July 2025

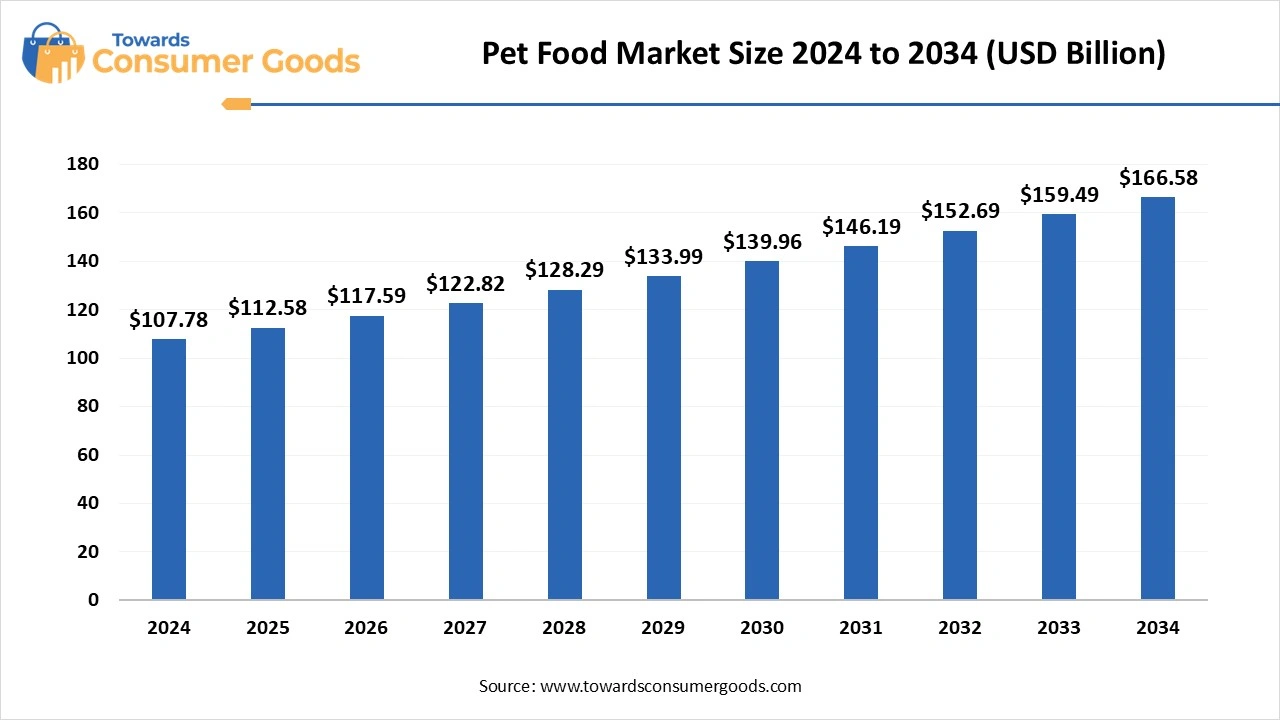

The global pet food market size was valued at USD 107.78 billion in 2024 and is estimated to hit around USD 166.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.45% during the forecast period 2025 to 2034. The demand for pet food is increasing due to the increasing pet ownership among urban families.

Pet food is a specially formulated food that aims to fulfil the nutritional requirements of domestic animals like dogs, cats, birds, fish, rabbits, hamsters, and many more. These foods are designed in a way that targets various animals based on their species, which also takes into account factors like age, size, breed, activity levels, health conditions and many more. The nutrients mainly include protein and vitamin-based products like grains, vegetables, meats, insects and many more.

The humanization of pets is one of the major drivers that has been attracting a wider consumer demand for pet foods. The pet food market is evolving due to the changing role of pets in households, which are no longer seen as animals but as an emotional support, especially in nuclear families.

This emotional factor is leading towards the increasing willingness of the pet owners to spend more on pet nutrition and other requirements. As a result, the companies are heavily innovating premium products, which would attract a wider consumer base. The rising pet ownership is also leading towards the expansion of the product portfolio for middle-class consumers.

| Report Attributes | Details |

| Market Size in 2025 | USD 112.58 Billion |

| Expected Size by 2034 | USD 166.58 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Animal Type, By Form, By Distribution Channel, By Source, By Region |

| Key Companies Profiled | Mars Incorporated, Nestle S.A. , The J.M. Smucker Company, Colgate-Palmolive Company , General Mills, Inc. , Diamond Pet Foods , Heristo AG , Tiernahrung Deuerer GmbH , Merrick Pet Care, Inc. , WellPet LLC. |

How are sustainable food innovations helping in the growth of pet food?

The humanization of pets has also led to many changes in their food consumption trends, leading towards the influence of human health trends like veganism, gluten-free and many more. The rising educational awareness among Gen Z and millennials is promoting alternative protein sources, which have a less environmental impact on the environment, like water usage and GHG emissions. These sustainable innovations are helping the growth of pet food through plant-based protein growth, like peas, lentils, and other lab-grown meats. The major regulatory changes in the packaging industry are also leading towards the adoption of biodegradable and recyclable packaging.

The pet ownership has marked significant growth the rural areas due to nature connectivity, but there are still some concerns that tend to affect the market growth. The limited digital presence in these regions affects the company’s marketing campaigns, restricting the growth of the pet food market. Additionally, the new advancements are also lacking due to lower consumer awareness of the latest advancements in the pet food industry. The new product innovations are also higher in costs due to the use of advanced materials and manufacturing technologies, which also make it unaffordable the consumers in rural areas.

Why does North America dominate the global pet food market?

North America dominated the global pet food market by generating the highest revenue share in 2024. The dominance of the region is attributed to the increasing number of pet owners in the United States and Canada, where humanization of these pets is becoming popular. The region is also expanding globally in sustainable innovations due to stricter government and regulatory support. The educational institutions in the region are also investing heavily in R&D for more advanced and sustainable food solutions.

United States Pet Food Market Trends

The United States stands as a dominant player in the North American pet food industry due to the higher consumption and sales of brands like Nestle Purina, Mars Petcare and other companies. The higher disposable income of the American population also increases their spending capacity on pet health and nutrition. The healthcare services in the region are also promoting pet health, which would increase the demand for vet-recommended food products in the country.

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034. The growth of the region is attributed to the rising pet ownership in developing countries like India, Indonesia, China and Japan. The growth of nuclear families is also promoting the humanization of pets, mainly for emotional support in busy lifestyles.

The growing number of working professionals in these families is also promoting the rising demand for nutritious packaged foods. The region is also witnessing a rapid growth in digital platforms, which will significantly help companies to invest in digital marketing strategies to attract more consumers.

China Pet Food Market Trends

China stands as a prominent player in the Asian market due to the higher number of middle-class families, leading towards the increasing pet adoption. The domestic and international companies are keen on focusing on online channels, which would help in the expansion of D2C businesses in the pet food market. The rising awareness regarding pet health and product safety is also expected to play a major role in the upcoming years.

The dog segment generated the largest revenue share in 2024. The dominance of the dog segment is attributed to the higher pet ownership rate in the majority of the regions, like North America, Latin America and Europe. This has led to a major business ground for the companies to introduce a wide variety of products in different breeds and sizes. These pets are also considered to be one of the most loyal domestic animals, which increases their popularity among households. Additionally, the active lifestyle of these animals also increases the requirement for more personalized nutrition, demanding the growth of joint-care and muscle-building diets.

The cat segment is expected to rise at the fastest CAGR from 2025 to 2034. The growing popularity of cats is mainly attributed to the growing number of compact living spaces in urban areas. These animals are also gaining wider recognition due to less time commitment and lower maintenance as compared to other pet animals. These factors highly comply with urban working lifestyles, increasing their ownership rate in the developing economies. As a result, many companies are introducing their cat-based product lines that focus on various dietary needs.

The dry pet food segment marked its dominance by generating the highest revenue share in 2024. The dominance of dry pet food is attributed to the longer shelf life of these foods, which makes it convenient for storage and bulk purchasing. The pet food market is expected to advance more rapidly as dry foods are gaining popularity due to their cost-effectiveness. Many households in developing countries are investing in these foods that help them manage their expenditure and the dietary requirements of their pets.

The snacks & treat segment is expected to rise at the fastest CAGR from 2025 to 2034. The growth of these foods is attributed to the increasing focus on training and behaviour rewards of these pets, which includes the nutritional requirements of these pets. The pet food market is experiencing significant growth due to the expansion of product lines that are offering organic food products. The retail channels are heavily adopting its adopting in many stores due to increasing impulse purchases from the pet owners.

The supermarkets and hypermarkets segment emerged as the dominant force in 2024. This dominance is attributed to the broader availability of pet products, including food. Numerous companies, such as Drools, are investing in expanding their physical presence, thereby enhancing their revenue in both developed and developing economies. Physical stores have remained dominant due to higher consumer trust and reliability.

The online stores segment is expected to grow at the highest CAGR from 2025 to 2034. The dominance of the segment is attributed to the increasing number of e-commerce services in the developing regions that provide home delivery services. The changing lifestyles of individuals are promoting online shopping, where the leading companies are also investing in digital marketing to expand their presence. Additionally, the increasing number of young pet owners is expected to boost the market growth in the upcoming years.

The animal segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the increasing demand for high-protein diets for animals like dogs. The increasing recommendations from healthcare professionals are also expected to increase the business base for the emerging brands in the pet food market. The higher cultural understanding of animals consuming meat is expected to drive more product innovations in the future.

The plant-based segment is anticipated to emerge at the fastest CAGR from 2025 to 2034. The growth of the segment is attributed to the rising influence of human dietary trends on pets, which promote plant-based foods for pet animals. The companies are focusing on investing towards foods designed for allergic animals, promoting the use of hypoallergenic alternatives.

Drools

Farmers Dog

By Animal Type

By Form

By Distribution Channel

By Source

By Region

The global antibacterial products market size was valued USD 27.95 billion in 2024 and is projected to grow from USD 28.97 billion in 2025 to USD 40.0...

According to market projection, the global household appliances market size is calculated at USD 503.19 billion in 2024, grew to USD 529.61 billi...

The global surfing tourism market size is calculated at USD 64.1 billion in 2025 and is forecasted to reach around USD 109.31 billion by 2034, acceler...

The global travel retail market size is calculated at USD 75.46 billion in 2024, grew to USD 82.67 billion in 2025 and is predicted to hit a...

July 2025

July 2025

July 2025

July 2025