June 2025

The global smart washing machine market size was calculated at USD 12.11 billion in 2024 and is projected to hit around USD 109.66 billion by 2034 with a CAGR of 24.65%. The 24/7 availability and the convenience of washing clothes have driven the market growth.

Convenience and AI-Driven Capabilities Attracts Consumer Base

Smart washing machines represent the cutting edge of convenience, transforming the tedious chore of laundry into a seamless and tailored experience. These innovative appliances are engineered to elevate everyday tasks through advanced connectivity and intelligent features. Imagine controlling your washing machine from anywhere in your home or even when you’re miles away using a sleek smartphone app or simply your voice, thanks to integration with smart home systems like Alexa and Google Assistant.

Featuring sophisticated Artificial Intelligence (AI) technology, these machines analyze every load with remarkable precision, assessing fabric types and soil levels to automatically optimize water usage, detergent quantities, and wash cycles. This ensures your clothes receive the perfect care they deserve while minimizing waste. Some models even include auto-dispensing systems that banish the guesswork, dispensing the precise amount of detergent needed based on the specifics of each load, thus eliminating the risk of overuse or underuse.

As these machines do their work, you’ll receive timely notifications on your phone, informing you when cycles are complete, alerting you to potential issues, and reminding you about necessary maintenance checks. Moreover, many smart washing machines come equipped with energy monitoring features, offering valuable insights into your energy consumption and providing practical tips for further reducing your carbon footprint. Customization is key, allowing users to tailor wash cycles for specific fabric types, stubborn stains, and personal preferences, ensuring every wash feels bespoke.

The market for smart washing machines is experiencing meteoric growth, fuelled by a surging demand for advanced home appliances that deliver unparalleled convenience and efficiency. Rapid urbanization, rising disposable incomes, and the embrace of smart technologies are driving this trend. Today’s consumers crave control over their household tasks, and smart washing machines answer this call with remote monitoring and control capabilities that save valuable time and energy. The ability to start or pause cycles right from your smartphone, receive alerts, and schedule washes for optimal timing enhances the convenience and efficiency of laundry days.

| Report Attributes | Details |

| Market Size in 2025 | USD 15.10 Billion |

| Expected Size by 2034 | USD 109.66 Billion |

| Growth Rate | CAGR of 24.65% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Capacity, By Application, By Region |

| Key Companies Profiled | Haier Inc., IFB Appliances, Electrolux (AB Electrolux (publ)), BOSCH, Panasonic Corporation, Motorola Mobility LLC, SAMSUNG, GIRABU, LG Electronics, Whirlpool |

Expansion and Rapid Adaptation of the Smart Home Technologies

The opportunities in the smart washing machine market are abundant, fueled by a burgeoning interest in smart appliances and the rapid adoption of smart home technologies. The expanding middle class in emerging markets such as India, China, Brazil, and Indonesia signifies a vast potential customer base willing to invest in premium, advanced machines. The widespread availability of smartphones and affordable internet access is making digital connectivity a staple of modern life, paving the way for consumers to embrace smart home innovations. Furthermore, supportive government initiatives advocating for smart cities and energy-efficient appliances further bolster demand for smart washing machines, aligning perfectly with consumers’ growing desire for sophistication, functionality, and sustainability.

Cost of the High-Tech Machines

However, this promising market does not come without its challenges. Cultural preferences for traditional laundry methods continue to influence consumer behaviour, while concerns surrounding the reliability and maintenance costs of these high-tech machines linger. Additionally, competition from online laundry services and conventional washing machines poses a threat, alongside economic fluctuations that can impact consumer spending. Yet, despite these hurdles, the allure of smart washing machines complete with AI-driven capabilities for optimal performance makes them an attractive prospect for the modern consumer.

Front-load smart washing machines segment dominated the market in 2024. The segment is largely attributable to their exceptional efficiency and a host of advanced features that meet the growing consumer appetite for smart home technology. One of the standout advantages of front-loading washers is their capacity to accommodate larger loads, making them ideal for households with varying laundry needs. Moreover, many front-load models incorporate innovative smart functionalities such as Wi-Fi connectivity, remote operation, and AI-powered wash cycles, which provide users with greater control and convenience. The eco-friendly design of front-load washers aligns perfectly with the current consumer trend towards sustainability, appealing to environmentally conscious buyers.

The top-load smart washing machines segment expects the significant growth in the market during the forecast period. This segment is particularly appealing to consumers prioritizing affordability, ease of use, and accessible smart technology. Top-load models cater effectively to individuals in developing nations and those with physical challenges, as their design allows users to load and unload laundry without bending. The widespread adoption of smart home technologies and improvements in digital literacy further amplify the popularity of top-load washers, marking a significant trend within the industry.

The 6-10 kg segment held the largest market share in 2024. The machines in this category cater effectively to families, offering the capability to manage moderate laundry loads while maximizing energy efficiency. The ongoing trend towards smart washing machines, with features like remote control, voice commands, and real-time monitoring, further enhances their attractiveness, making them an appealing option for modern families seeking efficient laundry solutions.

More than a 10 kg capacity segment is experiencing rapid growth in the market during the forecast period, driven primarily by an escalating need among larger families and commercial laundry services. These high-capacity machines are indispensable for commercial applications such as hospitals and hotels, where the need to wash bulk items like bedding and towels is commonplace. By efficiently handling larger loads in fewer cycles, these machines save both time and energy.

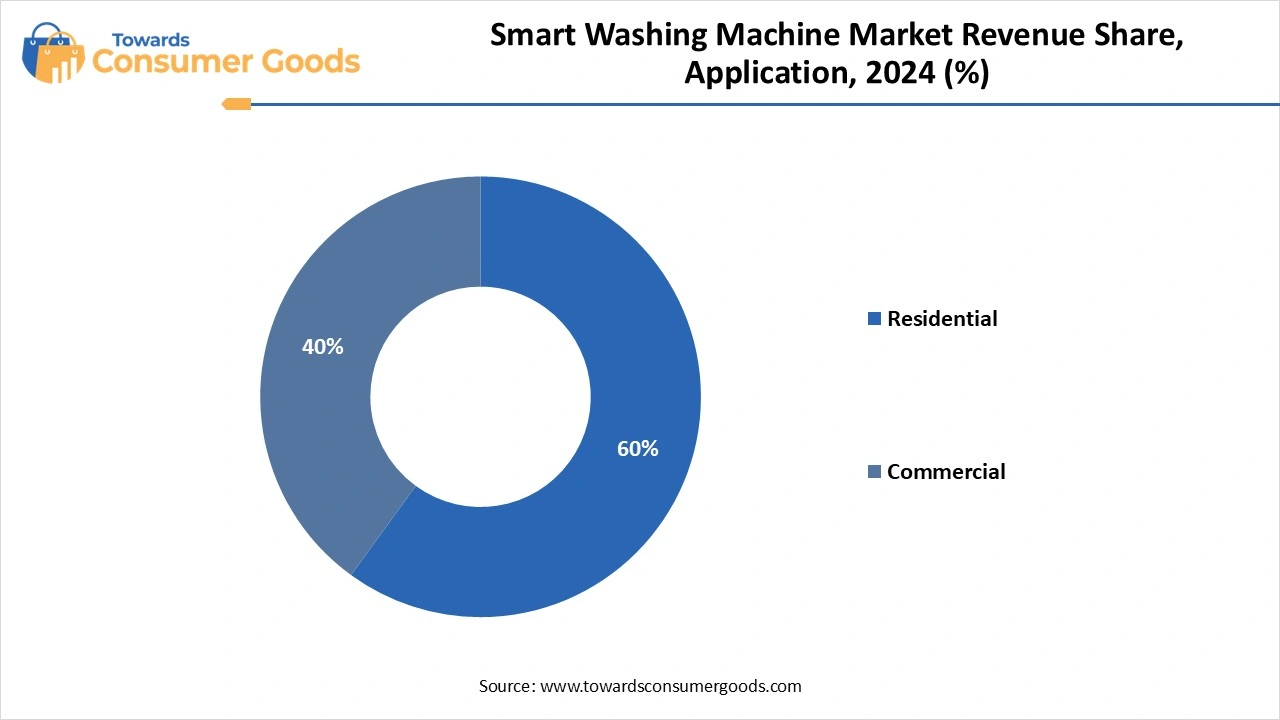

The residential segment emerges as the undisputed leader in the smart washing machine market in 2024, primarily due to the essential nature of laundry and clothing maintenance in households. This ascendance is significantly fueled by increasing public awareness of personal hygiene, greater disposable incomes, and ongoing urbanization trends. Furthermore, there is a marked shift toward environmentally friendly products, and consumers are increasingly seeking washing machines that align with their eco-conscious values.

The commercial segment is experiencing rapid growth in the market during the forecast period, riven by heightened infrastructure development, an expanding global population, and a burgeoning construction industry. The commercial sector's dependence on laundry services to uphold cleanliness standards and enhance operational efficiency plays a crucial role in this trend. Thus, the intersection of construction activity and laundry service utilization is propelling market expansion.

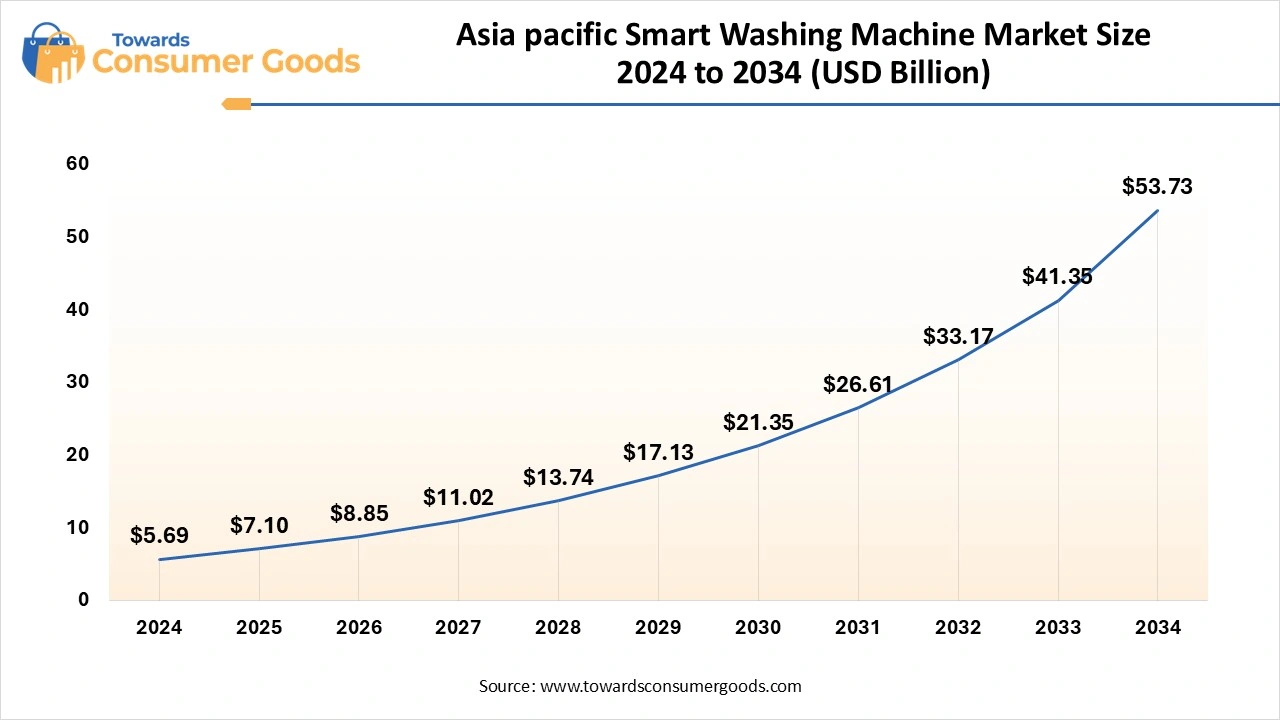

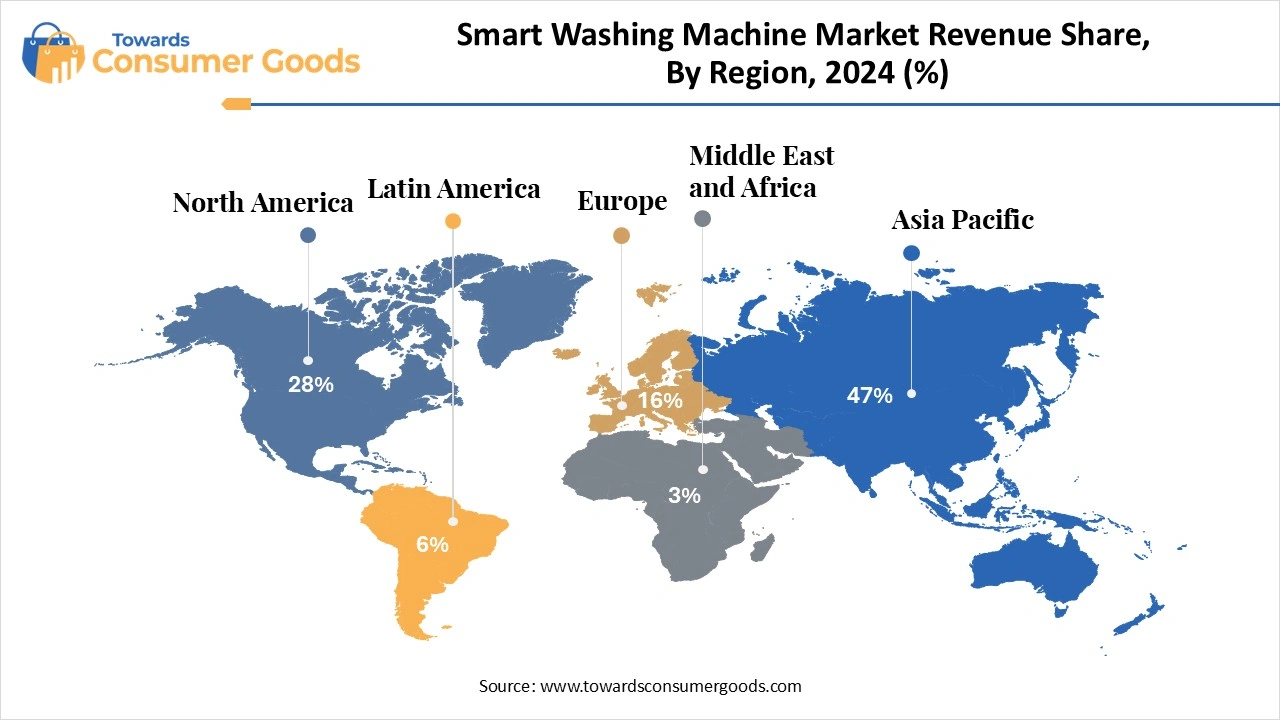

Asia-Pacific stands as the leader in the smart washing machine market in 2024, the Asia-Pacific smart washing machine market size was valued at USD 5.69 billion in 2024 and is expected to be worth around USD 53.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 25.17% over the forecast period 2025 to 2034. driven by significant factors including high adoption rates in nations like Japan, China, and South Korea. These countries are experiencing rapid urbanization and benefit from a youthful population coupled with substantial investments into the sector. Notably, India plays a pivotal role in this regional dominance, particularly in urban centers where corporate environments thrive. The market in India is expected to grow further, bolstered by investments aimed at improving public infrastructure and organized retail frameworks.

North America expects the fastest growth in the smart washing machine market during the predicted period, attributed to a strong consumer demand for convenience and the swift embrace of smart washing technologies. Within this region, the United States serves as the dominant force, although Canada is also making significant strides, contributing to market expansion through an increase in washing machine presence in the travel and leisure sectors. Canada’s market expansion is further stimulated by the adoption of smart washing technologies, such as touchscreen interfaces and mobile payment capabilities, all aimed at delivering a more streamlined and customer-friendly experience.

North America expects the fastest growth in the smart washing machine market during the predicted period, attributed to a strong consumer demand for convenience and the swift embrace of smart washing technologies. Within this region, the United States serves as the dominant force, although Canada is also making significant strides, contributing to market expansion through an increase in washing machine presence in the travel and leisure sectors. Canada’s market expansion is further stimulated by the adoption of smart washing technologies, such as touchscreen interfaces and mobile payment capabilities, all aimed at delivering a more streamlined and customer-friendly experience.

China is a formidable presence in the global washing machine space, boasting a rapidly expanding market characterized by automation and innovative digital solutions. Chinese manufacturers are leading the charge in the adoption of AI-powered vending machines, seamless digital payment integration, and even advanced robotic systems for in-machine food preparation. Additionally, soaring urbanization rates, higher disposable incomes, and evolving lifestyle choices coupled with the growth of online retail platforms are propelling the market forward. Consumers are actively seeking appliances that not only offer convenience but also significantly enhance their living environments, fueled by a rising consciousness about smart home technologies.

The area benefits from a robust economy and a high level of consumer spending power, particularly observed in the United States and Canada. As urbanization continues to rise, there is a notable demand for innovative, smart, and energy-efficient appliances that cater to modern lifestyles. Consumers here are progressively favoring appliances that not only conserve energy but also incorporate sustainable practices, reflecting a growing awareness of environmental impact.

Innovation: In August 2024, Samsung, a prominent player in the consumer electronics sector in India, teased its upcoming AI-driven laundry specialist designed specifically for the Indian market, promising a transformative laundry experience for consumers in the region.

Innovation: In May 2025, Xiaomi debuted the Mijia Dual-Zone Washer Pro, an innovative smart washer-dryer that features a compact design with a dual-drum system, catering to contemporary living spaces while maintaining a 10 kg capacity for efficient laundry handling.

Launch: In July 2024, Electrolux made headlines by launching a smart laundry range aimed at resource conservation and prolonging the lifespan of garments, aligning with the growing consumer focus on sustainability and responsible consumption.

Anticipated market trends show that, the global outdoor lighting market size accounted for USD 19.11 billion in 2025 and is forecasted to hit around U...

June 2025

June 2025

June 2025

June 2025