July 2025

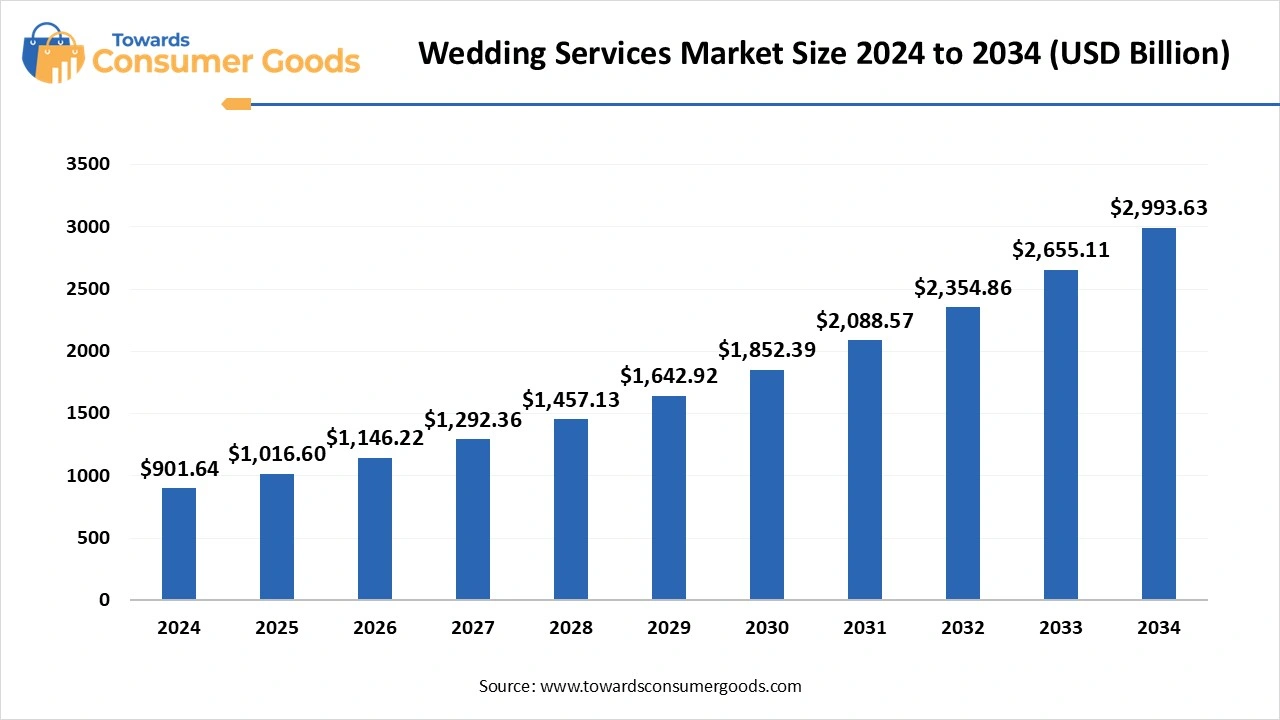

The global wedding services market size was valued at USD 901.64 billion in 2024 and is estimated to reach around USD 2993.63 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 12.75% during the forecast period 2025 to 2034. The consumer shift towards luxury wedding receptions and the replication of high-profile wedding experience has driven the market growth.

The wedding services market is a dynamic industry dedicated to assisting couples in meticulously planning and executing their weddings, covering every facet from pre-wedding festivities to post-wedding celebrations. This market encompasses a diverse array of services and products designed to cater to the unique visions of each couple. Offerings include comprehensive wedding planning, gourmet catering, professional photography, videography, stunning décor, and entertainment options that range from live bands to DJs.

In addition to traditional services, the market also caters to the demands for destination weddings, personalized invitations, and specialty entertainment that aligns with the couple's themes and preferences. Skilled wedding planners serve as central coordinators, expertly managing budgets, liaising with vendors, creating timelines, and overseeing every detail of the wedding day to ensure a seamless experience. Couples increasingly desire memorable, personalized experiences that reflect their individual stories, leading to a rising demand for distinct themes and tailor-made services.

Quality documentation of wedding events has become paramount, with many couples seeking advanced technological solutions for capturing and preserving their special moments.

Wedding service providers are stepping up to the plate by also offering post-wedding services such as honeymoon planning. Technology plays an increasingly vital role in the industry with online booking platforms streamlining processes and social media marketing becoming a significant tool for reaching prospective clients. The market is witnessing robust growth fueled by an uptick in disposable income, evolving societal norms, and a burgeoning interest in destination weddings. Recent trends indicate a noticeable shift towards unique and customized wedding experiences, pushing service providers to innovate and offer specialized services.

In recent years, market dynamics have transformed, largely due to increased disposable income, heightened influence from social media platforms, and the escalating popularity of personalized and destination weddings. The advent of cutting-edge planning tools and event management technologies has further propelled growth. Strategic partnerships with social media influencers have also been instrumental in shaping the market landscape. As couples find themselves with greater financial flexibility, they are allocating more resources towards their wedding expenses, manifesting a demand for lavish and customized experiences.

| Report Attributes | Details |

| Market Size in 2025 | USD 1016.6 Billion |

| Expected Size by 2034 | USD 2993.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

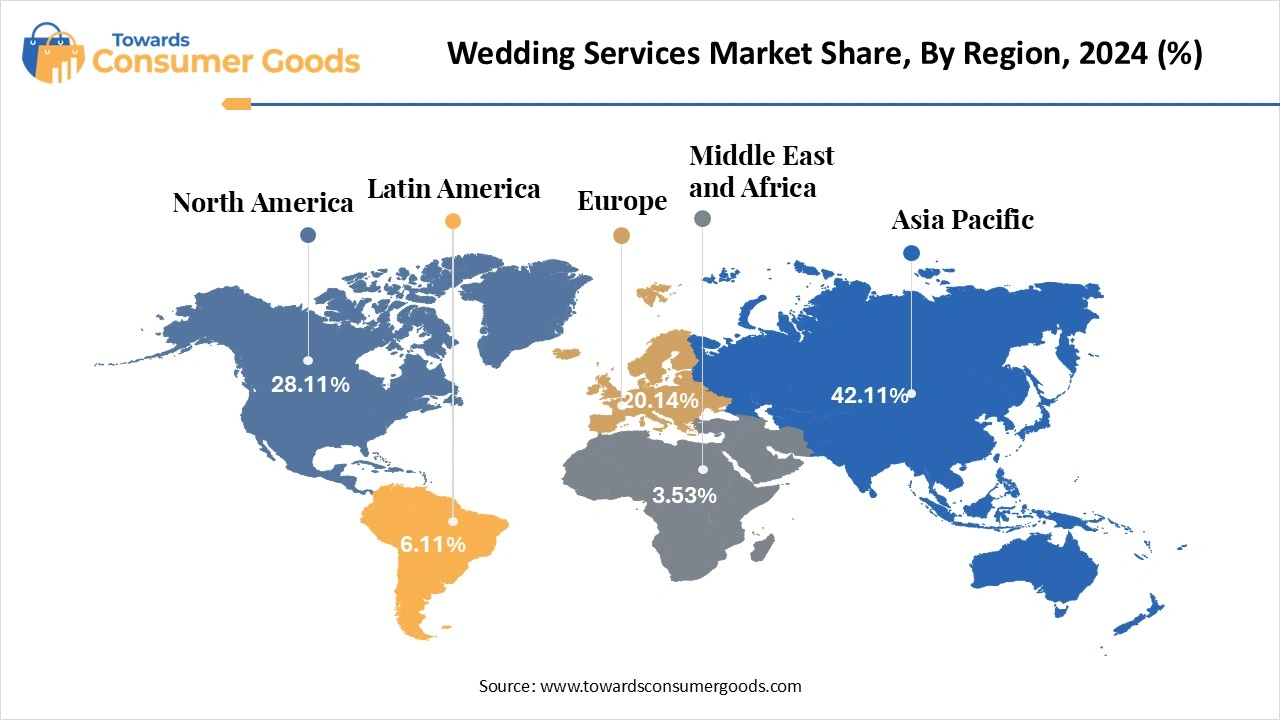

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Booking Type, Service Type , By Videography & Photography Services, By Regional |

| Key Companies Profiled | BAQAA Glamour Weddings and Events, Nordic Adventure Weddings, Augusta Cole Events, A Charming Fête, David Stark, Fallon Carter, Lindsay Landman, JZ Events, Colin Cowie, Eventures Asia |

The wedding services market is a vibrant and rapidly growing sector filled with significant opportunities. Various trends are driving its evolution, including increasing disposable income among couples, the rising popularity of destination weddings, and the demand for unique and personalized experiences. Key areas ripe for development include wedding planning, catering, venue management, photography and videography, along with essential services such as makeup, decor, and logistics.

The growing inclination towards destination weddings presents ample opportunities for businesses that specialize in planning, logistical management, and venue selection across various locales. Couples are continually seeking to create memorable occasions that reflect their personalities and values, thus opening the door for innovative and customizable wedding services that cater to these aspirations.

The wedding services market is currently navigating a landscape fraught with challenges that significantly impact both wedding planners and vendors. These challenges include cutthroat competition among service providers, economic fluctuations that create uncertainty, and the ongoing need to adjust to rapidly changing trends and technological advancements. This competitive environment necessitates that wedding planners and vendors develop strategic approaches to manage escalating costs, adhere to industry standards, and offer highly personalized services that cater to individual client needs.

One of the foremost challenges in the market is the intense rivalry among numerous vendors striving to attract the same pool of potential clients. Economic downturns can further complicate matters, as they can lead to decreased spending on weddings resulting in what is often referred to as a "wedding gap" or a significant decline in booking rates. Many couples face difficulties keeping their wedding expenses within budget, particularly in light of unforeseen costs and the inevitable need for last-minute revisions. Wedding planners frequently contend with tight deadlines and must skillfully juggle multiple vendors, tasks, and logistical details to ensure smooth execution.

Why do local weddings dominate the market?

Local weddings are currently the predominant force within the wedding services market. This prominence can be attributed to several key factors: convenience, familiarity with local vendors, and cost-effectiveness significantly enhance their appeal. Couples often prefer local weddings because they provide a personalized experience that feels both comfortable and meaningful within their own communities. This intimate knowledge can alleviate stress during the planning process, making it feel more manageable. Moreover, local weddings generally incur lower travel and accommodation expenses, making them a financially viable option for many couples. The increasing trend towards community-oriented events and an emphasis on local sourcing further amplify the demand for local wedding services.

Conversely, the destination wedding segment stands out as the fastest-growing area within the wedding services market. The growing inclination towards smaller, more intimate weddings and the allure of luxurious settings play pivotal roles in this trend. Destination weddings offer couples the chance to host their celebrations in breathtaking locales, rich cultural settings, and exclusive venues, allowing for a distinctive and tailor-made experience that leaves a lasting impression.

Why do offline wedding services dominate the wedding services market?

In terms of booking methods, the offline segment remains at the forefront of the wedding services market. Given the complexities involved in wedding planning, many couples seek a highly personalized experience that begins with detailed in-person discussions regarding their specific needs and desires. This personal touch fosters a sense of reassurance and confidence in the vendors they choose to work with. In many cultural contexts, the significance of personal relationships is paramount, underscoring the importance of trust in these vendor-client interactions. Many couples find comfort in building relationships with their chosen vendors, which helps them navigate the array of details associated with planning a wedding.

On the other hand, the online segment of wedding services is experiencing rapid growth, driven by its appeal of convenience, accessibility to a wider range of options, and the ability to streamline the planning process. The increasing reliance on digital platforms for research and inspiration, coupled with the pervasive influence of social media, has encouraged couples to explore and engage with vendors online.

These platforms enable couples to effortlessly compare offerings, read reviews, and secure services from the comfort of their homes, thereby saving both time and effort. The internet provides access to an extensive array of wedding planning resources that facilitate exploration across diverse styles and options, empowering couples to curate their ideal wedding experience.

Why do videography and photography dominate the wedding services market?

The wedding services market is significantly shaped by the videography and photography segment, which has surged in prominence due to several interconnected factors. With the growing influence of social media, couples are increasingly prioritizing high-quality visual documentation of their wedding day. The evolution of digital technologies, including advanced high-resolution cameras and sophisticated editing software, has further enhanced the quality of services offered in this sector, enabling photographers and videographers to deliver stunning, professionally-crafted visuals that capture the essence of the celebrations. Wedding photography and videography serve as tangible reminders of the day, providing an emotional outlet for couples to relive their special moments.

In parallel, the decorative services segment of the wedding market is experiencing a remarkable surge in demand. Social media trends significantly impact these preferences, as couples are inspired by captivating images and videos of lavish and imaginative décor displayed online. As a result, there is an increasing inclination towards creating visually stunning and memorable wedding atmospheres, driving the need for customized decorations, themed events, and innovative design solutions. Recent advancements in materials and design technologies have allowed for the development of more intricate and elaborate decorations, elevating the visual appeal and overall experience of weddings.

Why Does the Asia-Pacific region dominate the market?

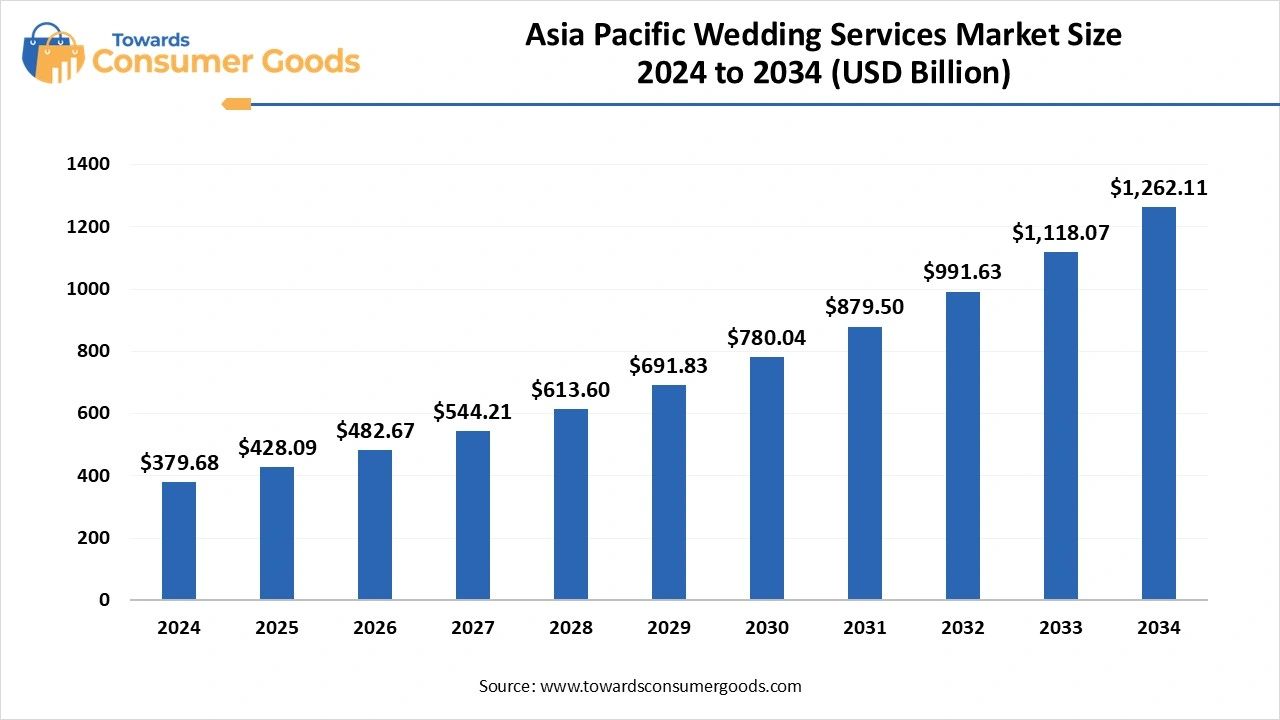

The Asia Pacific wedding services market is expected to increase from USD 428.09 billion in 2025 to USD 1,262.11 billion by 2034, growing at a CAGR of 12.76% throughout the forecast period from 2025 to 2034.

The Asia-Pacific region currently holds the largest market share in the wedding services sector. This leadership is influenced by several factors, including its dense population, rising disposable incomes, and the cultural importance of weddings across myriad traditions. The fascination with destination weddings is also gaining traction in this region, as couples seek to celebrate their unions in picturesque locations. The economic advancements and increasing affluence in these nations allow couples to pursue elaborate wedding experiences, further propelling market growth. Given that weddings in many Asia-Pacific cultures involve extensive guest lists and grand ceremonies, there is a consistent demand for a variety of wedding services and vendors, further energizing the market.

Conversely, the North American wedding services market is acknowledged as the fastest-growing segment, bolstered by a robust cultural focus on weddings as pivotal life milestones. Couples in this region exhibit a strong preference for distinctive and personalized experiences that resonate with their identities and values. The diversity of beautiful settings across the continent, coupled with an increase in destination weddings, adds to the appeal of North American weddings. Couples are actively seeking bespoke services, such as custom décor, tailored catering menus, and unique venues, to craft the perfect backdrop for their special day.

Hyatt India

Weddingz.in

Lynchburg

Type

Booking Type

Service Type

Videography & Photography Services

By Regional

The global gaming console market size was estimated at USD 28.89 billion in 2024 and is predicted to increase from USD 31.35 billion in 2025 to approx...

Market analysis indicates that, the U.S. creatine supplements market size was estimated at USD 427.50 million in 2024 and is predicted to increase fro...

The global musical instruments market size is calculated at USD 47.61 billion in 2024, grew to USD 50.99 billion in 2025 and is predicted to hit aroun...

The latest market outlook reports that, the global tissue paper market size is calculated at USD 97.55 billion in 2025 and is forecasted to reach arou...

July 2025

July 2025

July 2025

July 2025