July 2025

The global travel retail market size was valued at USD 75.46 billion in 2024 and is estimated to hit around USD USD 187.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% during the forecast period 2025 to 2034. This market is growing due to a resurgence in international travel, increased consumer spending at transit hubs, and rising demand for premium and exclusive goods offered in travel environments.

The global travel retail market is undergoing rapid expansion as airports; cruise terminals and border shops witness a post-pandemic recovery in footfall and spending. Brands are increasingly adopting omnichannel strategies, while immersive retail experiences and curated product offerings are redefining the travel shopper journey. Premiumization, personalization, and convenience are becoming key decision factors for consumers at transit locations.

Retailers provide seamless experiences across digital and physical touchpoints by utilizing AI AR and real-time inventory data. Pre-order and collect options like loyalty integration and mobile payments are changing the retail landscape in airports and other travel hubs. Brand-retailer collaboration is increasing the appeal of products as consumers look for unique and limited-edition items.

| Report Attributes | Details |

| Market Size in 2025 | USD $187.86 Billion |

| Expected Market by 2034 | USD $82.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Distribution Channel, By Geographic |

| Key Companies Profiled | Avolta AG, Lotte Corporation, China Duty-Free Group Co. Ltd., LVMH Moët Hennessy Louis Vuitton (DFS Group), Gebr. Heinemann SE & Co. KG, Lagardere Travel Retail Group, The Shilla Duty-Free, The King Power International Group, Aer Rianta International cpt, Duty-Free Americas |

A combination of captive audience's high foot traffic and discretionary spending travel retail is a great place for luxury brands to grow. Brands can create memorable engagement moments that boost traveler satisfaction and increase spend per passenger by making strategic investments in store design personalized services and exclusive merchandise. With curated shopping tours, art galleries, and opulent lounges, airports are evolving into destination retail hubs. Companies that provide temporary travel exclusives have the potential to increase repeat business and brand affinity.

Bridging digital gaps and supply challenges in global travel hubs

Despite strong demand, disparities in retail tech adoption and frequent inventory misalignment affect shoppers' experience. Complex import/export rules, fluctuating currency rates, and geopolitical tensions also create unpredictability for stakeholders. Vendor delays and regional taxation inconsistencies further impact inventory turnover and pricing. Addressing these issues requires cross-border logistics coordination and digital supply chain management systems.

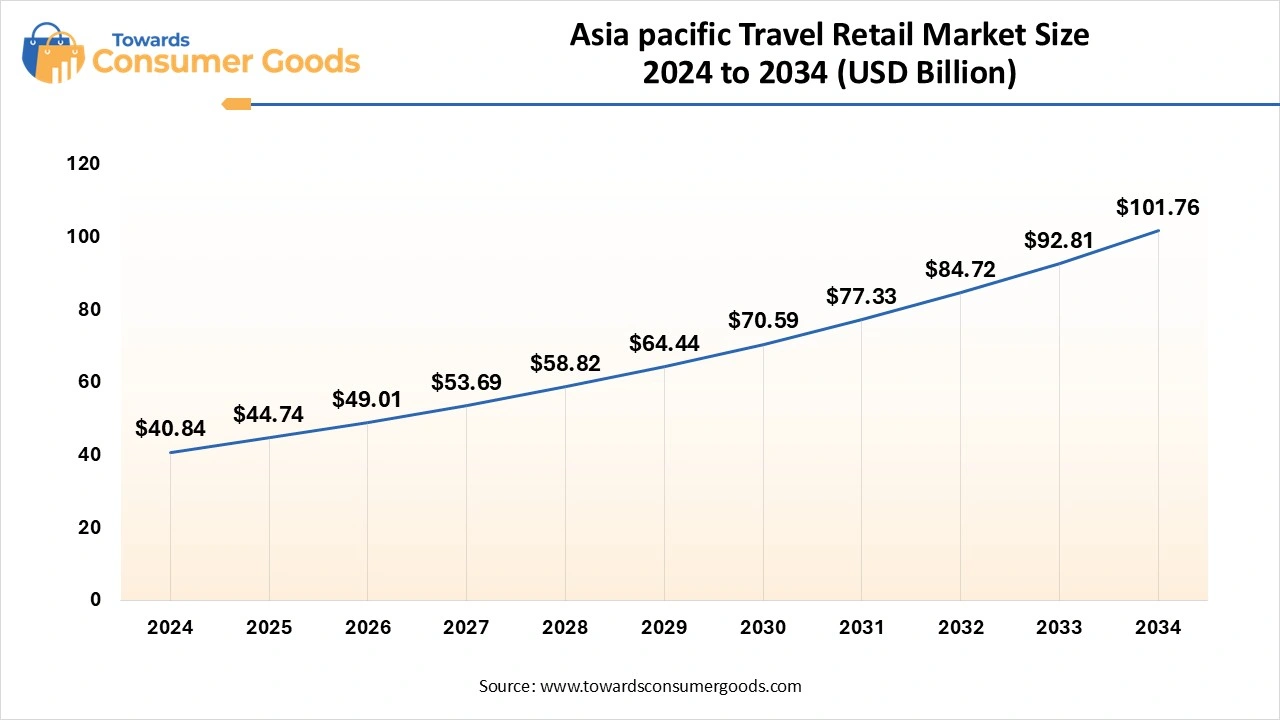

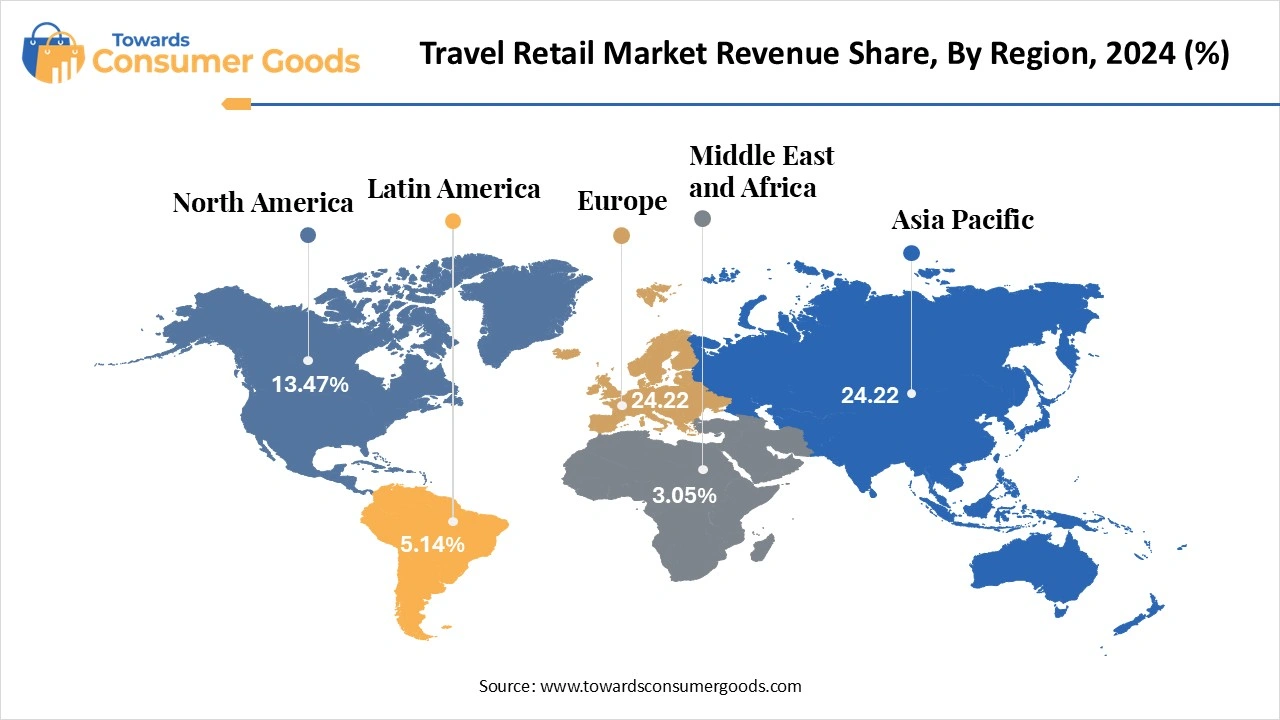

The Asia Pacific travel retail market size was valued at USD 40.84 billion in 2024 and is expected to be worth around USD 101.76 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 9.56% over the forecast period 2025 to 2034. Asia Pacific emerged as the leading region in the global travel retail market owing to major economies experiencing rapid urbanization, robust economic growth, and rising consumer demand. Product adoption has increased across several industries because of growing industrialization and infrastructure development. The market momentum in this region has been further accelerated by government initiatives that support local manufacturing and technology adoption.

A robust demand environment is also maintained by the large population base and the growing middle class. Regional growth is being fueled by rising investments in industries like electronics retail and construction which are aided by advantageous regulatory frameworks and easy access to reasonably priced labor and raw materials.

North America is projected to experience the fastest growth in the travel retail market fueled by increased use of technology and product development driven by innovation. Demand is being driven by a mature digital ecosystem, high per capita income levels, and increased consumer awareness in several important industry segments. The government's encouragement of efficiency and sustainability is also driving up investment in contemporary technologies. Further altering market dynamics is consumer preference for cutting-edge networked and sustainable products. Due to broad adoption in the commercial industrial and residential sectors, the region's emphasis on automation and RandD is also driving growth

Europe is currently experiencing the most rapid growth in the travel retail market, marked by high consumer demand for high-end sustainable products with stringent environmental regulations and energy efficiency standards. Strong policy frameworks supporting green initiatives and high levels of technological advancement have made this region a progressive marketplace. Smart city initiatives, a strong manufacturing base, and a greater focus on circular economy concepts are the main drivers of market activity. Product development trends are being shaped by consumer preferences for eco-friendly alternatives and quality and innovation.

Perfumes and cosmetics segment dominated the market in 2024. Due to duty-free shopping and specially designed product launches for tourists, these categories are major sources of income for airports and other transit hubs. To appeal to wealthy tourists' luxury brands are increasingly releasing perfume and cosmetic gift sets and travel-exclusive editions. These unique products along with individualized services and in-store experiences support the segment's continued growth and high sales volumes.

Electronics and gifts segment is anticipated to witness the fastest growth over the forecast period driven by growing consumer interest in smart wearables, tech devices, and unusual mementos. A wide range of tourists looking for convenience and novelty find these products appealing. The most recent smartphones, wireless accessories, and smart travel devices are being added to retailers' product lines. Another factor driving demand in this market is the expansion of gifting options that include personalized and customizable goods.

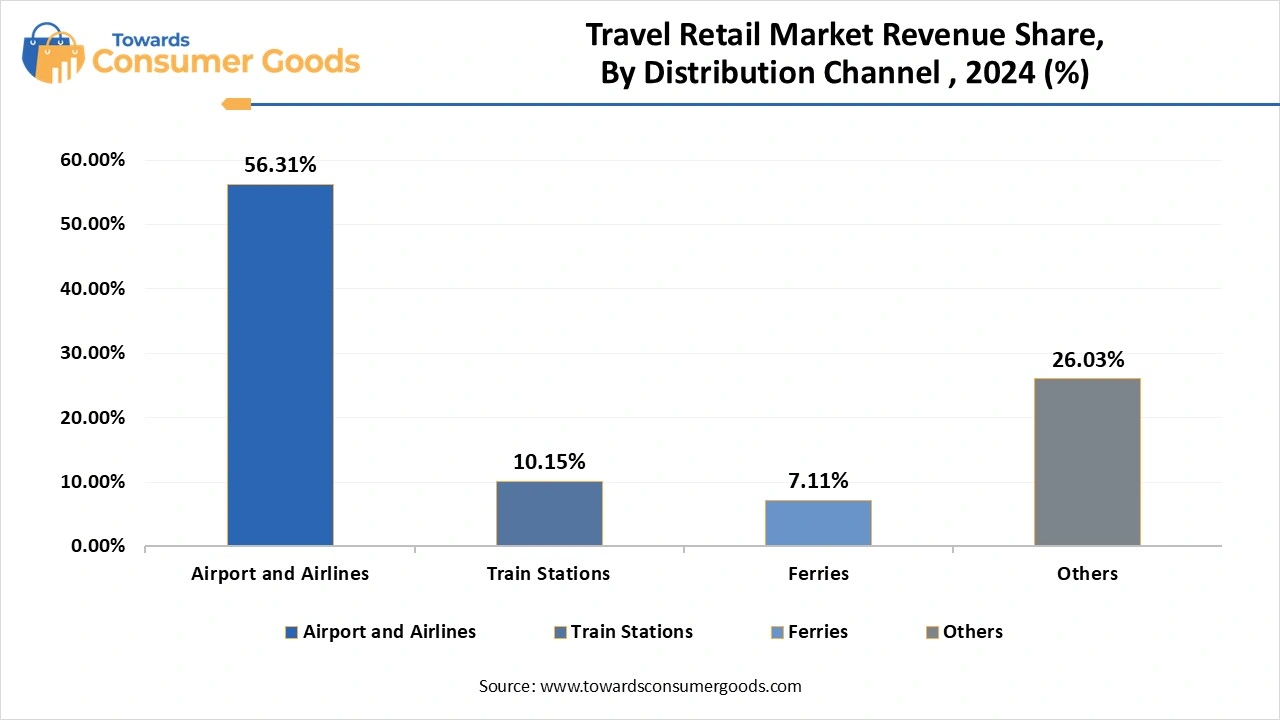

Airport & airline segment dominated the market in 2024 because of the large number of passengers and the long dwell times of captive audiences. By providing branded retail services and exclusive merchandise both onboard and through in-flight sales platforms, airlines also contribute. Airports and airlines can take advantage of high-margin duty-free sales and exclusive product launches due to their strategic location and varied passenger profiles, which maintain their status as important retail hubs.

Railway station outlets/shops segment is anticipated to witness the fastest growth over the forecast period particularly in areas with networks of high-speed rail. For commuters and local travelers, these outlets provide easy access points. To increase sales outside of airports operators are expanding their retail offerings in railway station shops by adding more electronics gifts and cosmetics. Customer engagement is also enhanced by the combination of contactless and digital shopping.

By Product

By Distribution Channel

By Geographic

July 2025

July 2025

July 2025

July 2025