July 2025

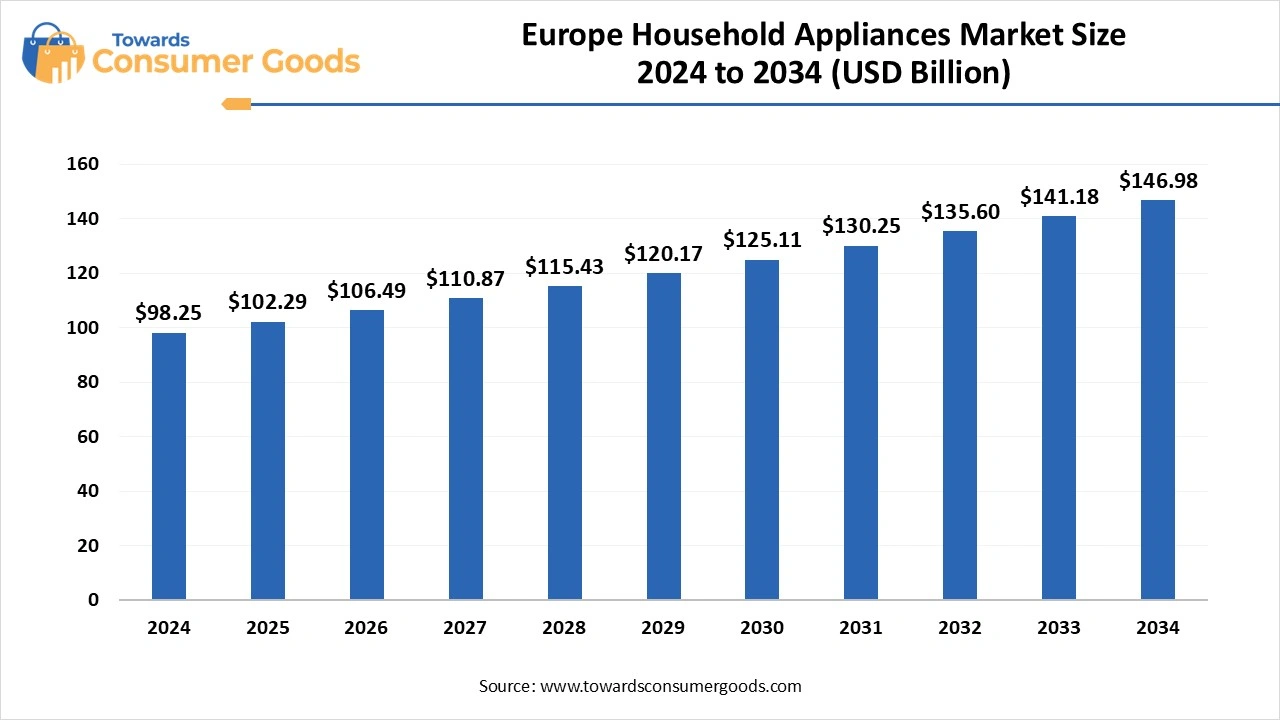

The europe household appliances market size was estimated at USD 98.25 billion in 2024 and is predicted to increase from USD 102.29 billion in 2025 to approximately USD 146.98 billion by 2034, expanding at a CAGR of 4.11% from 2025 to 2034. The demand for premium home appliances has increased among European consumers, driving the European household appliances market. The demand for sustainable materials-based appliances is also shaping the market.

The Europe household appliance market is witnessing transformative growth, driven by factors like growing demand for sustainable and energy-efficient home appliances, driven by EU regulations for electronic product energy utilization, and growing consumer awareness regarding sustainability. The presence of strong manufacturing giants is fostering the availability of customized, sustainable, smart, and premium household appliances.

“Europe has about 130 home appliance manufacturing facilities in 2024 a supporting over 1 million jobs supported by the manufacturing industry.”

The demand for household appliances, including refrigerators, washing machines, dishwashers, cook tops, ovens, irons, vacuum cleaners, coffee makers, and food processors, is high in the European market. The expanding distribution channels, like multi-brand stores and online platforms, are contributing and providing access to convenient and competitive pricing products across the region. Countries like Germany, the UK, France, and Italy are highly contributing to the market growth with an advanced focus on eco-friendliness and initiatives to meet changing consumer demands.

The trend for energy-efficient and sustainable household appliances is the major driver of the market. EU regulations like Ecodesign and the energy labeling directive mandate manufacturers to develop sustainable products and consumers to buy only low-emission products. Consumers are seeking lower utility costs and less impact on the environment from products. The smart household appliances featuring optimized energy consumption and remote control are trending in the European market.

| Report Attributes | Details |

| Market Size in 2025 | USD 249.05 Billion |

| Expected Size by 2034 | USD 444.56 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel, By Country |

| Key Companies Profiled | LG Electronics Inc., Robert Bosh GmbH, Whirlpool Corporation, Samsung Electronics Co. Ltd., Electrolux AB, Sharp Corporation, Miele, Panasonic Corporation, Haier Smart Home Co., Ltd, SEB Groupe , Breville Group Limited |

The government initiatives and regulations are playing a vital role in enhancing market competitiveness across Europe. Regulations like the EU’s Eco-Design Directive and Energy labeling Regulations are encouraging manufacturing companies to innovate and develop home appliances with less power and water consumption, aligning with consumer preference for sustainable solutions. Additionally, the government's promotion of digitalization and smart home technologies is contributing to market growth. The robust investments in research and development by the EU government enable innovative and competitive products in the regional household appliances market.

EU manufacturing companies have witnessed significant losses due to the increased cost of raw materials, driven by rising energy prices in Europe. The household appliances are competitively reliable on essential parts and require elaborate components. The factors like supply chain distribution, geopolitical leverage, and material price fluctuations are the major restraints of the market. The growing government investments in sustainable products are also projected to increase the cost of critical raw material extraction and recycling operations, leading to hamper market competition. Europe needs to ensure a sustainable supply of critical raw materials within the region and partnerships to incorporate domestic and international dimensions.

Germany Household Appliances Market

Germany dominates the European household appliances market with a strong manufacturing base and focuses on high-quality products in the country. The presence of living appliances manufacturers like BSH Hausgeräte GmbH, Wirepool Corporation, LG Electronics, and Samsung Electronics contributes to the market growth. German companies are well known for innovative and technology-based, high-quality, and energy-efficient home appliances. The ideal trade and distribution industry of Germany contributes to sending high exports of appliances across Europe.

UK Household Appliances Market

The UK is a significant player in the market, with growth driven by increased demand for smart and energy-efficient appliances in the country. The major demand for sustainable home appliances, the existence of popular brands, and the wide expansion of e-commerce across the country are fostering market growth. Additionally, the ongoing trend for home renovations provides significant opportunities for manufacturing to develop upgraded and advanced kitchen appliances.

What Made the Major Appliances Segment Dominant in the Europe Household Appliances Market in 2024?

In 2024, the major appliances segment dominated the market, due to growing urbanization and changing consumer lifestyles. Urbanization has an intended trend of modern household appliances, driving demand for advanced, high-priced, and technology-connected major appliances, including washing machines, cooking appliances, dishwashers, and refrigerators.

The small appliances segment is the second-largest segment, leading the market, due to increased spending on smart products, driven by the growing availability of disposable income. The demand for energy-efficient and recyclable small appliances, including coffee makers, ovens, hair dryers, and toasters, is high in Europe. Additionally, the growing demand for premium small appliances in the region is contributing to the market growth.

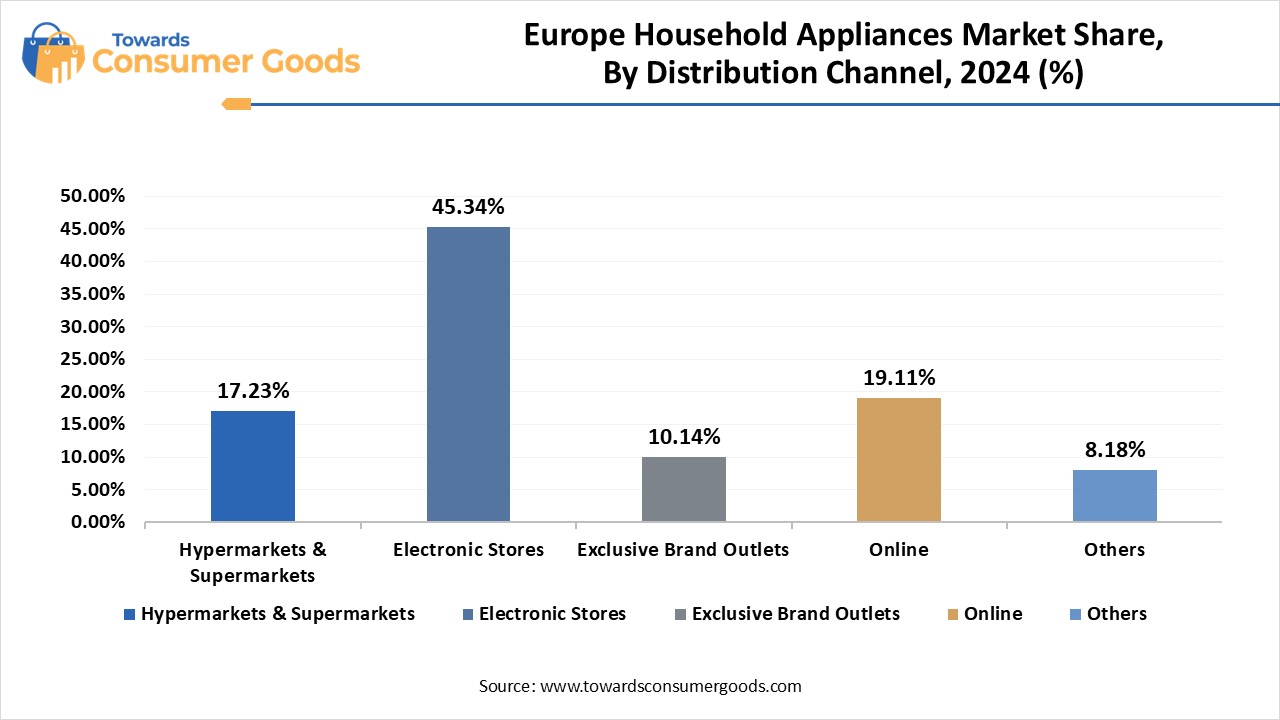

Which Distribution Channel Segment Led the Europe Household Appliances Market in 2024?

The electronic stores segment led the market in 2024, due to the widespread distribution reach of the electronic stores across European countries. This store offers product expertise and personalized services, influencing the consumer's purchase choices. The electronic stores also provide product varieties, making consumer easy to purchase personalized products and also enabling comparative purchasing. The well-developed trust and brand loyalty shape the segment growth.

The online segment is expected to grow fastest over the forecast period, driven by expanding e-commerce platforms across Europe. The technological advancements, robust international adoption, and increased smartphone consumption across European countries are supporting segment growth. Moreover, the changing consumer preference toward convenient, advanced, and competitive pricing products is fostering the segment.

By Product

By Distribution Channel

By Country

July 2025

June 2025

June 2025

May 2025