July 2025

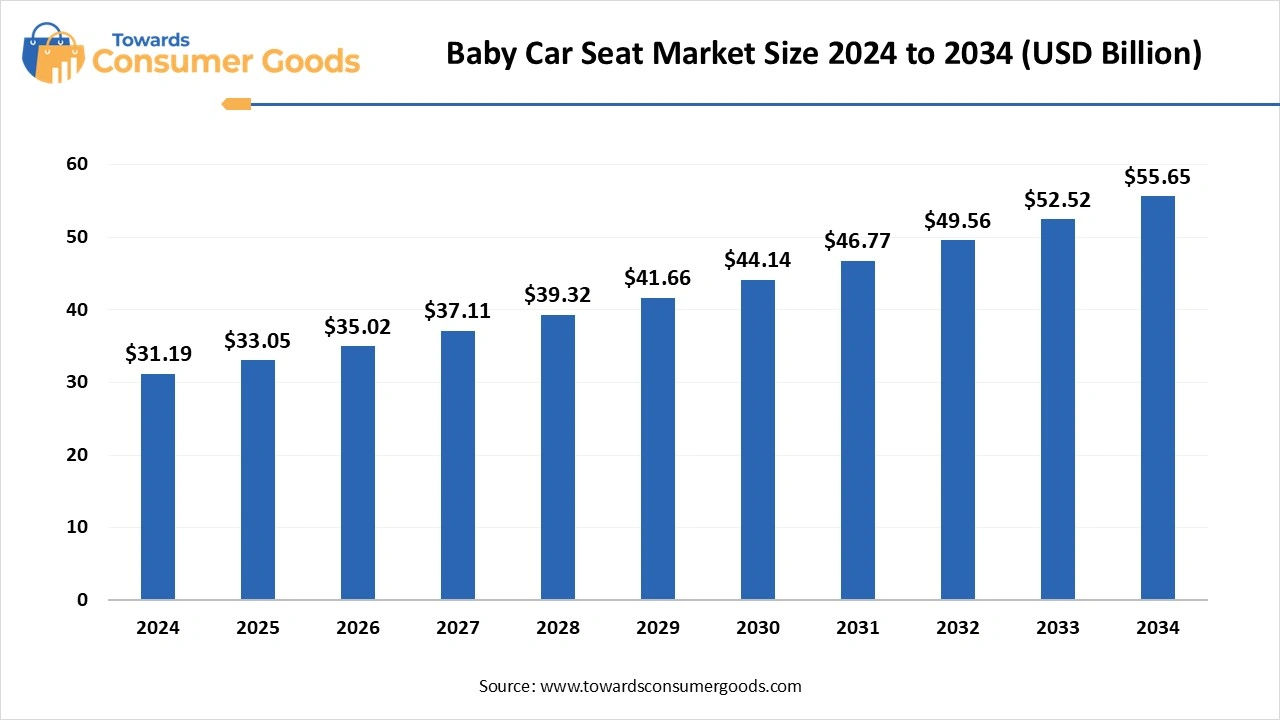

The global baby car seat market was valued at approximately USD 31.19 billion in 2024 and is projected to grow at a CAGR of 5.96% from 2025 to 2034, reaching a value of USD 55.65 billion by 2034. This market is growing due to increasing awareness about child safety during travel and enforcement of stringent government regulations.

The baby car seat market is experiencing steady growth driven by a rise in traffic accidents, growing awareness of child restraint systems, and growing parental concerns about their children's safety. Demand in the market is being further stimulated by governments all over the world imposing stronger laws requiring the use of child safety seats. Increased adoption is also being facilitated by improvements in design comfort and installation simplicity as well as the rising appeal of travel and family road trips. Market expansion is also supported by the growth of e-commerce platforms and rising disposable incomes, especially in emerging economies.

Modern parents are opting for advanced baby car seats due to their upgraded safety features, which include 5-point hardness systems, adjustable headrests, and slide impact protection. As kids get older, these updated models provide more comfort and flexibility, which makes them a more affordable long-term option. Additionally, smart features like integrated sensors that notify caregivers if the child is unbuckled or left unattended appeal to tech-savvy parents. Both developed and emerging markets are safe and convenient, and innovation has become a more important consideration.

Government Initiatives in Promoting Baby Car Seat in 2025

| Report Attributes | Details |

| Market Size in 2025 | USD 33.05 Billion |

| Expected Size by 2034 | USD 55.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.96% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Strength, By Distribution Channel, By Geography |

| Key Companies Profiled | British American Tobacco PLCO, Altria Group, Inc., NIQO Co. (Swedish Match AB), Nicopods ehf., SnusCentral, Japan Tobacco International, Swisher, GN Tobacco Sweden AB, Skruf Snus AB, Tobacco Concept Factory |

The demand for baby car seats is greatly increased by changes in modern lifestyles including urbanization, increased disposable incomes, private vehicle ownership, and more frequent family travel. Since dual-income households frequently depend on their cars for family vacations, daycare drop-offs, and outings, child safety products are necessary rather than optional. Additionally, a growing number of young parents are choosing car seats that are portable multipurpose, and compatible with travel as they lead active lifestyles.

Brands can capitalize by offering compact, foldable, and lightweight car seats that are easy to transfer between vehicles or carry during flights and road trips. Travel systems (car seat + stroller combos), airline-approved models, and convertible seats that grow with the child are particularly appealing to mobile, convenience-seeking families.

Bulkiness and Inconvenience

Due to their weight and bulk, traditional baby car seats can be difficult for parents to install transport or switch between different cars. These annoyances make car seats less appealing to families who travel frequently or reside in urban areas with limited space. Parents frequently look for portable foldable or multipurpose designs that don't sacrifice safety. However, it can be difficult for manufacturers to strike a balance between portability and strong safety features which slows adoption among mobile customers.

Which Region Dominates the Baby Car Seat Market?

North America continues to dominate the baby car seat market due to stringent governmental regulations, general awareness of child safety, and almost all state's mandatory usage laws. Modern car seats such as convertible and all-in-one models have become more popular due to consumer demand for premium safety-certified goods.

Furthermore, the existence of major producers and merchants guarantees robust product accessibility across a range of price points. The area's developed car market and high level of disposable income encourage regular car seat replacements and upgrades. The market strength has also been aided by the growing use of travel systems and online sales.

Asia Pacific is emerging as the fastest-growing baby car care market, driven by growing urbanization and increased awareness of child passenger safety. The need for reasonably priced and dependable car seats is continuously rising since birth rates are still in a number of regions of the nation. Market penetration is being accelerated by government initiatives to improve road safety and implement safety mandates.

Additionally, the growing middle class and rising car ownership are encouraging parents to spend money on child safety gear. Additionally, social media initiatives and online retail platforms are impacting consumer behavior and increasing local sales.

Why do infant car seats dominate the baby car seat market?

Infant seats dominate the market due to their specific design for newborns and younger babies, offering optimal safety and support for infants during travel. Their compatibility with strollers and easy-to-carry structure makes them a popular choice among new parents. Hospitals and safety experts widely recommend infant seats as the first travel solution for newborns. Additionally, many models now come with advanced side impact protection and ergonomic inserts, boosting their popularity. High birth rates in developing nations further contribute to sustained demand.

Convertible seats are growing the fastest because they allow for both forward-facing and rear-facing positions, providing long-term usability. The market demand for its affordable flexible option that grows with the child is being driven by parents' growing preference. As the child gets older, they remove the need for numerous purchases, which is particularly alluring in households with tight budgets. Improved safety features like energy-absorbing foam and adjustable recline levels are also included in modern convertible seats. Because they produce less waste, they appeal to consumers who care about sustainability.

Why are backward-facing car seats considered the dominant category in terms of usage and market share?

Backward-facing seats remain dominant as they provide superior protection for a baby's head, neck, and spine in the event of a crash. These seats are heavily recommended for younger infants, making them a safety standard across markets. Regulations in countries like the U.S. and Europe strongly advise using rear-facing seats up to at least age two. This extended use, coupled with rising parental awareness around crash test safety ratings, supports their market dominance. Additionally, they often integrate with infant carriers enhancing functionality.

Forward-facing seats are gaining traction as children grow older, as kids get older and stop using rear-facing models. Their incorporation of features like adjustable recline settings and harness systems is accelerating their market expansion. After their child reaches a particular height or weight threshold, many parents choose forward dancing seats. Adoption is also being accelerated by the availability of models with extra comfort features like ventilation panels and padded headrests. Growth is being further stimulated by educational campaigns about proper seat transition.

Why do car seats designed for children under 50 pounds hold the largest share of the market?

Below 50LB segment dominated the market, catering to the largest group of infants and toddlers. These seats fulfill critical safety regulations and are widely accepted due to their suitability for early developmental stages. They are lightweight, compact, and often compatible with travel systems, enhancing convenience for on-the-go parents. The segment also includes a wide price range, making it accessible to diverse income groups. Manufacturers continue to innovate in this range with better cushioning and infant support features.

The 50LB-100 LB segment is rapidly expanding as parents look for long-lasting products that will last through the preschool and early school years. These models frequently serve as booster seats, which promotes greater uptake. Changing safety regulations which mandate that children be buckled up in booster seats until they are 7-12 years old in many areas also encourage growth. Families on a tight budget searching for multistage car seats will also find these seats to be perfect. This market is growing as more people choose to buy seats that are flexible and long-lasting.

Why do children aged 9-16 months account for the highest usage of car seats?

9-16 months represents the dominant user group for car seats since this stage necessitates frequent transportation for checkups and excursions as well as improved travel safety. Demand for seat designs targeted at this age group is frequently higher. Children start sitting up straight at this age and need more support and structured seating which these seats provide. During these phases, parents also become more active which increases the amount of car travel. Age-appropriate features like easy harness adjustments and breathable fabric are examples of how brands are still innovating.

17-24 months segment is becoming notable as toddlers stay in car seats for longer. Manufacturers are improving the design to effectively support this slightly older age range as safety and regulatory compliance become more important. Even though this group frequently switches to forward-facing models they still require sufficient head and side protection. At this stage, parents place a high value on comfort features like legroom extensions and reclining angles. Market participants are aiming their convertible seats at this age group with ergonomics specifically for toddlers.

Why does the offline segment dominate baby car seat distribution despite the rise of e-commerce?

Offline segment dominated the baby car seat market due to the trust placed in physical product inspections safety demonstrations and personalized guidelines. Physical stores also offer immediate product availability, influencing higher sales. Retailers often provide expert staff to assist parents in choosing appropriate models based on age, weight, and car type. In-store promotions and bundled offers with strollers or accessories also help boost offline sales. Showroom testing helps parents feel confident in product quality and safety.

Online segment is rapidly expanding, brought about by the convenience of a greater range of brands and models and growing digital adoption. Competitive pricing and improved delivery logistics are also driving up online sales. To improve the purchasing experience, e-commerce platforms also provide user reviews, safety ratings, and virtual fitting tools. Due to behavioral shifts brought on by the pandemic, buying baby products online has become commonplace. It has grown quickly because of the numerous brands that have now introduced exclusive online collections.

By Product Type

By Category

By Weight

By Age

By Distribution Channel

By Geography

According to market projections, the global baby care products market, valued at USD 107.88 billion in 2024, is anticipated to reach USD 165.15 billio...

July 2025

June 2025

June 2025

June 2025