June 2025

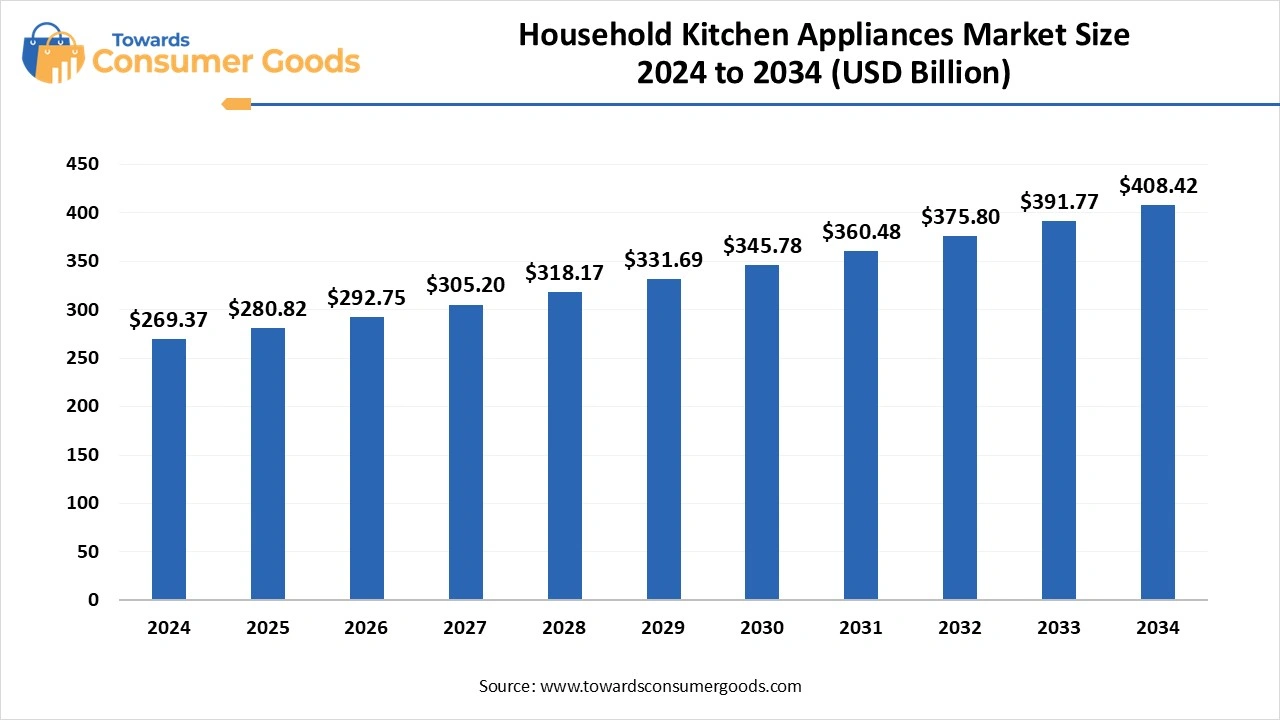

The global household kitchen appliances market size was valued at USD 269.37 billion in 2024 and is expected to reach around USD 408.42 billion by 2034, growing at a CAGR of 4.25% from 2025 to 2034. The demand for household kitchen appliances is increasing due to the growing home cooking trends in urban economies, driving the need for convenient solutions.

Household kitchen appliances are electrical and mechanical devices designed to assist individuals in various food preparation, cooking and other kitchen-based tasks. They include various appliances like refrigerators, ovens, air fryers and many more that help in improving the efficiency and also save time. The demand for these appliances is mainly driven by the increasing global urban population, which is providing multiple business opportunities for the companies.

The World Bank data also stated that the global urban population in 2024 was estimated to be around 4.4 billion, covering 56% of the world’s total population. The report also added that the target is expected to be reached by 68% by 2050. (Source : un.org)

The growing home renovation and upgradation trends are one of the major drivers that have led to the increasing growth in various upgradations, including the kitchen. Modern homeowners are investing heavily in kitchen spaces to utilize the space efficiently and also adopt various major and small appliances to manage their daily cooking and cleaning-related tasks.

The majority of the households are now aging, which is attracting significant demand for various upgrades within walking distance. Additionally, many individuals are also hiring designers to create customizable kitchen spaces. The household kitchen appliances market is expanding rapidly as the current trends are creating a massive business growth for space-saving appliances.

| Report Attributes | Details |

| Market Size in 2025 | USD 280.82 Billion |

| Expected Size by 2034 | USD 408.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Technology, By Region |

| Key Companies Profiled | AB Electrolux, SAMSUNG, Haier Group, LG Electronics, Morphy Richards, Panasonic Holdings Corporation, Miele & Cie. KG, Whirlpool Corporation, Robert Bosch GmbH, Smeg S.p.A |

How Energy Efficiency Initiatives Support the Household Kitchen Appliances Market?

The rising government focus towards sustainability and energy efficiency is attracting several initiatives and regulations towards reducing carbon emissions. The household kitchen appliances market is expected to grow significantly due to rising government regulations from bodies like the U.S. Environmental Protection Agency (EPA) and Ecodesign Directives from Europe, which mandate certified appliances in their particular region.

The consumers are also adopting these energy-efficient appliances as they can be financially beneficial in the long run due to low energy consumption. Additionally, they are also providing tax offers and rebates in some regions, which may help in attracting a massive consumer base. The rising investments in educational and advertising programs are expected to increase the product penetration in the coming years.

The rapid technological adoption in various household appliances, including the kitchen, is playing a crucial role in attracting significant revenue from the developed regions. The household kitchen appliances market may face certain challenges due to the affordability gap between the urban and rural population, which restrains the penetration of smart appliances.

The lower disposable income in these regions is reducing their adoption rate, saturating the business opportunities for the new emerging companies. The marketing scope also reduces in the particular areas, which would also affect its expansion.

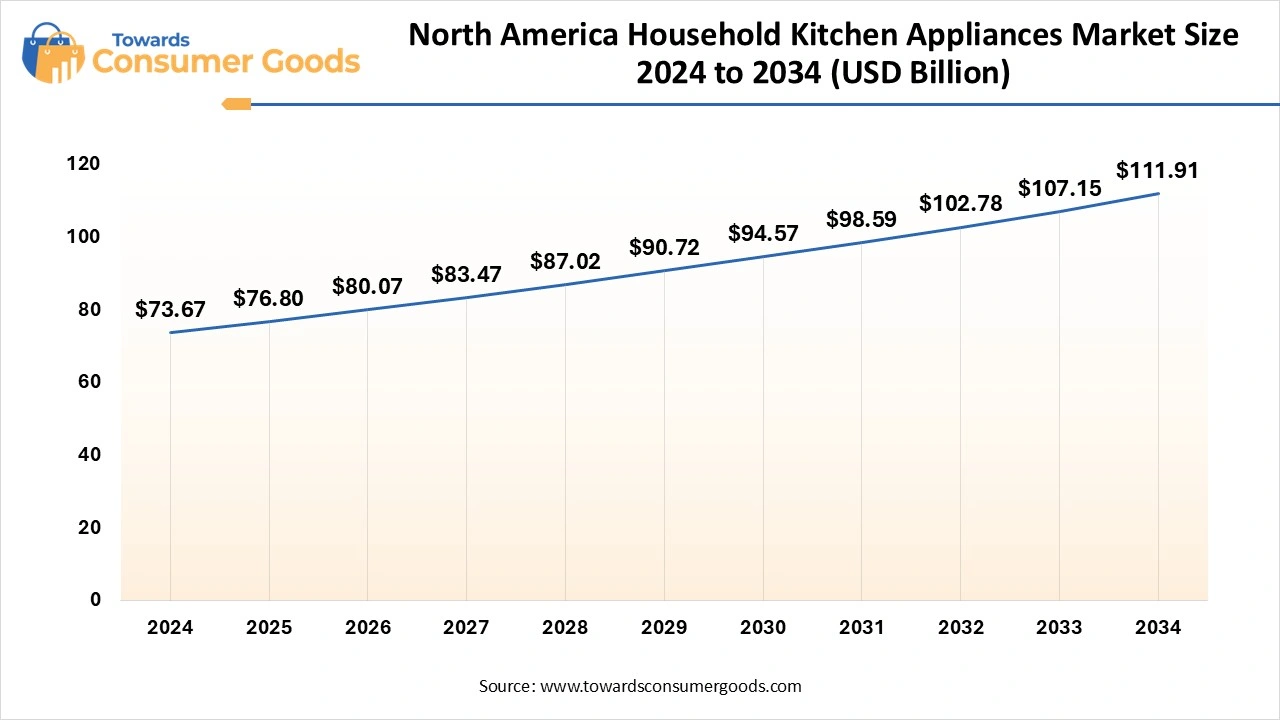

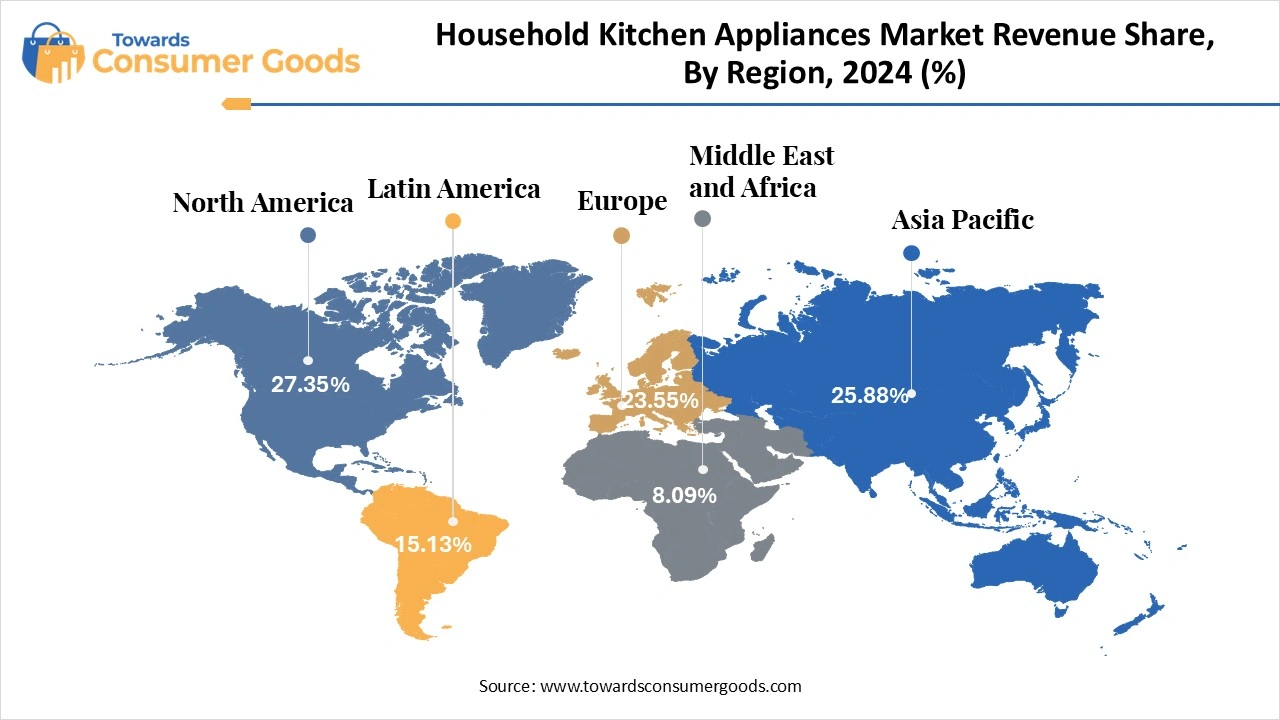

The North America household kitchen appliances market size was valued at USD 73.67 billion in 2024 and is expected to be worth around USD 111.91 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.27% over the forecast period 2025 to 2034. North America dominated the global household kitchen appliances market by generating the highest revenue share in 2024. the dominance of the region is attributed to the higher technological adoption in countries like the United States and Canada. The adoption of these technologies also influences the consumer in the region to adopt newer models more rapidly as compared to other population bases. The fast-paced lifestyles in these countries are also significantly boosting the demand for various smart appliances that can help the owners manage their daily cooking and cleaning tasks. The rising urban homes in this region is also expected to increase the demand for various space-saving appliances.

Why is United States Dominant in the Household Kitchen Appliances Market?

The United States stands as a prominent player in the household appliances market due to the higher disposable income of the American population, who tend to spend more on convenient and time-saving solutions. The dual-income households in the region are mainly attracting demand for various appliances like dishwashers, air fryers and other appliances. The US-based companies are also a major exporter of these appliances to other neighboring nations. The US government is also playing a major role by mandating Energy Star-certified products, helping in reducing carbon emissions.

Which is the Fastest Growing Region in Household Kitchen Appliances Market?

Asia Pacific is expected to rise at the highest CAGR from 2025 to 2034. The growth of the region is attributed to countries like India and China, which are witnessing a rapid growth in the middle class. The household kitchen appliances market is expected to grow more rapidly due to the growing influence of Western lifestyles.

Companies are targeting Tier II, III and IV cities with more affordable products, which can help them in generating more revenue in Asian countries. Additionally, the living spaces in these countries have been reducing in recent times, which will increase more demand for space-saving and multi-functional appliances.

China Household Kitchen Appliance Market Trends

China stands as a major player in the Asian region due to their exceptional manufacturing capabilities. The country is also witnessing a rapid growth in their per capita income, which is increasing the consumer base for various household appliances like dishwashers, juicers, ovens and many more. Additionally, the Chinese government is giving a push to the domestic players like Haier, Midea to innovate more advanced products at affordable pricing. Additionally, the country is the largest exporter of household appliances in the world, which helps in holding an upper hand in the global trade landscape.

Europe is expected to emerge at a notable CAGR during the projected period of 2025 to 2034. The major growth factor of the region is their higher focus on sustainable appliances, which mandates the production and use of energy-certified products. Countries like the United Kingdom, Germany and others are witnessing a rapid growth in their per capita income, which will help the companies to create more advanced products. Additionally, the region is witnessing a higher number of aging homes, which is raising the requirement for kitchen remodelling.

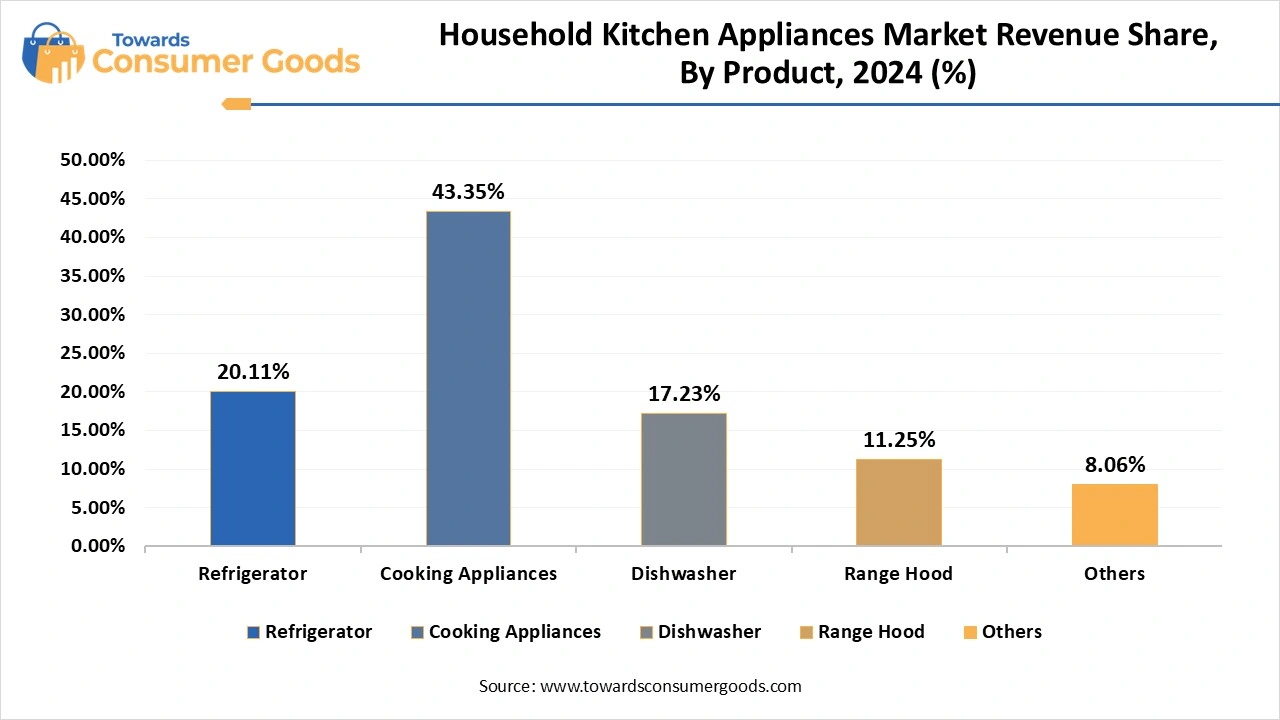

How cooking segment dominated the household kitchen appliances market in 2024?

The cooking appliances segment marked its dominance by generating the highest revenue share in 2024. The dominance of the segment is attributed to the higher necessity of various products like induction stoves, microwaves, ovens and many others, which are frequently used in daily cooking activities. As a result, the companies are offering a wider range of products that help various consumer according to their preferences. The frequent use of these appliances is also expected to help the household kitchen appliances market as it will increase the replacement cycle and upgradation rates. Many companies are now focusing on innovating multi-functional devices that can cover a variety of tasks and also consume less space, targeting urban households.

The range hoods segment is anticipated to emerge at the fastest CAGR during the projected period of 2025 to 2034. These products are designed to improve the indoor air quality that is affected by frying and other tasks. The household kitchen appliances market is expected to grow more rapidly as these products help in managing the ventilation and also improving the functional appeal. The companies are advancing through innovation, with various aesthetic centerpieces in matte black, stainless steel and many more, specially for middle-class populations.

The conventional appliances segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the affordability and accessibility of these products that target a wider consumer base, especially in the semi-urban and rural areas. The household kitchen appliances market is expanding rapidly as companies are focused on innovating easy-to-operate appliances suited for these economies. The majority of consumers are adopting conventional appliances due to the lower maintenance costs, which also helps them manage their monthly expenditure. The growing number of working professionals and immigrants is expected to increase its popularity through subscription models.

The smart appliances segment is anticipated to grow at the fastest CAGR during the projected period of 202 to 2034. The increasing smartphone penetration is one of the major reasons that has managed to attract a significant consumer base in recent years. The household kitchen appliances market is expected to grow at a faster CAGR as companies are innovating various solutions, like voice-enabled assistants like Google and Alexa.

The rising disposable income also helps these companies to innovate advanced products that can be connected to mobile applications for updates and emergency purposes. The rise of AI is expected to play a game-changing role in the coming years as it will mark advancements according to consumer preferences.

USHA

THOR KITCHEN

Samsung

By Product

By Technology

By Region

The global thermal spa & wellness market size was valued at USD 287.19 billion in 2024 and is projected to grow from USD 298.51 billion in 2025 to...

According to market projections, the global home entertainment devices market size was valued at USD 323.55 billion in 2024 and is projected to grow f...

June 2025

June 2025

May 2025

May 2025