July 2025

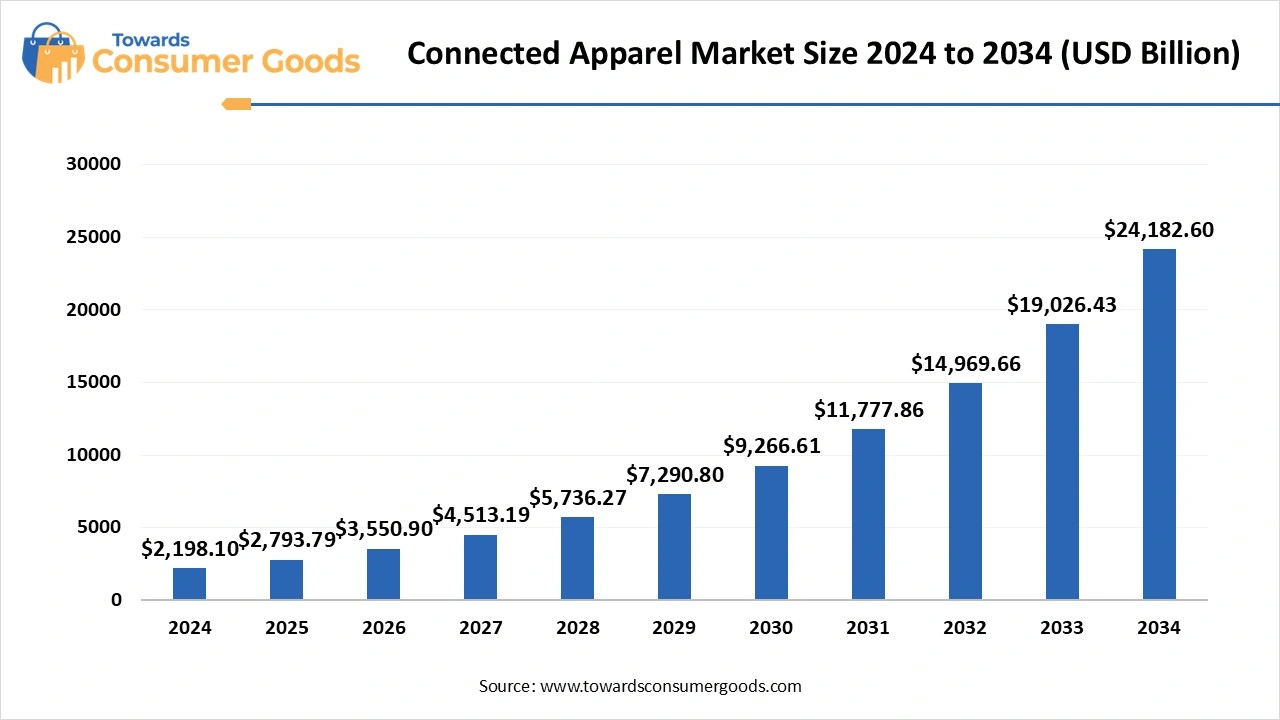

The global connected apparel market size reached USD 2,198.1 billion in 2024 and is projected to hit around USD 24,182.6 billion by 2034, expanding at a CAGR of 27.10% during the forecast period from 2025 to 2034. The demand for connected apparel is attributed to the growing health consciousness among individuals in urban areas. The rising technological adoption is helping them to monitor their real-time conditions

Connected apparel is the integration of digital technology in clothing, which usually includes sensors, microprocessors and Bluetooth or Wi-Fi connectivity features that are used to analyze real-time data of the user. They are also referred to as smart clothing and wearable tech apparel, which are used in different applications like healthcare, military and defence, fitness and many more.

The rising demand for real-time monitoring is one of the major drivers that has led to a larger consumer base in recent years. The connected apparel market is growing rapidly as many consumers are preferring instant health feedback like heart rate, respiration, posture and other metrics.

This is helping the consumers to make instant changes according to the feedback. Moreover, athletes are investing in this apparel as they have a higher demand for metric updates, which helps them in enhancing their overall performance. The healthcare sector is also investing in these apparels, which give live health data to the professionals that can improve the operational outcomes.

| Report Attributes | Details |

| Market Size in 2025 | USD 2,793.79 Billion |

| Expected Size by 2034 | USD 24,182.6 Billion |

| Growth Rate from 2025 to 2034 | CAGR 27.10% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Technology Integration, By Consumer Group, By Distribution Channel, By Region |

| Key Companies Profiled | Ralph Lauren, Sensoria, Wearable X, AiQ Smart Clothing, Ajanta Shoes, Arrow, Athos, Baliston, Hexoskin, OMsignal |

The healthcare sector is marking significant technological adoption due to the rising shift towards preventive care and remote patient monitoring. The connected apparel may generate significant revenue due to rising requirements for constant tracking of oxygen levels, body temperature and heart rate of the patients when not under professional surveillance. The rising incidence of chronic diseases like diabetes, heart diseases and other respiratory issues, drives increasing growth in home-based healthcare. The majority of the population is elderly, who require constant monitoring. As a result, the health organizations are investing in smart apparel through tie-ups and deals, which include purchasing apparel in bulk.

The smart apparel usually includes expensive technologies like biosensors, microchips and others that make them costly. As a result, the connected apparel market may face certain challenges due to its limited consumer approach, mainly in the developed regions. Additionally, these garments also require constant maintenance for advanced functionality, making them more expensive. This may limit its expansion in the rural areas due to lower consumer awareness and requirements.

How did North America Dominate the Connected Apparel Market in 2024?

North America dominated the connected apparel market by generating the highest revenue share in 2024. The region's dominance is attributed to the higher adoption of technology in everyday use, which has managed to generate revenue in the apparel sector. The higher health and fitness awareness in countries like the United States and Canada is also one of the major reasons promoting the growth of products like smart shirts and sports bras with biosensors. The rising popularity of sports-oriented population is also expected to play a vital role in promoting the growth of the connected apparel market.

United States Connected Apparel Market Trends

The United States stands as a major player in the North American region due to the higher disposable incomes that can afford this smart apparel. The presence of major tech companies like Google, Apple and Under Armour is heavily investing in smart apparel and wearables, which is helping in generating significant revenue. The US Healthcare sector is also focused on improving its overall operational outcomes, which is creating a huge market scope for the new startups to innovate connected apparel integrated with sensors and IoT. The rising disposable income of Americans is also expected to support many companies in innovating new products for different uses.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the region is mainly driven by the rising health awareness in developing countries like China, Japan and Southeast Asia that are preferring this smart apparel, which would help them in generating significant revenue.

The connected apparel market is expected to gain rapid demand in the coming years due to the rising social media usage of young populations like Gen Z and Millennials in fitness and other tasks. The healthcare infrastructure is also expected to support these initiatives due to higher investments in healthcare digitalization.

China Connected Apparel Market Trends

China stands as a prominent player in the Asian region due to its dominance in textile and electronics manufacturing on a global level. The technological capabilities among the local companies are expected to play a vital role in generating significant revenue in the coming years, too. The connected apparel market is also poised to expand rapidly due to the rising disposable income in the middle-class section, which is shaping their preferences towards purchasing connected apparel. Moreover, the lower manufacturing costs in the country is expected to gain global investments in the coming years, which would help them to generate massive ROI.

How did the clothing segment dominate the product segment in 2024?

The clothing segment marked its dominance by generating the highest revenue share in 2024. The dominance of the segment is attributed to its wider product application that can be targeted in fitness, sports, healthcare, defence and fashion. Moreover, they are broader in terms that include topwear, bottom wear and undergarments. The consumer response is also mainly attracted by these products as they cover a larger portion of the body, helping in detecting accurate body metrics. The majority of the demand is expected to be attracted from the sports and fitness industry as the youth engagement is expected to rise rapidly in future.

Why did the top wear emerge as a dominant sub-segment?

The top wear products include smart t-shirts, jackets, sports bras and vests, which have a higher popularity due to their comfort and usability. The majority of health monitoring is done from the upper body, like heart rate, breathing rate, posture and many more, making it more ideal for placing sensors and microchips. The companies are investing in higher adoption of top wear due to the rising number of gym-goers preferring lightweight and stretchable apparel.

Why did the sensor-embedded dominate connected apparel technology in 2024?

The sensor-embedded segment generated the highest revenue in 2024. The dominance of the segment is attributed to its core technology that makes the apparel ‘smart’ in an actual sense. The connected apparel market may witness rapid growth as these sensors are being used in multiple applications like healthcare, sports and fitness, military and industrial. The companies are now investing heavily to boost their textile production by integrating advanced technologies like AI and ML. Further, these companies are increasing their investments in commercial use, which will make it more popular in the coming years.

The Bluetooth and Wi-Fi connectivity segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The majority of the growth is attributed to the rising requirement for real-time data transmission into the mobile applications, healthcare dashboards and cloud platforms. Many applications of the connected apparel market demand constant feedback, which makes it more demanding in the overall textile technology. The rising RPM (remote patient monitoring) is expected to increase the Bluetooth and Wi-Fi connectivity in this apparel.

What made male consumers dominant in connected apparel users in 2024?

The male segment accounted for the highest revenue share in 2024. The dominance of the male segment is attributed to its higher adoption in health and fitness applications used to track their workouts, heart rates, muscle exertion and many more. Apart from the dominance in sports and athleisure, connected apparel is largely used by males in defence and industrial use. As a result, the companies are also investing heavily in male apparel like t-shirts, jackets, vests and many more. The male population suffering from chronic conditions is also higher, which attracts investments in this apparel.

Distribution Channel Insights

How did the offline channel stand dominant in connected apparel distribution in 2024?

The offline segment marked its dominance by generating the highest revenue share in 2024. The dominance of the segment is attributed to the product testing options for various garments. The offline retail stores are also setting up their outlets in the urban cities, which is helping them to generate more rapid demand.

The connected apparel market is expanding as companies are also investing in expert guidance, which improves the overall consumer engagement. Moreover, Brands like Under Armour, Nike and Adidas have an established offline retail presence, which is helping them to attract more sports and fitness-oriented consumers.

The online segment is anticipated to emerge at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising e-commerce expansion in developed and developing economies. These channels have a wider product availability, which helps consumers select various products according to their preferences.

Moreover, the consumers are purchasing this apparel due to social media influence, which is helping the new startups to invest in digital platforms for marketing and advertising. These online channels are also offering high discounts to consumers due to D2C models, eliminating other trade costs.

Avery Dennison

MIT

By Product Type

By Technology Integration

By Consumer Group

By Distribution Channel

By Region

The U.S. range cooker market size was valued USD 1.95 billion in 2024 and is projected to grow from USD 2.13 billion in 2025 to USD 4.81 billion by 20...

July 2025

June 2025

June 2025

June 2025