June 2025

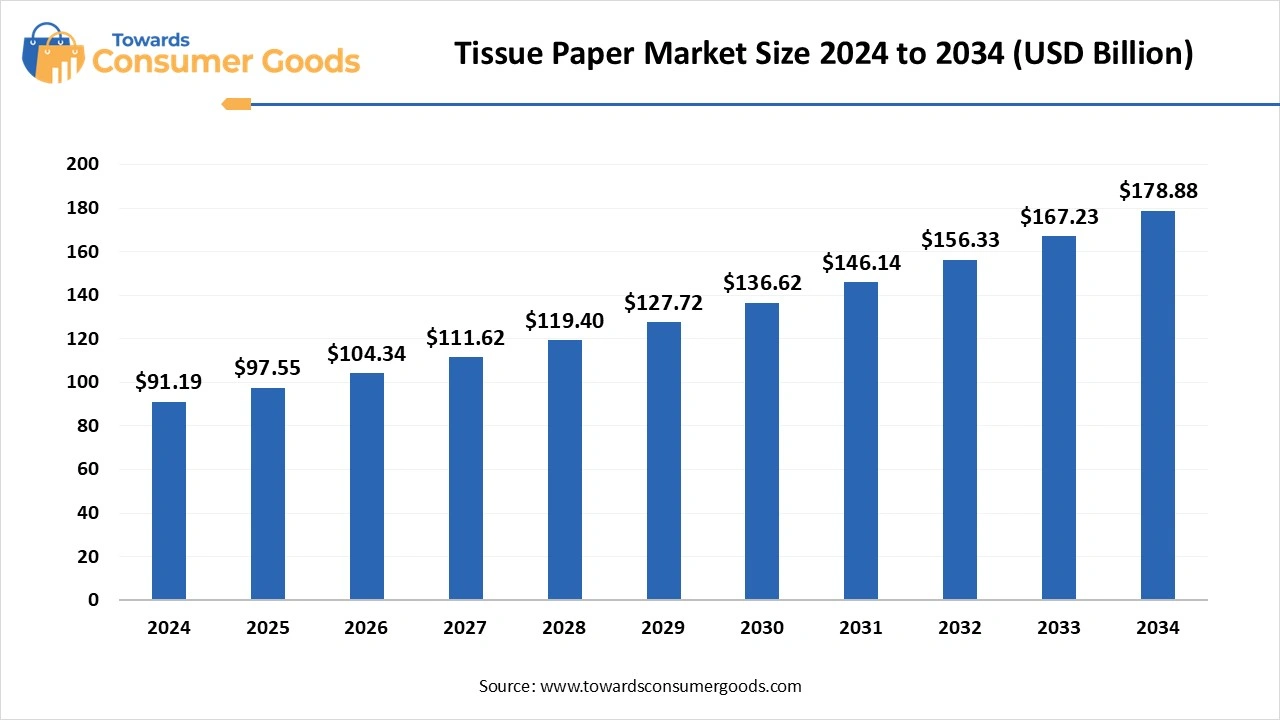

The global tissue paper market size was valued at USD 91.19 billion in 2024 and is estimated to reach around USD 178.88 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.97% during the forecast period 2025 to 2034. The tissue paper market is a vital component of the global hygiene and paper products industry, driven by rising consumer awareness about health, sanitation, and convenience. From household wipes to commercial-grade sanitary rolls, tissue paper products have become everyday essentials across both developed and emerging markets.

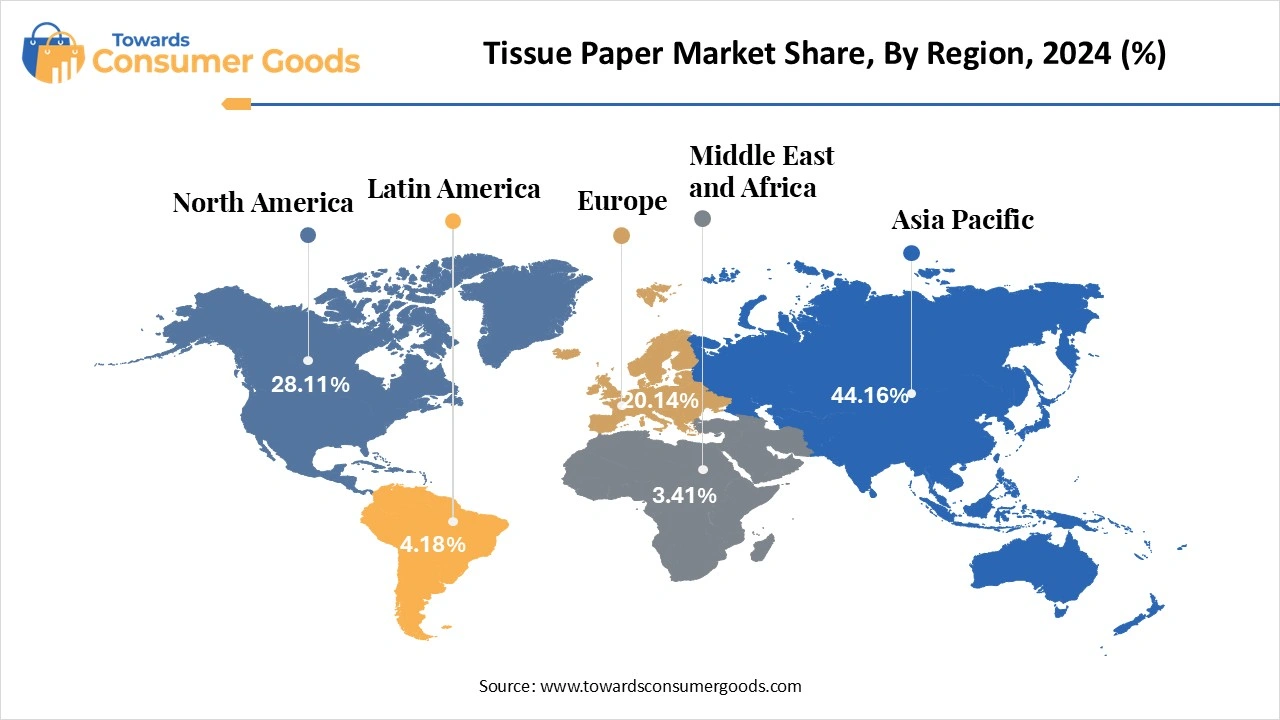

Once considered a basic hygiene product, tissue paper has evolved into a multi-billion-dollar global industry, with applications spanning households, healthcare, hospitality, and commercial settings. The market is fueled by increasing urbanization, rising living standards, and a growing emphasis on cleanliness and personal hygiene, especially post-pandemic. Developed economies in North America and Europe have mature tissue markets with high per capita consumption, while Asia-Pacific and Latin America are experiencing rapid growth due to expanding middle-class populations and improvements in sanitation infrastructure. Innovations in eco-friendly and biodegradable tissues are also driving growth, as sustainability becomes a top consumer priority. Moreover, the rise of e-commerce and private-label brands is reshaping distribution dynamics, offering new opportunities for both global giants and regional players.

| Report Attributes | Details |

| Market Size in 2025 | USD 97.55 Billion |

| Expected Size by 2034 | USD 178.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.97% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application, By Distribution Channel, By Geographical Region |

| Key Companies Profiled | Procter & Gamble (Cascade), Kimberly - Clark, Essity, Kirkland Signature (Costco), Georgia- Pacific, Solaris Paper, Seventh Generation, Charmin Paper, Angel Soft, Naturelle |

| (25-45 years) Core consumer base | (55+ years) Senior loyal customers |

| The age group represents the largest share of global tissue paper purchases, especially in households. These consumers are often primary decision-makers for family needs, purchasing a wide range of products such as toilet paper, facial tissues, napkins, and paper towels. Their buying decisions are influenced by: Brand reputation, softness and strength, eco-friendly options, and bulk packs. | Consumers aged 55 and older, especially in developed markets, are consistent users of tissue paper products and often favor premium products and hypoallergenic varieties, especially facial tissues and moist wipes. Health and comfort are key considerations for this demographic. They tend to be brand-loyal and often value sustainability and packaging simplicity. |

The global tissue paper market is poised for substantial growth, driven by a convergence of social, economic, and environmental shifts. One of the most powerful drivers is urbanization, especially in emerging economies across Asia, Africa, and Latin America. As more people move to cities, there is a sharp rise in the demand for convenient, disposable hygiene products from toilet paper and paper towels to facial tissues and wet wipes. In parallel, the increasing awareness of personal hygiene and health, particularly after the COVID-19 pandemic, has accelerated the use of tissue products across households, schools, public places, and medical facilities.

This awareness has normalized the use of tissues even in regions where traditional alternatives were once preferred. Additionally, the rise of eco-friendly and biodegradable tissues presents a unique growth frontier. With sustainability becoming a non-negotiable concern for younger consumers, brands that offer recycled materials, plastic-free packaging, and carbon-conscious manufacturing are gaining traction. E-commerce also offers a major growth lane, especially for private labels and niche tissue brands. Consumers are embracing subscription-based and bulk-buying models, creating opportunities for direct-to-consumer platforms that deliver convenience and affordability.

Despite strong global demand, the tissue paper market faces several notable constraints that could impact its expansion, particularly in cost-sensitive or resource-strained regions. One of the primary challenges is the high cost of raw materials, especially wood pulp and recycled fibre. These costs are volatile and subject to global supply chain disruptions, which in turn drive up retail prices and pressure profit margins. Another major restraint is the environmental footprint of tissue production. The industry is resource-intensive, requiring significant water, energy, and chemicals, all of which contribute to pollution and deforestation concerns. In regions with strict environmental regulations, compliance can limit production flexibility and increase operating costs.

Which Region Holds the Largest Share in Tissue Paper Market?

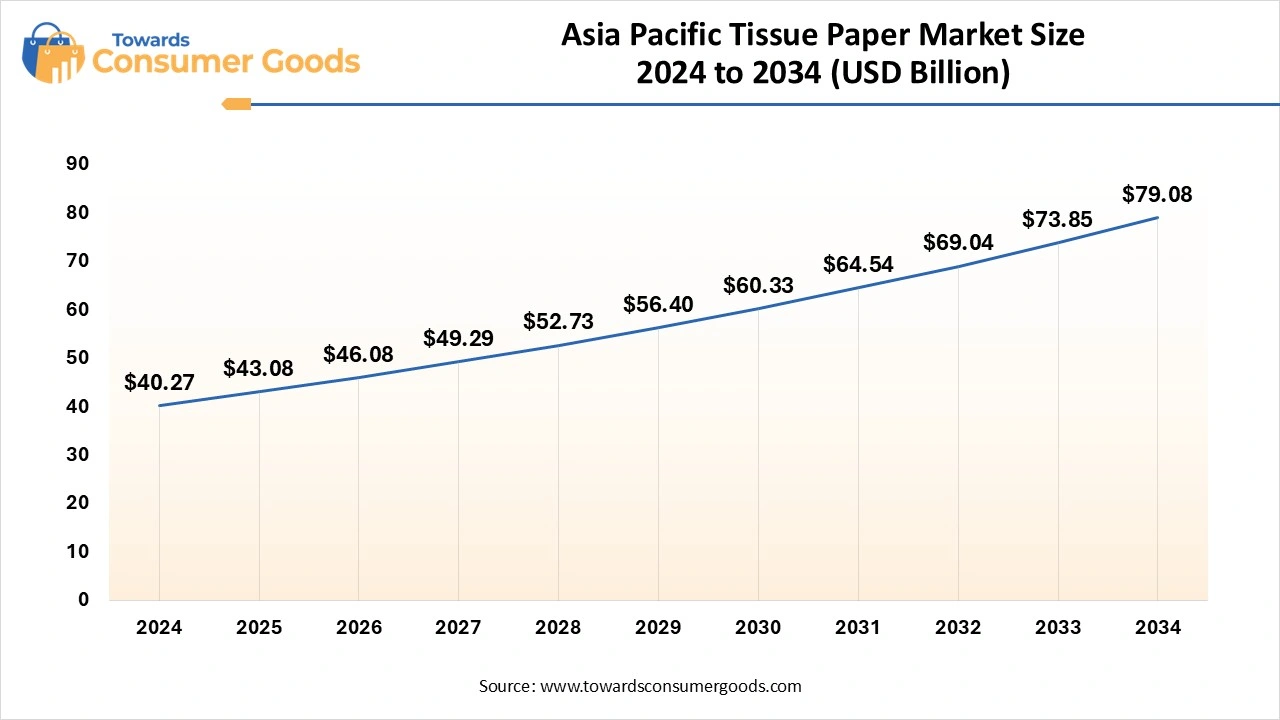

The Asia Pacific tissue paper is expected to increase from USD 43.08 billion in 2025 to USD 79.08 billion by 2034, growing at a CAGR of 6.98% throughout the forecast period from 2025 to 2034.

Asia-Pacific is the undisputed leader in the global tissue paper market, driven by massive population density, rising disposable incomes, and rapid urbanization. Countries like China, India, Indonesia, and Vietnam are experiencing a surge in hygiene awareness and lifestyle upgrades, which have made tissue paper an everyday essential. China dominates both production and consumption, supported by well-established manufacturing hubs, domestic raw material availability, and government-backed industrial expansion. Local brands are thriving alongside global players, catering to a wide demographic from premium urban consumers to rural newcomers entering the hygiene economy.

Moreover, the growing middle class and youth population are embracing convenient, on-the-go tissue products such as facial tissues and wet wipes, further propelling demand. In nations like India, where tissue use was once limited, changing cultural norms and increasing sanitation campaigns have significantly expanded the consumer base. Asia-Pacific is also at the forefront of e-commerce adoption, with digital platforms enabling direct-to-consumer tissue sales, particularly in Tier 2 and Tier 3 cities.

With expanding retail networks, improving infrastructure, and a strong push for eco-friendly products, the region is expected to remain the powerhouse of global tissue demand for the foreseeable future.

How Is North America Tearing Through the Competition as the Fastest-Growing Region?

North America is emerging as the fastest-growing region in the tissue paper market, thanks to a dynamic combination of premium product demand, eco-conscious consumer behavior, and technological innovation. While the market is already mature in terms of per capita tissue consumption, recent trends are accelerating its evolution, rather than slowing it. Consumers in the U.S. and Canada are shifting toward luxury and sustainable tissue products, including ultra-soft, hypoallergenic, and bamboo-based options.

There is a strong focus on environmental responsibility, with high adoption of recycled and unbleached tissues, as well as plastic-free packaging. Another key growth factor is the booming Away-From-Home (AFH) segment, as commercial establishments, healthcare centers, and hospitality venues increase usage following the COVID-19 hygiene reset. Simultaneously, private label expansion through major retailers like Walmart, Costco, and Amazon is reshaping consumer habits by offering affordable, high-quality alternatives to name brands.

North America is also leading in smart manufacturing, with companies investing in AI, automation, and circular production models to reduce costs and environmental impact. Combined with a strong online retail ecosystem and rising demand for sustainable convenience, North America is poised to outpace other regions in growth velocity.

The home application segment continues to dominate the global tissue paper market, accounting for most of the total consumption. Tissue paper products used at home such as toilet paper, kitchen towels, facial tissues, and napkins are staples of daily life, making them essential and recurring household purchases. Consumers prioritize comfort, hygiene, and softness, particularly in personal care and cleaning routines.

This segment thrives due to the predictable consumption pattern, with most households purchasing tissue products weekly or monthly in bulk. In both developed and emerging economies, home use tissue demand is closely linked to lifestyle upgrades, growing awareness of cleanliness, and increasing disposable incomes. What solidifies this segment’s dominance is its product diversity: families use tissues not just for sanitation but also for wiping, drying, makeup removal, and baby care.

On the other hand, the Away-From-Home (AFH) segment is experiencing the fastest growth, driven by a rebound in commercial activities post-pandemic and the reopening of offices, educational institutions, hotels, airports, malls, and hospitals. This includes large-volume tissue products like jumbo toilet rolls, folded paper towels, and industrial wipes used in public washrooms and service facilities like stricter public hygiene standards, increased sanitization efforts in hospitality and healthcare, a surge in business travel and tourism and corporate and institutional awareness of hygiene branding.

Tissue manufacturers are tapping into this opportunity by offering cost-efficient, bulk-packaged solutions and durable, high-absorbency products tailored for high-traffic environments. As hygiene becomes a central public concern, the AFH segment is likely to outpace traditional growth rates in the years to come.

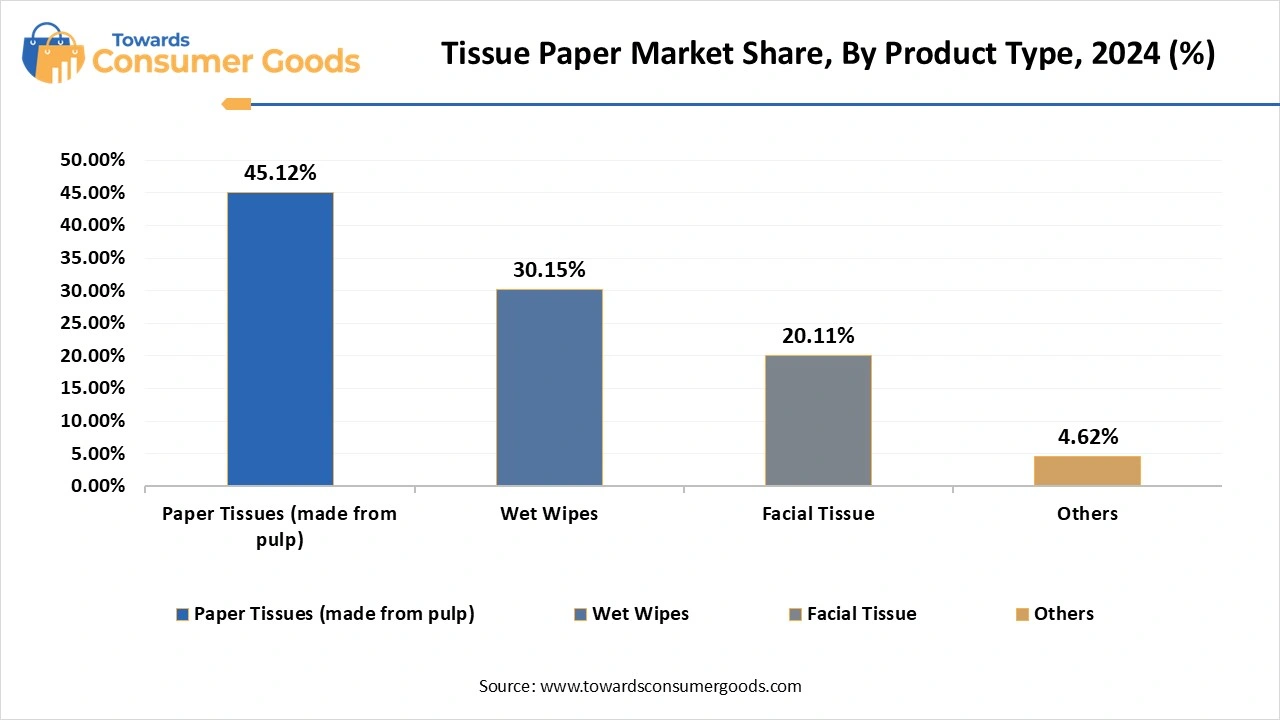

Paper tissues remain the dominant product type in the tissue paper market due to their versatility, affordability, and universal demand. This category includes a wide range of products like toilet tissue, kitchen rolls, napkins, and general-purpose soft tissues. Consumers across all demographics and geographies use paper tissues in some form, whether it is for personal care, hygiene, cleaning, or meal-time convenience. Manufacturers continue to innovate within this segment, introducing ultra-soft textures, multi-ply options, embossed designs, and natural fibre products to appeal to evolving consumer preferences.

The mass appeal of paper tissues is also supported by their ease of availability through retail, supermarkets, and convenience stores, as well as bulk affordability for families. Moreover, paper tissues are highly scalable in production and adaptable to a wide variety of markets, from luxury tissues in developed nations to low-cost alternatives in emerging economies. This adaptability has helped maintain the segment's dominance across global markets.

Moreover, facial tissues are the fastest-growing product category, particularly among urban consumers, thanks to increasing interest in personal care, skin sensitivity, and portability. These tissues are used not only for nose and face wiping but also for makeup removal, on-the-go hygiene, and skincare routines. Consumers now expect facial tissues to be soft, dermatologically safe, and aesthetically appealing.

Growth is being driven by rising disposable income, higher awareness of skin-friendly products, and growing demand for premium features like lotion-infused or scented tissues. The convenience of pocket packs and travel-size packaging also appeals to younger consumers and frequent travellers. Additionally, the surge in seasonal allergies, pollution, and flu-related hygiene consciousness has turned facial tissues into a must-have item in many households and workplaces, further accelerating their global demand.

Despite digital disruption, offline retail remains the dominant distribution channel for tissue paper products. Supermarkets, hypermarkets, grocery chains, and convenience stores account for the largest volume of sales, offering instant accessibility, bulk purchasing options, and the ability to physically assess product quality before buying. In emerging markets, offline channels are often the only available or preferred method of purchase, especially where internet penetration or trust in online shopping is low. Major retailers also dominate with private label offerings, further strengthening the appeal of physical retail outlets.

Promotions, product bundling, and in-store visibility drive impulse purchases, especially for tissue categories like toilet paper and paper towels. Moreover, institutional buyers, such as hotels, schools, and offices, often purchase directly from wholesalers and distributors, adding to the dominance of the offline channel.

On the other hand, online retail is the fastest-growing channel, fueled by changing shopping behaviors, convenience, and the rise of e-commerce platforms. Consumers increasingly value the ease of doorstep delivery, subscription services, and the ability to compare products, reviews, and prices. Platforms like Amazon, Alibaba, and regional e-commerce giants have made it easier for both global and niche tissue brands to reach consumers directly. The COVID-19 pandemic significantly accelerated this trend, with many consumers now preferring to stock up on tissue essentials online.

E-commerce also supports customized marketing, such as targeting health-conscious buyers with eco-friendly options or offering bundle deals. As mobile commerce and digital payment options grow, the online segment is expected to continue expanding rapidly, especially among younger, urban populations.

By Application

By Product Type

By Distribution Channel

By Region

Based on comprehensive market projections, the global eyewear market size was accounted for USD 201.19 billion in 2024 and is expected to be worth aro...

The global handbag market size is calculated at USD 56.85 billion in 2024, grew to USD 60.57 billion in 2025 and is predicted to hit around USD 107.22...

Based on comprehensive market projections, the global connected apparel market size accounted for USD 2,793.79 billion in 2025 and is forecasted to hi...

The U.S. range cooker market size was valued USD 1.95 billion in 2024 and is projected to grow from USD 2.13 billion in 2025 to USD 4.81 billion by 20...

June 2025

June 2025

June 2025

June 2025