July 2025

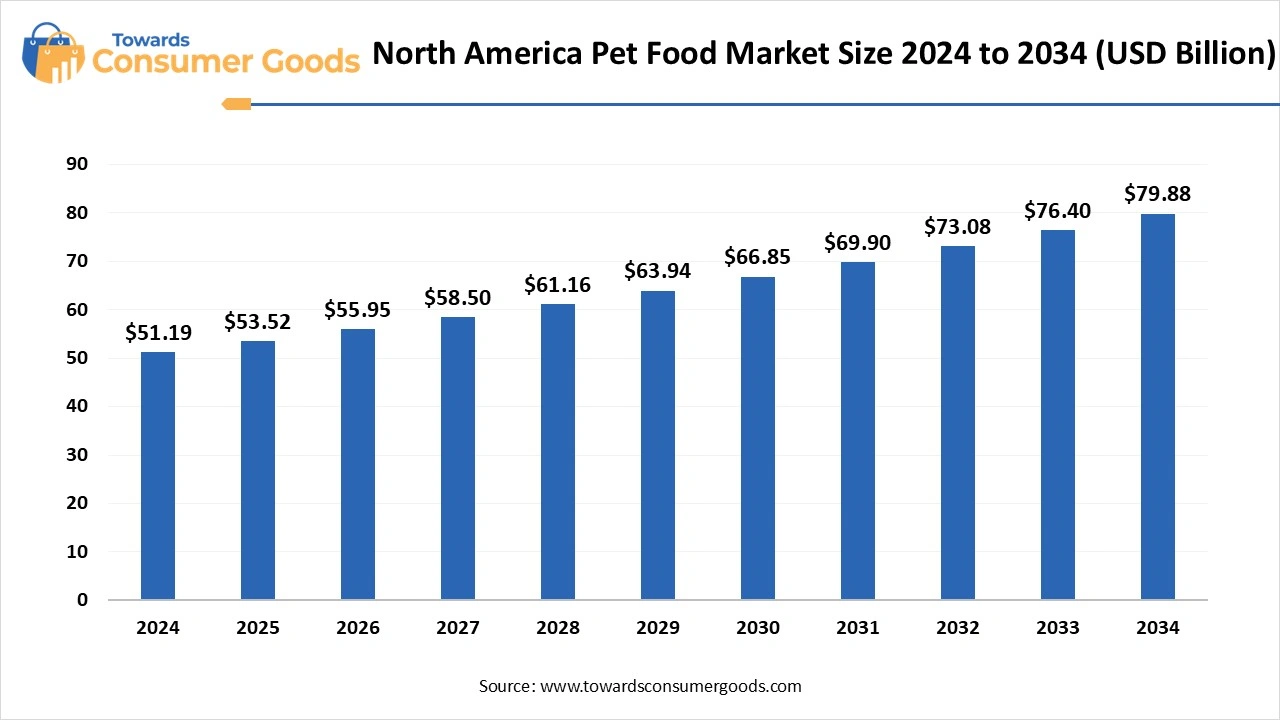

The North America pet food market size was valued at USD 2.47 billion in 2024 and is expected to reach around USD 6.26 billion by 2034, growing at a CAGR of 9.75% from 2025 to 2034. The demand for premium pet food has increased, driven by rising pet ownership and heightened pet health awareness, which is fueling the growth of the North American pet food market.

The North American pet food market is a continuously growing market, driven by various factors including increased pet ownership, especially across young & Gen Z, rising awareness about pet health and wellness, and growing humanization of pets. Pet owners are treating their pets like children, taking better care and giving them love. North America has well-established research institutions, drives initiatives for innovation and development of novel, premium, and organic food ingredients. The rising young pet ownership in North America is a potential opportunity for novel innovations and developments of pet food. Stringent regulations associated with food and health further contribute to the market growth. North American organizations are continually adhering to international standards established by the World Organization for Animal Health (WOAH). PFI advocates for the continued trade of pet food that meets the WOAH safe commodity standards, which requires the U.S. to choose to use vaccination to control HPAI.

The trend towards premiumization is the major driver for the North America pet food market. Increased pet ownership, humanization, and awareness about pet health and wellness are increasing the demand for high-value food. The demand for highly nutritious food has witnessed growth. Pet owners are seeking nutrition profiles and ingredients in their pets’ food. Additionally, the shift toward vegetarian-formulated and natural food contributes to the market growth by providing significant opportunities for innovations, developments, and retailers.

| Report Attributes | Details |

| Market Size in 2025 | USD 2.71 Billion |

| Expected Size by 2034 | USD 6.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Category, By Distribution Channel |

| Key Companies Profiled | Nestlé Purina, Mars Petcare Inc, The J.M. Smucker Company, LUPUS Alimento, General Mills Inc., The Hartz Mountain Corporation, Total Alimentos, Hill’s Pet Nutrition, Inc., WellPet LLC, Diamond Pet Foods |

The rising demand for functional ingredients holds a significant opportunity for the North America pet food market. Rising awareness of pet health & wellness, demand for natural & organic, and specialized diet, fostering demand for functional ingredient-based food for the pet. Pet food with includes vitamins, minerals, amino acids, and specialty proteins is trending in the market. The demand for gut health ingredients is leading in the region, driven by consumer demand for better gut health for their pets. The demand is expected to boost innovative developments of functional ingredients and sustainable & eco-friendly ingredients-based pet food.

Lack of Standardized Regulations

The lack of standardized regulations in various countries is a major restraint on the North America pet food market. Countries of North America have different regulatory frameworks, which lead to complexity and confusion for manufacturers and distributors. Additionally, the labeling and ingredient requirements hinder production volume. Lack of standardized regulations leads to varying product quality and safety. This limitation can minimize investments and innovation in pet food products.

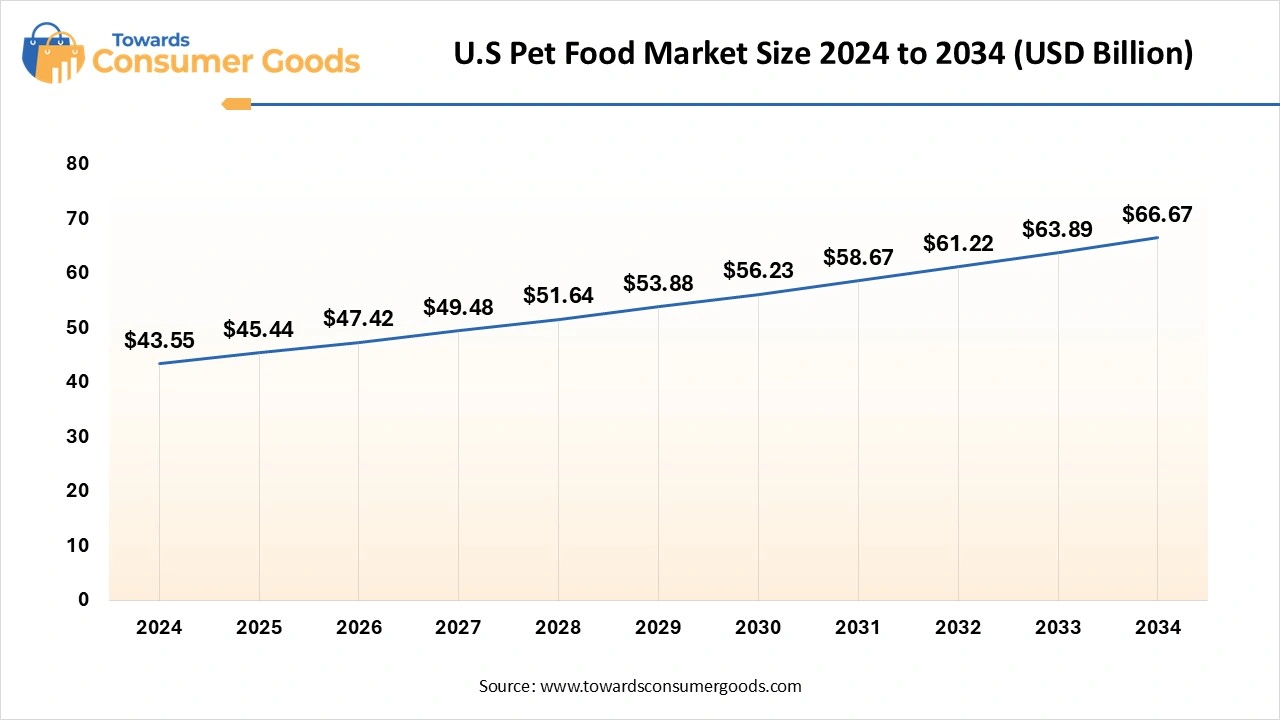

High Pet Ownership: to Make the U.S. the Dominant Country

The U.S. pet food market is expected to increase from USD 45.44 billion in 2025 to USD 66.67 billion by 2034, growing at a CAGR of 4.35% throughout the forecast period from 2025 to 2034. The U.S. dominated the North America pet food market in 2024, driven by increased pet ownership across the country. The U.S. has witnessed increased pet ownership in households. Millennials and Gen Z are the major population for owning pets in the country. The increased pet ownership and rising humanization have led to the demand for premiumization. The U.S. has a robust food & beverage sector, catering to potential opportunities for innovation and development of a premium, customized, and wide range of pet food products.

US Government Innovative Approaches for Pet Food- 2025

Growing preference for premium/specialized pet foods: Fueling Canada’s pet food market

Canada is the second-largest country, leading the regional pet food market, driven by high pet ownership, rising demand for premium and specialized pet foods in the country. Canada is witnessing rapid growth in humanization and premiumization. The growing focus on pet health & wellness is fostering the market growth. The influence of the broader North American market on Canada’s consumers has driven the trend for premium, natural, and specialized pet foods.

Which Product Segment Dominated the North America Pet Food Market in 2024?

The pet snacks/treats segment is the second-largest segment, leading the market, driven by increased demand for premium and healthy pet food options. The increased pet humanization and rising health-conscious consumers are driving the preference for nutrition-based, natural, organic, and health benefits of pet snacks/treats. The demand for chewable treats, natural ingredients, and personalized snacks and treats has increased in the market.

Why Did Dog Segment hold the Largest Revenue of the North America Pet Food Market in 2024?

The dog segment held the largest market revenue in 2024, due to increased dog ownership and high purchases of dog food. North America has a high rate of dog owners, treat their dogs like family. The awareness of dog health and issues has increased, driving demand for pre-emptive measures. The manufacturers of North America are developing therapeutic diets and specialized formulations according to specific health conditions of dog pets. The trend for sustainability and ingredient transparency has increased product developments and purchases in the region.

The cats segment is anticipated to witness significant growth over the forecast period. The segment growth is driven by the increased popularity of cats as pets due to their adaptability and self-sufficient nature. The awareness of feline health needs has increased, especially in urban areas. Cat owners are higher spenders on specialized, premium, specialty diet, and super-premium foods. The demand for specialized ingredients-based wet food for cats has increased, fostering segment growth.

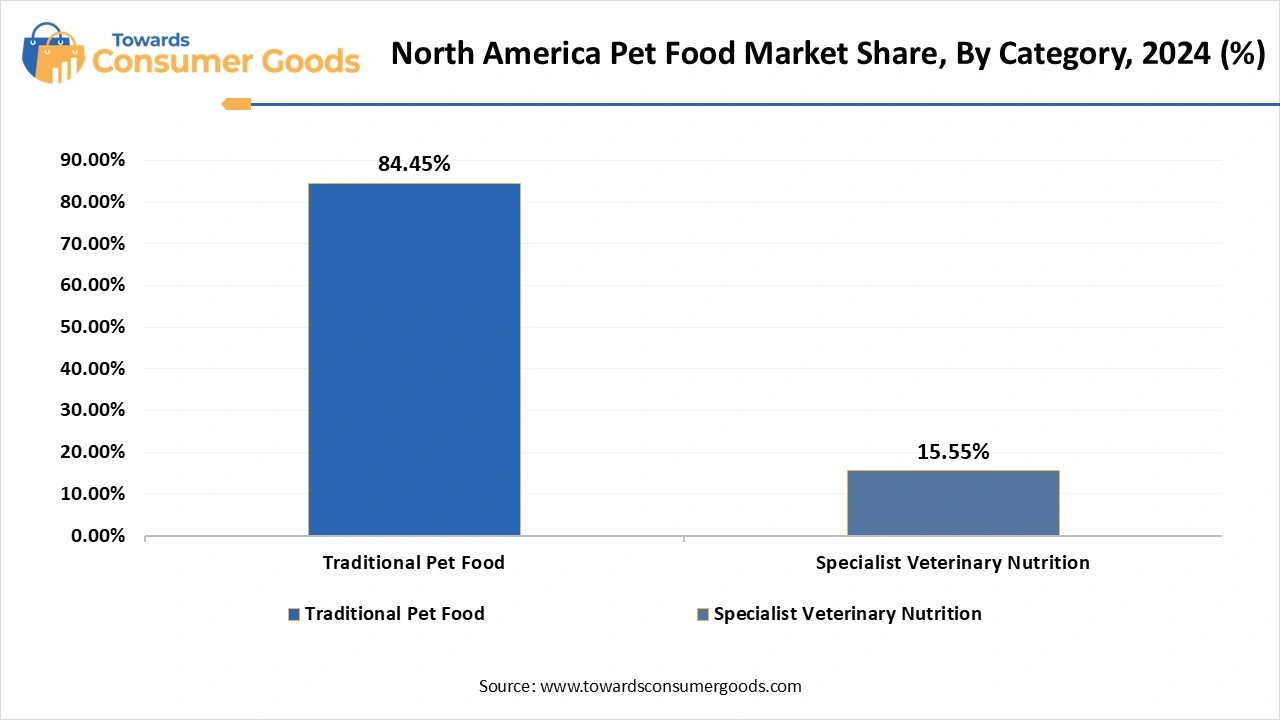

How Traditional Pet Food Segment Dominated the North America Pet Food Market?

The traditional pet food segment dominated the market in 2024, driven by consumer demand for convenience, cost-effective pet food. Traditional pet foods are easily available, easy to store, and more affordable compared to the premium options, making them ideal for a wide range of consumers. Additionally, easy and wide distribution of traditional pet foods, in retail stores and online platforms, contributes to a high adoption rate. The dry kibble and canned meals are highly adopted transitional pet food products in North America.

The specialist veterinary nutrition segment is expected to grow fastest over the forecast period, due to rising awareness about pet health & wellness among pet owners. The prevalence of diabetes, digestive sensitivity, urinary tract diseases, and obesity has increased among pets, driving demand for specialist veterinary nutrition-based foods. Additionally, ongoing collaborations between manufacturers and veterinary professionals are enabling the development of effective therapeutic diets, leading to the expansion of the segment further.

Which Distribution Channel held the largest revenue of the North American Pet Food Market in 2024?

the pet specialty stores segment marked its dominance by generating the largest revenue in 2024, driven by the easy availability of personalized solutions and high-quality options in pet specialty stores. This store provides a comprehensive product range and expert guidance. Pet owners seek well-trained staff to recommend personalized and specialized food products according to their pet's breed, health condition, and taste. Various specialty stores offer value-added services, attracting a wide range of consumers.

The online/e-commerce channels segment is expected to lead the market in the forecast period. online/e-commerce channels are gaining popularity due to their convenience and wide availability of specialized, premium, and customized pet food options. Well-established e-commerce platforms in countries like the U.S. and Canada are fostering the purchase rate of pet foods. Consumers prefer competitive pricing for products, and online retailers offer discounts, offers, and promotions, which drives popularity among a wide consumer base.

By Product

By Pet Type

By Category

By Distribution Channel

By Region

July 2025

June 2025

June 2025

June 2025