June 2025

The global latex mattress market was valued at USD 10.87 Billion by the end of 2024 and is expected to increase to USD 16.32 Billion by 2034. This is a significant 4.15% increase from 2025 to 2034. The latex mattress market is growing as more consumers recognize its benefits in terms of health, sustainability, durability, and comfort.

The latex mattress market is experiencing steady growth globally, fueled by rising demand for eco-friendly, durable, and health-oriented bedding solutions. Latex mattresses, made from natural or synthetic rubber tree sap, are gaining popularity as consumers become increasingly aware of sleep quality on overall health. An uptick in back and posture-related issues, encouraging investment in orthopedic and pressure-relieving sleep products. Growing environmental consciousness, with natural latex mattresses offering biodegradable, chemical-free alternatives to conventional foam and spring variants.

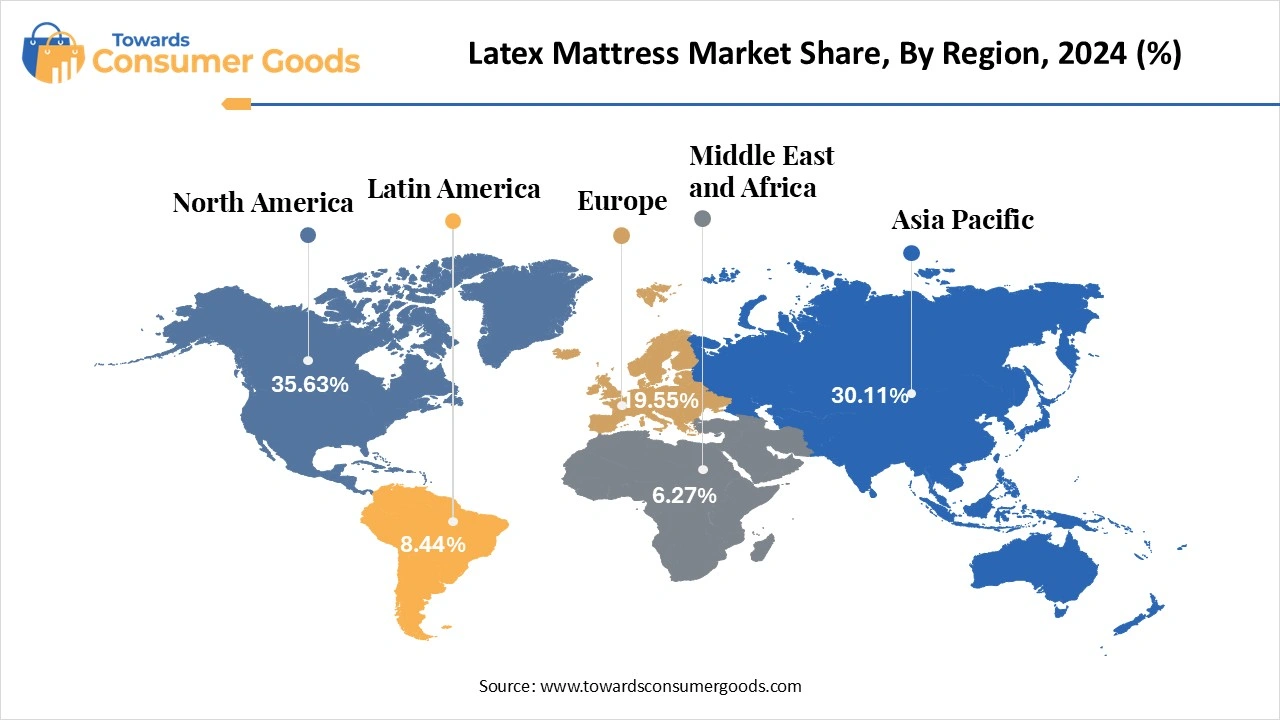

An increase in disposable incomes and urban lifestyle upgrades, where consumers seek both comfort and sustainability. The hospitality industry’s shift toward luxury sleep products in premium hotels and resorts. The market is also witnessing regional momentum, especially in North America and Europe, where consumer preference leans toward non-toxic, hypoallergenic bedding, and in Asia-Pacific, where expanding middle-class populations and awareness campaigns are supporting market penetration.

| Consumers of 25-40 age group | Consumers of 41-60 age group |

| Eco-conscious, digitally savvy, first-time buyers | Wellness-focused, comfort seekers, long-term quality |

| Report Attributes | Details |

| Market Size in 2025 | USD 11.32 Billion |

| Expected Size by 2034 | USD 16.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By Application, By Distribution Channel |

| Key Companies Profiled | Tempur Sealy International, Latexco NV, Serta Simmons Bedding LLC, Foshan Aussie Hcl Furniture Co., Ltd., Kingsdown, Inc., Avocado Green Brands, Inc., Royal Pedic Mattress, Spring Air International, Savvy Rest, Inc., Spindle Mattress Company |

Laying the Foundation for a Greener Sleep Future

The latex mattress market is ripe with opportunity as the world transitions towards more sustainable and health-oriented lifestyles. Consumers are becoming increasingly aware of the toxins and allergens found in traditional foam and spring mattresses, prompting a shift toward natural latex alternatives. With rising disposable incomes in emerging economies and an ongoing wellness revolution in developed markets, latex mattresses are gaining visibility as a premium yet essential product.

The growth of e-commerce platforms, coupled with the expansion of direct-to-consumer business models, is breaking geographical barriers, making it easier for manufacturers to reach a broader, global audience. Additionally, innovations in material science, such as cooling-infused latex and hybrid layering, are attracting new customer segments. From luxury hotels to health-conscious homeowners, the market is positioned to expand into both B2B and B2C verticals, driven by a growing demand for comfort, longevity, and eco-friendliness in sleep products.

Despite its numerous benefits, the adoption of latex mattresses is restrained primarily by high initial costs. Compared to conventional foam or innerspring alternatives, latex, especially natural and organic variants, comes at a significantly higher price point, making it less accessible to cost-sensitive consumers. Furthermore, limited consumer education about the long-term value of latex (such as durability and health benefits) often leads buyers to favor short-term affordability over quality.

The heaviness and bulk of latex mattresses can also complicate logistics, increasing shipping costs and deterring some online purchases. Lastly, the market suffers from fragmented certification standards, where not all “natural” claims are verified, leading to confusion and mistrust among informed buyers. Unless these barriers are addressed through pricing strategies, consumer awareness campaigns, and stronger regulatory labelling, growth potential may remain somewhat stifled, particularly in developing economies.

Why Is North America the Comfort King for Latex Mattress Market?

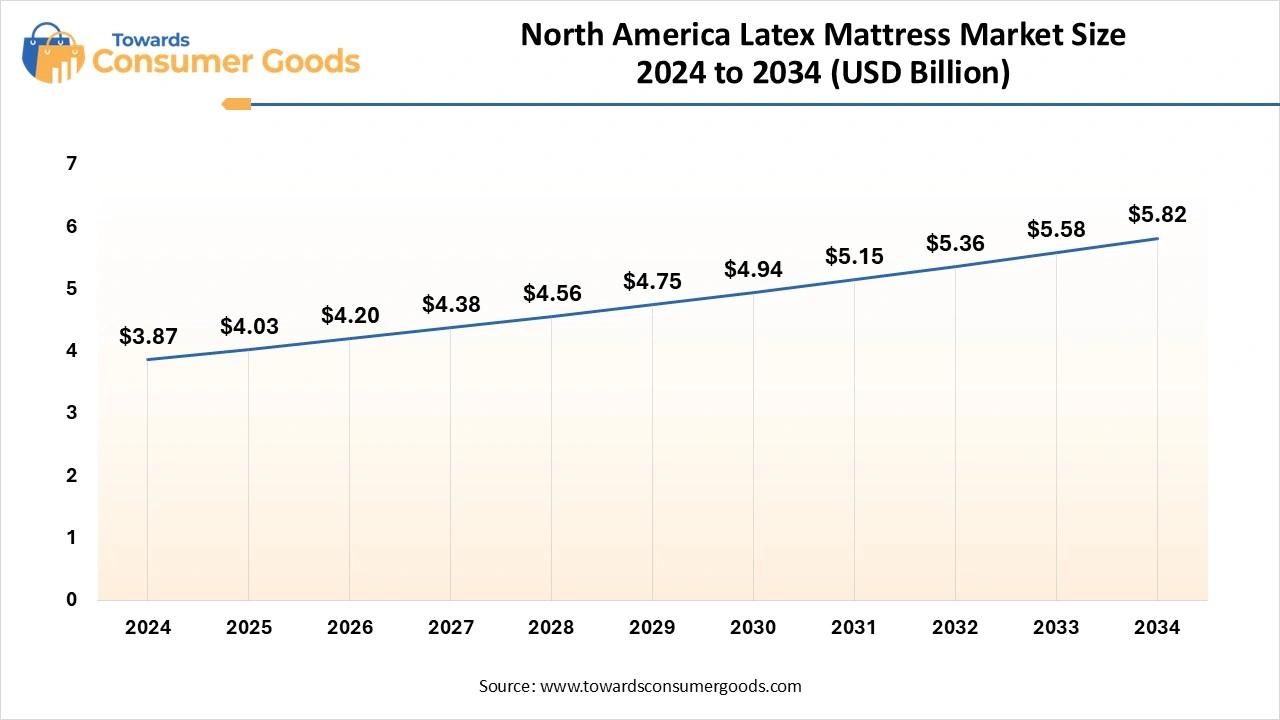

The North America latex mattress market is expected to increase from USD 4.03 billion in 2025 to USD 5.82 billion by 2034, growing at a CAGR of 4.16% throughout the forecast period from 2025 to 2034. North America dominates the latex mattress market due to its mature consumer base, high health awareness, and strong presence of premium bedding brands. Consumers in the US and Canada are increasingly focused on wellness, sleep hygiene, and sustainability, making latex a preferred material. The widespread availability of organic and certified products, along with aggressive digital marketing by direct-to-consumer brands, has solidified the region’s leadership. Furthermore, a rise in orthopedic concerns and allergy sensitivities has encouraged medical professionals and sleep experts to recommend latex bedding as a safe, therapeutic solution.

How Is Europe Leading the Green Mattress Movement?

Europe is the fastest-growing region in the latex mattress market, driven by a deeply rooted commitment to environmental sustainability, clean living, and strict regulatory standards. Consumers across Germany, France, the Nordics, and the UK are actively seeking eco-labelled and ethically sourced bedding solutions, with a strong preference for GOTS- and GOLS-certified latex mattresses. Government incentives supporting green products, along with increasing demand in both residential and hospitality sectors, have accelerated market momentum. Europe’s cultural emphasis on quality, longevity, and minimalism fits perfectly with the latex mattress proposition, pushing it toward accelerated adoption.

Is Asia the Next Frontier for Latex Sleep Solutions?

Asia-Pacific is witnessing notable growth in the latex mattress market, supported by rapid urbanization, rising middle-class incomes, and evolving lifestyle aspirations. Countries like India, China, Thailand, and Vietnam are not only key producers of natural latex but are also becoming enthusiastic consumers of latex-based bedding. The market is gradually shifting from traditional cotton bedding and basic foam mattresses to more ergonomic, long-lasting, and eco-conscious sleep solutions. The region’s expansion is further boosted by the digital retail boom, where global brands and local manufacturers alike are targeting health-conscious millennials in metropolitan areas. While challenges around cost and awareness remain, the sheer volume of potential buyers makes Asia-Pacific a crucial growth engine for the years ahead.

Why Is Nature Taking Over the Mattress Market?

Natural latex mattresses are dominating the market thanks to the growing global demand for eco-friendly, non-toxic, and durable sleep solutions. Sourced from rubber tree sap, natural latex is prized for its biodegradability, hypoallergenic properties, and superior comfort, making it the go-to option for health-conscious and sustainability-driven consumers. Its ability to resist sagging, regulate body temperature, and provide zoned support for spinal alignment gives it a stronghold in both residential and luxury segments. Additionally, the market is witnessing increased adoption of certified organic variants, further reinforcing its dominance as green living becomes a mainstream priority.

On the other hand, synthetic latex, typically made from petrochemicals like styrene-butadiene rubber (SBR), is emerging as the fastest-growing segment, largely due to its cost-effectiveness and wider availability. While it may not match the sustainability credentials of its natural counterpart, synthetic latex appeals to price-sensitive consumers and offers reasonable durability and comfort. Manufacturers are blending it with natural latex to achieve hybrid solutions that combine affordability with resilience, particularly in regions where full-natural latex options are either costly or less accessible. As technology improves, the quality gap between synthetic and natural latex continues to narrow, expanding the segment’s appeal.

Why Are Homeowners Choosing Latex for Better Sleep?

The residential segment remains the dominant application area in the latex mattress market, driven by a strong shift toward healthier, ergonomic home environments. With growing awareness of the importance of sleep in physical and mental well-being, consumers are investing in high-quality bedding solutions that offer long-term comfort and support. Natural latex mattresses, with their low VOC emissions, resistance to dust mites, and body-contouring ability, have become a top choice for personal use. Additionally, the post-pandemic focus on wellness at home has further amplified demand among homeowners seeking to upgrade their sleeping experience with sustainable and orthopedic-friendly options.

Quietly Waking Up to the Potential

The commercial segment, especially in the hospitality and healthcare industries, is emerging as the fastest-growing application category. Luxury hotels, boutique resorts, and wellness retreats are increasingly turning to latex mattresses to enhance guest comfort and promote eco-conscious branding. Hospitals and rehabilitation centers are also integrating latex solutions due to their pressure-relieving and antimicrobial properties. The commercial appeal is strengthened by latex’s durability under frequent use, making it a smart investment for high-traffic environments that prioritize hygiene and long-lasting quality.

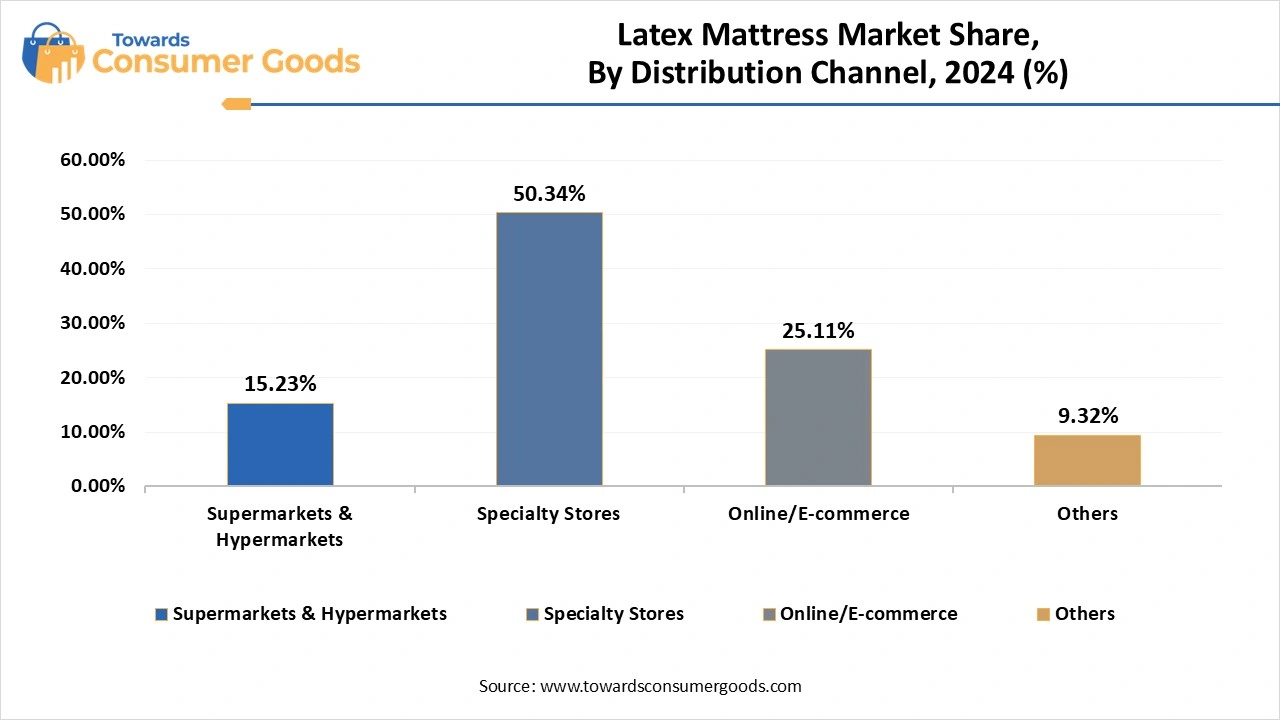

Why Do Sleep Seekers Still Prefer to Try Before They Buy?

Specialty sleep stores continue to dominate the latex mattress distribution landscape due to their consultative approach, in-store trials, and tailored recommendations. For many consumers, especially those aged 40 and above, purchasing a mattress is a tactile, personal experience where touch, firmness testing, and professional guidance matter. These stores often offer customization options, along with certifications and expert advice on posture, sleep disorders, and material choices, giving them an edge over mass-market and online platforms. Their role is particularly critical in converting hesitant buyers into loyal customers, especially for high-investment products like natural latex mattresses.

On the other hand, online and e-commerce platforms are the fastest-growing distribution channel, fueled by the millennial preference for convenient, informed, and trial-based shopping experiences. Direct-to-consumer (DTC) brands are capitalizing on this trend by offering 100-night trials, easy returns, and “mattress-in-a-box” delivery models, making high-quality latex mattresses more accessible than ever. The ability to compare features, read customer reviews, and explore eco-credentials online resonates particularly well with the younger demographic. As digital tools like augmented reality and AI-based mattress quizzes gain popularity, online channels are set to reshape the buying journey for latex mattresses globally.

Type Outlook

Application Outlook

Distribution Channel Outlook

The global second-hand collectibles market is projected to grow from USD 132.90 billion in 2025 to USD 233.26 billion by 2034, exhibiting a compound a...

June 2025

June 2025

June 2025

June 2025