July 2025

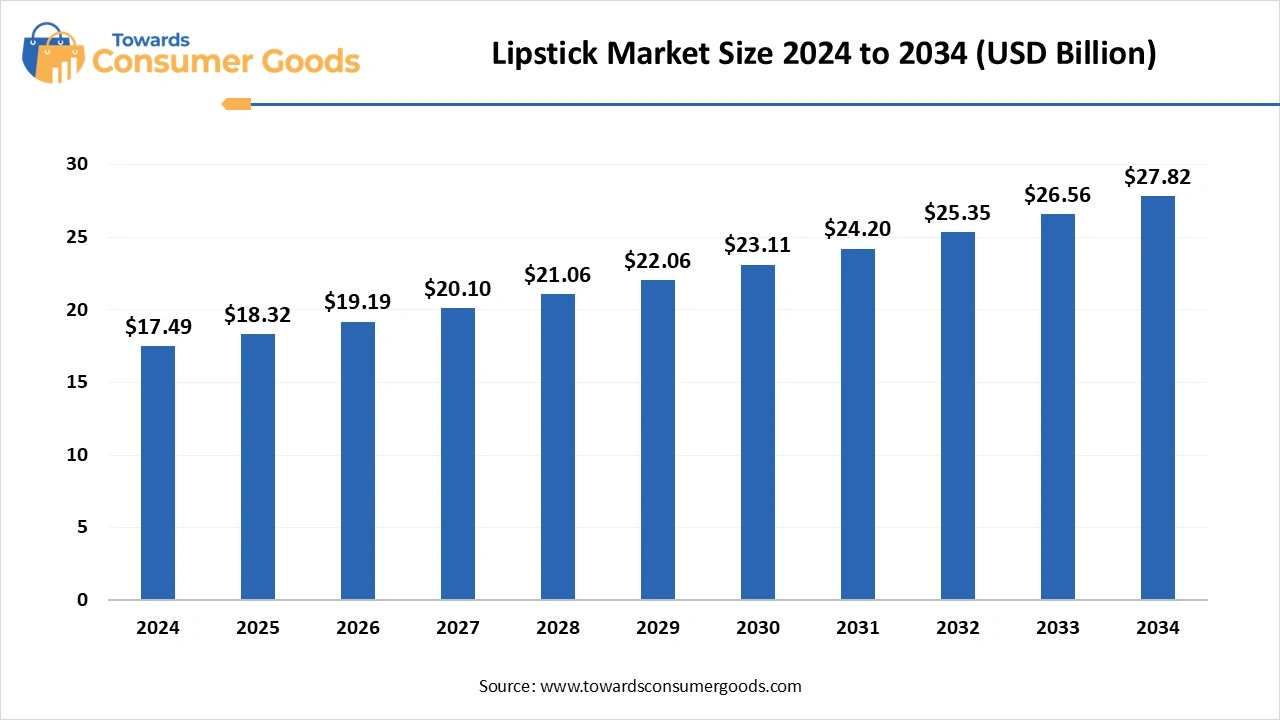

The global lipstick market size was estimated at USD 17.49 billion in 2024 and is predicted to increase from USD 18.32 billion in 2025 to approximately USD 27.82 billion by 2034, expanding at a CAGR of 4.75% from 2025 to 2034. The global lipstick market has evolved from being a simple cosmetic product to a powerful symbol of self-expression and personal identity. As consumer preferences shift towards ethical, inclusive, and skin-friendly formulations, the market continues to witness a vibrant transformation.

The lipstick market has evolved into a dynamic segment within the global cosmetics industry, capturing the attention of both established brands and emerging players. Valued for its versatility and emotional connection with consumers, lipstick transcends mere beauty to embody empowerment, confidence, and style. The market has been in continuous expansion due to increasing disposable incomes, urbanization, rising beauty consciousness, and the social media-fueled desire for on-trend aesthetics. From matte to satin, liquid to bullet, and sheer to high-pigment formulations, lipstick offerings are becoming more diverse than ever.

Notably, inclusivity in shade ranges to cater to varied skin tones is no longer optional but a competitive necessity. Furthermore, the surge in vegan, cutlery-free, and organic formulations reflects the shift in consumer behavior towards responsible beauty. Online channels are witnessing tremendous growth, fueled by influencer marketing, digital try-on tools, and e-commerce convenience. In essence lipstick market stands as a colorful canvas where tradition meets innovation, and vanity embraces value.

| Report Attributes | Details |

| Market Size in 2025 | USD 18.32 Billion |

| Expected Size by 2034 | USD 27.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

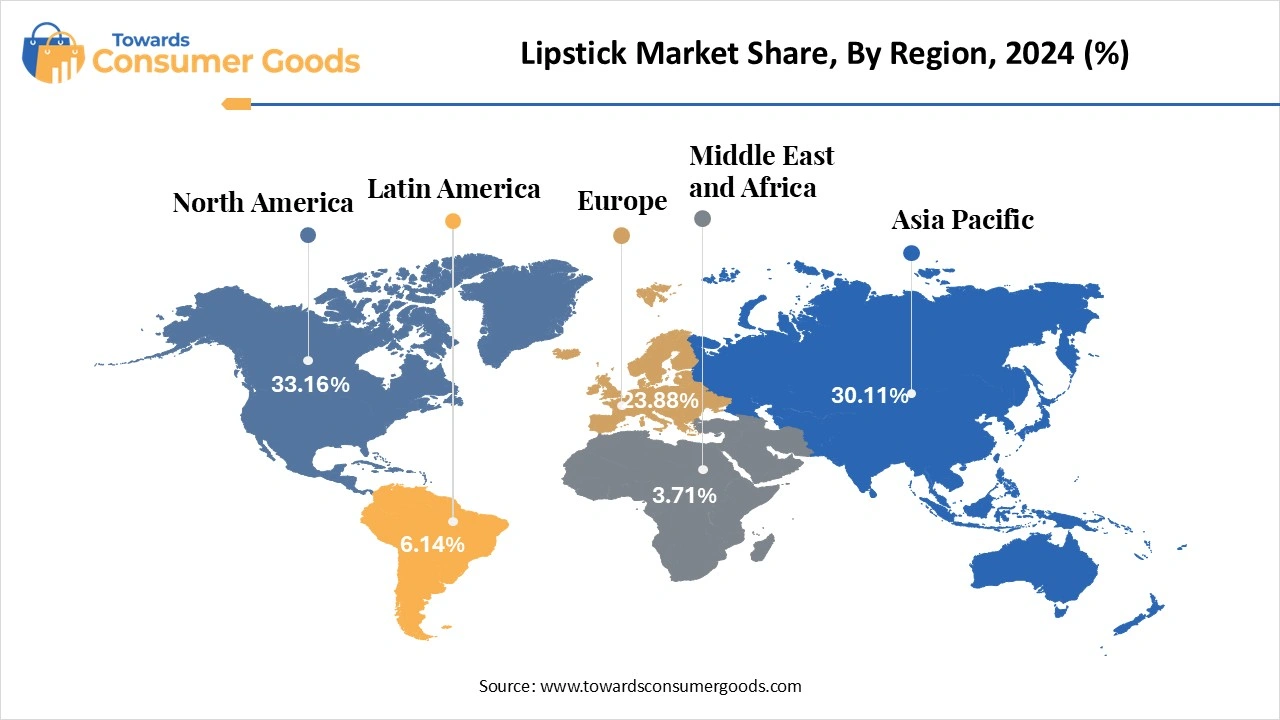

| Dominant Region | North America |

| Segment Covered | By Product, By Applicator, By Age, By Distribution Channel, |

| Key Companies Profiled | L’Oréal S.A., Estée Lauder Inc, Revlon, Coty Inc., Procter & Gamble, Shiseido Co.,Ltd., Unilever, Chanel S.A., Parfums Christian Dior, Beiersdorf AG |

Beyond the Tint, a Billion-dollar Smile

The lipstick market is poised for robust growth, thanks to a confluence of evolving consumer behavior, global cultural shifts, and innovation in product formulation. As beauty becomes more inclusive and self-expression more valued, lipsticks are no longer seen as luxury accessories but everyday essentials spanning across income levels, regions, and age groups. One major opportunity lies in the rising demand for clean, natural, and multifunctional products. Consumers, particularly millennials and Gen Z, are increasingly mindful of what goes onto their skin. This opens doors for brands offering lipsticks enriched with natural ingredients like shea butter, honey, vitamin E, and essential oils, adding skincare benefits to color.

Additionally, e-commerce and digital beauty tech have democratized access to high-quality lipstick products, especially in emerging markets. Augmented reality tools, influencer-led marketing, and subscription boxes help brands target niche markets and personalize user experiences like never before. Another promising growth avenue is men’s grooming and unisex beauty. The shift towards gender-neutral beauty.

The shift towards gender neutral beauty standards presents a largely untapped demographic for lipstick brands to explore with subtle shades, tinted balms, and neutral tones. Furthermore, festive and bridal collections, travel-friendly miniatures, and localized colored palettes can help bands cater to regional taste and cultural preferences, boosting seasonal sales.

Despite its vibrancy and allure, the lipstick market is not without its challenges. One of the primary restraints is the growing scrutiny around ingredients and safety concerns. With increased consumer awareness, products containing parabens, synthetic dyes, lead, and allergens face backlash, forcing brands to constantly reformulate and invest in regulatory compliance, often increasing production costs and delaying go-to-market timelines. Another pressing issue is the saturation and intense competition in both premium and mass-market segments. New entrants flood the market with similar claims of “long-lasting,” “smudge-proof,” or “vegan,” making it difficult for brands to establish a distinctive identity. The result is frequent price wars and thin profit margins, especially among smaller players.

he counterfeit products continue to plague the industry, especially online. They not only damage brand reputation but also endanger consumer health, prompting stricter regulatory interventions and complicating the distribution landscape. To truly thrive, brands must address these underlying cracks with transparency, adaptability, and an unwavering commitment to quality.

Why Does North America Still Reign Supreme in the Lipstick Landscape?

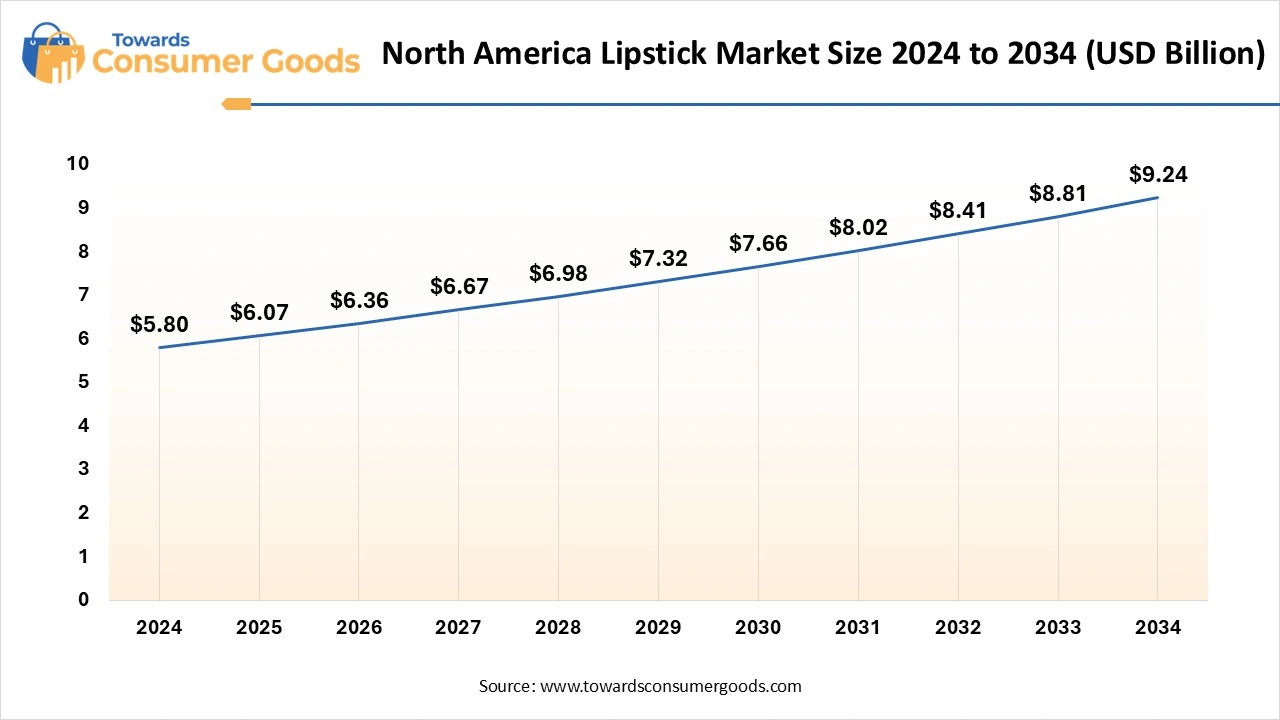

The North America lipstick market is expected to increase from USD 6.07 billion in 2025 to USD 9.24 billion by 2034, growing at a CAGR of 4.77% throughout the forecast period from 2025 to 2034. North America, particularly the United States and Canada, continues to dominate the global lipstick market. This regional supremacy is underpinned by a powerful combination of high disposable income, strong brand loyalty, and an ever-evolving beauty consciousness. Consumers here are not only willing to spend on cosmetics, but they also expect premium quality, safety, and ethical transparency, compelling brands to constantly innovate and diversify. One defining trait of the North American market is its trendsetting culture.

Global beauty trends often originate or gain traction in the U.S., thanks to influential celebrities, YouTube beauty gurus, TikTok influencers, and major fashion events. This trend-forward environment fosters quick product adoption, especially when it comes to limited editions, collaborative launches, and exclusive collections. Moreover, the North

American consumer is highly ingredient-conscious.

The demand for clean beauty, vegan formulations, and cruelty-free certification has skyrocketed. This pushes brands to embrace transparency and sustainability in both production and packaging. The region also benefits from a mature retail ecosystem, with a perfect blend of high-end department stores, boutique cosmetic retailers, and powerful e-commerce platforms. Online-to-offline (O2O) experiences, AR-driven virtual try-ons, and subscription beauty boxes have made purchasing more convenient and personalized.

How Is Asia-Pacific Becoming the Powerhouse of Lipstick Growth?

The Asia-Pacific region is witnessing an unprecedented surge in the lipstick market, positioning itself as the fastest-growing geography globally. With a massive and youthful population, rising urbanization, and increasing disposable income, the region provides a fertile ground for both international and domestic beauty brands to flourish. One of the strongest growth drivers is the explosion of K-beauty and J-beauty influences, which have redefined beauty standards and preferences across countries like South Korea, Japan, China, and even extending into Southeast Asia. The popularity of lip tints, glossy finishes, and natural hues aligns well with local beauty ideals that emphasize subtle elegance and skincare-infused cosmetics.

Digital innovation plays a pivotal role in this growth. Mobile-first consumers, especially in countries like India, Indonesia, and Vietnam, are increasingly relying on social media platforms, influencer reviews, and virtual try-on tools to explore and purchase lipstick products. This tech integration bridges the gap between aspirational branding and accessible shopping. Moreover, cultural diversity across the region demands hyper-localization. Brands that tailor their product lines to suit regional skin tones, climate conditions, and cultural preferences stand out. For instance, hydrating formulas with SPF are preferred in humid climates, while bolder shades may trend in urban nightlife hubs like Bangkok or Seoul.

The region also sees a growing awareness around natural and herbal ingredients, with consumers gravitating towards Ayurvedic, green tea, honey, and flower-extract-based lip products. Local brands offering such solutions are gaining traction, often preferred over Western luxury brands due to cultural resonance and affordability.

Why Is Shimmer Lipstick Dominating the Market?

Shimmer lipsticks have established a dominant presence in the global lipstick market due to their versatility and glamour appeal. Unlike traditional matte or satin finishes, shimmer adds a dimensional sparkle that enhances lip volume and creates an immediate festive or evening-ready look. This finish is particularly favored in fashion-forward regions and during seasonal or celebratory periods. What further fuels its dominance is the emotional connection shimmer evokes, a touch of shine often symbolizing luxury, confidence, and femininity.

Brands have capitalized on this association by launching shimmer variants in limited edition collections and celebrity collaborations. In addition, shimmer lipsticks work well across age groups and skin tones, offering both subtle and bold statements with just one swipe. Their appeal in both premium and affordable segments, and their ability to be worn alone or layered over matte lipsticks, makes shimmer lipsticks an indispensable part of many consumers’ beauty arsenals.

On the other hand, matte lipsticks are gaining momentum as the fastest-growing segment because they embody modern sophistication and long-lasting wear. Today’s beauty consumers, especially young adults, are drawn to products that align with busy lifestyles. The transfer-resistant, smudge-proof quality of matte lipsticks makes them a practical and fashionable choice.

Moreover, matte finishes offer bold pigmentation with minimal shine, allowing for a sleek and confident appearance, both in professional and social settings. Unlike earlier matte formulas that were drying, innovations in formulation now combine mattifying textures with nourishing ingredients like hyaluronic acid and shea butter, making them more comfortable to wear. With their increasing representation in minimalist, gender-neutral, and artistic makeup trends, matte lipsticks cater to a broad and evolving consumer base, propelling their growth at a rapid pace.

Why Do Traditional Stick Lipsticks Still Lead the Market?

The traditional tube or stick format continues to dominate the lipstick market due to its unmatched familiarity, convenience, and emotional appeal. Stick lipsticks are easy to apply, mess-free, and travel-friendly, making them the first choice for consumers of all ages. Their iconic status also plays a major role. The tactile experience of twisting a lipstick tube and the satisfaction of applying a solid bullet remain deeply ingrained in consumer memory. Brands often focus on innovating within this format by enhancing packaging aesthetics, adding built-in mirrors, or incorporating click mechanisms. Stick lipsticks also allow for versatility in finish from creamy to matte to shimmer, which makes them a universal favorite. They suit impulse purchases, gift sets, and promotional offers, ensuring they remain a core product in both retail shelves and personal makeup kits.

Moreover, liquid lipsticks are booming in popularity due to their precision, pigmentation, and performance. With sleek applicators and intense color payoff, these products offer the promise of a perfectly defined pout with just one glide. Consumers seeking full-day wear without touch-ups find liquid lipsticks incredibly appealing. The modern beauty consumer is also drawn to the customization offered by liquid formats. From velvet mattes to metallic glosses, the formulation spectrum is vast. Liquid lipsticks are ideal for both beginners and makeup artists alike, offering an exact and controlled application, particularly for bold or intricate makeup looks. Their sleek packaging and alignment with digital and influencer aesthetics have made them a star in online promotions, contributing to their rapid adoption, especially among young adults and beauty enthusiasts.

Why Are Consumers Under 20 Driving the Lipstick Market?

The under-20 demographic leads the lipstick market due to their early engagement with beauty culture, fueled by social media, peer influence, and digital beauty trends. This age group views lipstick not merely as makeup but as a means of self-expression, often experimenting with colors, textures, and finishes. Young consumers are particularly drawn to fun, affordable, and expressive options, from shimmer glosses to fruity balms and vibrant tints. Brands targeting this age group focus on youthful packaging, influencer tie-ins, and ethical claims, aligning with the values of this generation.

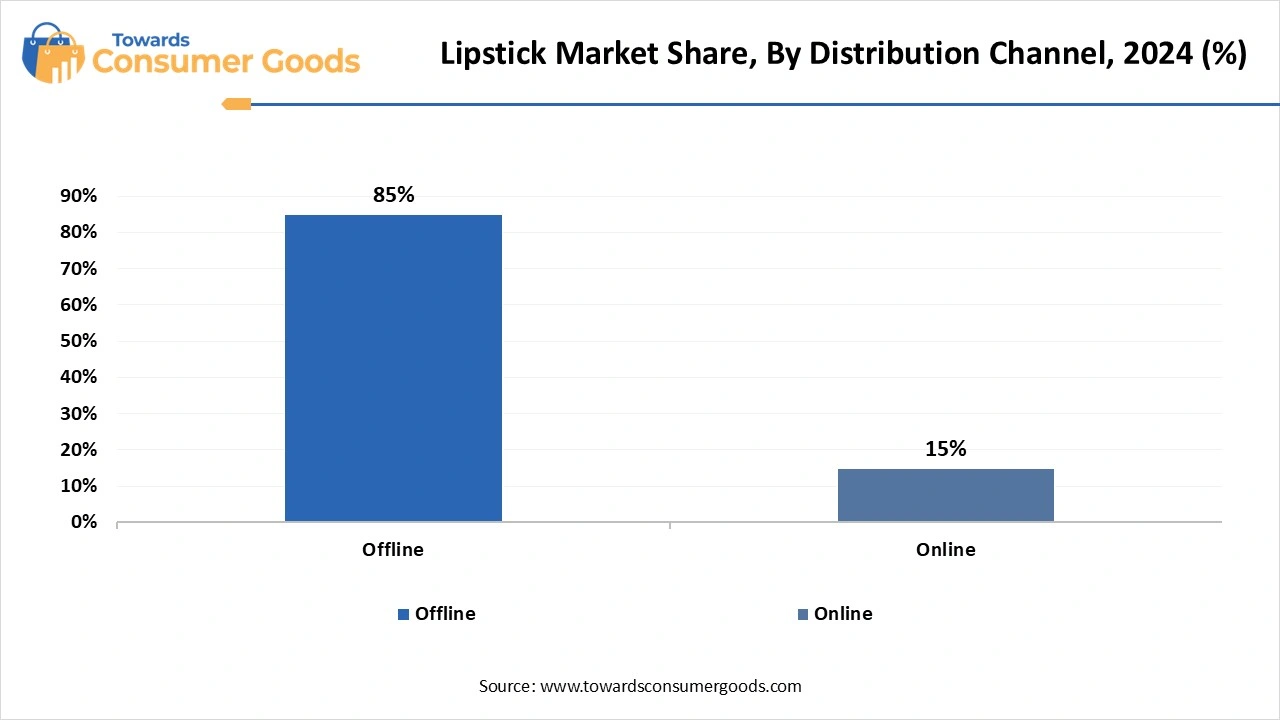

Why Does Offline Retail Still Dominate Lipstick Sales?

Despite the digital wave, offline retail holds a commanding share in lipstick sales due to the tactile and experiential nature of cosmetics shopping. Consumers often prefer to test shades, feel textures, and receive in-store consultation before purchasing, especially in the case of high-involvement products like lipstick. Department stores, beauty chains, and local cosmetic shops offer the ability to instantly try and compare products.

On the other hand, Online channels are experiencing explosive growth in the lipstick market due to their convenience, personalization, and access to variety. E-commerce platforms, beauty apps, and brand websites offer consumers the freedom to explore, compare, and purchase products from anywhere, anytime. What sets online apart is the power of digital engagement, influencer reviews, AR-based virtual try-ons, tutorials, and flash sales create a vibrant and immersive buying experience. For busy professionals and tech-savvy youth, the digital route is not only practical but preferred.

On June 2025, Honey has emerged as a trending ingredient in the beauty industry, gaining widespread popularity for its natural healing, moisturizing, and antibacterial properties. Increasingly featured in lip care and skincare products, honey is being celebrated for its ability to nourish, soothe irritation, and promote a radiant complexion, making it a go-to solution. (source:hindustantimes.com)

By Product

By Applicator

By Age

By Distribution Channel

July 2025

July 2025

July 2025

July 2025