July 2025

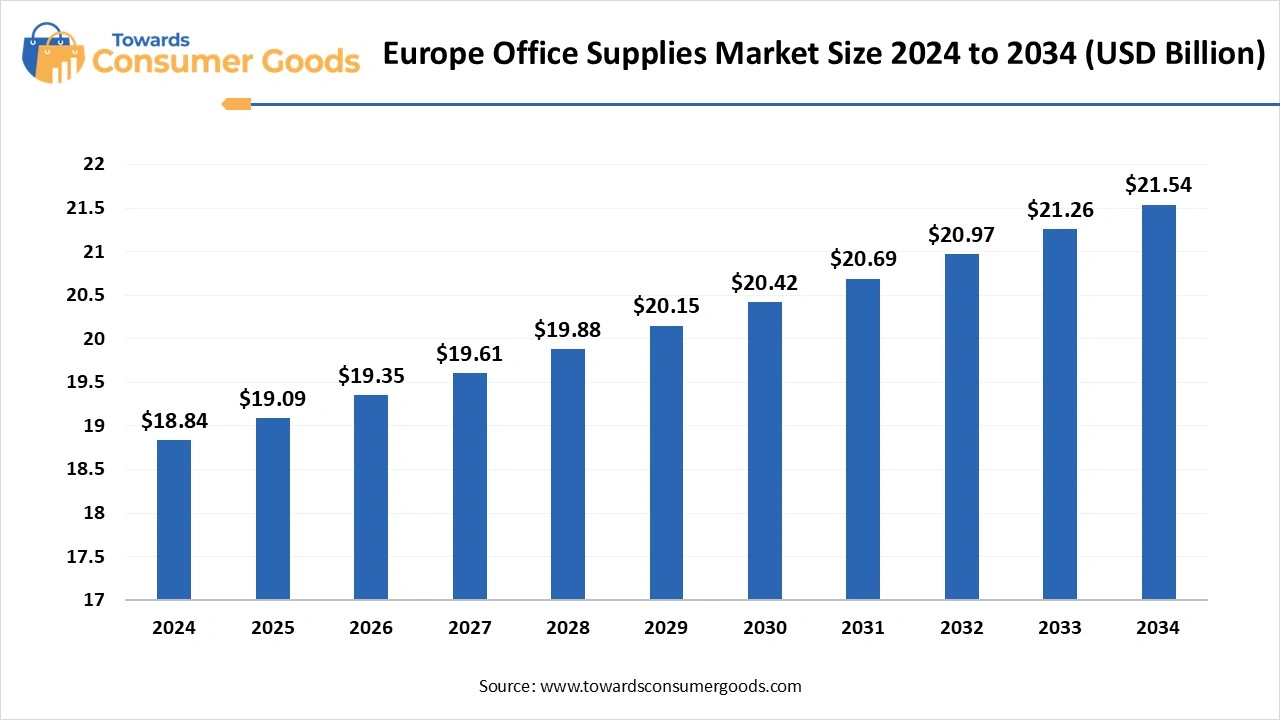

The Europe office supplies market size accounted for USD 19.09 billion in 2025 and is forecasted to hit around USD 21.54 billion by 2034, representing a CAGR of 1.35% from 2025 to 2034. The Europe office supplies market is undergoing a dynamic transformation driven by hybrid work models, digital integration, and sustainability trends. While traditional stationery items remain essential, the demand for ergonomic furniture, smart organisation tools, and eco-friendly products is rapidly rising across European corporates and SMEs.

The European office supplies market in Europe has evolved far beyond pens and paper. In recent years, the shift towards hybrid and remote working has redefined what “office supplies” mean for professionals. Demand is no longer restricted to traditional items; instead, there is a surge in purchases of home-office setups, ergonomic accessories, and digital tools like smartboards, webcams, and wireless peripherals. This evolution reflects a broader reimagining of how workspaces function, both in corporate offices and in remote environments. Germany, the United Kingdom, and France dominate the European office supplies market owing to many enterprises and a strong corporate infrastructure.

These regions are seeing increased investments in modern workspace designs, contributing to growing sales of high-quality office chairs, adjustable desks, and tech-integrated accessories. Meanwhile, Scandinavian countries are setting benchmarks in sustainable office product consumption, influencing the product preferences across the region. The growing environmental awareness among European consumers has significantly influenced the market.

Businesses and educational institutions are opting for recycled paper, refillable pens, and biodegradable stationery, pushing manufacturers to align with green certification standards. This trend is further reinforced by stringent EU regulations that favor eco-labelled products, opening new avenues for innovation and competition in the sector. E-commerce has emerged as a critical channel in this market, offering convenience, competitive pricing, and product variety. Online platforms are catering not only to B2C but increasingly to B2B customers through bulk ordering and subscription-based services.

| Report Attributes | Details |

| Market Size in 2025 | USD 19.09 Billion |

| Expected Size by 2034 | USD 21.54 Billion |

| Growth Rate from 2025 to 2034 | CAGR 1.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Distribution Channel, By End User, By Material Type, |

| Key Companies Profiled | Staples Solutions (Europe), Lyreco Group , RAJA Group , Office Depot Europe , Viking Direct , 3M Europe , ACCO Brands EMEA, Staedtler Mars GmbH , Faber-Castell AG , Pilot Corporation of Europe , Hamelin Group (Oxford Notebooks) , Esselte (Europe) , Newell Brands (Paper Mate, Sharpie), BIC Europe, Deli Europe , Canon Europe , Brother Industries Europe, Hamelin Brands, Amazon Business Europe, Kokuyo Europe |

Redefining the Workplaces

hybrid and remote work culture. Organizations across Europe are adopting flexible work arrangements, which have boosted the demand for home-office furniture, portable accessories, and digital communication tools. Compact desks, ergonomic chairs, and mobile storage solutions have become essential, creating new revenue streams for both established brands and emerging players. Another strong trend is the emphasis on sustainability and eco-friendly materials. European consumers are highly conscious of their environmental footprint, driving demand for products made from recycled, biodegradable, or reusable materials.

This sustainable shift is no longer a niche preference but a mainstream expectation. Companies investing in circular economy models and eco-labelling are gaining a competitive edge across B2B and B2C segments. Technological integration is revolutionizing the office supplies sector. From AI-enabled planning boards to IoT-connected smart printers, offices are moving towards smarter work environments. This trend offers a substantial opportunity for tech firms to collaborate with traditional stationery brands, resulting in hybrid products that cater to modern productivity needs.

Barriers in Europe's Office Supplies Evolution

Despite the optimistic outlook, the European office supplies market faces challenges, starting with the digital shift reducing dependence on traditional supplies. With increasing digitization across workplaces, the usage of paper, pens, and manual filing systems is decreasing. Cloud-based platforms and e-signature tools are replacing physical documents, gradually shrinking the stationery market share. The rising cost of raw materials, particularly for sustainable and biodegradable alternatives, is affecting profit margins. Many SMEs find it difficult to switch to eco-friendly production due to higher operational costs. This restricts their ability to compete in a market that is steadily moving towards greener expectations, creating a gap between consumer demand and business capacity.

Supply chain disruptions and geopolitical tensions, such as Brexit-related trade complexities and ongoing global logistics challenges, have impacted the timely delivery of office products across European borders. These issues often result in price fluctuations and product shortages, leading to dissatisfaction among both corporate and retail customers. The fragmentation of the market also poses a restraint. With a mix of large international players and thousands of local retailers, market consolidation is slow. Smaller players struggle to innovate or invest in digital transformation due to limited resources, which may hinder the overall growth and modernization of the sector.

Why is Western Europe dominating the office supplies?

Western Europe holds the lion’s share of the office supplies market owing to its well-established corporate infrastructure and high office density. Countries like Germany, France, the U.K., and the Netherlands have a vast presence of multinational corporations, government institutions, and SMEs, all of which are key consumers of office essentials ranging from furniture to stationery to digital tools. A major reason for this dominance is early digital adoption. Western Europe has been quick to embrace hybrid work models and smart office environments.

This has led to steady demand for ergonomic furniture, collaborative tech tools, and customizable work accessories. Premium office supply brands have found a mature, tech-savvy customer base in this region, enabling stable year-on-year growth. Furthermore, sustainability consciousness is deeply rooted in Western European markets. Consumers and institutions alike prioritize products that are eco-certified, recyclable, or biodegradable. As EU regulation further tightens around plastic use and carbon emissions, this region continues to drive the demand for green office products, creating both a challenge and an opportunity for manufacturers. Well-developed e-commerce ecosystems in Western Europe also give the region an advantage. Online B2B and B2C portals streamline the purchase and delivery of office supplies across urban and semi-urban areas.

What Makes Eastern & Central Europe the Fastest-Growing Region?

Eastern and Central Europe are witnessing rapid market expansion, fueled by rising industrialization, foreign investment, and a growing start-up ecosystem. Countries like Poland, Czech Republic, Hungary, and Romania are seeing an uptick in new business formations and office setups. This is translating directly into demand for essential office infrastructure and productivity tools. The cost-effectiveness and untapped market potential of this region are attracting international players. Global office supply brands and e-commerce giants are entering these markets through partnerships, warehouses, and fulfillment centers. This influx is improving product availability, price competitiveness, and overall quality in the region, key contributors to market acceleration.

Digitization and automation are also gaining momentum across Central and Eastern Europe. As businesses modernize, the need for multifunctional office equipment, ergonomic furniture, and digital communication tools is growing. Local governments are encouraging digital transformation, further increasing the demand for smart work solutions and connected office supplies. Another significant factor is the growth of the education sector and public administration. With EU funding and government focus on improving infrastructure, educational institutions and public offices in these regions are investing in better supplies and technology. This diversification of end-users is making the region a lucrative hub for both consumables and tech-driven office products.

Why Are Stationery and Writing Supplies Still the Backbone of the Office?

stationery and writing supplies continue to dominate the European office supplies market due to their indispensability in daily operations. Pens, notebooks, folders, markers, and paper remain integral across sectors such as education, legal, healthcare, and corporate environments, where documentation and manual input still hold value. The institutional and government sector plays a significant role in the dominance of this segment. Regular procurement of basic stationery in bulk quantities ensures consistent demand throughout the year. These products also have a long shelf life and low replacement cost, making them staple purchases for public and private institutions alike. Brand loyalty and product familiarity further strengthen this segment.

Consumers often prefer well-known stationery brands due to perceived quality, reliability, and availability. Additionally, companies focus on innovations like ergonomic designs, refillable pens, and smooth-flow ink technologies to maintain customer interest. With the return of employees to physical workspaces, even in hybrid formats, there is renewed demand for traditional office stationery. Employees tend to maintain personal desk supplies, planners, and notebooks, especially in collaborative settings where quick note-taking or brainstorming is frequent.

On the other hand, the office machines and equipment segment is the fastest growing due to the increasing need for automation, connectivity, and efficient workflow management. Products like printers, shredders, scanners, projectors, and multi-functional devices are gaining traction, particularly in digitized and hybrid office environments. As European businesses embrace smart office ecosystems, there is a rising investment in integrated hardware that supports remote and hybrid work models. Smart printers with cloud integration, video conferencing kits, and high-resolution monitors are in demand across corporations, co-working spaces, and even home offices.

The expansion of SMEs and start-ups across Europe has fueled the need for affordable yet powerful equipment. Brands offering compact, multi-purpose machines that conserve space and energy are winning over cost-sensitive yet performance-focused buyers. The multifunctionality of these tools appeals to the agility of new businesses. Additionally, government and EU-funded initiatives to promote digital transformation in education, public administration, and small businesses are further accelerating the adoption of modern office equipment. Educational institutions have become key buyers of AV equipment, laminators, and interactive whiteboards.

Why Do Offline Stores & retail chains lead the market?

Offline retail stores and office supply chains dominate the distribution of office supplies in Europe due to consumer preference for physical inspection, instant purchase, and immediate availability. For many customers, especially institutional and corporate buyers, purchasing from physical stores ensures quality verification and better bulk negotiation. Long-standing trust and relationships between businesses and local retailers have kept this channel strong. Many organizations have dedicated procurement partners or preferred vendors who offer customized services, including after-sales support, scheduled deliveries, and tailored inventory solutions.

Offline retailers benefit from geographical penetration, especially in regions where digital literacy is moderate. Stores in industrial zones, education hubs, and business districts ensure easy access for frequent, small-quantity purchases, which are common among SMEs and freelancers. Seasonal demand surges, such as back-to-school shopping or office reopening post-holidays, create spikes in footfall and drive revenue for brick-and-mortar outlets. These stores often run promotional campaigns and bundled deals that attract both individual consumers and businesses.

Moreover, E-commerce platforms are emerging as the fastest-growing channel in the European office supplies market, driven by convenience, variety, and digital purchasing habits. From freelancers to large enterprises, buyers increasingly prefer ordering online for its time efficiency and cost benefits. The rise of B2B marketplaces and supplier portals allows organizations to automate procurement, track expenses, and manage inventories all from a centralized dashboard. This digitization trend has streamlined purchasing for everything from stationery to office electronics.

Pandemic-driven remote work culture significantly boosted online buying patterns, a trend that continues even as physical offices reopen. Online platforms provide easy access to both essential and specialized items often unavailable at local stores, making them a one-stop solution. E-commerce also thrives due to competitive pricing and frequent discounts, especially for bulk orders or subscription models. Customized delivery schedules and real-time shipment tracking add value for corporate buyers who prioritize reliability and planning.

Why Do Corporations and Enterprises Lead Office Supply Consumption?

Corporations and enterprises dominate the end-user segment, primarily due to their scale and consistent procurement needs. Large companies often operate across multiple locations and require a constant supply of consumables, furniture, tech equipment, and customized branding materials. Bulk procurement, contract-based supply chains, and dedicated vendors give corporations strong purchasing power. They often opt for premium quality supplies that ensure durability, productivity, and brand consistency across departments and branches.

Many organizations have well-established procurement departments or third-party facility managers, ensuring structured and recurring purchases. This guarantees long-term contracts for suppliers, making corporates a high-value segment in terms of volume and revenue. The growing focus on employee well-being, inclusivity, and productivity in workplaces also drives diversified demand, from ergonomic furniture to wellness accessories and sustainable consumables. Companies are investing more in creating modern, collaborative office environments.

On the other hand, Freelancers and home offices are the fastest-growing end-user segment, thanks to the rise of the gig economy, remote work, and creative entrepreneurship. Across Europe, millions of professionals now work independently, driving demand for compact, affordable, and aesthetic office setups. This segment seeks convenience, flexibility, and personalization, unlike corporate buyers. Freelancers often buy supplies that reflect their work style, from graphic tablets to colorful organizers and portable tech accessories.

Home offices are also more likely to invest in furniture that blends functionality with home décor. E-commerce platforms have made it easier for freelancers to access a wide range of products, often offering bundled deals and EMI options. The rise of drop-shipping and direct-to-consumer (D2C) brands also contributes to meeting the unique needs of this segment. Government incentives and tax benefits for remote work setups have further encouraged home office investment. Additionally, online learning, tutoring, and remote counselling professionals now require formal setups, creating new demand subcategories.

Why Do Plastic-Based Products Still Dominate Office Supplies

Plastic-based products remain dominant in the office supplies market due to their affordability, durability, and mass availability. Items like plastic folders, trays, pens, clips, and organizers are integral to office setups and are often preferred for their lightweight and long-lasting nature. The cost advantage of plastic makes it a go-to material for bulk procurement in schools, offices, and public institutions. These products are also easy to manufacture, mold, and color, allowing for variety and customization across use cases and branding. While sustainability is gaining momentum, many plastic-based products are now recyclable or reusable, which helps them retain their relevance

Manufacturers are also innovating with biodegradable plastic alternatives to meet green compliance standards without losing functionality. Plastic’s versatility in design supports both functional and aesthetic applications. From minimalist desk accessories to brightly colored stationery for creative offices, plastic offers unmatched design freedom, ensuring continued demand across consumer segments.

On the other hand, the Paper-based supplies segment is the fastest growing in the market, driven by sustainability movements and changing consumer preferences. Recycled notebooks, kraft paper folders, paper-based pens, and even paper furniture are gaining popularity across eco-conscious workplaces. The EU’s green procurement policies have been pivotal in promoting paper over plastic. Offices aiming to reduce carbon footprints are switching to paper where possible, especially for one-time-use items, internal documents, and client-facing material that aligns with brand values

By Product Type

By Distribution Channel

By End User

By Material Type

July 2025