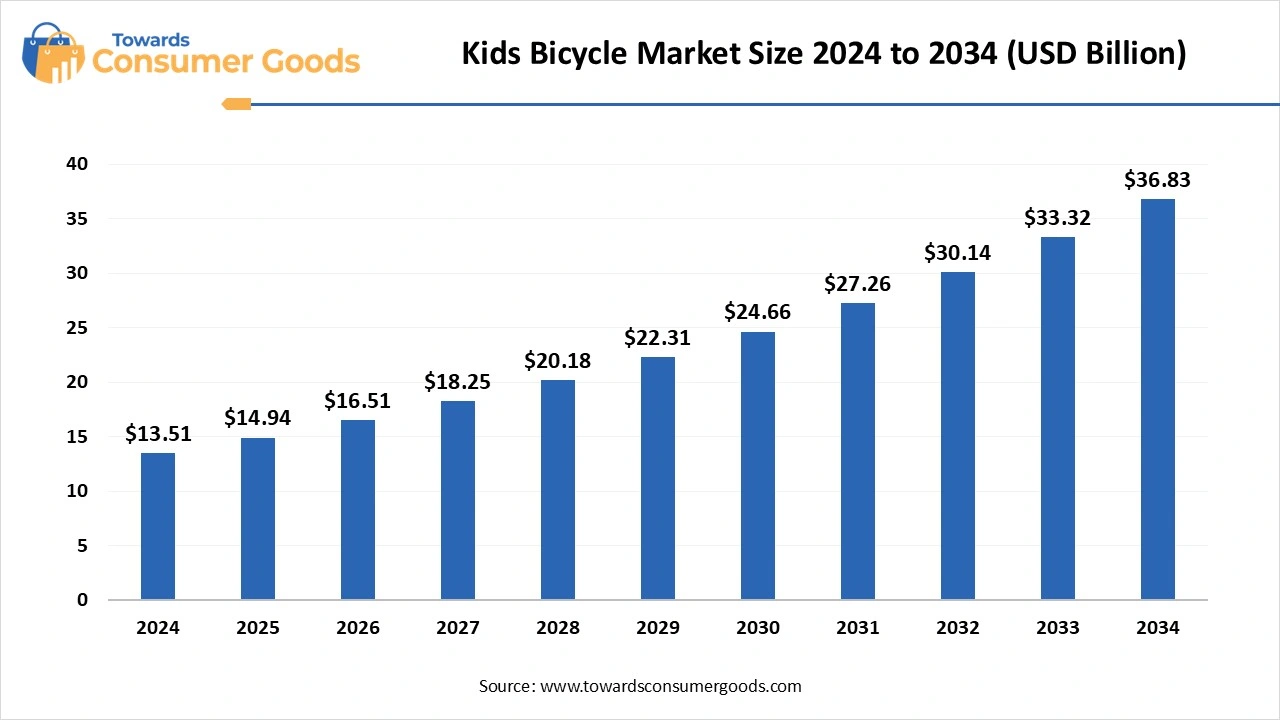

The global kids bicycle market size is calculated at USD 13.51 billion in 2024, grew to USD 14.94 billion in 2025, and is projected to reach around USD 36.83 billion by 2034. The market is expanding at a CAGR of 10.55% between 2025 and 2034. This market is growing due to increasing awareness among parents about the importance of outdoor physical activities for children's overall development.

The kids bicycle market comprises bicycles specifically designed for children, typically aged between 2 to 14 years. These bicycles vary by age, size, wheel diameter, gear system, material, and added safety features. The market includes balance bikes, pedal bikes, BMX bikes, mountain bikes, and e-bikes for kids. It is driven by increasing health awareness among parents, emphasis on outdoor physical activity, growing urban infrastructure supporting cycling, and rising disposable income in developing economies. Technological integration (smart features, lightweight materials), rising e-commerce penetration, and growing environmental awareness also play crucial roles in market expansion.

Innovations in design and safety features are significantly boosting the demand for kids' bicycles by addressing both parental concerns and children's preferences. To guarantee better control and safety, even for novice manufacturers, they are introducing lightweight frames, anti-slip pedals, ergonomic seating, and improved braking systems.

Parents feel more secure when making purchases thanks to features like enclosed chains, stability-controlled training wheels, and reflective components. Bold colours, decals with character themes, and accessories that can be customized are also drawing in kids and enhancing the appeal of cycling as an enjoyable and fashionable pastime. In a cutthroat market, these developments not only enhance the riding experience but also encourage recurring business and brand loyalty.

| Report Attributes | Details |

| Market Size in 2025 | USD 14.94 Billion |

| Expected Size by 2034 | USD 36.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Age Group, By Material, By Sales Channel, By End Use, By Region |

| Key Companies Profiled | Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Accell Group N.V., Scott Sports SA, Hero Cycles Ltd., Strider Sports International, Inc., Schwinn (Pacific Cycle Inc.), Specialized Bicycle Components, RoyalBaby, Woom Bikes, Guardian Bikes, Frog Bikes, Cannondale, BTWIN (Decathlon), Raleigh Bicycles, Yedoo (Balance bikes), Huffy Corporation, PUKY GmbH, Diamondback Bicycles, Radio Flyer |

Parents have made physical activity a top priority due to growing awareness of childhood obesity, posture issues, and screen addiction. Riding a bicycle is a fun, non-technological way to improve mental focus, coordination, and endurance. Additionally, outdoor activities are advised by paediatricians and child health specialists worldwide to improve social skills and immunity. For parents, riding a bicycle is an enjoyable and meaningful way to support their child's growth. Urban and semi-urban households are seeing a consistent year-round demand for children's bicycles due to growing health consciousness.

The high initial cost of high-quality children's bicycles restricts affordability for budget-conscious buyers in many developing nations. When education and necessities are already top priorities, parents frequently hesitate to spend money on luxury models.

Additionally, children outgrow bikes quickly, adding to the expense of having to replace them frequently. Branded bikes with added safety features, improved suspension, or clever features are frequently more expensive, which increases the disparity in affordability. Local inexpensive or used options are typically preferred by families over more recent international options. This reduces the potential revenue for multinational corporations aiming to enter emerging markets. Larger purchases are also deterred by restricted access to installment payment plans or consumer financing options.

Why is Asia Pacific dominating the global kids' bicycle market?

Asia Pacific dominates the kids' bicycle market due to its sizable child population, growing middle class, and rising interest in outdoor exercise. Bicycle demand is increasing in urban and semi-urban areas as a result of parents' growing encouragement of active lifestyles for their kids. Growing urbanization has also led to better safety regulations and cycling infrastructure, which encourages families to choose recreational bikes for their children.

Affordability-priced local manufacturing and government-run school-based bicycle distribution initiatives also increase the region's market share. Its leadership is further cemented by its broad retail distribution networks, low average selling price, and cultural emphasis on outdoor play.

North America is witnessing rapid growth due to the growing demand for high-end safety features, branded or character-themed models, and electric children's bikes. Parents are spending more money on sturdy, high-quality bicycles as part of their lifestyles and health decisions. Children are becoming more active outside thanks to digital awareness campaigns and a growing emphasis on cutting back on screen time.

Additionally, innovation in lightweight and tech-enhanced models and the widespread use of e-commerce are greatly assisting regional expansion. This upward trend is also being fueled by investments in safe biking infrastructure and growing concerns about childhood obesity.

Why are pedal bikes (16–24-inch wheels) dominating the product segment?

Pedal bikes (16–24-inch wheels) dominate the product category because they serve the widest age range, usually children between the ages of 5-12, where riding independently becomes crucial. These bikes, which provide different degrees of control and balance appropriate for developing children, are popular for both educational and recreational uses.

They are popular for both educational and recreational purposes. They are a popular choice among parents due to their availability in a variety of designs, price points, and branded themes. They are frequently used by communities' sports organizations and schools to impart basic cycling skills, which increases their widespread appeal. Their volume-driven dominance is further reinforced by the presence of physical retail stores and local assembly models for these bikes.

Electric kids' bicycles are gaining traction as they put convenience technology and enjoyment together. Because of their controlled speed and ease of use, e-bikes are attractive to parents searching for entertaining alternatives to screens. Safety features like throttle locks and low-speed modes are being added to battery-powered models by manufacturers. These bikes are particularly well-liked for play and casual commuting in cities, and they also fit in with larger e-mobility trends. Innovations in mini motors, D2C brand launches, and falling lithium-ion battery prices are all contributing to the momentum in this rapidly expanding market.

Why do 5-8-year-old children dominate the age group segment?

The 5-8 years age group dominates the market as the best time to develop your skills, balance, and ability to cycle on your own. Kids in this age group usually switch from balance bikes or training wheels to pedal bikes. Parents frequently purchase mid-range to high-end bicycles as birthday or seasonal presents for this group are particularly fond of bike sizes, colors, and accessories with cartoon themes, which makes them a significant source of income. Bike use is beneficial for both play and short-distance commuting, as this group also includes those who are just starting school.

The 2-4 years (balance bikes) age group is the fastest growing due to balance bikes' growing popularity. Before learning to ride a full bike, these pedal-less bikes help toddlers gain confidence and coordination. Their bright, appealing designs, low standing over heights, and lightweight frames make them appropriate for young students. More parents are buying bikes for their younger children as part of early physical education, as awareness of motor skill development grows. Adoption of balance bikes in this market is also being aided by Montessori-style learning resources, pediatricians' recommendations, and online parenting influencers.

Why are steel-frame bicycles dominating the market?

Steel frame bicycles dominate due to their appeal to a broad spectrum of customers, due to their robust construction, affordability, and longevity. Steel bikes provide sturdy performance and low maintenance for active kids who ride in a variety of settings. These bikes' strength and affordability make them popular choices among parents, particularly for growing children who might soon outgrow the bike size. Steel frame bikes' widespread availability in both branded and unbranded markets adds to their dominance. In rural and price-sensitive markets where convenience in repair and resale is important, they are also favored.

Composite/plastic parts bikes are growing fast as parents look for options that are easy to manage and offer high performance for their kids. Young riders can carry and maneuver these bikes more easily, especially on uneven or inclined terrain. Urban families and fitness-conscious homes that appreciate both style and utility are starting to use them more frequently. Brands are spending money on cutting-edge designs and materials that combine strength and light weight, making them a high-end but more widely available option. This market is growing due to factors like premium gifting trends, growing availability through D2C platforms, and an increase in urban cycling culture.

Why are specialty and offline retail stores dominating the sales channel?

Specialty & offline retail stores dominate due to parents' value of size fittings, test rides, and in-person safety inspections before making a purchase. Direct evaluation of the bike's comfort construction and accessories is possible in physical stores. Additionally, store employees can provide knowledgeable advice on choosing a bike based on usage and age, which increases customer trust. The in-store shopping experience is further improved by customization choices, loyalty discounts, and post-purchase assistance. These shops frequently partner with neighborhood sporting events or schools to increase foot traffic and community loyalty.

Online retail & D2C E-commerce platforms are rapidly expanding due to competitive pricing, increased product selection, and ease of use. From home, parents can access exclusive launches, read reviews, and compare models. To draw in online shoppers, many brands now provide virtual sizing tools with extended warranties and free return policies. Furthermore, social media campaigns influence marketing, and unboxing videos have increased the visibility and accessibility of children's bicycles online. This market is expanding due to flash sales, Instagram-based brand discovery, and product drops that are exclusively available digitally.

Why is recreational use dominating the kids' bicycle market?

Recreational use dominates because bicycles are mostly bought for leisure, fitness, and outdoor play. Cycling is seen by parents as a fun, healthy, and developmental activity for their kids. Recreational biking is supported by park rides on weekends, community events, and holiday gift-giving trends. To meet this demand, manufacturers produce models with character themes, safety accessories, and vibrant designs. This use case supports growing interest in screen-free activities and coincides with seasonal peaks.

School commuting & daily utility are growing fast as interest in non-motorized transportation is fueled by environmental concerns, fuel prices, and urban congestion. Bikes made for short distances that are lightweight and foldable are becoming increasingly popular. Bicycles are also being considered by parents as an affordable and healthy option for their kids' school commute. In certain areas, school-age children are given bikes through government-sponsored programs, which further accelerates growth. Adoption in this market is accelerating with the introduction of visibility gear baskets/utility add-ons and city-specific school commuting models.

By Product Type

By Age Group

By Material

By Sales Channel

By End Use

By Region