July 2025

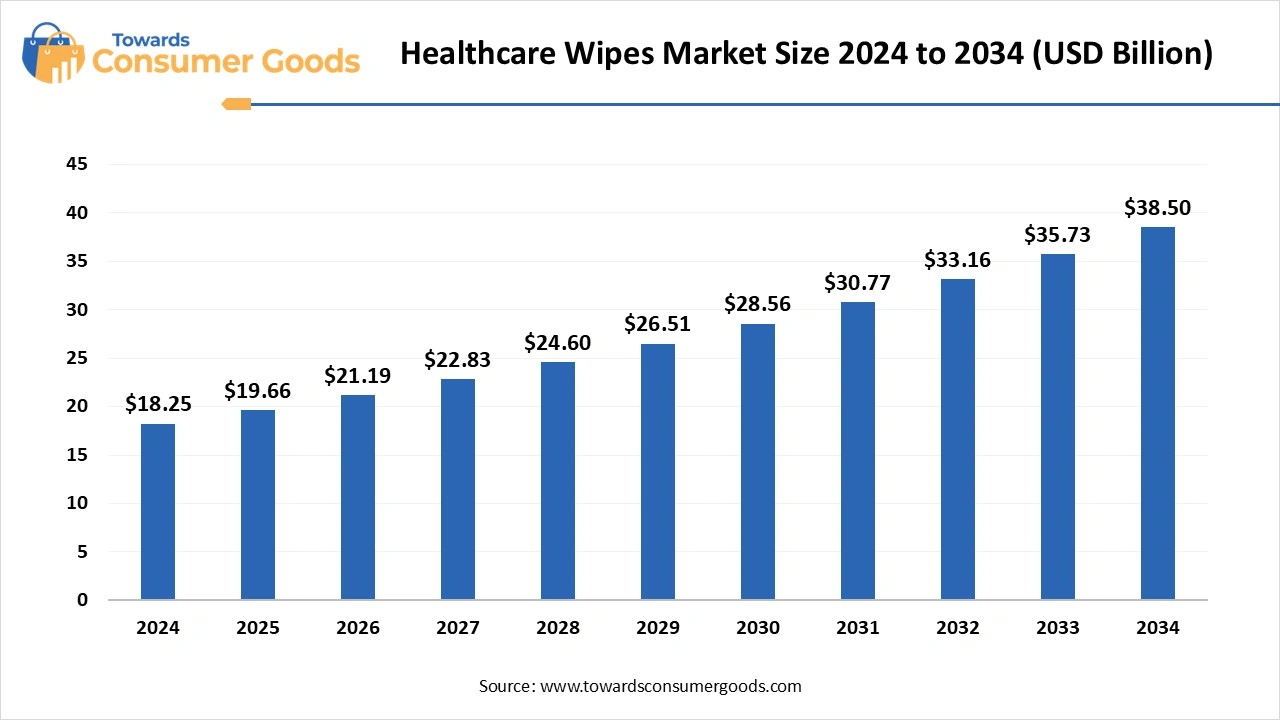

The healthcare wipes market size was calculated at USD 18.25 billion in 2024 and is projected to hit around USD 38.50 billion by 2034 with a CAGR of 7.75%. The growing awareness regarding hygiene and expansion of healthcare infrastructure have driven the market growth.

The healthcare wipes market is primarily focused on addressing the pressing need for enhanced hygiene and robust infection control measures within medical environments. This demand has been significantly spurred by an increased awareness of healthcare-associated infections (HAIs) and the convenience that readily accessible disinfection solutions provide. The market encompasses a diverse array of wipes, including but not limited to antibacterial and disinfectant varieties, specifically designed for surface sanitization and equipment cleaning in hospitals and a range of healthcare facilities.

Disinfectant wipes stand out as a practical and portable solution for disinfection, appealing significantly to healthcare professionals. The pre-moistened design of these wipes simplifies the cleaning process by eliminating the necessity for additional cleaning supplies or water, ultimately streamlining the disinfection routine in fast-paced healthcare settings.

The growth trajectory of the healthcare wipes market can be attributed to several key factors, including a rising awareness of hygiene, an alarming increase in HAIs, and the lasting impact of the global pandemic, all of which have amplified the demand for effective cleaning solutions within healthcare environments. Contributing to this trend are broader societal changes such as urbanization, the expansion of healthcare infrastructure, and the growth of medical tourism, all of which further drive the need for dependable disinfection products.

| Report Attributes | Details |

| Market Size in 2025 | USD 19.66 Billion |

| Expected Size by 2034 | USD 38.50 Billion |

| Growth Rate | CAGR of 7.75% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Distribution Channel, By Region |

| Key Companies Profiled | Procter and Gamble, 3M, Johnson & Johnson Services, Inc., Diamond Wipes International, Inc, The, Clorox Company, KIMBERLY-CLARK CORPORATION, Costco Wholesale Corporation, Reckitt Benckiser, Group PLC, Procotech Ltd, Beiersdorf AG, Ecolab, Berry Global Inc. |

Personalization in the Healthcare Wipes

In terms of healthcare wipes market opportunities, there is significant potential for innovation. Developing healthcare wipes that boast improved efficacy, faster kill times on pathogens, and a broader spectrum of antimicrobial activity represents a prime opportunity in this sector. Additionally, exploring the incorporation of biodegradable or compostable materials can address rising environmental concerns linked to traditional wipe production.

There is also room for creating specialized wipes tailored to unique applications, such as hand hygiene in different healthcare contexts or cleaning specific medical equipment, which can cater to targeted needs in the market. Expanding the availability of such wipes through diverse channels ranging from hospitals and clinics to pharmacies, online platforms, and retail stores will likely enhance sales and increase market share. Targeted marketing efforts towards healthcare professionals and facilities are essential to drive product adoption and bolster demand.

Side Effects and Usage Challenges

Despite the promising growth and opportunities, certain healthcare wipes market restraints must be acknowledged. In healthcare, restraints refer to various devices employed to limit a patient's movement, primarily to protect them from potential self-harm or harm to others. These restraints can be physical (such as belts, vests, or mitts) or pharmacological, involving medications like sedatives. Their usage becomes critical in circumstances where alternative interventions prove ineffective, such as during episodes of agitation, confusion, or behavioural disturbances.

However, the application of restraints remains a contentious issue due to the possible negative impacts on a patient’s overall well-being, including the risk of pressure ulcers, deterioration of muscle strength, or psychological distress. Healthcare professionals bear an ethical obligation to implement the least restrictive methods necessary to ensure patient safety, balancing the need to protect patients while promoting their dignity and autonomy.

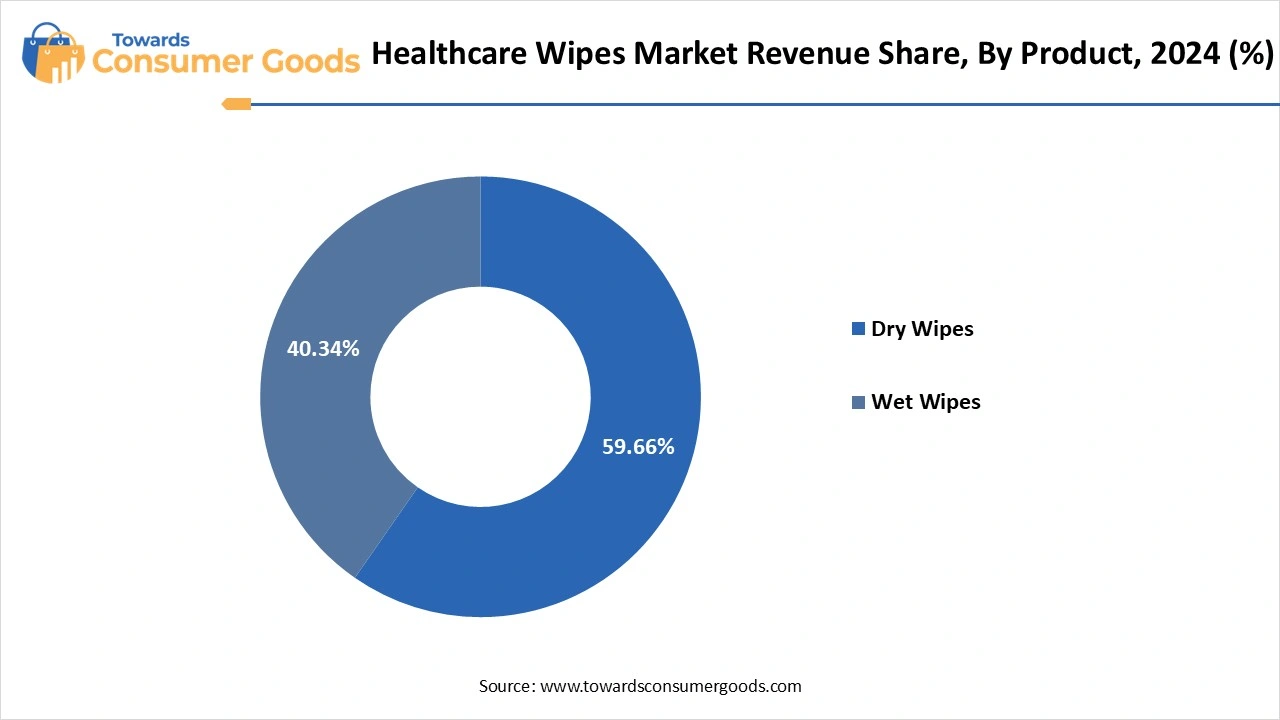

The dry wipes segment led the healthcare wipes market in 2024, primarily due to their remarkable versatility and economical advantage. These wipes are extensively used across various healthcare settings, including hospitals, outpatient clinics, and long-term care facilities such as nursing homes. Their applications range from cleaning hard surfaces and disinfecting medical instruments to promoting personal hygiene.

A noteworthy aspect of dry wipes is their critical role in infection control; healthcare facilities are increasingly emphasizing rigorous sanitation practices to avoid hospital-acquired infections (HAIs). For example, in operating rooms, dry wipes are essential for ensuring that areas remain sterile during surgical procedures, underscoring their importance in high-stakes environments. Furthermore, dry wipes typically possess a longer shelf life and have a reduced environmental impact compared to their wet counterparts, thereby appealing to healthcare providers aiming for sustainable, eco-friendly solutions.

The wet wipes segment is projected to experience the fastest growth rate in the healthcare wipes market throughout the forecast period, driven predominantly by a surge in consumer desire for convenience and heightened hygiene standards. Trends such as urbanization, evolving lifestyles, and an increasing number of professionals in the workforce lead to a growing demand for quick, efficient cleaning solutions that integrate easily into daily routines.

Wet wipes provide an instant solution for sanitizing hands and surfaces, making them preferable for personal care needs. For instance, antibacterial wet wipes have become increasingly popular in various public environments such as restaurants and public transport allowing users to rapidly disinfect surfaces before use and thus actively contributing to infection risk mitigation. Additionally, innovations in the market, including hypoallergenic formulas and environmentally friendly materials, are attracting health-conscious consumers while addressing pressing ecological considerations.

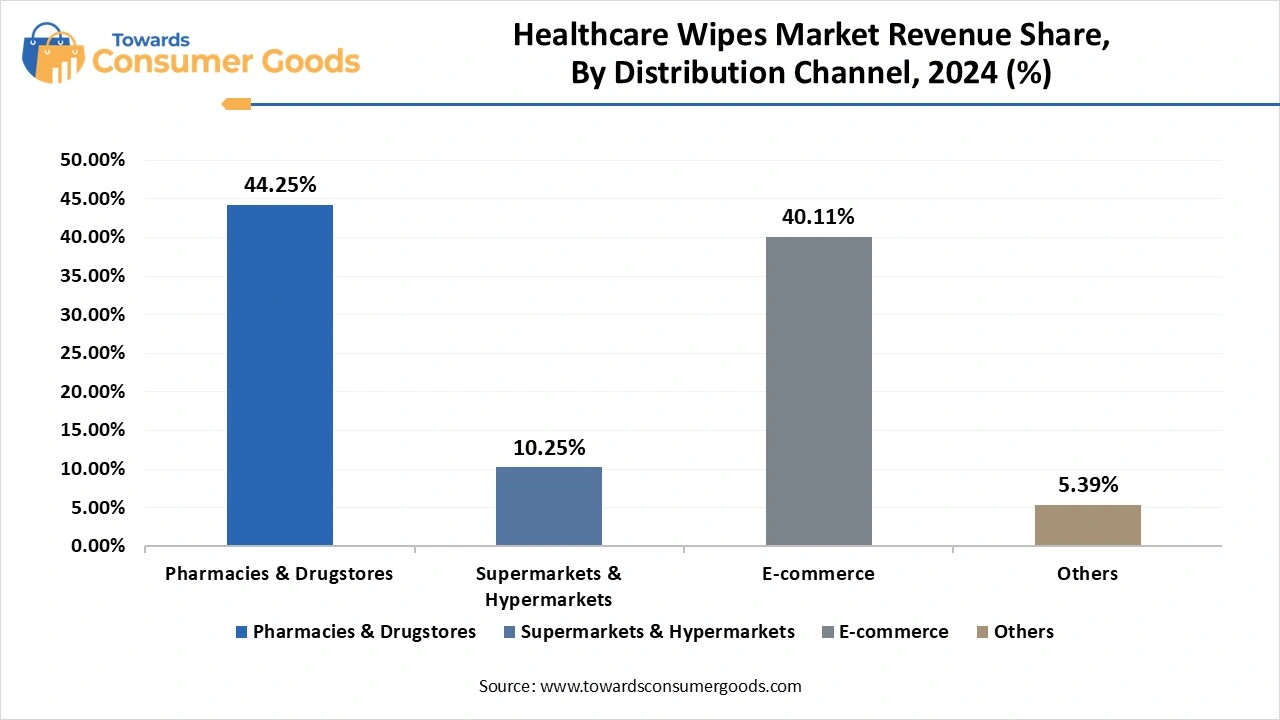

Pharmacies and drugstores segment dominate the healthcare wipes market in 2024. This prominence can be attributed to their vital position as easily accessible retail outlets for hygiene products. Particularly in times of health crises, such as flu seasons or pandemics, pharmacies become the go-to hub for consumers seeking immediate access to healthcare wipes. The convenience of purchasing wipes alongside other health-related items boosts their appeal; for example, many consumers will casually add antibacterial wipes to their shopping carts while picking up prescription medications. Additionally, pharmacies often stock a variety of reputable brands and specialized products tailored to various consumer needs, including formulations for sensitive skin and environmentally friendly options.

The e-commerce segment is expected to achieve the highest compound annual growth rate in the healthcare wipes market over the forecast period, thanks to the convenience offered by online marketplaces. This channel empowers consumers to purchase wipes from the comfort of their homes, a trend that has particularly surged since the COVID-19 pandemic. For instance, many individuals have turned to e-commerce platforms to buy antibacterial wipes in bulk, ensuring they have ample supplies available for everyday use. Online shopping provides access to a wide array of products, including specialized wipes that may not be easily found in brick-and-mortar stores. Moreover, the ability to compare prices and take advantage of online discounts incentivizes many consumers to choose e-commerce as a cost-effective shopping solution.

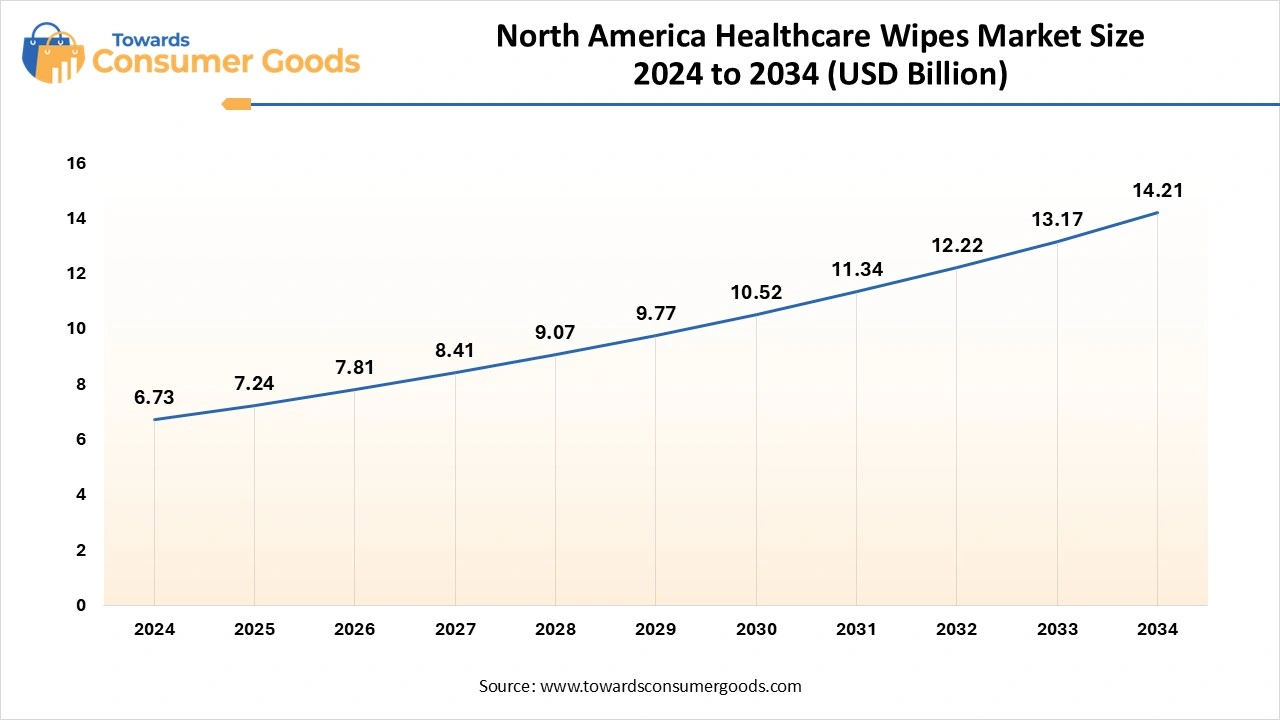

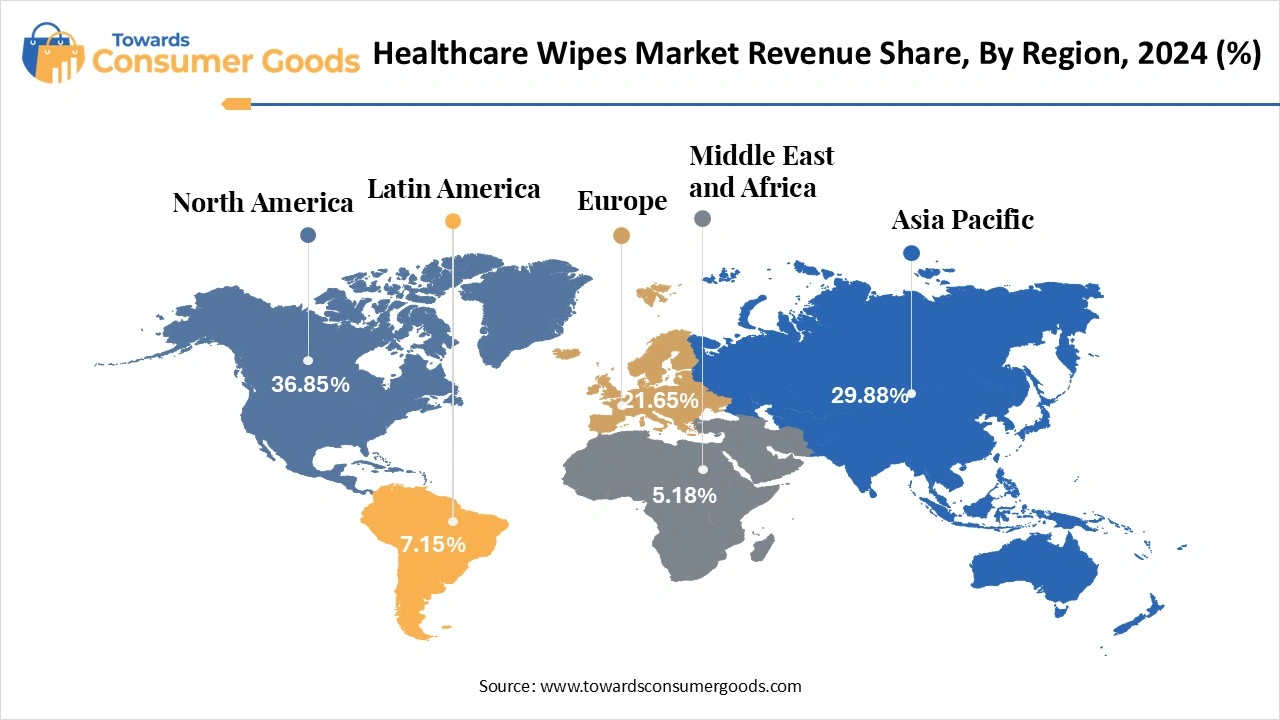

North America dominated the healthcare wipes market in 2024. North American market for healthcare wipes commands the largest share, The North America healthcare wipes market size was valued at USD 6.73 billion in 2024 and is expected to be worth around USD 14.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.76% over the forecast period 2025 to 2034.

Primarily driven by the region's advanced healthcare infrastructure. This includes an extensive network of hospitals and clinics committed to upholding stringent hygiene and infection control practices. The high demand for effective cleaning solutions, such as healthcare wipes, is particularly evident in settings where maintaining sterile environments is non-negotiable. For example, hospitals regularly employ disinfectant wipes to sanitize surfaces and medical equipment, significantly reducing the potential for hospital-acquired infections. Additionally, the substantial investment in healthcare in North America fosters ongoing innovation and ensures a diverse portfolio of healthcare products, further enhancing market growth. The well-established healthcare system in this region necessitates comprehensive cleaning and disinfection protocols, ultimately leading to a sustained demand for healthcare wipes.

Asia Pacific expects the significant growth in the market during the forecast period. The region is on track for the fastest growth in the healthcare wipes market, fueled by a combination of heightened awareness surrounding hygiene and infection control, along with a rise in healthcare-associated infections (HAIs). The expansion of healthcare infrastructure in rapidly developing countries such as China and India, combined with increasing disposable incomes and urbanization, is propelling this demand. A growing understanding of hygiene practices and the escalating prevalence of HAIs, particularly within hospitals and other medical settings, are driving the adoption of efficient disinfectant wipes to help mitigate the risks of cross-contamination. The ongoing development of healthcare facilities in these nations, alongside investments in state-of-the-art medical technologies, further elevates the need for products like healthcare wipes, establishing a promising outlook for the industry.

Innovation- In March 2025, Alkem Laboratories Ltd made a significant announcement regarding the launch of its generic formulation of empagliflozin, named "Empanorm," along with its various combinations, in the Indian market. This new product line will be marketed under the brand name ‘Empanorm’ and is being offered at prices approximately 80 percent lower than those of the original innovator drugs. This initiative reflects the company's commitment to enhancing accessibility to important medications for patients in India.

Innovation- In July 2024, Ecolab debuted a groundbreaking disinfectant product: the Disinfectant 1 Wipe, which is notable for being the first of its kind registered by the Environmental Protection Agency (EPA) that is completely plastic-free and readily degradable. This innovative wipe not only supports environmentally friendly practices but also ensures efficient hospital-grade disinfection in just one minute.

Innovation- In December 2024, Blue Bear Baby, a company based in the United States, launched a new line of sensitive baby wipes that have been dermatologically tested for safety. These hypoallergenic wipes are enriched with nourishing ingredients, providing a gentle cleansing solution for babies. The brand prioritizes transparency by sharing a detailed list of ingredients, which notably excludes alcohol, soap, and parabens, catering to parents seeking safe and healthy products for their children.

Industry forecasts suggest that, the global home furnishing market size was estimated at USD 1,019.10 billion in 2024 and is predicted to increase fro...

A new research report, the U.S hair care products market size is calculated at USD 21.19 billion in 2024, grew to USD 22.56 billion in 2025 and is pre...

The global women intimate care products market size was valued at USD 42.83 billion in 2024. The market is projected to grow from USD 44.78 billion in...

The global online sports betting market size was accounted for USD 78.19 billion in 2024 and is expected to be worth around USD 142.29 billion by 2034...

July 2025

July 2025

July 2025

July 2025