July 2025

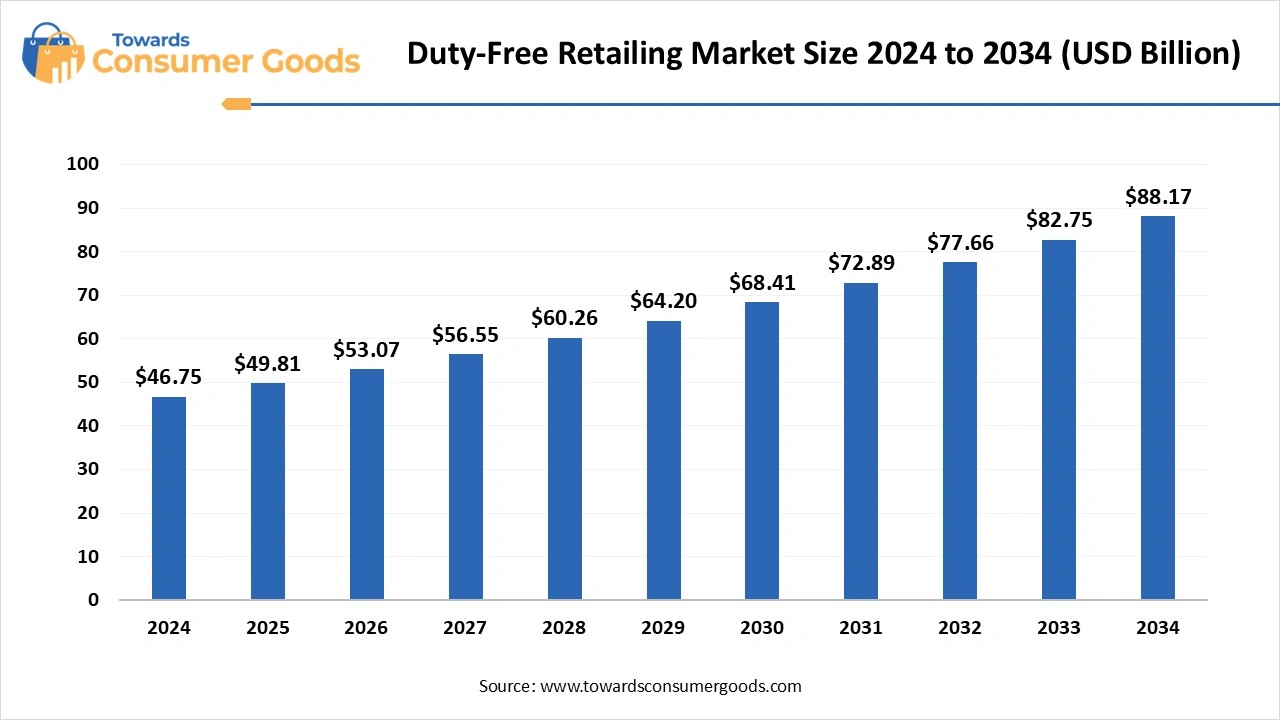

The global duty-free retailing market size is estimated at USD 49.81 billion in 2025. It is predicted to reach around USD 88.1 billion by 2034. The market is expected to grow at a CAGR of 6.55% from 2025 to 2034. The demand for duty-free retail stores has increased, driven by increased international travel and tourism, fostering the market.

The global duty-free retailing market has witnessed a transformative trend due to an increased number of international travel and tourism, the attraction of high-end brands, and rising disposable income. The internal tourism has increased demand for luxury goods, making spectacular appeal to duty-free retail shops. The increased middle-class population and availability of disposable income allow consumers to spend on high-end products, driving a surge in duty-free shopping. The airports and seaports are the major areas, have established a wide range of duty-free retailing. Additionally, ongoing US traffic driving consumers shifted toward duty-free shopping to avoid high prices and taxes, bringing significant opportunities for the duty-free retail shops.

The growth in airport infrastructure is a significant driver of the market. Expanding airport infrastructure is increasing traffic, enabling duty-free retailing to reach a broader audience and consumers. Modern airports provide improved shopping experiences, with luxurious shopping areas, attracting travelers to browse and purchase duty-free goods. The expanded airport infrastructure allows retailers to increase their shop space, making it wider for product and brand ranges. The rise in accessibility has made it easier for travelers to reach duty-free shops and products, increasing seamless shopping experiences.

(Source: forbes)

| Report Attributes | Details |

| Market Size in 2025 | USD 49.81 Billion |

| Expected Size in 2034 | USD 88.1 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Sales Channel, By Region |

| Key Companies Profiled | Gebr. Heinemann SE & Co. KG, Avolta (Dufry AG), DFS Group, China Duty Free Group, King Power International Group, Lotte Duty Free, The Shilla Duty Free, Shinsegae Duty Free Inc., Lagardère Group, Dubai Duty Free |

Digital Integration and Omnichannel Strategies

The adoption of digital integration and omnichannel retailing provides significant growth opportunities for the duty-free retailing, driven by enhancing consumer experiences, increasing reach, and offering streamlined operations. Digital integration and omnichannel strategies are offering enhanced customer experiences through both online and offline channels. Omnichannel allows duty-free retailers for wide to reach broader audiences and also helps retailers to streamline their operations, improve efficiency, and reduce cost burden. Digital integration is making it possible to provide personalized consumer experiences and personal recommendations, appealing to a larger consumer base.

Fluctuations in Currency Exchange Rate

Fluctuation of currency exchange rates is the major restraint in the duty-free retailing market. The currency exchange rate fluctuation causes uncertainty and volatility, which creates challenges for retailers in the prediction of demand and the management of inventory. This fluctuation leads to price instability, hampers the competitiveness of duty-free products. additionally, currency exchange rate fluctuation can lead to make the duty-free product more expensive for travelers, which can reduce their spending on the duty-free goods.

Asia Pacific dominated the duty-free retailing market in 2024, driven by a rapidly growing travel industry in the region. the high middle-class population and rising availability of disposable income have increased the demand for travelling in the region. Asia is the hub for major tourism countries like China, Japan, South Korea, and Singapore. The country has a significant culture of duty-free shopping, attracting major travellers who seek luxury and tax-free shopping. The rising airport infrastructure development, contributing to regional market expansion.

China is a major player in the regional market, with growth driven by a large and rapidly growing middle-class population. China has witnessed spectacular growth in tourism. Countries with rich culture and government support in infrastructure developments, attracting international tourists. The US tariffs implemented on the import of Chinese goods are creating significant opportunities for market growth, as consumers are preferring to purchase goods from duty-free channels to avoid the high cost.

India is a significant player in the regional market, witnessing growth due to countries' increased air travel and changing consumer behavior. India is set to rise to 52 million travellers by 2029, making India the fastest-growing travel market in South Asia. Indian duty-free stores have covered 3,630 sqm of retail space in airport areas, influenced by the local area. (Source: dfnionline)

Millennials and Gen Z are major shoppers who have increased demand for experiential and lifestyle products, impacting the adoption of duty-free retail shopping. India is focusing on enabling duty-free retail shops for premium travellers for international luxury brands, including liquor, designer fragrances, and elegant accessories.

Europe is expected to witness the fastest growth over the forecast period, driven by increased international tourism and consumer demands for luxury goods. Europe has an increased number of duty-free shops at airports and seaports. The high trend for tac-free shopping is shifting the market growth. Rising disposable income, collaboration between airports and seaports, and heavy investments in advanced technologies have enhanced shopping experiences in the region. Additionally, the trend of sustainability and digitalization is contributing to market growth.

Germany is a major country dominating the European duty-free retailing market in 2024. The growth is driven by Germany's increased international tourism, robust retail infrastructure, and rising consumer demand for luxury goods, including skincare, haircare, and fragrances. German airports have witnessed major demand for beauty and cosmetic products. Growing online shopping and social media influence, fostering purchasing rates. Additionally, Germany’s strong economy allows a high level of consumer spending, boosting the market.

The perfumes segment dominated the duty-free retailing market in 2024 due to increased consumer spending on luxury goods, driven by increased disposable income and international travel & tourism. Duty-free retail stores provide exclusive and affordable price strategies, attracting consumers to purchase luxury fragrances. The global surge toward premium fragrances, innovative products, and the trend of e-commerce and online shopping, fostering segment growth.

The cosmetics segment expects the significant growth in the market during the forecast period. The increased demand for luxury-branded cosmetic, skincare, and personal care products is shaping the segment's growth. Cosmetic demands have witnessed significant growth among travelers, especially among females. The innovations of travel-sized cosmetic products are gaining popularity among travelers and in duty-free shops, contributing to the demand.

The airports segment dominated the duty-free retailing market in 2024, due to the appeal of a prime location and a large audience. Airports provide large retail space compared to high-end malls and supermarkets. International travellers are the primary consumers of duty-free products. airports have captive international audiences and increased impulse purchases. The high rate and purchasing ratio of duty-free products in airports leads to the segment expansion.

The seaports segment is anticipated to witness the fastest growth over the forecast period, driven by a high range of curious tourism at seaports. Seaports provides interantion travellers to purchases duty-free goods with convenience and low prices. Internal travelers can purchase products at seaports, without the need to pay for import duties or taxes. Seaports are well-known to provide opportunities for retailers to attract audiences with diverse preferences and provide exclusive shopping experiences.

Collaboration: In March 2025, ARI, a leading travel retailer, and its partners Vinci Airports and ANA Aeroportos de Portugal unveiled the novel-look Portugal Duty Free stores. The launch has set “a new standard of excellence in global travel retail”. (Source: moodiedavittreport)

Announcement: In April 2025, Adani Group expanded its duty-free retail sector, through airport operations, to enhance non-aero revenue. The Adani group is targeting domestic and international expansion, like acquiring a stake in a French duty-free company and setting up duty-free shops at Macau International Airport. (Source: thehansindia)

July 2025

July 2025

July 2025

July 2025