June 2025

The asia pacific rum market was valued at approximately USD 7.51 billion in 2024 and is projected to grow at a CAGR of 4.15% from 2025 to 2034, reaching a value of USD 11.28 billion by 2034. The demand for premium and craft spirits has increased, driving the Asia Pacific rum market. The rising cockatiel and mixology culture are fostering market growth.

The Asia Pacific rum market has witnessed significant growth due to various factors like the influence of Western drinking culture, changing consumer preferences, demand for premium and unique flavor profiles, especially among young consumers, and increased disposable income. India is one of the largest countries providing high-end production and consumption of rum, with a rise of 90% of alcohol consumption in the country. India is one of the greatest alcohol composed per capita in the world's top economies. The country has witnessed growth in premium rum consumption, about 59% higher in accounts favored by Travelers and sales of 42% higher than average. The Asia Pacific market is witnessing innovative product launches, mostly for spiced rums and artisanal blends. However, the Asian rum industry has shifted its focus to the White House’s most senior resident of U.S. tariffs, a surging shift in export demand for travel retailers of Asia.

The demand for premium and craft spirits has increased, especially among urban millennials and Gen Z consumers, driven by increased disposable income, waster drinking culture influence, and rising cocktail culture. Consumers have changed their preference for premium and craft spirits to experience luxury experiences. Young consumers are seeking story-led branding, unique flavor nature, and sophisticated rum products. Additionally, increased use of social media is driving the influence of Western drinking culture on young Asian consumers. Rising middle class population and forging traveling driving shift toward premium and craft spirits averages, including rum, making spectacular opportunities for local brands.

| Report Attributes | Details |

| Market Size in 2025 | USD 7.82 Billion |

| Expected Market by 2034 | USD 11.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel, By Country |

| Key Companies Profiled | Tanduay Distillers, Inc., Asahi Group Holdings Ltd, Bacardi Limited, Bleeding Heart Rum Company, Ginebra San Miguel Inc., Pernod Ricard SA, United Spirits Ltd. (A Diageo Company), Amrut Distilleries Ltd., Third Eye Distillery Pvt. Ltd., Husk Distillers Pty Ltd., Brix Distillers Pty Ltd., |

The rising organized retail stores like supermarkets and department stores, and expanding e-commerce platforms hold significant growth opportunities for the Asia Pacific rum market. The consumer demand for customized products has increased, making the need for convenience and easy access to stores, like organized retail and e-commerce. Retailers of supermarkets and liquor stores, and e-commerce are focusing on providing accessible and convenient solutions for consumers. The growing urban and socially active populations are asking for experimentation with different spirits, generating significant opportunities for organized retail and e-commerce platforms.

Strengths of certain cultural factors, including local spirits, cultural attitude toward alcohol, and traditional preference, are the major challenges for the rum market in the Asia Pacific. Various countries have their traditional drinking preferences, for instance, sake in Japan, Baiju in China, and soju in Korea, limiting the adoption of rum. Additionally, strict regulations and social conventions toward alcohol consumption in various countries hamper the Asia Pacific rum market. However, the sign of western driving influence, hospitality culture, and trend of premiumization are expected to shape the rum market in Asia Pacific.

Indian Robust Consumer Base: to Foster the Asia Pacific Rum Market

India dominated the Asia Pacific rum market due to its widespread consumer base, strong culture for acceptance of beverages, and increased disposable income. India is a leader in the production of rum, with a strong presence of domestic rum producers, like United Spirits Ltd. (India), Allied Blenders, Distillers Limited, and Radico Khaitan. The consumer demand for high-quality craft rums fosters market growth. The Maka zai and Two Indies rums are gaining rapid popularity among affluent and younger consumers of the country. Additionally, increased foreign travel is driving initiatives in increasing demand for duty-free alcoholic beverages, including rum.

The Philippines is a significant player in the Asia Pacific rum market, growth driven by robust cultural connections to rum production and consumption in the country. The Philippines is a high-per-capacity consumer of rum. The country has witnessed significant interest in high-quality and locally produced rum. Tanduay Distillers is one of the largest rum producers in the world. The consumer demand for premium and super-premium rum is leading market growth, driven by increased availability of disposable income and rising middle-class populations.

In 2024, the dark and golden rum segment dominated the market, due to its cultural significance in many Asian countries like India and the Philippines. The dark and golden rum is affordable and has a large base of loyal consumers. The dark and golden rums are highly versatile, as dark rums can be enjoyed in cocktails, and golden rums are also popular for their mixed drink natures. The rising trend of premiumization in Japan and Australia, increasing adoption of dark and golden rums in the Asia Pacific. Asia has major brands, offering premium dark and golden rums. The consumer loyalty with specific brands fosters segment growth.

The white rum segment is expected to witness the fastest growth over the forecast period, driven by robust cocktail culture. White rums are versatile and popular for cocktails due to their neutral flavor profile. Young consumers ' preference for cocktail culture makes white rum more appealing. Additionally, the increased trend for home mixology, fueling segment growth. The rising demand for high-quality ad premium white rums with unique and neutral flavors, driving segment growth. Australia and Japan are the major adopters of white rums, driven by consumer demand for high-end bars and cocktail culture.

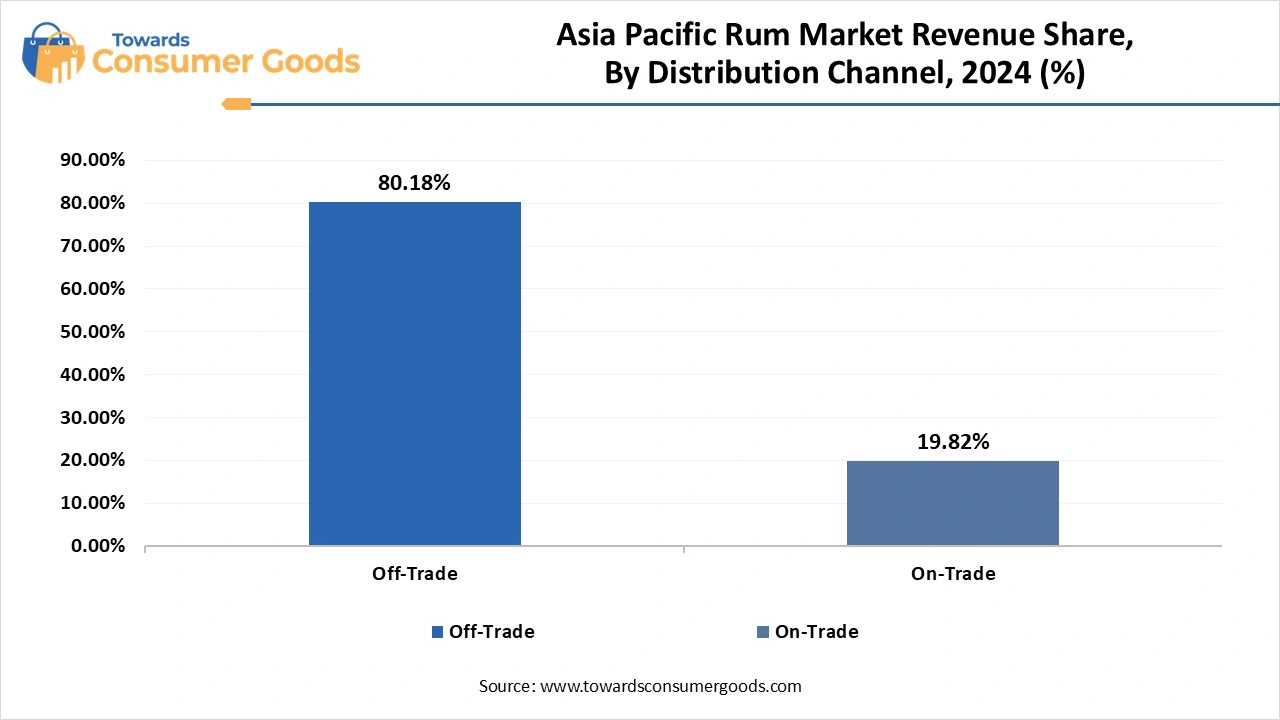

The off-trade segment dominated the market in 2024, growth driven by consumer preference for convenience and affordable rum purchase. The off-trade segment includes liquor stores, retail stores, and e-commerce platforms, which provide affordable and convenient purchase of rums. These stores provide a wide range of options, like crafty and premium rums. Consumers prefer to explore different brands and flavors, making the off-trade segment more convenient. Additionally, off-trade stores offer price sensitivity and easy access to premium rums, driving segment growth.

The on-trade segment is the second-largest segment, leading the market. The segment growth is mainly attributed to the expanding hospitality industry and demand for craft and premium rums.

Various urban cities like Singapore, Tokyo, and Sydney are hubs for the consumption of premium rum in on-trade distribution. The rising trend of mixology, creating opportunities for brands to develop unique cocktails featuring rums, is driving the on-trade segment. The on-trade segment provides unique experiences, enables consumers to explore new products, and promotes premium and craft rum brands.

By Product

By Distribution Channel

By Country

According to latest report, the U.S. real estate market size is calculated at USD 1.75 trillion in 2024, grew to USD 1.80 trillion in 2025 and is pred...

June 2025

May 2025

April 2025