconnectivity improves efficiency and comfort.

Limited After-Sales Support and Maintenance Complexity

Smart bathroom devices, in contrast to conventional plumbing products, frequently call for both hardware and technical support. Malfunctions can include firmware bugs, sensor calibration problems, or connectivity problems, all of which call for specialist maintenance. However, there are often few skilled technicians and limited access to replacement parts in many areas. Downtime is feared as a result, particularly essential fixtures like showers and toilets. The inconvenience deters consumers from moving to more intelligent options.

North America dominated the smart bathroom products market due to high consumer awareness, strong smart home adoption, and robust infrastructure for connected devices. Smart mirror showers and toilets are frequently incorporated into residential and commercial buildings in the area, especially in luxury homes and smart city projects. Government initiatives that promote energy and water efficiency also help increase adoption rates. North America remains at the forefront of market innovation due to the presence of prominent players and early tech adopters. Furthermore, the ongoing demand for smart bathroom technologies is fueled by high disposable income and interest in high-end home improvements.

Asia Pacific's fastest-growing smart bathroom products market is, fueled by the increasing demand for connected home technologies, swift urbanization, and growing disposable incomes. Customers in the area are spending more money on contemporary compact homes with automated personal care systems. The development of smart cities, growing real estate industries, and a younger population that is tech-savvy all contribute to market growth. The market is expanding quickly in both urban and semi-urban areas due to the growing availability of reasonably priced smart bathroom solutions. To accommodate cultural preferences and small spaces, manufacturers are also introducing product lines tailored to specific regions.

Europe remains a notable market because it places a strong emphasis on sustainability, energy efficiency, and high standards of building. Water-saving showers, LED mirrors, and digital faucets are examples of smart bathroom technologies that consumers are embracing to satisfy their comfort and environmental concerns. The use of intelligent bathroom systems is also being aided by government initiatives that promote resource conservation and green buildings. Credibility to product adoption is also increased by the region's strong presence of well-known plumbing and bathroom brands. In this market, eco-label compliance and environmental certifications have a significant impact on consumer behavior.

Smart showers dominated the market due to their convenience, eco-efficiency, and integration with voice assistants and home automation systems. Both luxury and eco-conscious users are drawn to features like temperature presets, flow control, and water usage monitoring. These products are becoming more and more well-liked because they encourage water conservation while providing spa-like experiences at home. Smart showers are becoming more and more popular in both new construction and retrofits as people are becoming more conscious of sustainable living. The value proposition for customers is also being improved by product innovations like app-controlled presets and aromatherapy infusions.

Smart lights & accessories are the acting growing segment, driven by growing consumer interest in energy-saving technologies, motion-activated features, and ambient lighting. Both the appearance and functionality of bathrooms are improved by-products like touchless lighting control, automatic nightlights, and smart LED mirrors. They are appealing for entry-level smart upgrades due to their simplicity of installation and affordability when compared to essential fixtures like showers or toilets. Their increasing popularity is boosted by their incorporation of wellness and mood-enhancing elements. Their modular design, which enables simple retrofitting without requiring structural alterations, is another feature that appeals to consumers.

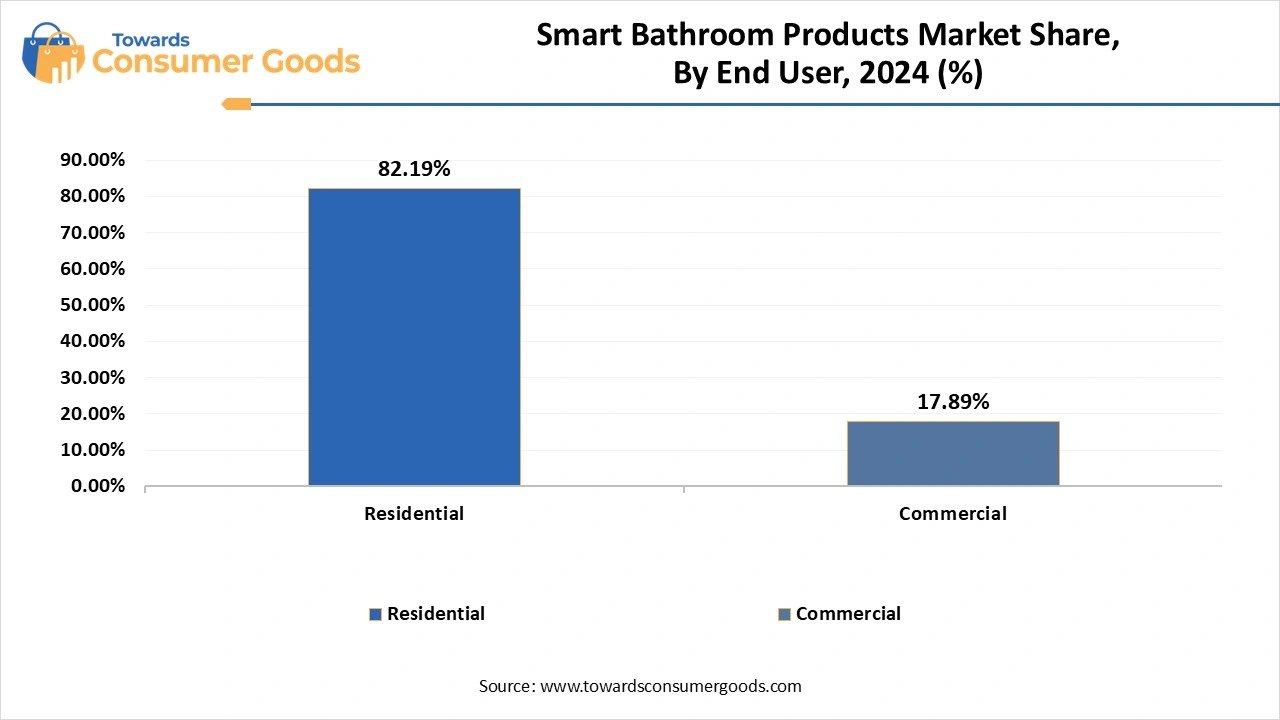

Residential segment dominated market demand as homeowners increasingly prioritize bathroom automation for convenience, hygiene, and energy efficiency. Smart budgets for showers and mirrors are increasingly found in upscale villas and apartments, particularly among tech-savvy buyers. Interest in connected bathroom solutions has increased as people become more conscious of their health hygiene and environmentally friendly water use. Adoption in this category has been further accelerated by post-pending trends in home renovation. Appeal to middle-class and wealthy homeowners is further increased by integration with whole home automation systems.

Commercial segment is the fastest-growing end-user category, especially across hotels, resorts, office buildings, and healthcare facilities. Smart bathroom solutions enhance guest satisfaction, hygienic standards, and operational effectiveness with real-time monitoring systems. Automated toilets and touchless faucets are becoming more and more common in public restrooms. This market is expanding quickly due to the growing need for smart infrastructure in the commercial real estate and hospitality industries. To lower long-term operating expenses, facility managers are also investing in IoT-based predictive maintenance and energy optimization features.

Offline distribution channels dominate the market, owing customers prefer to see high-end bathroom fixtures in person and get professional installation guidance. Particularly for high-commitment purchases like smart toilets and showers, specialty shops and showrooms enable customers to test product features in person. Additionally, collaborations with interior designers and architects support offline retailers in maintaining robust sales momentum. Additionally, retail employees provide individualized advice and demonstrations that foster trust and promote upselling opportunities.

Online channels are the fastest-growing distribution mode, supported by rising digital literacy, quick access to product reviews, and expanding e-commerce platforms. Due to competitive pricing doorstep delivery and virtual consultation options, consumers are becoming more comfortable making smart accessory mirror and fixture purchases online. Online sales are greatly increased by brand websites and marketplaces that provide bundled solutions, simple financing, and AR-enabled tools for clever bathroom design. Higher engagement and conversions are also being driven by YouTube product walkthroughs influencer marketing and flash sales in this channel.

By Type

By End-use

By Distribution Channel

By Geographic

July 2025

June 2025

June 2025

June 2025