June 2025

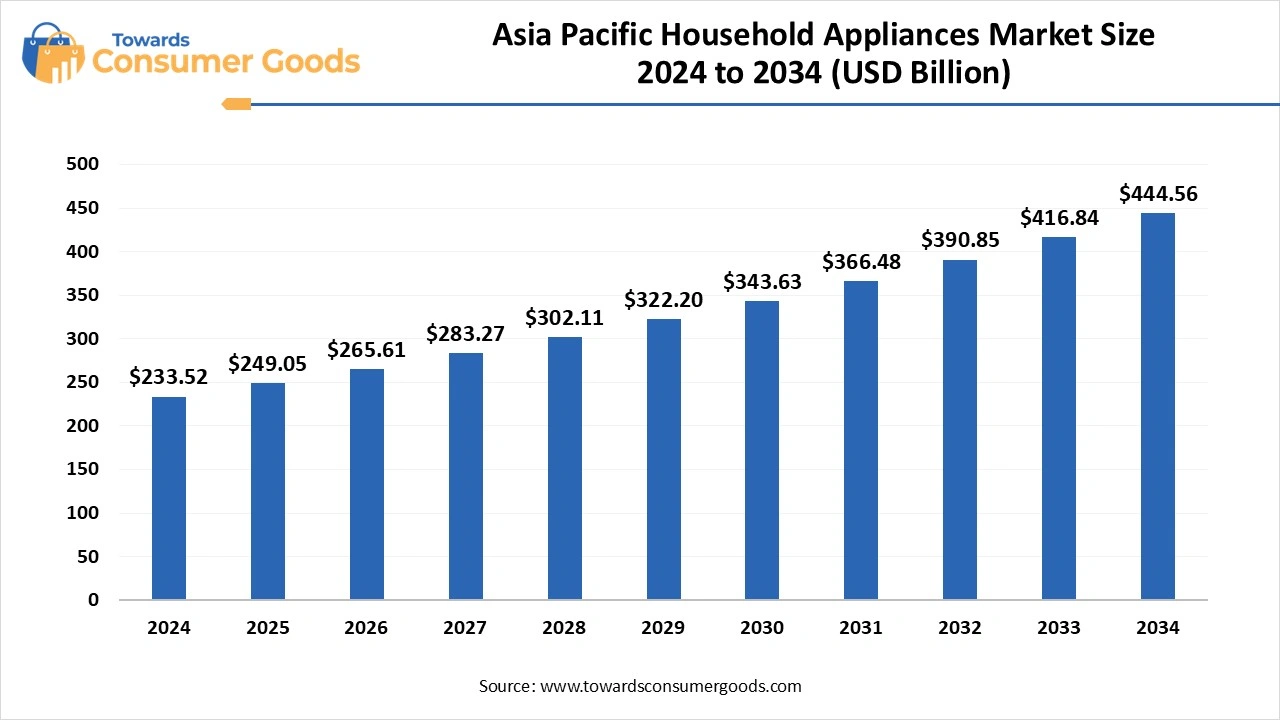

The asia pacific household appliances market was valued at USD 233.52 Billion by the end of 2024 and is expected to increase to USD 444.56 Billion by 2034. This is a significant 6.65% increase from 2025 to 2034. The demand for convenient, cost-effective, high-performance, and efficient household appliances has increased in nuclear families, driving the growth of the Asia Pacific household appliances market.

The Asia Pacific household appliance market has witnessed transformative growth driven by factors like rapid urbanization, growing disposable income, rising demand for sustainable & energy-efficient appliances, and demand for innovative products with smart and multifunctional features. The Asian manufacturers are focusing on integrating cutting-edge technologies like AI with household appliances to enhance performance and make it more convenient for consumers.

With government support in R&D and local manufacturing practices, the manufacturing sector is expected to provide innovative production in the upcoming years. Asia has witnessed high demand for major appliances like washing machines and cookers & and ovens. The expanding e-commerce platform is enabling more sales of consumer goods in the region. However, growing social media influence and consumer shift toward international goods are likely to hinder Asian market growth.

According to the Mid-Year Consumer Outlook report by NielsenIQ, the world’s leading global consumer intelligence company, the Asia Pacific consumers are highly shifting toward international consumption. The changing consumer attitude, purchasing decision, and disposable income are expected to provide significant ways fr CPG and T&D manufacturers and retailers to achieve consumer by the end of 2025 and beyond.(Source: businesswire.com)

Government initiatives are the major driver of the Asia Pacific household appliances market. Governments of developing countries like India, China, and Japan are investing heavily in local manufacturing vendors. The government investments and support in research & development enable manufacturing companies to develop and provide innovative appliances with cutting-edge technology integration. The government initiatives like “Make in China” and “Make in India” are fuddling market competition.

Additionally, the promotion of energy-efficient and sustainable products is also contributing to the market competition.

| Report Attributes | Details |

| Market Size in 2025 | USD 249.05 Billion |

| Expected Size by 2034 | USD 444.56 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel, By Country |

| Key Companies Profiled | Samsung Electronics Co. Ltd, Dyson Limited, Whirlpool Corporation, Robert Bosh GmbH, Haier Smart Home Co., Ltd., Miele, LG Electronics Inc., Midea Group, Electrolux AB, Sharp Corporation, Panasonic Corporation |

Growing Focus on Premiumization and Design

The increased urbanization, changing consumer lifestyle, and increasing availability of disposable income have increased consumer spending on smart and multifunctional appliances. The trend for premium and cutting-edge design appliances is growing in Asia. The young consumer has been witnessed with a higher demand for aesthetic design appliances for their homes. The high consumer pool in countries like China and India is making manufacturing emphasis on developing premium products. the increased disposable income enables consumers to spend on luxury items, including household appliances.

Supply Chain Distribution

Supply chain distribution and insufficiency are the major restraints of the market, driven by major rural areas in countries like India and China. The lack of availability of raw materials and the high cost associated with materials hampers the manufacturing of innovative products. additionally, inadequate infrastructure, lack of transportation, and limited e-commerce logistics in rural areas hamper the sale of household appliances.

China Household Appliances Market Trends:

China is dominating the Asia Pacific household appliances market, driven by factors like government policies, a large consumer pool, increased availability of disposable income, and demand for energy-efficient and smart appliances. Chinese government initiatives like “Make in China” play a vital role in the expanding market growth. additionally, a well-established manufacturing industry and continuous innovations in technologies are enabling access to the market and cutting-edge technology-based household appliances in China, to boost the overall market.

Major Initiatives and Report of China Household Appliances in 2025

India Household Appliances Market Trends:

India is the fastest-growing country in the regional market, driven by a robust consumer pool, rising disposable income, and the presence of major giants. India is becoming a significant market with a growing trend of premiumization and demand for energy-efficient, AI-enabled, and cutting-edge technology-connected products. The major companies' efforts in kitchen appliances, including BSH Home Appliances' expansion, are bringing innovative products to the market.

India's household appliances and consumer electronics industry is expected to grow by 10 to 15 % due to rising consumer demand for premiumization, energy-efficient, AI-enabled, and connected products, and growing availability of income. The industry focuses on enhancing safety measurement and innovative features, underscoring the market growth.

Which Product Segment Dominated the Asia Pacific Household Appliances Market in 2024?

In 2024, the major appliances segment dominated the market due to the rapid growth of urbanization, availability of disposable income, and growing demand for modern appliances. The major appliances segment includes water heaters, refrigerators, cooktops, cooking ranges, microwaves, ovens, washing machines & dryers, air conditioners, vacuum cleaners, and dishwashers. The changing consumer lifestyle contributes to the segment's growth.

The small appliances segment is the second-largest segment, leading the market, driven by the rising shift of consumers toward convenient and healthy living and growing disposable income. The small appliances include toasters, deep fryers, space heaters, irons, hair dryers, juicers, blenders, & food processors, coffee makers, air purifiers, electric trimmers and shavers, air fryers, rice cookers & steamers, and humidifiers & dehumidifiers. The growing busy lifestyle schedule driven by urbanization is fostering the need for small appliances.

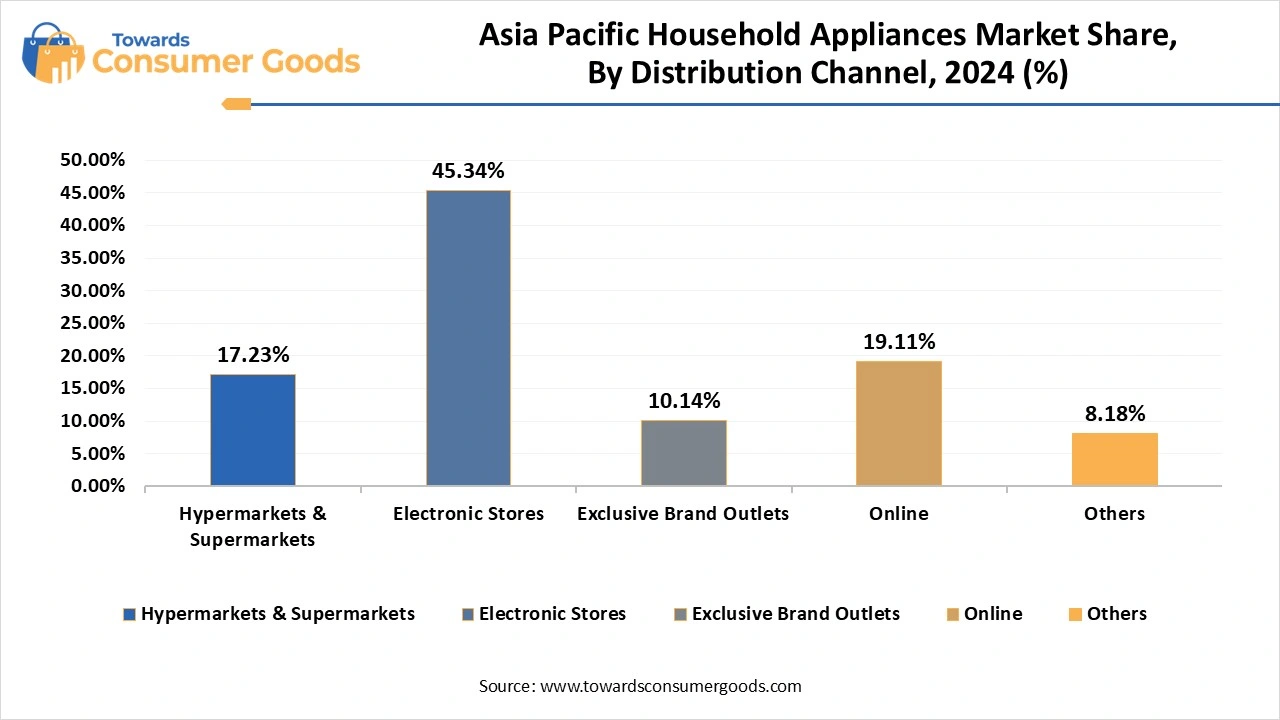

How Electronic Stores Segment Led the Asia Pacific Household Appliances Market in 2024?

The electronic stores segment led the market in 2024, due to the popularity of electronic stores for the purchase of household appliances. Electronic stores offer physical inspection of the products and provide immediate customer services, including installation, service, and support. The well-established trust in physical stores and brands encourages consumers to purchase home appliances from electronic stores.

The online segment is expected to generate significant revenue in the upcoming period, due to expanding e-commerce platforms in emerging countries, particularly in China and India. The growing demand for connected and smart appliances is shifting consumers toward online purchasing. Expanding distribution channels and consumer demands for convenient and competitive pricing are fueling the segment.

By Product

By Distribution Channel

By Country

June 2025

May 2025

May 2025

May 2025