July 2025

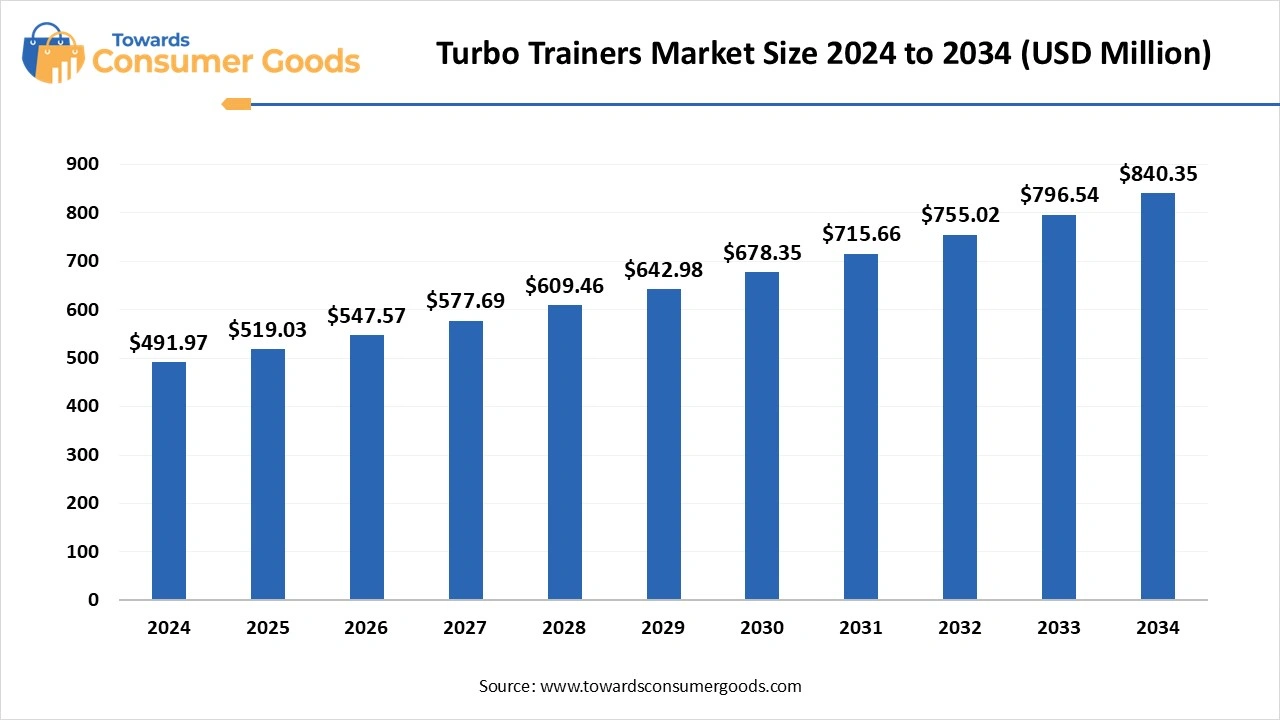

The global turbo trainers market size accounted for USD 491.97 million in 2024 and is expected to reach around USD 840.35 million by 2034, with a CAGR of 5.50% from 2025 to 2034. The demand. The demand for turbo trainers is increasing due to the growth of indoor fitness trends, offering a convenient exercise space for individuals.

Rise of Indoor Fitness Trends- Turbo Trainers Market to Expand Globally

A turbo trainer, also known as a bicycle trainer, refers to a static device that allows the user to ride a regular bicycle indoors while stationary. These devices offer resistance that offers an outdoorsy cycling feeling to the users. The turbo trainers market is expanding rapidly due to rising demand for convenient exercise preferences.

How is the Digital Fitness Ecosystem Promoting the Growth of Turbo Trainers?

The rising urbanization has led to many changes in lifestyle dynamics, which have led to many advancements in lifestyles. The turbo trainers market is expanding rapidly as most of the population is adopting healthy measures to improve their lifestyles. The digital fitness ecosystem is supporting the popularity of turbo trainers as platforms like Zwift, TrainerRoad, Wahoo SYSTM are providing virtual training platforms. These initiatives are marking significant growth as they also help the users to improve their social engagement in busy work lifestyles. Additionally, the rising advancements like virtual challenges, events and other activities are expected to maintain the demand for these devices in the future.

| Report Attributes | Details |

| Market Size in 2025 | USD 519.03 Million |

| Expected Size in 2034 | USD 840.35 Million |

| Growth Rate from 2025 to 2034 | CAGR of 5.50% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By product, By Resistance Mechanism, By Price Range, By Usage, By Distribuition Channel, By Region |

| Key Companies Profiled | Wahoo Fitness, Tacx (Garmin), Kinetic by Kurt, Bkool, Minoura, CycleOps (Saris), Elite Srl |

Product Innovation and Technology Integration

The integration of technologies like Artificial Intelligence (AI) and Machine Learning (ML) is playing a transformative role in enhancing the functionality of various devices in the fitness industry. The growth of smart turbo trainers provides advanced features like automated resistance control that adjusts according to workout intensity. ML algorithms also offer real-time coaching that can make immediate corrections and adjustments to techniques and cadence. Additionally, rising urbanization has limited access to nature, prompting companies to introduce Augmented Reality (AR) and Virtual Reality (VR) based devices that mimic natural environments and racetracks. Furthermore, companies are innovating foldable and portable products designed to fit compact urban homes, which may significantly help in the future.

Lower Penetration in Underdeveloped Regions

The demand for indoor fitness trends is mainly driven by the urban population due to their lifestyles. The turbo trainers market in the rural areas is limited due to limited awareness regarding indoor fitness solutions, which hampers the sales of the companies. Additionally, the lower disposable income among the rural population also restricts them from investing in these solutions. Additionally, the companies do not set up their manufacturing base in underdeveloped economies, which also raises many import barriers. The rising costs of new models may also affect its expansion in these areas.

North America dominated the turbo trainers market by generating the largest revenue share in 2024. The dominance of the region is attributed to the higher technology adoption in the health and fitness industry, where individuals also respond on a high note. The rising prevalence of health conditions has led to the increasing demand for workout equipment like cycling culture. The higher educational awareness also promotes the growth of turbo trainers, which can be used at convenient locations.

The US stands as a prominent player in the market due to the presence of a leading cycling community in the country, which has an upper hand on this device penetration. The American population also have a higher purchasing limit as compared to the others, which allows companies to innovate more advanced models. The country is also well-known for its tech integration that provides a upper hand for US based companies to mark their presence on the global market scenario.

Asia Pacific is anticipated to emerge at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the Asian countries is attributed to the rising middle-class population, mainly in countries like India and China, which is increasing their purchasing power for this equipment. The turbo trainers market is anticipated to gain more popularity due to rising advancements from countries like Japan, which is focused on tech-driven innovation that might create a significant presence in the upcoming years.

China is one of the hotspots for turbo trainers in China due to the dominance of middle-class expansion. The market is anticipated to gain significant outcomes from the country due to changing lifestyle shifts in the country. The rising health awareness promotion from the Chinese government is also giving leverage to the local manufacturers to promote affordable workout equipment for individuals. The rising e-commerce expansion in the country is anticipated to increase the penetration of turbo trainers in the upcoming years.

The direct drive turbo trainers segment accounted for the largest revenue in the turbo trainers market in 2024. The growth of the segment is attributed to their accuracy of power readings, which makes them more reliable among professional cyclists, who use used for their training and rehabilitation process. The rising demand for indoor cycling is also leading towards the adoption of these trainers as the companies are innovating advanced products with low vibration and noise that can also be adopted in commercial settings like premium gyms and training centers.

The wheel-on turbo trainers segment is anticipated to emerge at the fastest CAGR during the forecast period. The growth of the segment is attributed to the cost-effectiveness of these devices, which makes them more compatible for use among urban consumers. The turbo trainers market is expected to grow rapidly as home-based fitness is also expanding at a rapid pace, where social media platforms and other digital applications play an influential role. The suburban areas are also keen on investing in equipment, which leads towards rising product innovation from companies for more home-oriented and affordable products.

The electronic segment generated the largest revenue share in 2024. The mechanism helps in automatically adjusting to their software platforms. The dominance of the segment is attributed to the rising automation and application integration in these settings. The mechanism also helps in using advanced training features like ERG mode and real-time response options, which play a vital role in creating a structured training pattern. The rise of the advanced digital ecosystem is one of the major factors that has been significantly helping in attracting significant demand. Additionally, the rising number of premium settings like gyms, sports complexes and others is anticipated to mark more investments in these products.

The magnetic segment is anticipated to grow at the fastest CAGR during the forecast period. The mechanism requires manual adjustment, which makes it more affordable and accessible. The turbo trainers market is expected to rise significantly as the home-based fitness trend is adopting these mechanism-based trainers due to their affordability. Additionally, the underdeveloped regions are also expected to adopt these devices due to the rising popularity of indoor fitness.

The standard segment generated the largest revenue share in 2024. The dominance of the segment is attributed to the wider consumer appeal for the beginner consumer base. The turbo trainers market is expanding rapidly due to the rising health awareness, which is boosting the use of these devices for basic workouts. This market has evolved with these standard products, which have marked its reliability over the past few years.

The smart segment is anticipated to emerge at the fastest CAGR during the forecast period. The rising advancements in the health and fitness industry have innovated app-based fitness systems, which are increasing the popularity of smart turbo trainers. The companies are keen on investing in AI and internet of things (IoT), which will help in making more product offerings to consumers in the upcoming years. The rising disposable incomes are also leading towards a higher focus on health, which is promoting personalized training through this smart equipment.

The mid ($200-$500) segment generated the largest revenue share in 2024. The growth of the segment is attributed to the higher preference for balance in product quality and affordability. The companies are focusing on innovating advanced and affordable products for middle-class consumers. The rising number of intermediate users is also increasing the demand for these products, which will make them more affordable in the coming years due to market competitiveness. The companies are stepping into this price segment to gain a stable revenue growth due to higher product demand.

The commercial segment generated the largest revenue share in 2024. The growth of the segment is attributed to the higher product volume in these settings. The turbo trainers market is expanding rapidly due to rising collaboration between institutions and manufacturers that can help in generating more revenue. This allows the companies to generate high-end products due to higher consumer demand. Additionally, the rising popularity of rehab and therapy centers is anticipated to promote the use of these products on a larger scale. The rising growth of cycling as a professional carrier is anticipated to help the market grow at a significant pace.

The personal segment is anticipated to emerge at the fastest CAGR from 2025 to 2034. The rising home fitness trend is mainly being adopted in urban homes due to hectic work lifestyles. The companies are entering into home-based segment to offer them affordable options. The rising health awareness among the millennial and Gen Z is anticipated to be a game changer in the upcoming years.

The offline segment generated the largest revenue share in 2024. The dominance of the channel is attributed to the hands-on testing experience offered in the settings. The turbo trainers market has been mainly sold on these channels due to higher consumer trust and reliability. These channels have expert assistance, which allows consumers to get a better understanding of the particular product. Additionally, the commercial settings have partnerships with these suppliers, which help them in gaining significant revenue.

The online segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment is attributed to the rapid growth of E-commerce platforms, which make online shopping affordable to consumers. Leading manufacturers are also going digital, which helps in gaining consumer trust and reliability. Additionally, these channels offer a wider product range with technologies that help in comparing various models. The turbo trainers market is anticipated to expand more rapidly as e-commerce is getting more popular in developing countries.

Expansion: In September 2024, Zwift expanded its virtual gear shifting system to more turbo trainers from Wahoo, Elite, JetBlack, and Van Rysel through its Zwift Ready program. The feature, previously limited to select models, now enables a wider range of users to simulate gear changes digitally without mechanical shifting. (Source: forbes )

Launch: In July 2024, Italy-based Elite launched three new indoor-focused smart training products at Eurobike 2024, Germany, enhancing its virtual cycling lineup with advanced features like virtual shifting and improved gradient simulation. (Source: cyclingnews)

The global bath linen and accessories market size was valued at USD 12.31 billion in 2024 and is projected to grow from USD 13.13 billion in 2025 to U...

July 2025

July 2025

July 2025

July 2025