July 2025

The global maternity apparel market size is expected to be worth around USD 9.05 billion by 2034 from USD 6.45 billion in 2024, growing at a CAGR of 3.45% during the forecast period 2025 to 2034. The rising trend of maternity fashions is driving the global maternity apparel market. The rising number of working pregnant women worldwide is fueling the market expansion.

The Maternity Apparel Market comprises clothing designed specifically to accommodate the changing body shapes and comfort needs of women during pregnancy and postpartum. These garments combine fashion, function, and flexibility, with features such as stretchable fabrics, adjustable waistbands, nursing-friendly designs, and breathable materials.

Driven by increasing maternal health awareness, rising disposable income, global fashion consciousness, and growing participation of pregnant women in professional and social activities, the market spans a wide variety of styles, from casualwear to workwear and activewear, sold both offline and online. Sustainable and inclusive design trends, as well as celebrity influence and social media, further shape this evolving category.

The trend of maternity fashions is the major driver of the global maternity apparel market. The increasing number of women's pregnancies and changing lifestyle have increased emphasis on prioritizing style and comfort. Growing celebrity fashion trend influence further contributes to boosting demand for authentic fashion and unique clothing. The advancements in fabrics and design contribute to attracting a major consumer base. Additionally, the expansion of online retailers is supporting this trend.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.67 Billion |

| Expected Size by 2034 | USD 9.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By Fabric Type, By Distribution Channel, By End Use / Occasion, By Price Range, By Region |

| Key Companies Profiled | H&M Group (MAMA), Seraphine , Motherhood Maternity (Maternity Brands Inc.) , ASOS Maternity , Gap Inc. (GAP Maternity, Old Navy) , Isabella Oliver , ZARA Maternity , PinkBlush Maternity , Target Corporation (Isabel Maternity), Boob Design , Hatch Collection , JoJo Maman Bébé , Thyme Maternity , Cake Maternity , Storq , A Pea in the Pod , Mamalicious (Bestseller Group) , Ripe Maternity , PatPat , Belabumbum |

Demand for Sustainable and Organic Materials

The trend of sustainability and organic clothing holds potential growth opportunities for the market. Consumers are becoming aware of eco-friendliness and organic materials, driving demand for maternity wear made from organic and sustainable materials. The trend of ethically produced clothing has increased significant competition among well-known brands.

Major brands are actively producing sustainable luxury clothing to attract a large consumer base, particularly in regions like the U.S., Canada, Japan, and European countries. The Carter’s “Little Planet Mama Collection” is gaining rapid popularity in the market.

The maternity clothes require specialized fabrics and designs for better comfort and flexibility, which adds to the cost. The high product cost impacts the middle-income consumers. Women often prioritize essential expenses over maternity clothing, making high-cost products less no to the purchased. The high price hampers consumers lookout for a balanced perception. Cost further hinders the accessibility of maternity clothes to expectant mothers. Additionally, the availability of budget-friendly options can limit the market competition.

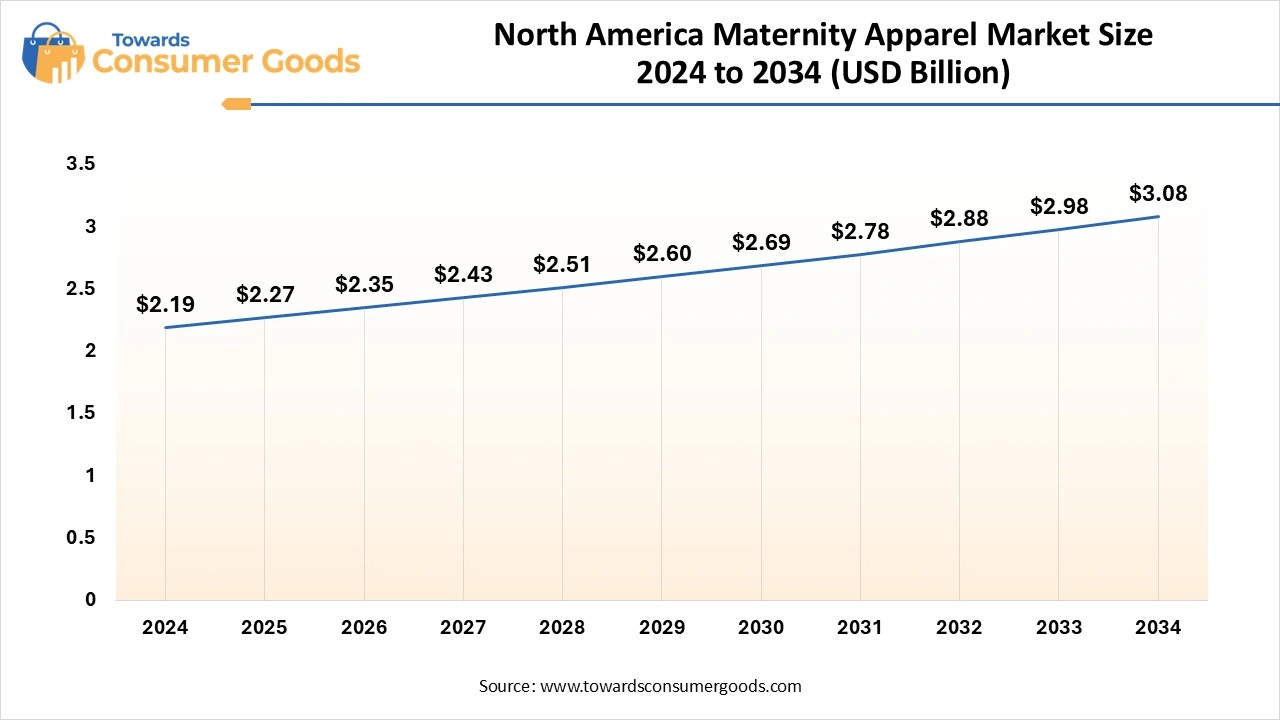

North America Maternity Apparel Market

The North America maternity apparel Market market is expected to increase from USD 2.27 billion in 2025 to USD 3.08 billion by 2034, growing at a CAGR of 3.47% throughout the forecast period from 2025 to 2034. North America dominated the global maternity apparel market, driven by increased female work participation, high demand for stylish and comfortable maternity wear, well-established e-commerce, and robust manufacturing gains. North America has a high number of working women’s and the disposable income availability hallmark fuels the demand for stylish and professional maternity apparel. Moreover, the existence of key market layers, well-established brands, and high credibility influence fosters the market.

The U.S. is a major player in the regional market, driving growth due to high disposable income, large female workforce participation, strong celebrity endorsements, existing online shopping platform, existence of well-known brands, and growing emphasis on sustainability. The demand for sustainable maternity wear has increased in the U.S., driving significant innovation approaches in the market. The existence of key market vendors and large fashion consciousness is contributing to the market expansion.

Asia Pacific Maternity Apparel Market Trends:

Asia Pacific is the fastest-growing region in the global market, driven by rising fashion consciousness, disposable income, and rising demand for stylish, flexible, and comfortable maternity wear. The celebrity and influencer endorsements are further fueling the fashion consciousness among Asian women. Government investments in local manufacturing companies and a growing focus on sustainability are shaping the market.

China is a major player in the regional market, driven by a large population, growing disposable income, expanding middle class, and rising awareness about maternity health & well-being. China dominates the production and consumption of maternity wear, with a large manufacturing and consumer base.

India is the fastest-growing country in the regional market, contributing to market growth due to the region's strong manufacturing base, large population, growing female workers, rising disposable income, and strong government investments in local manufacturing giants. The government initiatives like “Make in India” and the implementation of several awareness campaigns for maternity health and well-being are fostering growth. Additionally, the high celebrity influence is driving demand for unique, innovative, and high-quality maternity clothes in the country's market, shaping market competition.

What Made Tops & Bottoms Segment Dominate the Maternity Apparel Market in 2024?

In 2024, the tops & bottoms segment dominated 41%% of the market, driven by large consumer demand for comfortable, stylish, and specialized maternity wear. Tops with a design of style and comfort for a growing baby bump and bottoms like jeans, leggings, pants, and skirts with special designs and features like belly panels, waistbands, and stretchy fabrics are high in demand.

The activewear & postpartum loungewear segment is expected to lead the market in the forecast period, due to the rising trend of athleisure and demand for comfortable, stylish, and nursing-friendly designs. The growing demand for functional clothing among expectant and new mothers is contributing to the segment's growth.

Which Fabric Type Segment Leads the Maternity Apparel Market in 2024?

The cotton + spandex blends segment led the largest market revenue of 46% in 2024, due to increased demand for comfortable, durable, soft, and moisture-wicking properly based maternity wears. Cotton + Spandex Blends fabrics provide softness and gentleness on skin, reduce irritation and discomfort, making it ideal for expectant mothers.

The organic bamboo & sustainable textiles segment is the second-largest segment, leading the market due to rising consumer preference for organic and sustainable maternity clothing. The trend of sustainability, maternity fashion, and high quality and durability of organic bamboo & sustainably sourced textiles are fueling the segment.

What Made the Mid-Range Segment Dominate the Maternity Apparel Market?

The mid-range segment dominated 52% market in 2024, due to a large consumer base for stylish, high-quality, and affordable clothing. The increased demand for quality and price-balancing maternity wear is the major factor contributing to the segment's growth. The growing awareness about maternity fashion in the middle class is fostering the demand for mid-range maternity wear.

The premium/luxury segment is the second-largest segment, leading the market, driven by rising female entry in workplaces, disposable income, and growing celebrity influence. The demand for premium/luxury maternity wear is increasing due to the trend of fashion, style, and photo shoots for expectant and new mothers.

Which Distribution Channel Dominated the Maternity Apparel Market?

The specialty & fashion retail segment dominated 43% market in 2024, due to the wide offering of maternity clothing options in specialty & fashion retail stores. The trend of fashion-forward designs makes specialty & fashion retail a convenient option for consumers.

The online & D2C e-commerce segment is expected to lead the market over the forecast period, due to rising accessibility, convenience, and personalized shopping experience demands among consumers. The online & D2C e-commerce segment provides a wide range of options with ongoing fashion trends, making them ideal for advanced shopping.

Top Maternity Wear Collection on Amazon-2025

What Made the Everyday Casual Wear Segment Lead the Maternity Apparel Market in 2024?

In 2024, the everyday casual wear segment led the revenue with 48%, due to the rising adoption of style and comfortable maternity clothes for everyday wear. The expectant mothers are prioritizing comfort and practicality, driving the need for clothing according to their changing lifestyle and body shapes. Additionally, growing online shopping is making it easier to purchase everyday casual wear.

The nursing & postpartum recovery apparel segment is the second-largest segment, leading the market, due to increased demand for comfortable, flexible, and functional clothing solutions for breastfeeding and postpartum recovery. The comfort of wearing after giving birth to a child is essential, contributing to the segment's growth.

By Product Type

By Fabric Type

By Distribution Channel

By End Use / Occasion

By Price Range

By Region

July 2025

July 2025

July 2025

July 2025