July 2025

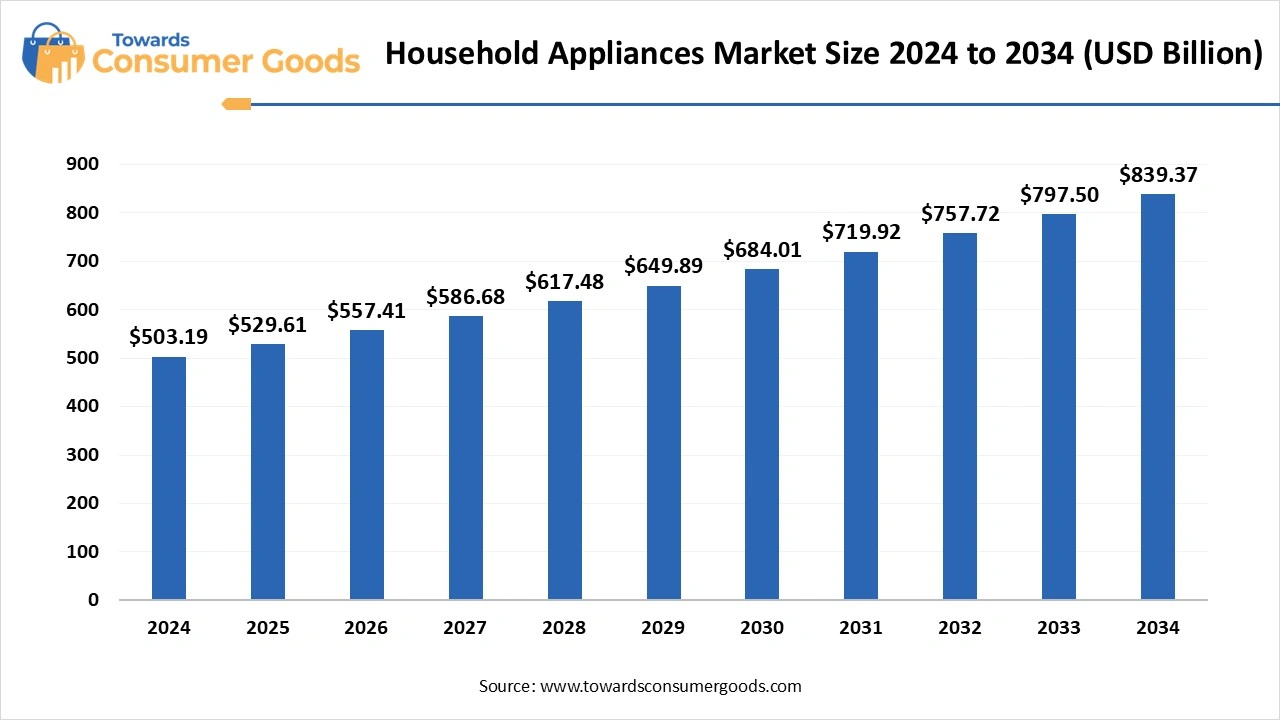

The global household appliances market size was valued at USD 503.19 billion in 2024 and is expected to reach around USD 839.37 billion by 2034, growing at a CAGR of 5.25% from 2025 to 2034. The demand for household appliances is increasing due to the rising urban construction, which leads to the adoption of these products for more convenient lifestyles.

Household appliances refer to an electric or mechanical device used to perform domestic tasks like cooking, cleaning, food preservation, and laundry. These products are categorized into major and small appliances that serve in different ways. The rising fast-paced lifestyles are helping companies to innovate more products.

The rising middle-class population is playing a significant role in attracting several investments from companies to innovate affordable products. The middle-class population is helping towards the increasing demand as the rising disposable incomes are increasing the first-time buyers. Additionally, the rural population is immigrating towards urban areas to attract higher opportunities. The companies are also helping consumers attract significant revenue through various financial options and tax rebates to attract more consumers. The consumers from these economies are also expected to increase the demand for rental and subscription-based services in the region.

| Report Attributes | Details |

| Market Size in 2025 | USD 529.61 Billion |

| Expected Size by 2034 | USD 839.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

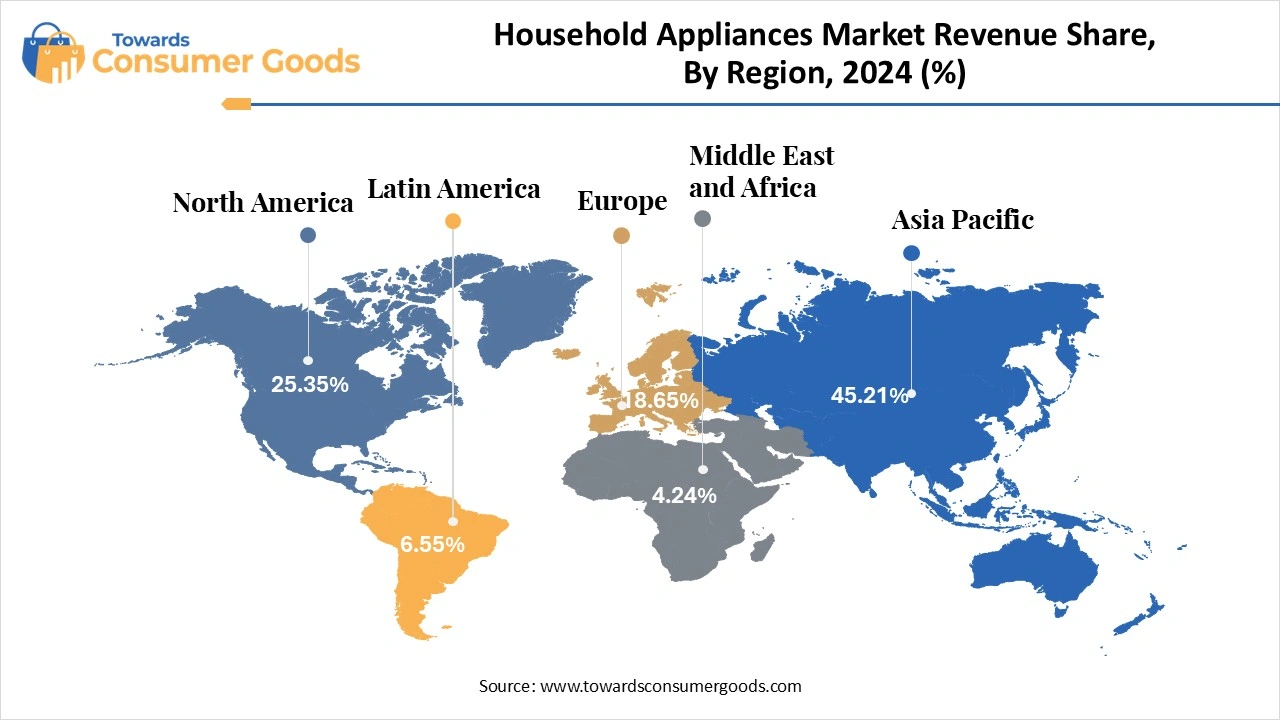

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Distribution Channel, By Region |

| Key Companies Profiled | Whirlpool Corporation, Samsung, Electronics Co. Ltd., Panasoni Corporation, Sharp Corporation, Miele Midea Group, Robert Bosch GmbH, LG Electronics Inc., Electrolux AB, Haier Smart Home Co., Ltd., Koninklijke Philips N.V. Breville Group Limited, De'Longhi S.p.A. |

How are sustainable innovations helping in the growth of the household appliances market?

The regulatory bodies from North America, Asian countries and Europe are highly focused on tackling climate change and environmental protection, which is leading towards multiple changes in the manufacturing and designing of consumer goods. Companies are investing in sustainable innovations which will use eco-friendly and recyclable materials in these products.

Additionally, investments towards smart appliances are anticipated to be less power-consuming as compared to traditional ones. The governments and organizations are also running educational campaigns, which would help in attracting several growth through consumer adoption. The rising environmental effects through products like air conditioners have already led to many changes in the product designs.

The household appliances have gained significant popularity in the developed and developing economies, but there are still many concerns that can restrain their demand in the underdeveloped regions. The household appliances market is expected to face challenges in rural areas due to a lack of consumer awareness, mainly towards small appliances. The lower disposable income also acts as a barrier to their spending capabilities. As a result, the companies may also face certain challenges while investing in these areas and the digital divide.

How Asian Countries Carry the Largest Market for Household Appliances?

The Asia Pacific household appliances market size was valued at USD 227.49 billion in 2024 and is expected to be worth around USD 379.90 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.26% over the forecast period 2025 to 2034. Asia Pacific dominated the global household appliances market, contributing the largest revenue share in 2024. The region's dominance is attributed to higher population density in countries like India and China. The US Census Bureau also reports that the Indian population stands at 1,4,19,316,933 and that of China at 1,407,181,209, which increases the overall business scope for household appliances. The rising disposable income in urban areas is also promoting the growth of smart appliances featuring more energy-efficient models. The retail channels are also expanding their business online and offline, which is helping them to increase their product penetration.

China Household Appliances Market Trends

China stands as a dominant country in the Asian market due to its exceptional manufacturing capabilities. Many companies are investing in the country due to its advanced infrastructure with lower production costs. For instance, in 2024, China exported 4.48 billion household appliances, which is an increase of 20.8% increase over the previous year. The majority of the shares are attributed to the rapid expansion of domestic companies that are making an impact on the global trade map. Additionally, the country is experiencing a rapid product demand from tier II and III cities for appliances like refrigerators, washing machines and air conditioners. (Source : cceeccic.org )

North America is anticipated to emerge at the highest CAGR from 2025 to 2034. The dominance of the region is attributed to the higher demand for smart appliances with other systems. Countries like the United States and Canada live a fast-paced lifestyle, which is leading towards the adoption of these products. The higher consumer demand is also adding revenue through the higher replacement cycle, towards energy-efficient models. The dual-income households in these countries are also boosting technological adoptions that use application-based systems to control and monitor these appliances.

United States Household Appliance Market Trends

The United States household appliances market is one of the major players on the global stage due to the increasing home renovation trends that boost the penetration of various household appliances designed for urban settings. The presence of global companies like Whirlpool, GE appliances, and other companies is innovating advanced appliances, which would help in catering to consumer demand. The US government is focused on promoting energy-efficient models that can help reduce carbon footprints. The rising disposable incomes are also expected to play a major role in attracting revenue as they increase the consumer spending capacity. The disposable personal income in the country marked a record high of 22391.70 USD billion in March 2025. (Source : tradingeconomics.com )

Europe is expected to grow at a significant CAGR during the forecast period of 2025 to 2034. The major driver of the household appliances market in the region is stricter energy efficiency regulations like the EU energy label and Ecodesign directive. These initiatives are increasing the business scope for advanced products which fulfil these criteria. Consumer awareness in the country is also higher, which is playing a significant role in boosting its expansion throughout countries like the UK, Germany, and France. Many companies are also making R&D investments to boost the innovation of automated products, highly suited for the premium price segments.

The major appliances segment marked its dominance by generating the largest revenue share in 2024. These appliances mainly include products like washing machines, water heaters, refrigerators, dishwashers and many more. The dominance of the segment is attributed to the frequent use of these products in daily lives. These appliances are highly used by households in both developed and developing regions. As a result, these products usually attract higher revenue due to higher spending capacity on these products. The companies are innovating multiple price segments for these products, which can easily target a wider consumer base. These products have longer replacement cycles, but the revenue is also being generated from various maintenance and part replacements. The market is also expected to rise due to the economic growth in countries like Indonesia, Vietnam and India.

The small segment is anticipated to emerge at the highest CAGR from 2025 to 2034. The segment refers to the manufacturing and selling of products like juicers, coffee makers, air fryers, hair dryers, vacuum cleaners and many more. The household appliances market is expected to gain significant popularity due to the changing lifestyle patterns that boost the demand for convenient household solutions. These products are marking rapid revenue due to easy availability and impulse purchases through various marketing initiatives. Additionally, the demand for the segment is expected to continue, attributed to the shorter replacement cycles that are boosting demand for new and affordable products.

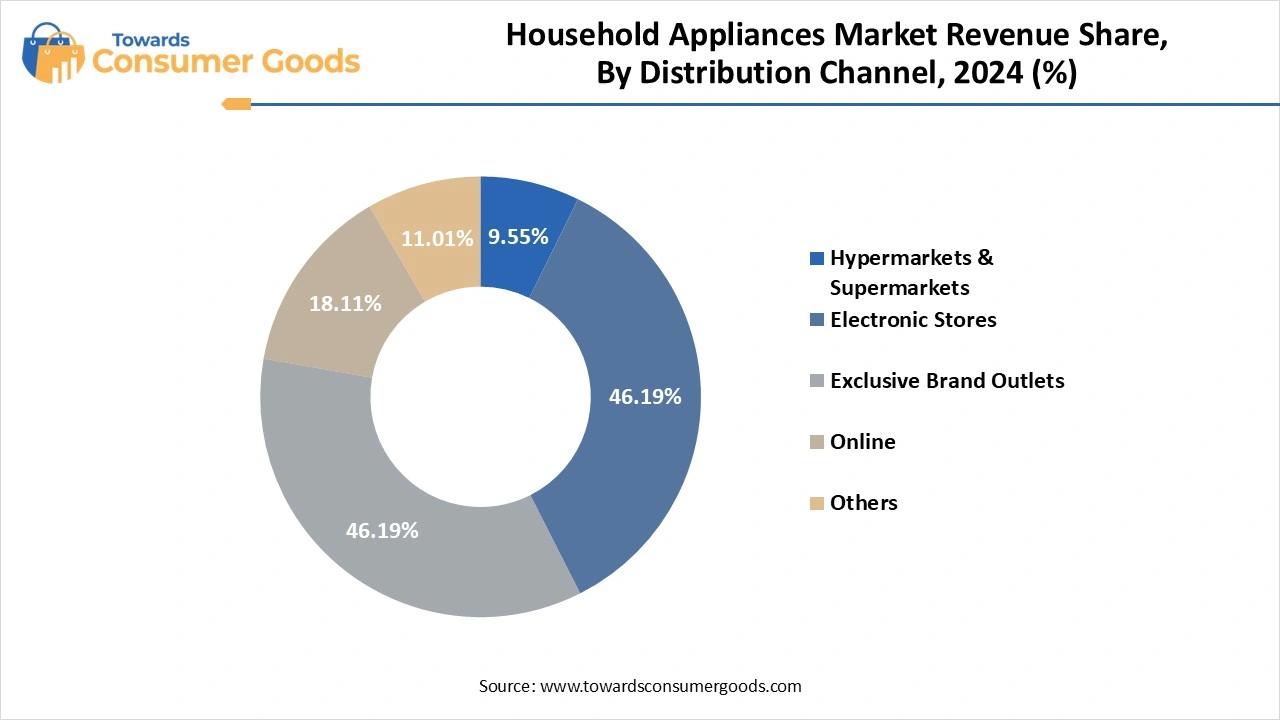

The electronic store segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the higher consumer reliability and trust in these stores, which makes them preferable in electronic purchases. The household appliances market is generating significant revenue from in-store purchases, as they are also providing free delivery and after-sales services to its consumers. The global companies are targeting to expand their stores in the developing areas, to target more revenue growth in the upcoming years. Additionally, these products are also easily available on finance, which will make them grow more rapidly in the developing economies.

The online segment is expected to rise at the fastest CAGR from 2025 to 2034. The growth of the region is attributed to the increasing smartphone demand and internet penetration in the developing economies. The household appliances market is expected to gain significant revenue from e-commerce channels like Amazon, Flipkart, and Alibaba as they are offering various products at affordable prices with extra discounts. These companies are investing in developing economies due to lower manufacturing costs and more revenue growth options due to D2C business models.

By Product

By Distribution Channel

By Region

The global surfing tourism market size is calculated at USD 64.1 billion in 2025 and is forecasted to reach around USD 109.31 billion by 2034, acceler...

The global travel retail market size is calculated at USD 75.46 billion in 2024, grew to USD 82.67 billion in 2025 and is predicted to hit a...

July 2025

July 2025

July 2025

July 2025