July 2025

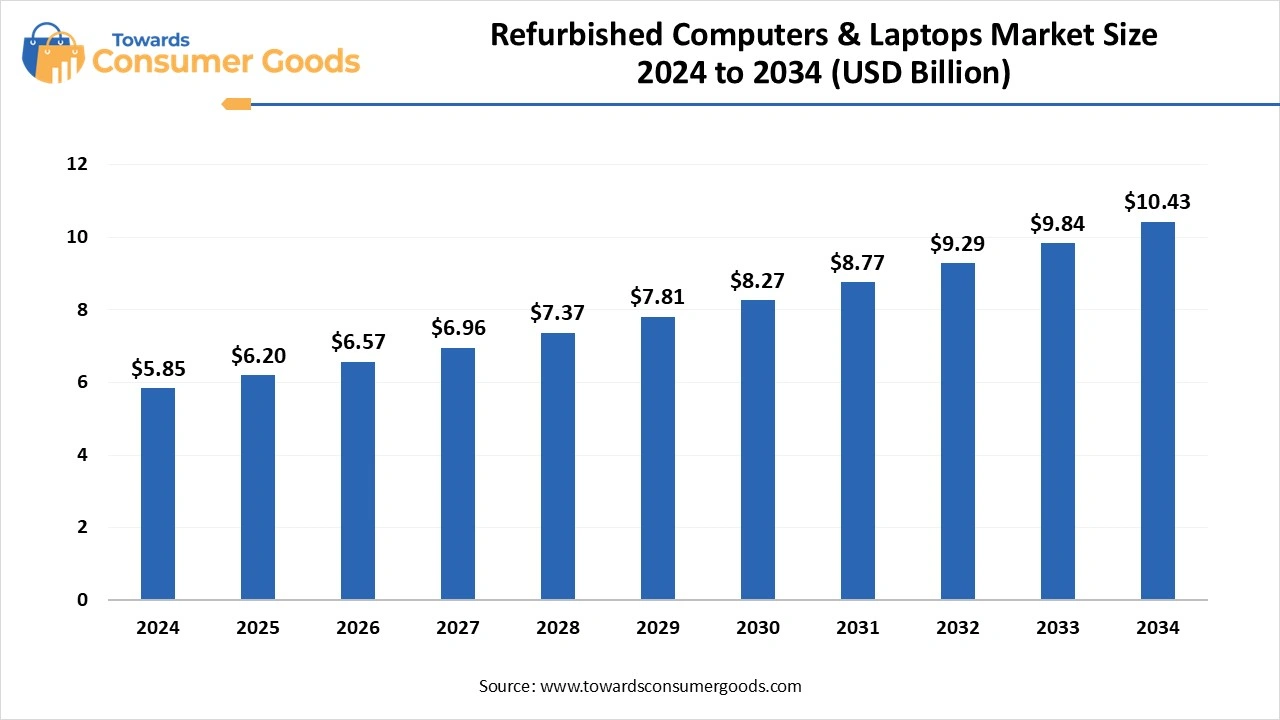

The global refurbished computers & laptops market size was accounted for USD 5.85 billion in 2024 and is expected to be worth around USD 10.43 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.95% during the forecast period 2025 to 2034 This market is growing due to increasing demand for cost-effective computing solutions, rising environmental awareness, and the growing acceptance of sustainable electronics among consumers and businesses.

The refurbished computer and laptop market is experiencing steady growth, driven by growing consumer awareness of e-waste reduction and their preference for high-performance reasonably priced devices. The use of refurbished systems is growing among small businesses, educational institutions, and consumers on a tight budget because they are more affordable than new devices. The quality and dependability of reconditioned goods have also increased due to advancements in diagnostic repair and certification technologies which have increased customer confidence. Global market penetration has also been accelerated by encouraging government policies that support e-commerce platform growth and electronic reuse.

Refurbished computers and laptops are more affordable, dependable, and environmentally friendly. More and more consumers are selecting them. For students, startups, and remote workers, refurbished devices are perfect because they provide almost the same performance as new systems at a much lower cost. Consumers on a tight budget are becoming more receptive to certified preowned electronics with warranties and quality assurance due to rising inflation and tech costs. Furthermore, since reconditioned products help lower carbon emissions and electronic waste, growing environmental concerns are influencing consumer choices. The market for reconditioned electronics is growing in large part due to this change in consumer attitudes.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.2 Billion |

| Expected Size by 2034 | USD 10.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Grade, By Operating System, By Screen Size, By End Use, By Distribution Channel, By Geography |

| Key Companies Profiled | Amazon Renewed, Apple Certified Refurbished Arrow Direct, Back Market, Dell Refurbished, HP Renew, Laptop Outlet, Lenovo Outlet, Newegg Renewed, Refurb That, Refurb.io, Refurbees, TechSoup, TigerDirect Refurbished, Walmart Renewed |

As digital access becomes a necessity for education, work, and basic services, many underserved populations are still unable to afford new devices. Refurbished desktops and laptops offer a practical, cost-effective way to close the digital gap. More and more governments with nonprofits and EdTech businesses are working with refurbishes to provide low-income communities and students with necessary computer equipment. Institutional demand is also rising as a result of increased public funding for programs promoting digital literacy and access. Businesses that customize their offerings to these markets with bulk pricing regional service and streamlined user support stand to gain over the long run.

Many consumers still associate refurbished electronics with lower reliability, outdated specifications, or hidden defects. Concerns about possible performance problems with battery deterioration or wear and tear on refurbished devices persist even after testing and certification by reliable vendors. This view has an impact on purchase confidence, particularly for enterprise users and premium buyers. Even though new devices are more expensive, consumers might prefer them if there is a lack of clear grading schemes, robust warranty support, or a reputable brand. Smaller and up-and-coming renovators still face difficulties in overcoming this stigma.

Why does North America dominate the refurbished laptop market?

North America leads the refurbished laptop market due to propelled by a robust network of accredited restorers' regular business refresh cycles and consumer confidence in used technology. Because they are more cost-effective, the government and educational sectors also frequently purchase refurbished systems. Because so many people in this area are tech literate they feel more at ease using used electronics. Market confidence is increased by well-established return policies and strict quality standards. Here specialized refurbishment programs run by companies like Apple Dell and HP are successful.

Asia Pacific is the fastest growing, driven by the widespread adoption of e-learning, rising affordability demands, and growing digital adoption. The need for reasonably priced computing is also fueled by fast urbanization and youth-centric digital habits. To satisfy growing customer expectations, local refurbishes and internet merchants are rapidly expanding their operations. Due to increased awareness, middle-class households are starting to view refurbished laptops as aspirational and are shedding their previous stigma. Programs for digital literacy run by the government are also indirectly fostering this expansion.

Europe holds a notable position in the refurbished laptop market, driven by strong environmental regulations, rising consumer awareness, and mature circular economy practices. Governments and institutions actively promote reuse and recycling through incentives and e-waste management laws. Consumers in Europe are more eco-conscious and increasingly favor sustainable tech purchases over new devices. Established refurbishing standards and certification systems ensure consistent product quality across the region. Retailers and refurbishes benefit from stable demand in both consumer and enterprise sectors, keeping Europe a key, though not the largest, market player.

Why do Grade A refurbished laptops maintain their dominance over other grades?

Grade A refurbished laptops dominate the market, driven by improved performance, near-new quality, and increased customer confidence. These laptops are well-tested, have little wear, and frequently have official warranties. Professionals' institutions and people who don't want to sacrifice quality choose them. Because of these models' high turnover rate retailers showcase them both in-person and online. They are recommended options for certified refurbishes due to their steady performance history.

Grade B laptops are the fastest-growing segment, driven by lower price points and higher availability for entry-level needs. Many users are willing to overlook minor cosmetic issues in exchange for significant savings. This segment appeals strongly to students, first-time buyers, and freelancers. Increased resale efforts through online marketplaces have brought Grade B laptops into the spotlight. Sellers are also offering short-term warranties and clearer grading, making these devices more acceptable to the masses.

Why do Windows-based refurbished laptops hold the largest share?

Windows refurbished laptops dominate, driven by availability from corporate IT offloads broad software compatibility, and widespread worldwide usage. Businesses have a significant secondary inventory because they rely so heavily on Windows-based infrastructure. Because Windows is easier to resell users also favor it for tasks like productivity gaming and educational software. Both technical assistance and replacement parts are available. The OS's continued dominance is further enhanced by user familiarity.

Mac refurbished laptops fastest-growing segment, driven by driven by increasing consumer interest in Apple products at lower price points. Users are drawn to the macOS ecosystem, known for its sleek interface, creative tools, and smooth performance. Certified refurbished Macs with M1 and M2 chips are particularly in demand for their speed and battery life. Apple’s longer product support cycles make older models viable for resale. The aspirational value of owning a Mac also contributes heavily to its rapid growth.

What makes 14–16-inch laptops the most dominant in the market?

14-16inch dominate the refurbished market driven by, motivated by their adaptability, comfort, and usefulness for work education, and leisure. These screens are perfect for multitasking without sacrificing portability. Because they are so common in business settings, refurbished units in this size range are very accessible. Their resale value is increased by the fact that they frequently have better hardware specifications. These laptops are popular in the secondary market because many brands give priority to this size for flagship and mid-tier models.

11–13-inch laptops are the fastest growing size segment, driven by the need for portable lightweight technology that can be used for homework and remote work. Students' minimalists and digital nomads are drawn to their small size. These days powerful specs are being added to smaller form factors which makes them even more appealing. This category is growing quickly thanks to Chromebooks and low-cost ultra books. Growth has also been accelerated by the growing demand for secondary personal laptops.

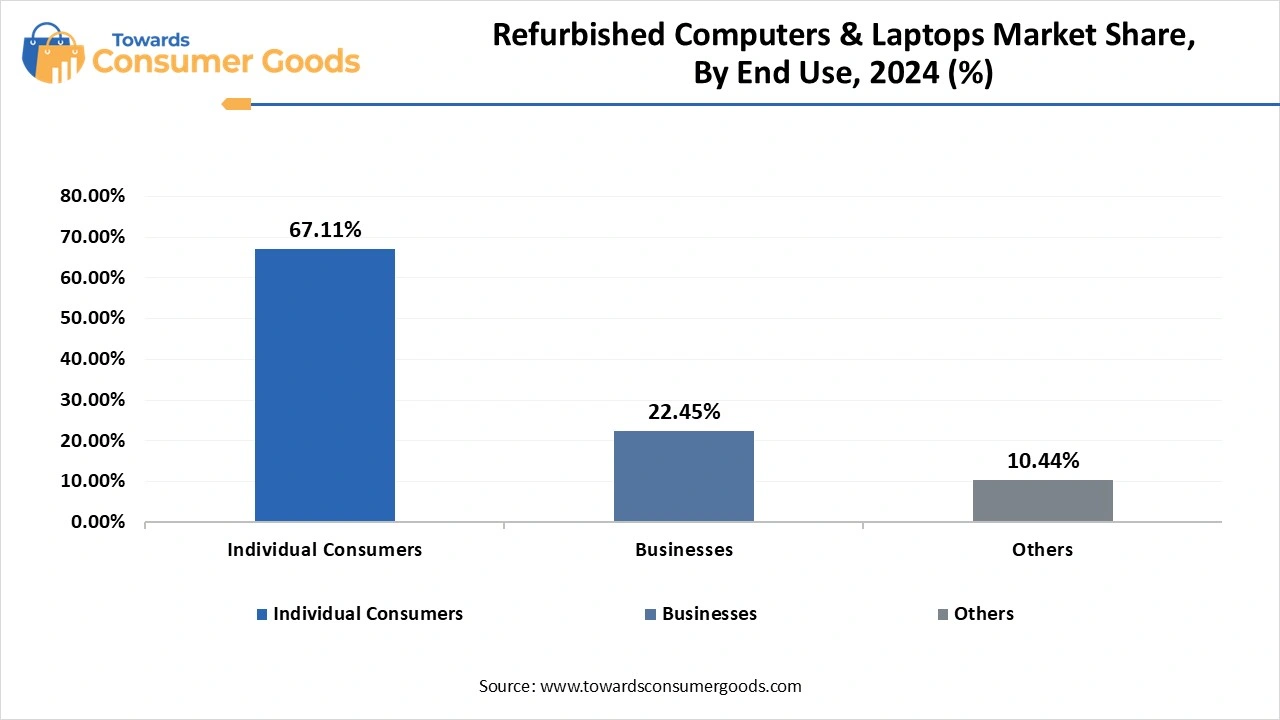

Why are businesses the leading end-user segment?

Businesses dominate the refurbished laptop market, driven and motivated by the requirement for uniformity in the IT fleet for sustainable sourcing and cost-effective procurement. To outfit new branches, contract employees or interns' businesses frequently purchase in bulk. Numerous companies have green policies that promote device reuse to cut down on e-waste. Businesses can also keep their tech stack consistent by using refurbished laptops. Adoption is further aided by the availability of software licensing and service agreements.

Individual consumers are the fastest-growing segment, driven by driven by heightened price sensitivity, broader access to e-commerce platforms, and increased awareness of refurbished quality. Many buyers now see refurbished as a smart, eco-conscious choice. Gen Z and millennials in particular are more open to second-hand tech, especially for casual use. Reviews, certifications, and transparent grading help build trust. The post-pandemic digital lifestyle has pushed more individuals toward affordable personal computing.

How do direct sales channels retain their dominance in the refurbished laptop market?

Direct channels dominate the market, driven by the availability of warranties, brand-backed assurance, and product condition transparency. More than third-party resellers buyers have greater faith in OEM websites and certified refurbishes. Extended service plans and certified components are frequently included in these channels. Long-term loyalty is increased by their capacity to provide post-purchase assistance. Direct channels are preferred by government purchasers and institutions for documentation and accountability.

Indirect sales channels are the fastest growing driven by the rapid rise of e-commerce platforms, third-party sellers, and global access to refurbished listings. Marketplaces like Amazon Renewed and Flipkart offer diverse inventory and price filters. Social media and online marketing campaigns have normalized second-hand tech purchases. Convenience, wider selection, and peer reviews attract younger, tech-aware buyers. The growth of mobile-first shopping experiences has made these channels highly scalable.

By Grade

By Operating System

By Screen Size

By End Use

By Distribution Channel

By Geography

Industry forecasts suggest that, the global lipstick market size is calculated at USD 17.49 billion in 2024, grew to USD 18.32 billion in 2025 and is ...

July 2025

April 2025