July 2025

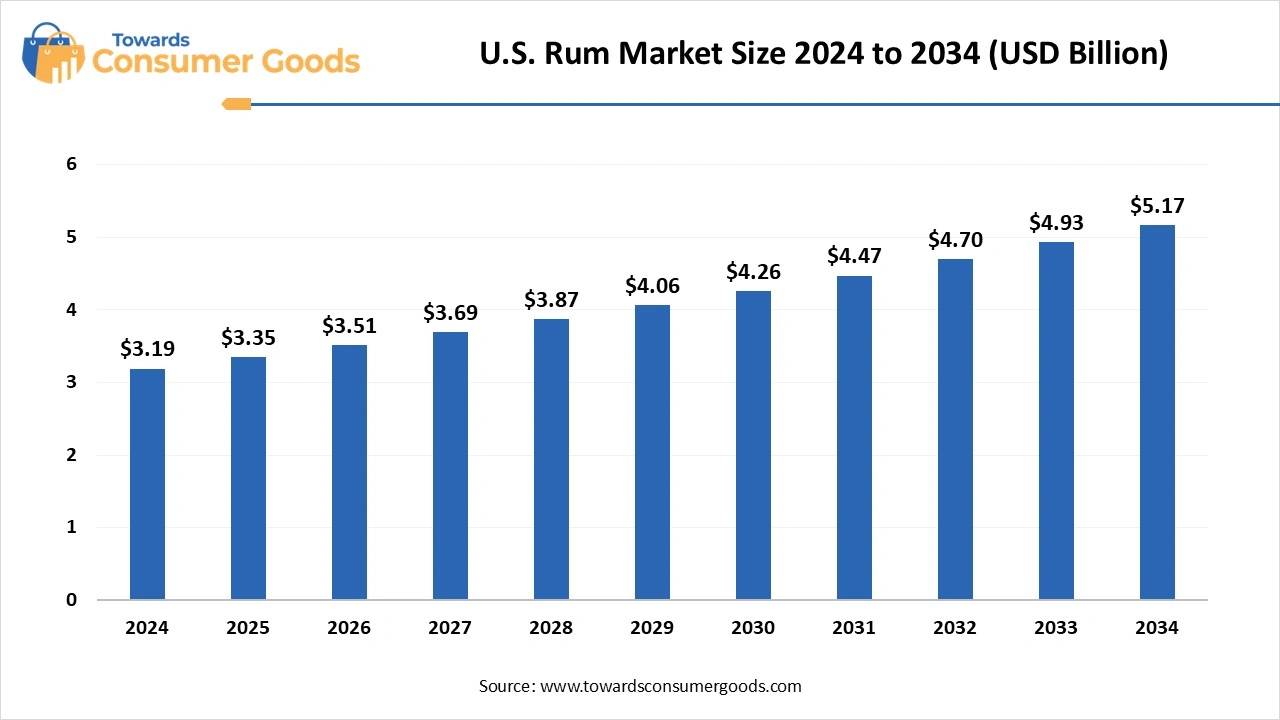

The U.S. rum market size reached USD 3.19 billion in 2024 and is projected to hit around USD 5.17 billion by 2034, expanding at a CAGR of 4.95% during the forecast period from 2025 to 2034. The U.S. rum market is experiencing steady growth, driven by consumer interest in premium and craft rum varieties. Innovative flavors, cocktail culture, and a shift toward authentic Caribbean styles are reshaping market dynamics and attracting a younger demographic.

The U.S. rum market is undergoing a vibrant transformation, blending tradition with innovation as it carves a new identity among spirit connoisseurs. Once overshadowed by whiskey and vodka, rum is now experiencing a renaissance driven by evolving consumer preferences, the craft movement, and a revived interest in Caribbean-inspired culture. Valued at several billion dollars, the U.S. rum market is witnessing steady growth, supported by a rising demand for premium and artisanal varieties.

Consumers are increasingly gravitating towards aged, spiced, and dark rums that offer depth, authenticity, and complexity. This shift is catalyzed by a broader trend toward mindful drinking, where quality trumps quantity, and storytelling through heritage, origin, and craftsmanship becomes a central theme. Craft distilleries across the United States are fueling this resurgence by introducing small-batch, locally produced rums that experiment with fermentation techniques, barrel ageing, and exotic flavor infusions.

| Report Attributes | Details |

| Market Size in 2025 | USD 3.35 Billion |

| Expected Market by 2034 | USD 5.17Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Distribution Channel |

| Key Companies Profiled | Bacardi Limited, Davide Campari-Milano N.V., Demerara Distillers Ltd. (DDL), Diageo Plc, LT Group Inc., Nova Scotia Spirit Co., Pernod Ricard SA, Dictador Europe Sp. z o.o., William Grant & Sons Ltd., Mohan Meakin Limited, |

The U.S. rum market presents a golden opportunity for growth, especially within the premium and craft segments. As consumers' preferences continue to evolve, there is a rising appetite for authentic, high-quality, and story-driven rum experiences. Small-batch distilleries, particularly those experimenting with barrel ageing, tropical infusions, and organic ingredients, are carving a niche and captivating a younger, curious demographic. Additionality, Additionally, the underexplored market for ready-to-drink (RTD) rum-based cocktails offers immense potential. With on-the-go consumption on the rise, pre-mixed rum beverages can cater to convenience-seeking consumers while preserving the appeal of classic rum cocktails.

Despite its vibrant revival, the U.S. rum market faces several barriers that may temper its growth trajectory. One of the primary challenges is the persistent perception of rum as a lower-tier spirit when compared to whiskey or tequila. This image, rooted in historical over-commercialization and poor-quality offerings, continues to hinder its appeal among more sophisticated drinkers. Moreover, stringent alcohol regulations and complex tax structures vary across states, making distribution, pricing, and marketing difficult, especially for small distilleries. These operational hurdles limit the visibility and shelf space of many artisanal rum brands.

Dark and golden rums hold a commanding presence in the rum market, known for their rich flavor profiles, deep color, and ageing processes. These variants are traditionally aged in oak barrels, which impart complex notes of vanilla, caramel, spice, and smoke qualities highly appreciated by connoisseurs and mixologists alike. This segment is popular among traditional rum drinkers and cocktail lovers who favor full-bodied, aged spirits.

Dark rums are often associated with heritage and authenticity, while golden rums strike a balance between lightness and depth, making them versatile for both sipping and mixing. Golden rum is frequently used in high-end cocktails such as the Mai Tai and

Dark & Stormy, while dark rum features prominently in premium sipping selections and tiki-style drinks.

On the other hand, White rum, also known as light or silver rum, is experiencing rapid growth, particularly among younger consumers and in markets embracing cocktail culture. Known for its clean, subtle taste and clarity, white rum is the base spirit of choice for iconic drinks like the Mojito, Daiquiri, and Pina Colada. Millennials and Gen Z are drawn to white rum’s refreshing taste, mixability, and its frequent use in low-calorie or tropical cocktails. The light profile allows for diverse experimentation, making it popular in bars, clubs, and RTD (ready-to-drink) innovations. The increasing popularity of at-home mixology and demand for pre-mixed rum beverages has significantly boosted sales. Major players like Bacardi and Havana Club are launching flavored white rum variants to cater to evolving preferences.

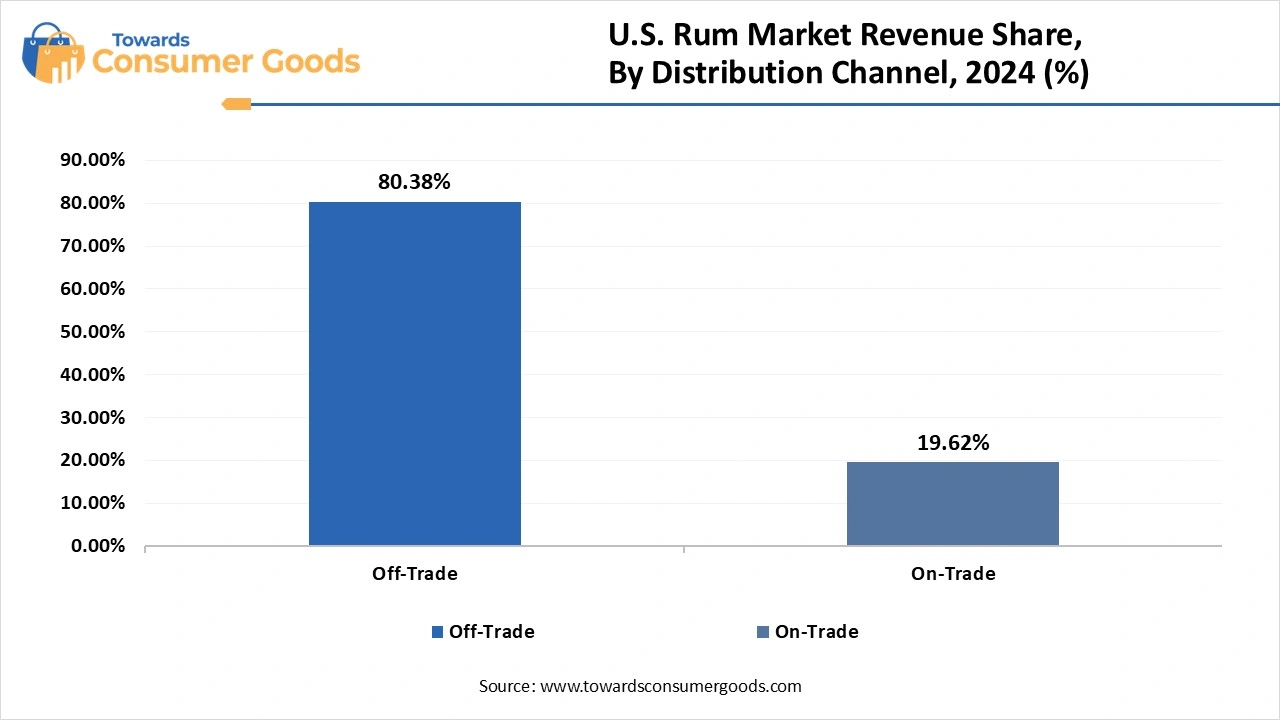

Off-trade sales channels such as supermarkets, hypermarkets, liquor stores, and online retailers are currently dominating the rum market, due to Consumer Convenience and Off-trade distribution offers unmatched convenience for consumers who prefer to enjoy their beverages at home. With growing interest in home mixology and cocktail-making, consumers are increasingly purchasing rum bottles for private use. Supermarkets and large retail chains have significantly expanded their alcohol sections, offering greater shelf space to premium and craft rum brands.

This has led to increased visibility, brand trials, and impulse buying. The digital transformation in alcohol retail, accelerated by the pandemic, has brought online sales of rum into the spotlight. From mobile apps to virtual tastings, digital platforms are making it easier for consumers to explore and purchase rum directly. Off-trade retailing allows for bundled offers, discounts, and loyalty programs, making it a lucrative channel for brands aiming to boost sales volume.

Furthermore, on-trade sales, referring to sales through hotels, bars, pubs, restaurants, and lounges, are emerging as the fastest-growing segment in the rum market. Driven by increasing popularity of rum-based cocktails such as Mojitos, Daiquiris, and Dark Rum, it has become a staple in premium bars and lounges. Consumers are eager to experiment with creative mixes and curated drink menus. With the return of nightlife and dining post-pandemic, on-trade channels are witnessing a surge in foot traffic.

Younger consumers, in particular, view drinking as a social experience, fueling demand for on-site rum consumption. Many bars are now investing in high-end and artisanal rum options to cater to discerning drinkers. Bartenders play a key role in influencing consumer choices and educating them on the uniqueness of specific rum labels. Rum brands are leveraging on-trade partnerships for tastings, signature cocktails, and brand-led experiences, boosting their market presence and encouraging repeat purchases.

By Product

By distribution channels

July 2025

July 2025

July 2025

July 2025